Are Contributions To A Retirement Plan Tax Deductible Verkko 10 jouluk 2019 nbsp 0183 32 If you re wondering Is my retirement plan tax deductible the answer is yes You can save for retirement using pre tax dollars or after tax dollars When you use pre tax dollars to

Verkko 29 elok 2023 nbsp 0183 32 No retirement plan at work Your deduction is allowed in full if you and your spouse if you are married aren t covered by a retirement plan at work These Verkko 6 p 228 iv 228 228 sitten nbsp 0183 32 Contributions to traditional IRAs are often tax deductible subject to certain conditions and limits based on your income your tax filing status and whether

Are Contributions To A Retirement Plan Tax Deductible

Are Contributions To A Retirement Plan Tax Deductible

https://southparkcapital.com/wp-content/uploads/2021/04/More-Time-to-File-Taxes-and-Review-Your-Retirement-Plan-scaled.jpg

Ira Contribution Limits 2022 Choosing Your Gold IRA

https://choosegoldira.com/wp-content/uploads/2022/08/ira-contribution-limits-2022.png

Kiplinger Retirement Budget Worksheet BudgetWorksheets

https://budgetworksheets.net/wp-content/uploads/2023/03/retirement-budget-worksheet-templates-at-allbusinesstemplates.png

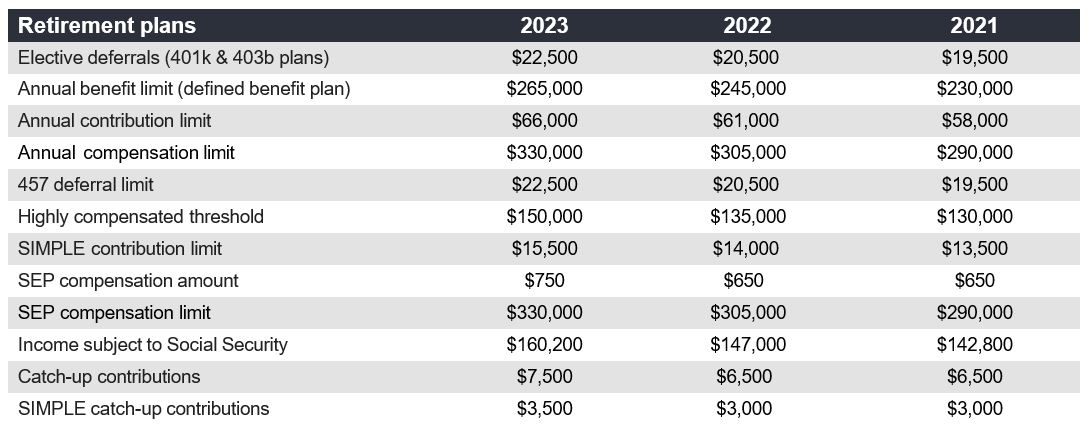

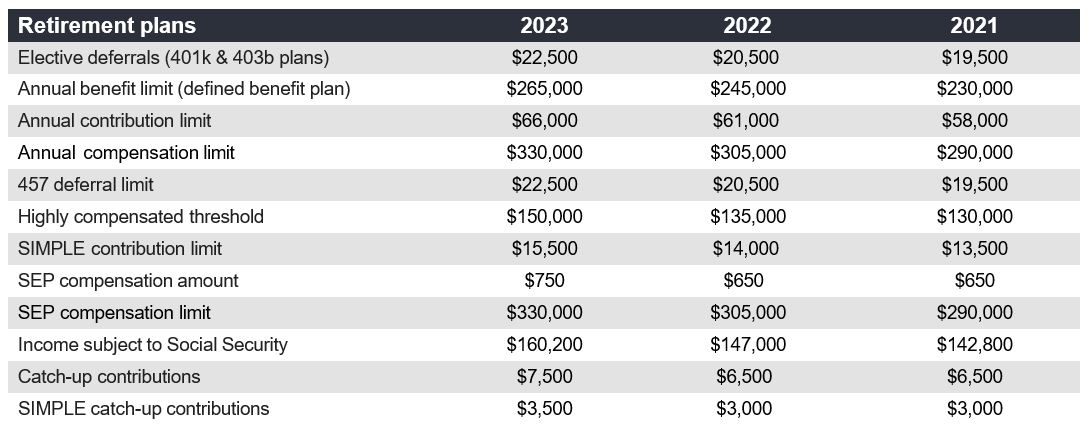

Verkko 6 p 228 iv 228 228 sitten nbsp 0183 32 That 6 500 or 7 500 in 2023 is the total you can deduct for all contributions to qualified retirement plans For 2024 this is 7 000 or 8 000 Verkko If you and your spouse if applicable aren t covered by an employer retirement plan your traditional IRA contributions are fully tax deductible If you or your spouse if

Verkko 22 jouluk 2023 nbsp 0183 32 There are limits to how much employers and employees can contribute to a plan or IRA each year The plan must specifically state that contributions or Verkko 7 jouluk 2023 nbsp 0183 32 The maximum annual traditional IRA contribution limit is 7 000 in 2024 8 000 if age 50 or older Traditional IRA contributions may be tax deductible in the year they are made depending on

Download Are Contributions To A Retirement Plan Tax Deductible

More picture related to Are Contributions To A Retirement Plan Tax Deductible

The Road To Retirement Savings With RRSPs Osoyoos Credit Union

https://ocubc.com/wp-content/uploads/2020/02/AdobeStock_293196436-1024x683.jpeg

4 Tips For Sticking To A Retirement Savings Plan Equitable

https://s10009.cdn.ncms.io/d9/wp-content/uploads/2017/08/thumbnail-cd409298a4db3a18fefea06b2c89c11b.jpeg

Annual Retirement Plan Contribution Limits For 2023 Social K

https://socialk.com/wp-content/uploads/image-12.png

Verkko 23 elok 2022 nbsp 0183 32 However not all retirement plan contributions are tax deductible The type of retirement plan you have will determine whether you can reduce your taxable income with your Verkko 6 marrask 2023 nbsp 0183 32 Yes IRA contributions may be tax deductible if you qualify and depending on the type of account you have Contributions to a traditional IRA are deductible while contributions to a

Verkko 5 p 228 iv 228 228 sitten nbsp 0183 32 Contributions to traditional IRAs are generally tax deductible But if you or your spouse have a 401 k or other employer retirement plan in addition to a traditional IRA you ll also need to Verkko 24 minuuttia sitten nbsp 0183 32 Although your pretax 401 k contributions are tax deductible today you ll eventually have to pay taxes on the money It s important to be aware of

Qualified Retirement Plan How It Works Investing Taxes

https://www.carboncollective.co/hs-fs/hubfs/Types_of_Qualified_Retirement_Plan.png?width=960&name=Types_of_Qualified_Retirement_Plan.png

:max_bytes(150000):strip_icc()/401kplan.asp-4103bbcbcf0943068955a6c47d6eca0c.png)

What Is Retirement Savings Tax Credit Leia Aqui Why Am I Getting A

https://www.investopedia.com/thmb/9Rj4BAvEf2P_WLFphJolmALSRUw=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/401kplan.asp-4103bbcbcf0943068955a6c47d6eca0c.png

https://humaninterest.com/.../retirement-plan …

Verkko 10 jouluk 2019 nbsp 0183 32 If you re wondering Is my retirement plan tax deductible the answer is yes You can save for retirement using pre tax dollars or after tax dollars When you use pre tax dollars to

https://www.irs.gov/retirement-plans/ira-deduction-limits

Verkko 29 elok 2023 nbsp 0183 32 No retirement plan at work Your deduction is allowed in full if you and your spouse if you are married aren t covered by a retirement plan at work These

RRSP Contributions How To Avoid Paying Taxes Qopia Financial

Qualified Retirement Plan How It Works Investing Taxes

Tabela Salarial 2023 Irs Contribution Limits IMAGESEE

2023 Dcfsa Limits 2023 Calendar

The Retirement Planning Pyramid Cool Money Retirement Planning Early

2023 Retirement Plan Contribution Limits Baker Tilly

2023 Retirement Plan Contribution Limits Baker Tilly

Retirement Savings Accounts Planning Services The Sudol Group

Sale Representative Compensation Plan Examples Addictionary

What s The Maximum 401k Contribution Limit In 2022 2023

Are Contributions To A Retirement Plan Tax Deductible - Verkko 5 maalisk 2021 nbsp 0183 32 A simple IRA lets you contribute to your own retirement as well as up to 100 employees who make at least 5 000 from your business Matching