Are Donations Taxable The donations have been in the form of assets digital camera camcorder and cash 250 and 500 Nothing has been given in return no work no services How do we treat these donations Presume they are not taxable income because they have not been received in the course of trade John John Perry

Unless they are very lucky the plan to run at a breakeven position will mean some years of surplus and some years of deficit The net surplus deficit is taxable according to normal CT rules If they are reluctant to pay tax and are reliant on donations to remain solvent they should set up a charity Treating the grant as taxable as it s released to P L in accordance with GAAP has the effect of matching the grant with the expenditure which gives an equitable tax effect Similarly with your correct treatment of the capital grant I think WhichTyler s link covers the donations which are likely to be considered a trading receipt

Are Donations Taxable

Are Donations Taxable

https://www.mycause.com.au/blog_images/donate.jpg

Donations Needed Makants Greyhound Rescue N W

https://makants.uk/wp-content/uploads/2021/01/donationsneeded.png

Tips On Tax Deductions For Donations

http://bargainbabe.com/wp-content/uploads/2014/02/taxable_donations.jpg

If it is a charity but isn t required to register the income will most likely fall within one of the charitable exemptions If it is a charity and is required to register it needs to register If it isn t a charity I agree with WhichTyler and I can t see why any of the income you refer to wouldn t be taxable 10th Jun 2020 17 21 Hi Matrix yes initial advice was to set up as a CIC and not a charity due to the founders role in the organisation It is only a small organisation run entirely by one person with the salary covered by a grant secured for 3 years who advised the CIC status Usually donations are allocated straight away to projects but

So best advice would be to ensure registration as a charity and confirmation by HMRC of exempt status before accepting donations Thanks 0 By pawncob 08th Oct 2015 17 14 It s a gift Gifts are not taxable Donations are gifts If you re not trading then any income received is exempt from tax 2 Well yes but a long time in the future i the loan will be worth less and ii the CIC may be better able to pay the tax as it will we hope have built up reserves Thanks 0 By memyself eye 24th Jan 2017 16 43 correct Thanks 1 Share this content An investor has offered a sum of money to us 50 as a loan 50 as a donation

Download Are Donations Taxable

More picture related to Are Donations Taxable

Donation Request Forms Template Beautiful Non Profit Organization

https://i.pinimg.com/originals/a1/86/e2/a186e2393f15a44392c2389add6ffcb7.jpg

Donations

https://res-4.cloudinary.com/deo07tbou/image/upload/q_auto/v1/woodswavewonder/D9483FB0-32E2-4D60-B303-CA61FFDE84E0.jpg

Corpus Specific Voluntary Donations Of Unregistered Trust Are Not

https://www.taxscan.in/wp-content/uploads/2023/02/Donations-Trust-Taxable-ITAT-TAXSCAN.jpg

In case of sole trader or partnership assuming not higher rate taxpayers net payment of 2 5K no taxable benefit for taxpayers in monetary terms down 2 5K but a nice warm feel good factor Charity collects 2 500 and then seeks further claim of 625 from HMRC so total income for them of 3 125 If taxpayers had been a limited S189 CTA 2010 states that with regard to charitable donations They are deducted from the company s total profits for the period after any other relief from corporation tax other than group relief Does this imply that all other claims that can be made i e current year trade loss relief have to be made before taking a deduction for the

[desc-10] [desc-11]

DONATIONS

https://www.msd.gov.lk/images/slide/30.jpg

Ways To Help Donate To Family Health Centers Of San Diego

https://www.fhcsd.org/wp-content/uploads/iStock-1208593873-2048x1360.jpg

https://www.accountingweb.co.uk › any-answers › donations-is-it-inc…

The donations have been in the form of assets digital camera camcorder and cash 250 and 500 Nothing has been given in return no work no services How do we treat these donations Presume they are not taxable income because they have not been received in the course of trade John John Perry

https://www.accountingweb.co.uk › any-answers › cic-donations-taxa…

Unless they are very lucky the plan to run at a breakeven position will mean some years of surplus and some years of deficit The net surplus deficit is taxable according to normal CT rules If they are reluctant to pay tax and are reliant on donations to remain solvent they should set up a charity

Ask Money Today Received Donations From Friends And Family Will It Be

DONATIONS

Donation Form For Tax Purposes Best Of 40 Donation Receipt Templates

Donations Land Of Parks

The Price Of Generosity Tax On Donations RALB Law

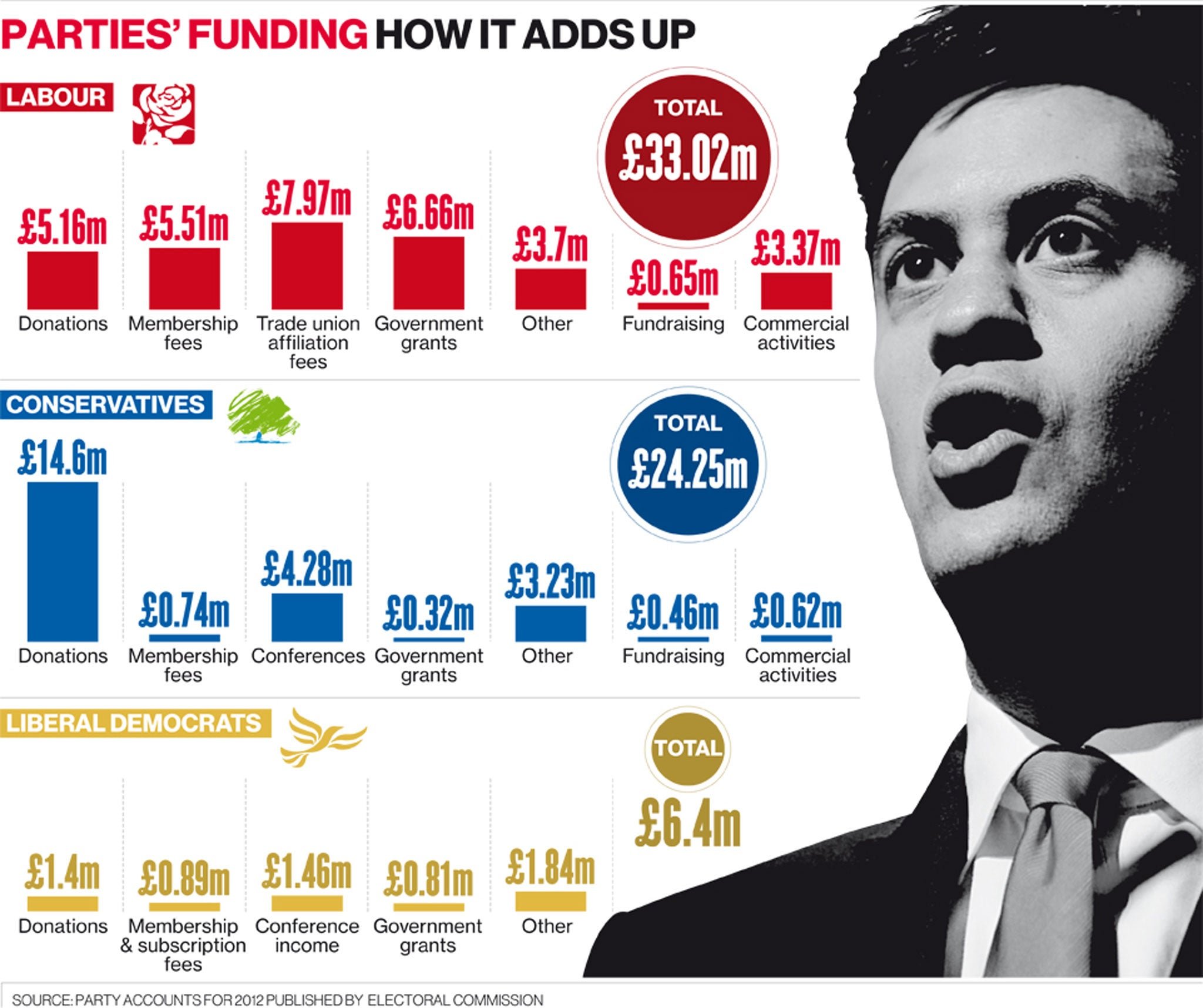

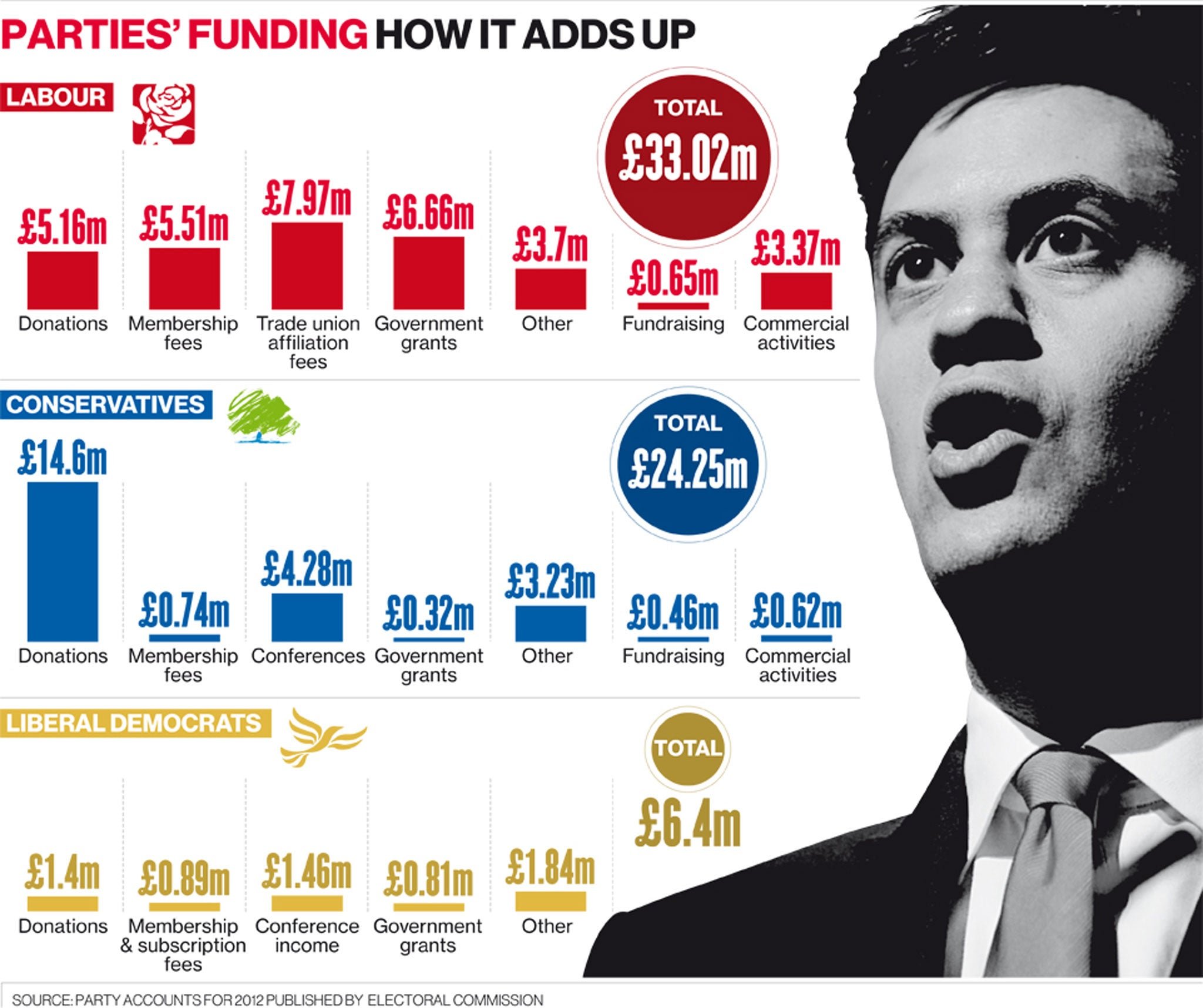

How Do I Donate To The Republican Party

How Do I Donate To The Republican Party

Disaster Relief Remains Top Of Mind For Donors Disaster Relief Remains

Are Plasma Donations Taxable Know All The Details

Wanna Help Jackson Residents Here s Where You Can Take Water Donations

Are Donations Taxable - [desc-12]