Are Employee Discounts Taxable Discounts in excess of the amounts allowed under Sec 132 a 2 are includible in the employee s taxable income The qualified employee discount

Are employee discounts taxable The tax treatment of employee discounts can depend on the specifics of the discount being offered In general discounts that are offered to all Many employers offer discounts on their goods or services to staff members as part of their employment benefit package However offering this benefit can have

Are Employee Discounts Taxable

Are Employee Discounts Taxable

https://www.benepath.net/wp-content/uploads/2022/08/text-tax-deductions-written-on-a-business-card-lying-on-financial-a-picture-id1372624737.jpg

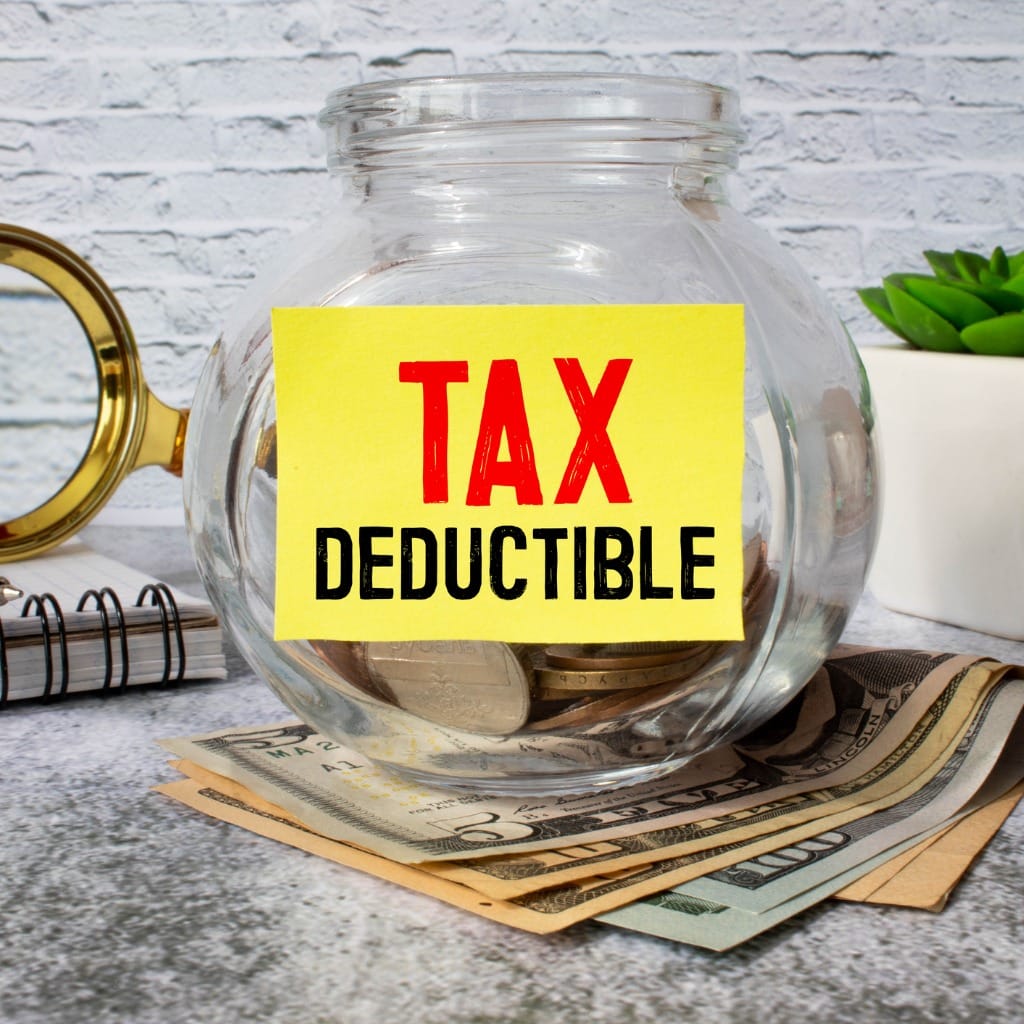

Employee Discounts Program Reward Gateway

https://www.rewardgateway.com/hs-fs/hubfs/00-Product-Assets-New/UK/USPs/2021_USP_b2b_Discounts1_UK.png?width=2400&height=1600&name=2021_USP_b2b_Discounts1_UK.png

Are Employee Retention Credits Considered Income

https://www.ertcsmallbusinesstaxrefund.com/img/323311fdbb4ed2b9a56412ef4afc5fc8.jpg?07

Are incentives and rewards taxable Generally speaking employees should plan to pay taxes on any incentives or rewards they receive from their employer This includes cash bonuses gift cards Are employee discounts taxable Employee discounts may be tax exempt depending on the type of company discount To qualify as a tax exempt employee discount the discount must cover the goods and

Fringe benefits are generally considered taxable income if the employer pays them to their employees in cash So bonuses or reimbursements for expenses paid Employee Discounts What it is This exclusion applies to a price reduction given to employees on property or services you offer to customers The discount may not be

Download Are Employee Discounts Taxable

More picture related to Are Employee Discounts Taxable

Employee Benefits And Compensation Ideas A Guide Blog H ng

https://blog.vantagecircle.com/content/images/2021/08/Corporate-Discounts-and-benefits.png

Revenue Canada To Tax Employee Discounts But Ottawa Says It s Not

https://thumbnails.cbc.ca/maven_legacy/thumbnails/493/638/PP-MPs-10-10-2017.png?crop=1.777xh:h;*,*&downsize=510px:*510w

Rectangular One Sided Employee ID Card At Rs 20 piece In Indore ID

https://5.imimg.com/data5/SELLER/Default/2020/12/ZB/AY/OA/109599877/employee-id-card-1000x1000.jpg

Discounted Prices Giving employees a price break on things like meals or in store purchases does not count as taxable income The exception does not apply to Learn how to exclude the value of a qualified employee discount from gross income under section 132 of the Internal Revenue Code Find out the definition rules and

You can generally exclude the value of an employee discount you provide an employee from the employee s wages up to the following limits For a discount on Discount programs such as the employee discount at a retailer coffee shop or even car dealership are common in many businesses and have been around for several years

SIP Law Firm Latest Tax Regulation 5 Taxable Services Subject

https://siplawfirm.id/wp-content/uploads/2022/12/tax.jpg

Salary Received By A Member Of Parliament Is Taxable Under The Head

https://ttplimages.imgix.net/tax-practice-images/IT-OS-R-1.jpg?w=1200

https://www.thetaxadviser.com/issues/2017/sep/irs...

Discounts in excess of the amounts allowed under Sec 132 a 2 are includible in the employee s taxable income The qualified employee discount

https://www.empuls.io/glossary/employee-discounts

Are employee discounts taxable The tax treatment of employee discounts can depend on the specifics of the discount being offered In general discounts that are offered to all

January Employee Discounts The Hub Digest

SIP Law Firm Latest Tax Regulation 5 Taxable Services Subject

Employee Discount Definition Types And Examples Marketing91

Event Pricing Discounts

Illinois Walmart Employee Signs Off After 10 Years On The Job Free

Employee Discounts Program Reward Gateway

Employee Discounts Program Reward Gateway

90k Salary Effective Tax Rate V s Marginal Tax Rate BI Tax 2024

80k Salary Effective Tax Rate V s Marginal Tax Rate BF Tax 2024

Write Off An Employee s Loan Tax Tips Galley And Tindle

Are Employee Discounts Taxable - Employee Discounts What it is This exclusion applies to a price reduction given to employees on property or services you offer to customers The discount may not be