Are Employee Reimbursements Taxable Income Taxes 3 minute read File for less and get more Your max tax refund is guaranteed Get Started The IRS considers some employee benefits to be taxable income But do employee expense reimbursements fall into

Published on 25 Oct 2018 Whether you run a small business or manage its finances it s essential that you understand the differences between reimbursable expenses and If a reimbursement plan is deemed accountable the reimbursements are not considered taxable income to the employee However if a reimbursement plan is deemed as nonaccountable the

Are Employee Reimbursements Taxable Income

Are Employee Reimbursements Taxable Income

https://im-next-wp-prod.s3.us-east-2.amazonaws.com/uploads/2022/11/Expense-Reimbursement-Invoice-Template.png

Are Employee Reimbursements Taxable Mesh

https://meshpayments.com/wp-content/uploads/2022/12/profit-700-418-1.png

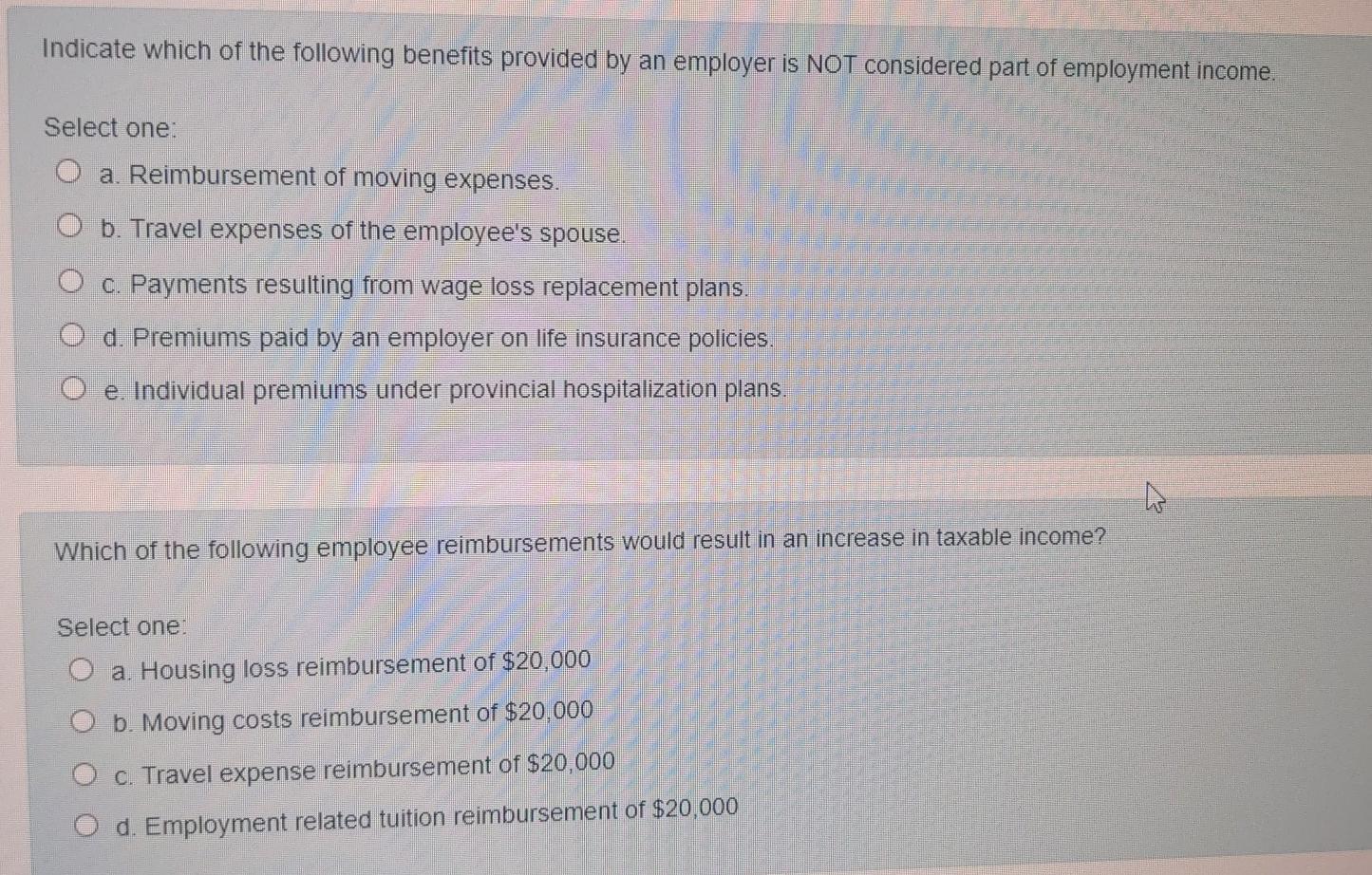

Indicate Which Of The Following Benefits Provided By An Employer Is NOT

https://media.cheggcdn.com/study/cf4/cf420baf-9130-46b5-9ab0-8913bf7e703b/image

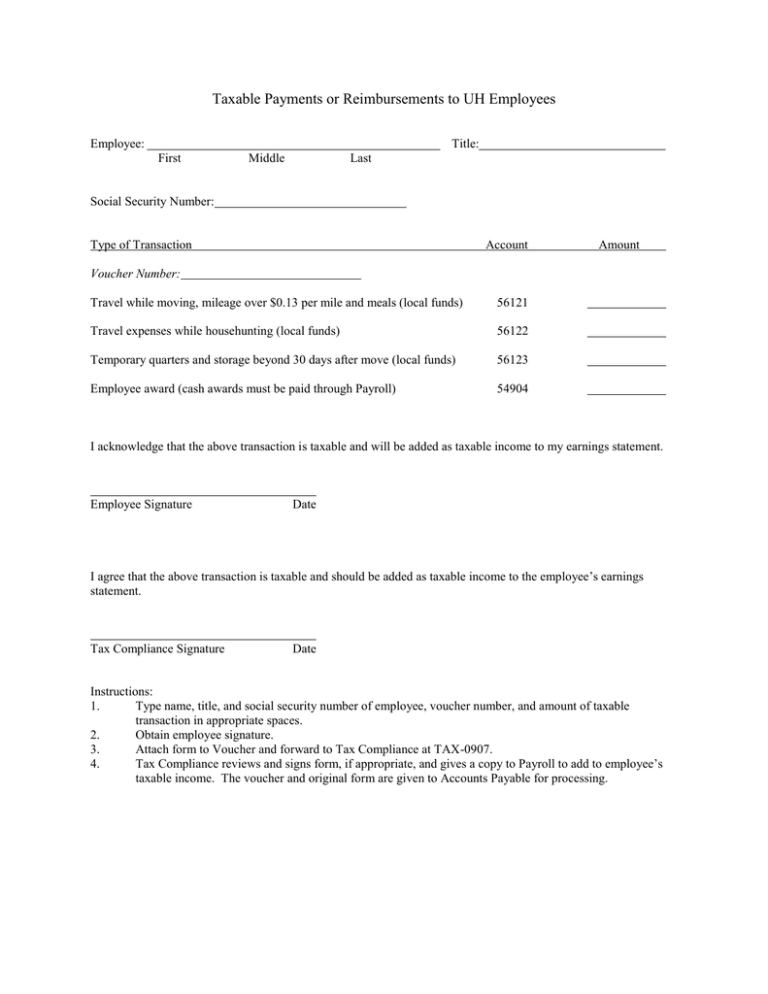

For example if an employee does not return excess amounts within a reasonable amount of time the excess amounts are taxable Because reimbursements Publication 525 2022 Taxable and Nontaxable Income Employer Provided Group Term Life Insurance Repaid wages subject to Additional Medicare Tax Year of deduction or

If the IRS determines a plan is nonaccountable all reimbursements will be transformed into taxable wages and will be subject to income tax for the employee as well as to employment tax for the Receipt cannot be generally classified as income In this scenario any reimbursement cannot be treated as income and therefore should not be subject to Income tax unless

Download Are Employee Reimbursements Taxable Income

More picture related to Are Employee Reimbursements Taxable Income

Filling Tax Form Tax Payment Financial Management Corporate Tax

https://static.vecteezy.com/system/resources/previews/025/022/782/original/filling-tax-form-tax-payment-financial-management-corporate-tax-taxable-income-concept-composition-with-financial-annual-accounting-calculating-and-paying-invoice-3d-rendering-png.png

Are Employee Reimbursements Taxable Divvy

https://getdivvy.com/wp-content/uploads/2020/09/Reimbursements-CTA-banner.png

Taxable And Nontaxable Income Lefstein Suchoff CPA Associates

http://bergencountycpa.com/blog/wp-content/uploads/2013/02/non-taxable-income.jpg

Our Solutions Resources Our Company Professional Partnerships Login Let s Get Started Employees who spend their own money on job related items may Currency conversion fees Public transportation Laundry dry cleaning suit pressing during business trips longer than five days

When an employer reimburses an employee under an accountable plan the reimbursement will not be considered the employee s salary or income Often the employer will be The employee does not have to account for these funds to the employer and as such the allowance is considered taxable income This should be recorded on the employee s W

Are SECA And Income Tax Reimbursements Taxable

https://static.wixstatic.com/media/5d88f9_aadee3f99348416fb26a465a8aced68d.jpg/v1/fill/w_1000,h_909,al_c,q_85,usm_0.66_1.00_0.01/5d88f9_aadee3f99348416fb26a465a8aced68d.jpg

Are QSEHRA Reimbursements Taxable

https://www.peoplekeep.com/hubfs/All Images/Featured Images/Are QSEHRA reimbursements taxable_featured.jpg#keepProtocol

https://blog.taxact.com/are-expense-reimburs…

Taxes 3 minute read File for less and get more Your max tax refund is guaranteed Get Started The IRS considers some employee benefits to be taxable income But do employee expense reimbursements fall into

https://bizfluent.com/info-11399744-reimbursable...

Published on 25 Oct 2018 Whether you run a small business or manage its finances it s essential that you understand the differences between reimbursable expenses and

Taxable Payments Or Reimbursements To UH Employees

Are SECA And Income Tax Reimbursements Taxable

What is taxable income Financial Wellness Starts Here

Budget 2023 Malaysia Income Tax Rate

What Is Taxable Income Explanation Importance Calculation Bizness

CA Income Tax Consultant In Pan India Company Rs 1000 session Infine

CA Income Tax Consultant In Pan India Company Rs 1000 session Infine

Are Expense Reimbursements Taxable Workest

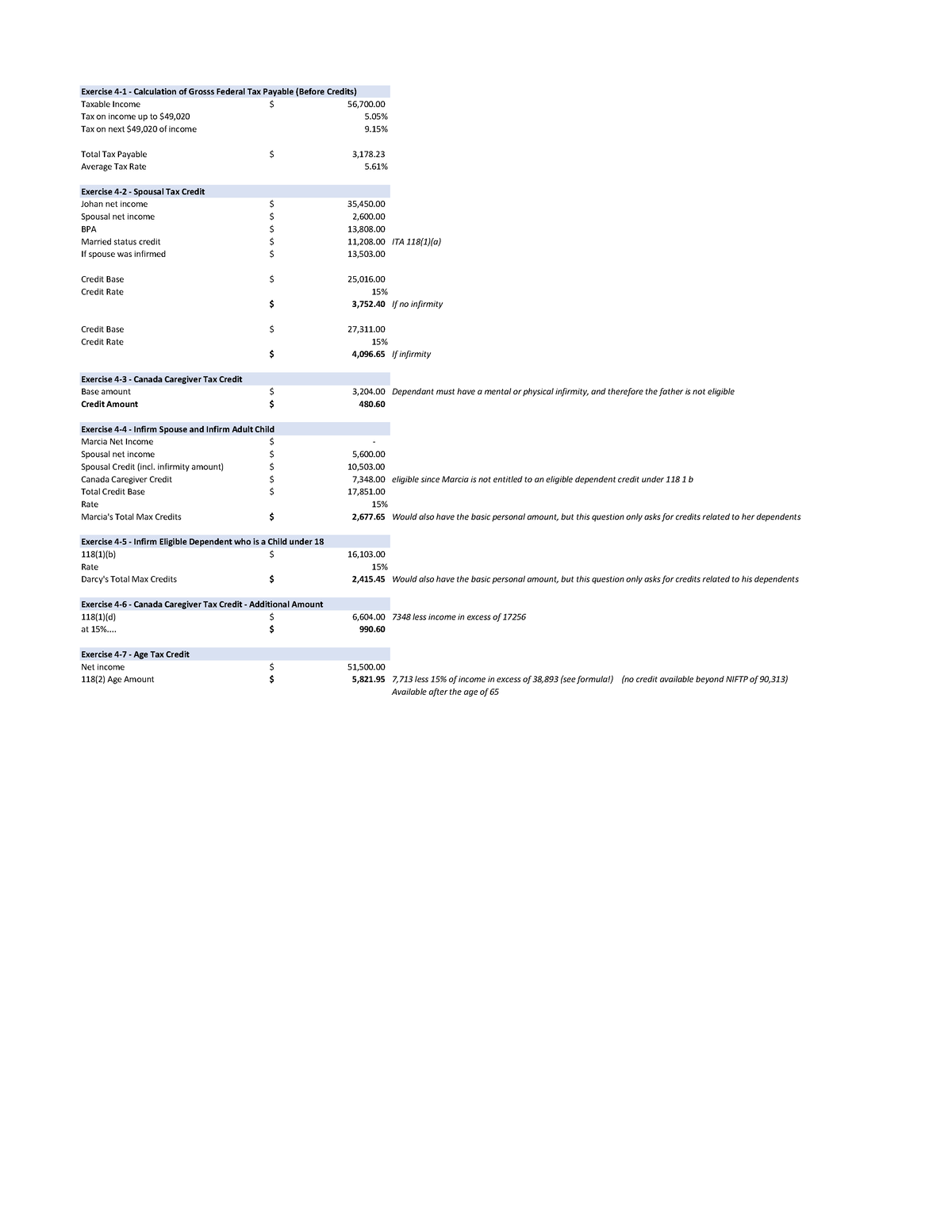

Chapter 4 Exercise Answers Taxable Income And Tax Payable For An

Are Health Insurance Reimbursements Taxable HealthPlanRate

Are Employee Reimbursements Taxable Income - If the IRS determines a plan is nonaccountable all reimbursements will be transformed into taxable wages and will be subject to income tax for the employee as well as to employment tax for the