Are Employees Tax Deductible As a business owner you can generally claim a tax deduction for the salaries and wages you pay to employees super contributions you make on time to a complying super

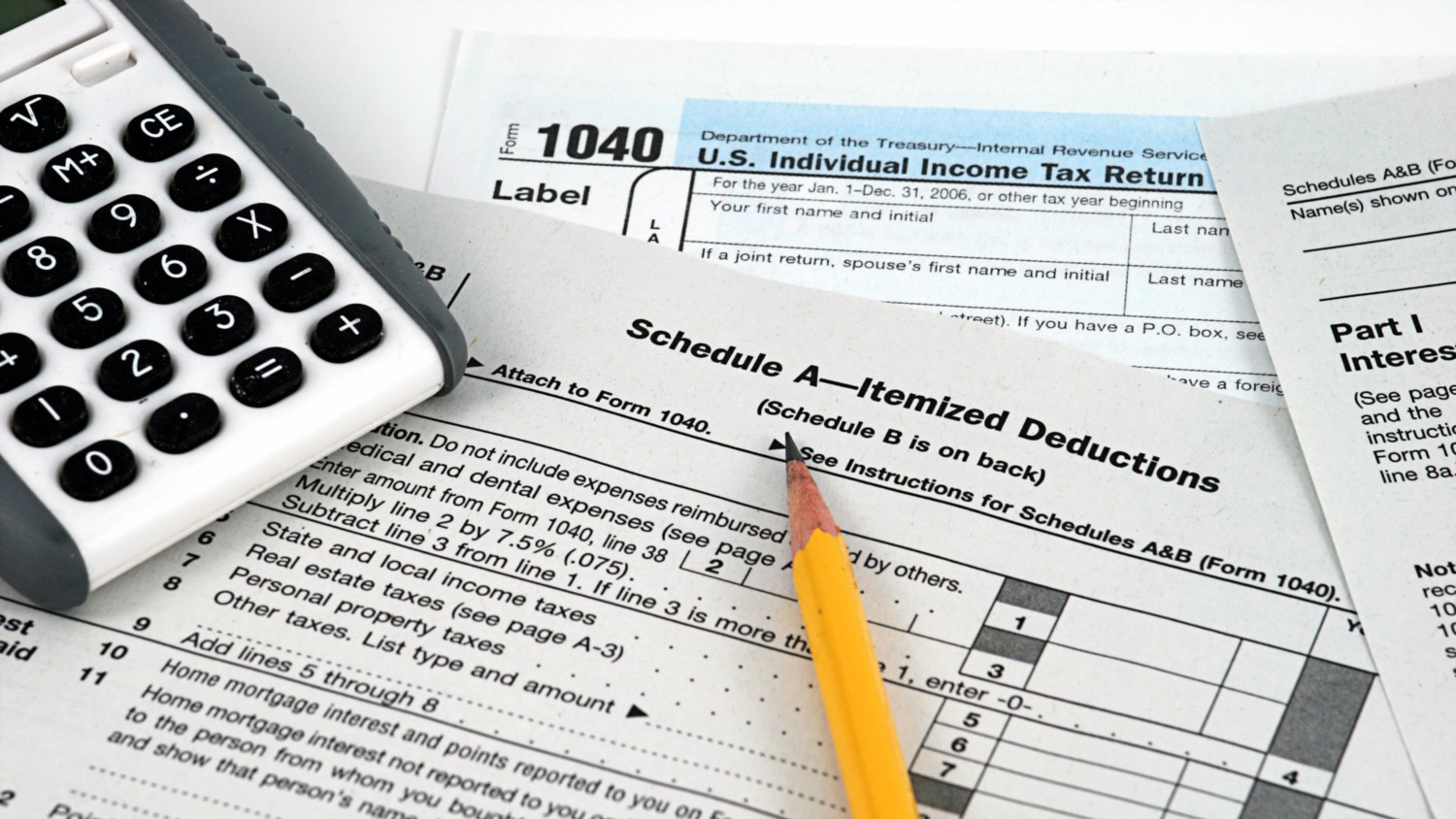

Are employer payroll taxes considered a business expense Yes employer payroll taxes are a business expense that you can deduct on your business taxes Employee wages are also a business Closing costs can be expensive but some are tax deductible Learn which closing costs are deductible when you file your taxes and how these deductions work

Are Employees Tax Deductible

Are Employees Tax Deductible

https://www.thesmithfamily.com.au/-/media/images/campaigns/tax-steps-infov2/Tax-page-infographicv2.png?h=2160&w=3840&la=en&hash=CD10B58E7976DC39CC2E07D255B005E2

Are The Benefits You Provide Your Employees Tax Deductible Benecaid

https://www.benecaid.com/wp-content/uploads/2017/03/Employee-Benefits-min-1024x684.jpg

Are Gifts For Employees Tax Deductible YouTube

https://i.ytimg.com/vi/xaKa5hu2iU8/maxresdefault.jpg

Find out if you re eligible to claim tax relief If you re eligible you ll be able to claim tax relief on your job expenses by post If you complete a Self Assessment tax return you must claim Payments made to a simplified employee pension SEP individual retirement account IRA are tax deductible for employers or the self employed but there is an annual limit on

Tax benefits for both employers and employees who contribute to a 401k employers can receive tax credits and savings for matches and employees can claim tax The government is ensuring that tax that is owed is paid by introducing the most ambitious ever package to close the tax gap raising 6 5 billion in additional tax revenue per

Download Are Employees Tax Deductible

More picture related to Are Employees Tax Deductible

Tax Deduction Letter Sign Templates Jotform

https://files.jotform.com/jotformapps/tax-deduction-letter-ba34c1cde26cab2d0fb9bbcbf35ce8d5_og.png

Tax Prep Checklist Tracker Printable Tax Prep 2022 Tax Checklist Tax

https://i.etsystatic.com/31990504/r/il/22f689/3639280950/il_fullxfull.3639280950_fitj.jpg

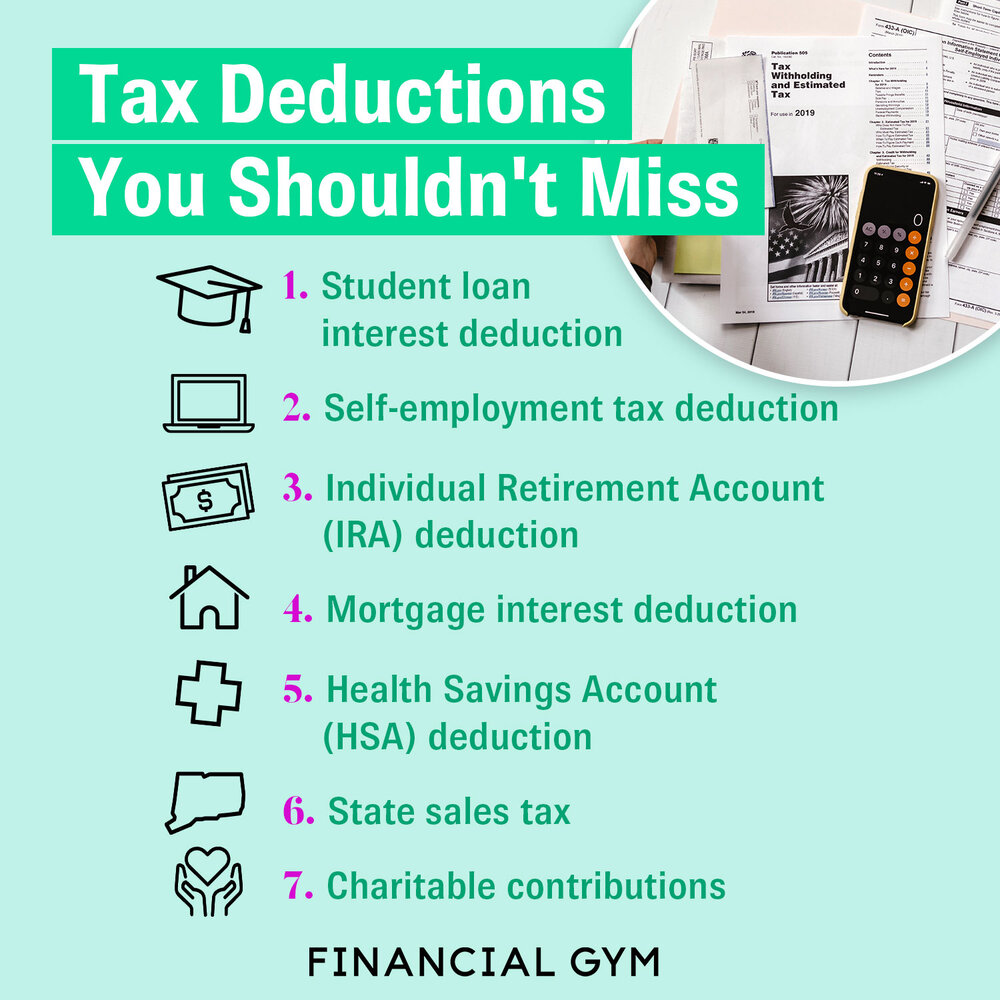

Tax Deductions Write Offs To Save You Money Financial Gym

https://images.squarespace-cdn.com/content/v1/5a1efe26914e6b83e9456629/1582581779280-IL3MNWGKUNKHXL5A4790/TFG_IG-post_7-Tax-Deductions-You-Shouldn't-Miss.jpg?format=1000w

Over the counter nicotine patches are not tax deductible Volunteer related expenses The hourly rate for time spent helping can t be deducted but unreimbursed items volunteers spent Employer s Quarterly Federal Tax Return Form W 2 Employers engaged in a trade or business who pay compensation Form 9465 For family coverage in tax year 2025

While employers often incorrectly assume gifts to employees and even to other service providers such as independent contractors hereafter collectively referenced as The costs of benefits you give to employees such as gifts and health plans are deductible as expenses on your business tax return That sounds easy but it s not because

Corporation Prepaid Insurance Tax Deduction Financial Report

https://i2.wp.com/www.patriotsoftware.com/wp-content/uploads/2019/12/business-tax-credit-vs-tax-deduction-visual.jpg

School Supplies Are Tax Deductible Wfmynews2

https://media.wfmynews2.com/assets/WFMY/images/181276e9-96af-4e3f-b43a-1cdd1d198fdc/181276e9-96af-4e3f-b43a-1cdd1d198fdc_1920x1080.jpg

https://www.ato.gov.au › businesses-and...

As a business owner you can generally claim a tax deduction for the salaries and wages you pay to employees super contributions you make on time to a complying super

https://www.fool.com › ... › employer-p…

Are employer payroll taxes considered a business expense Yes employer payroll taxes are a business expense that you can deduct on your business taxes Employee wages are also a business

Can You Deduct Unreimbursed Employee Expenses In 2022

Corporation Prepaid Insurance Tax Deduction Financial Report

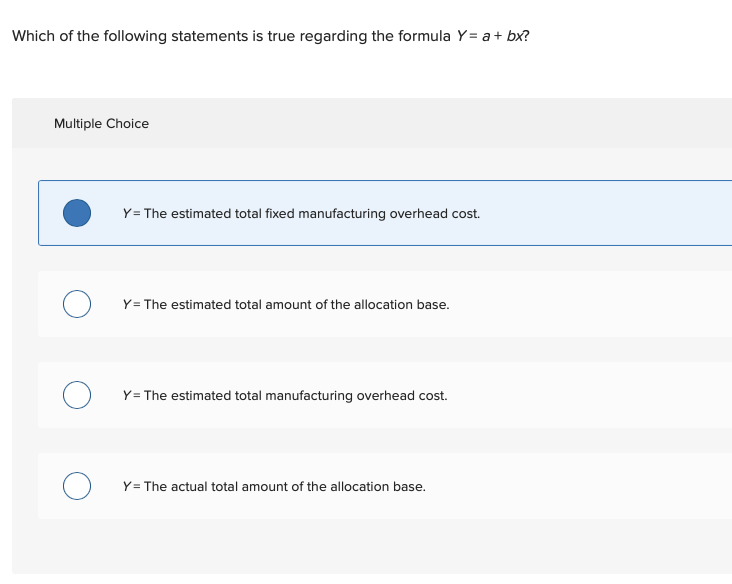

Solved Which Of The Following Statements Is True Regarding Chegg

Freelance Accounting Personal Tax Services

Are Closing Costs Tax Deductible Under The New Tax Law PNWR

Section 194D 2022 Guide On Section 194D Of The Income Tax Act

Section 194D 2022 Guide On Section 194D Of The Income Tax Act

Tax Reduction Company Inc

Tax Deductible Means It s Cheaper But You re Not Getting It For Free

7 Easy Ways To Save On Your Taxes This Year Ways To Save Money

Are Employees Tax Deductible - Payments made to a simplified employee pension SEP individual retirement account IRA are tax deductible for employers or the self employed but there is an annual limit on