Are Employer Hsa Contributions Tax Deductible The employee cannot deduct employer contributions on his or her federal income tax return Instead employer funded HSA contributions are exempt from federal income

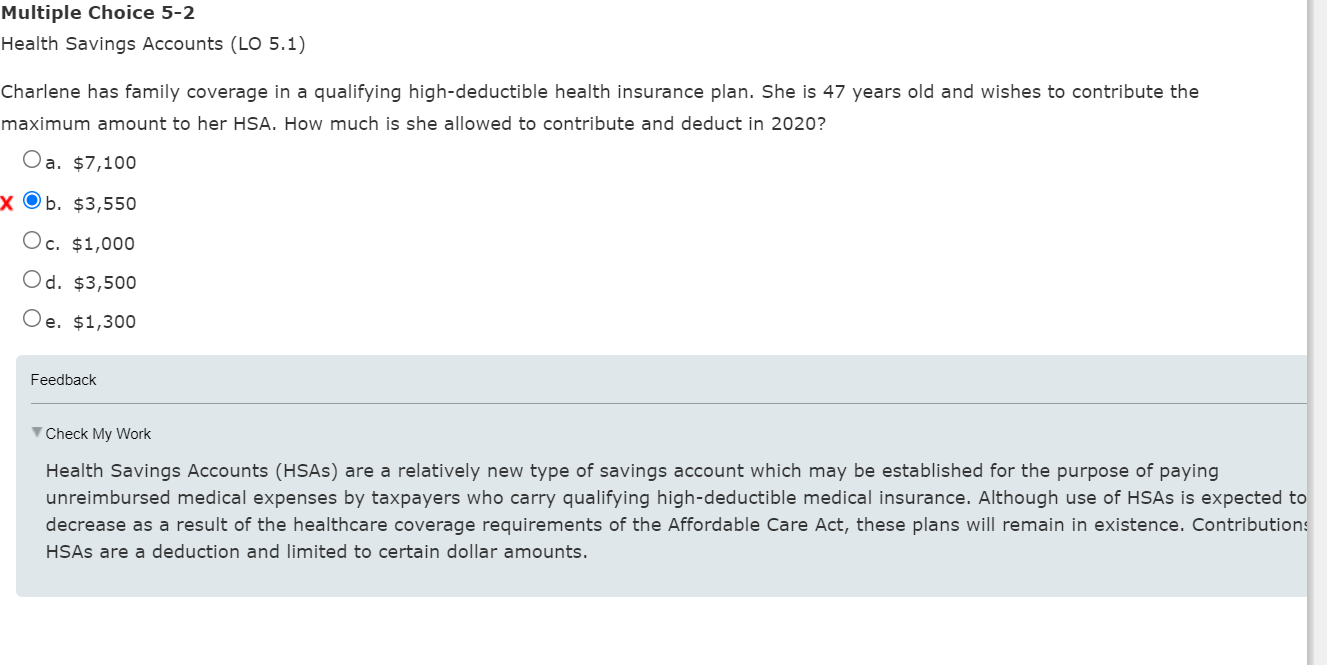

Contributing to a health savings account HSA allows you to pay for qualified medical expenses with tax free dollars If you have an HSA through an employer you can make Contributions to an HSA are tax deductible For employer sponsored plans the contributions are deducted from paychecks If you re self employed the deductions can be taken when your

Are Employer Hsa Contributions Tax Deductible

Are Employer Hsa Contributions Tax Deductible

https://blog.threadhcm.com/hs-fs/hubfs/HSA Contribution Limits Table.png?width=1024&name=HSA Contribution Limits Table.png

Max Hsa Contribution 2024 Family Deductions Audi Marena

https://medcombenefits.com/images/uploads/blog/2023_HSA_Limits_Table.jpg

Solved B Examine Your Sample Simulation And Give An Chegg

https://media.cheggcdn.com/media/276/27682696-637d-4030-8e93-bbac02436c02/phpDvcmzv

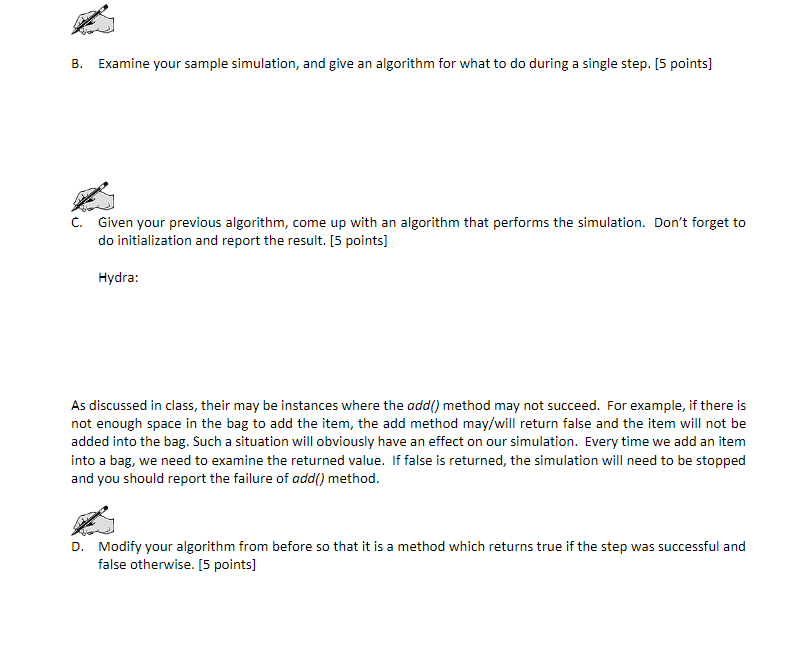

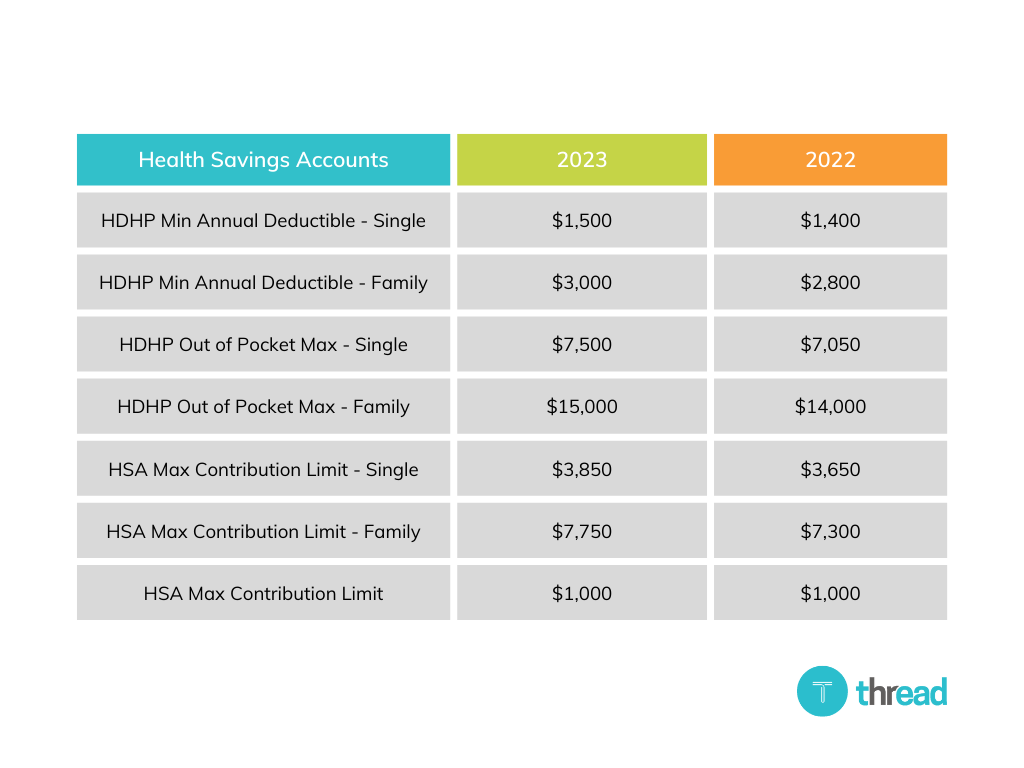

The employer must treat all employees equally providing a flat dollar amount for the contribution or a percentage of the deductible for family and single plans If an However employees who are age 55 and older can take advantage of additional catch up contributions and add 1 000 per year to their HSA HSAs are a unique health benefit option with triple tax advantages Tax

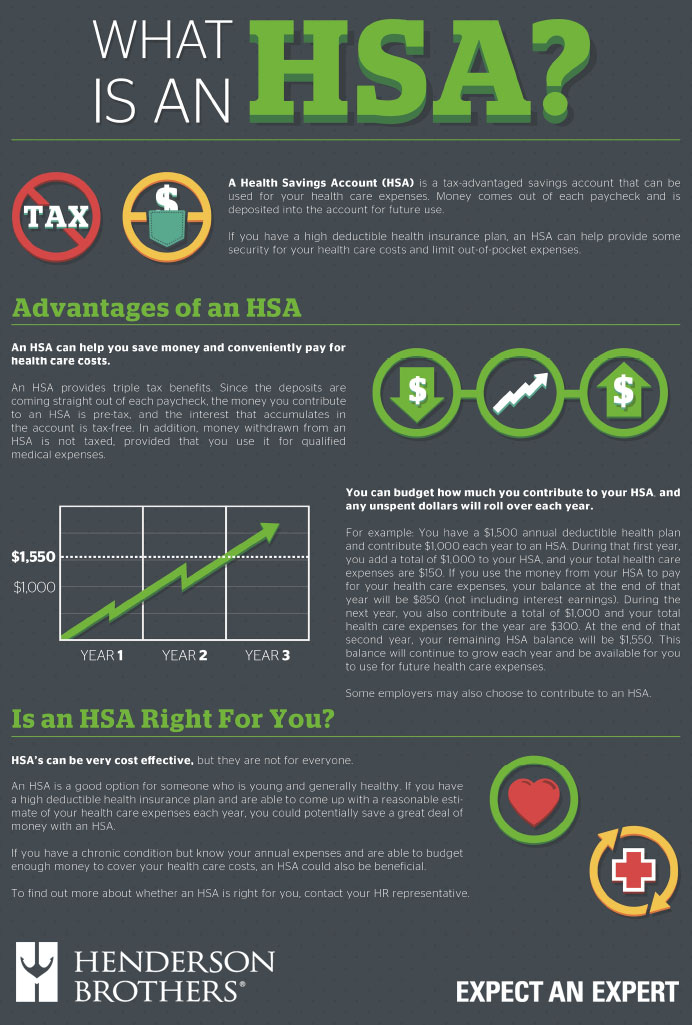

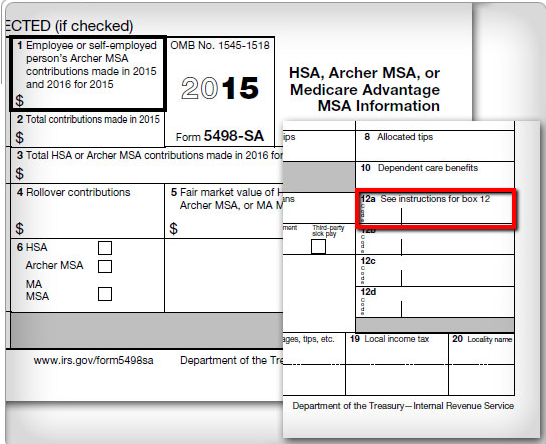

Generally contributions made by an employer to the health savings account HSA of an eligible employee are excludable from an employee s income and are not subject to You won t get a tax deduction for your employer s contributions the amount your employer contributes will reduce what you can contribute for the year and employer

Download Are Employer Hsa Contributions Tax Deductible

More picture related to Are Employer Hsa Contributions Tax Deductible

Solved Multiple Choice 5 2 Health Savings Accounts LO 5 1 Chegg

https://media.cheggcdn.com/media/fe6/fe6cf4f9-c3e3-4770-baf5-d7f0f7bc1463/phpgsLCY8

HSAs Health Savings Accounts Henderson Brothers

http://www.hendersonbrothers.com/wp-content/uploads/2017/09/HSA-inforgraphic.jpg

2023 HSA Contribution Limits Increase Considerably Due To Inflation

https://www.wexinc.com/wp-content/uploads/2022/05/ContributionLimitsChart_Blog_SupplementalGraphic_2023-1-1024x768.jpg

Your contributions to an employee s HSA are not included in their gross income and are exempt from taxation however all employer contributions and pre tax employee Personal HSA contributions are tax deductible for the year in which the contributions are made Since employer contributions are not counted as part of an employee s income

No tax is levied on contributions to an HSA the HSA s earnings or distributions used to pay for qualified medical expenses An HSA while owned by an employee can be funded by the Employer contributions to an HSA are not considered income so they re not subject to income tax or payroll tax

How Do Employer Contributions Affect My HSA Limit HSA Edge

https://hsaedge.com/wp-content/uploads/2016/09/W2_HSA_employer_contributions_box_12.png

Health Savings Accounts Contribution Limits Eligibility Rules Benefits

https://hackyourwealth.com/wp-content/uploads/2018/05/HSA-rules-and-strategies.jpg

https://www.thetaxadviser.com/issues/2017/jul/...

The employee cannot deduct employer contributions on his or her federal income tax return Instead employer funded HSA contributions are exempt from federal income

https://www.goodrx.com/insurance/fsa-hsa/tax...

Contributing to a health savings account HSA allows you to pay for qualified medical expenses with tax free dollars If you have an HSA through an employer you can make

Health Savings Account HSA

How Do Employer Contributions Affect My HSA Limit HSA Edge

[img_title-10]

[img_title-11]

[img_title-12]

[img_title-13]

[img_title-13]

[img_title-14]

[img_title-15]

[img_title-16]

Are Employer Hsa Contributions Tax Deductible - Are HSA contributions tax deductible In short contributions to an HSA made by you or your employer may be claimed as tax deductions even if you don t itemize deductions