Are Employer Paid Health And Dental Benefits Taxable In Quebec This guide contains information on the benefits most frequently provided to employees It indicates whether the value of a benefit must be included in the income of the employee

Outside of Quebec employer paid premiums for health insurance benefits like prescription drug coverage eye and dental care are not taxable In Quebec they This guide is for employers who provide their employees with benefits and allowances See the guide to determine if the benefit or allowance is taxable and the necessary reporting

Are Employer Paid Health And Dental Benefits Taxable In Quebec

Are Employer Paid Health And Dental Benefits Taxable In Quebec

https://www.infinitiofraleigh.com/static/group-crossroads-auto-group/HR/Normal_Health_Benefits__1900___900_px_.png

When Is Dental Insurance Worth The Investment

https://image.cnbcfm.com/api/v1/image/105764976-1551295334859visit-to-the-dentist-drilling-machine-medicine-health-medical-hospital-care-professional-dentistry_t20_avllpv2.jpg?v=1551295411

The Health Board Will Contact patients Whose Appointment Needs To Be

https://www.deeside.com/wp-content/uploads/2022/09/Screenshot-2022-09-13-at-17.32.22.jpg

Contributions or premiums paid by a former or retired employee to a private health services plan that covers for example medical or dental costs do not constitute a Quebec taxable benefits 2021 rates The purpose of this notice is to inform you of the 2021 Quebec taxable benefits calculations for the Public Service Dental Care Plan

For the purpose of provincial income tax life insurance contributions and health insurance contributions constitute taxable benefits Revenu Qu bec MRQ requires that all Quebec taxable benefits 2022 rates The purpose of this notice is to inform you of the 2022 Quebec taxable benefits calculations for the Public Service Dental Care Plan

Download Are Employer Paid Health And Dental Benefits Taxable In Quebec

More picture related to Are Employer Paid Health And Dental Benefits Taxable In Quebec

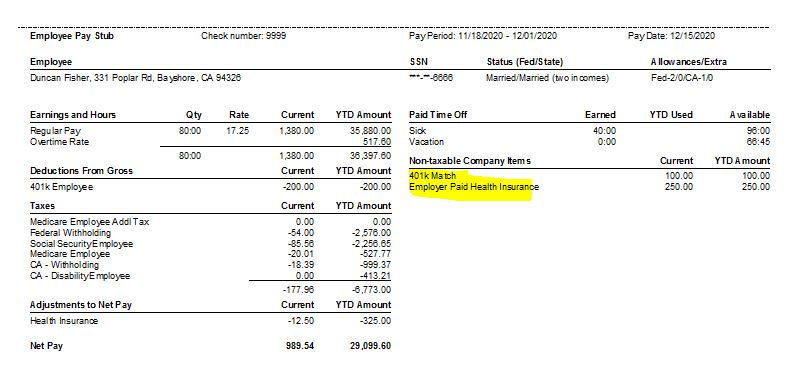

Employer Paid Healthcare On Paystub

https://quickbooks.intuit.com/learn-support/image/serverpage/image-id/63028i7EFEE2B90A17F91D?v=v2

Are Health And Dental Benefits Taxable In Canada HealthQuotes

https://healthquotes.ca/wp-content/uploads/2023/06/are-health-and-dental-benefits-taxable-in-canada-1024x684.jpg

Podium Product Stand With White Teeth Toothbrush And Toothpaste Tube

https://static.vecteezy.com/system/resources/thumbnails/012/069/646/original/podium-product-stand-with-white-teeth-toothbrush-and-toothpaste-tube-for-product-presentation-isolated-on-pink-background-in-concept-of-oral-health-and-dental-care-and-oral-care-3d-rendering-video.jpg

The employer portion of health and dental premiums is included in the tax base for Quebec To assist plan sponsors the following table illustrates the income tax treatment Often this appears in the form of a health and dental benefit plan which is not covered by the government and can be paid out tax free to employees A plan will

Life Accidental Death Dismemberment AD D and Critical Illness premiums are considered taxable benefits when paid by the employer as any benefits Since 1993 employer contributions toward some group insurance plans including health and dental are considered a taxable benefit for employees and pensioners who reside

7 Lessons I Learned From An Accidental Millionaire

http://www.danieledelnero.com/wp-content/uploads/2020/07/types-of-employee-benefits-and-perks-2060433-Final-65c1c14d22de4e10b4f4ea85af6bd187.png

Types Of Employee Benefits 12 Benefits HR Should Know 2023

https://www.aihr.com/wp-content/uploads/Employee-Benefits.png

https://www.revenuquebec.ca/en/online-services/...

This guide contains information on the benefits most frequently provided to employees It indicates whether the value of a benefit must be included in the income of the employee

https://www.sunlife.ca/en/group/benefits/employee...

Outside of Quebec employer paid premiums for health insurance benefits like prescription drug coverage eye and dental care are not taxable In Quebec they

Dental Benefits 101 Common Dental Insurance Terms Explained

7 Lessons I Learned From An Accidental Millionaire

Dental Insurance Solid Health Insurance

New US Health Insurance Laws Create Legal Risk For Employers Bloomberg

Knowing Your Dental Insurance Plan Ottawa Life Insurance

What Does It Mean To Have Your Total Financial House In Order

What Does It Mean To Have Your Total Financial House In Order

Dental Health And Dental Care Logo Graphic By Mujiyono Creative Fabrica

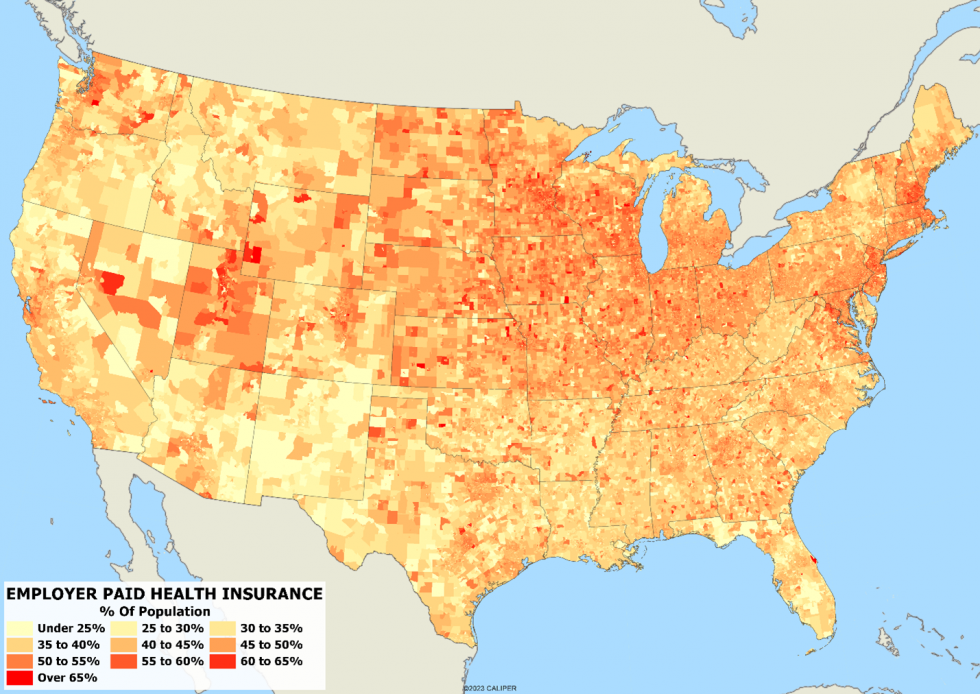

Health Insurance Coverage Applied Geographic Solutions

Videos Adding Dental Benefits To Your Health Plan

Are Employer Paid Health And Dental Benefits Taxable In Quebec - Contributions or premiums paid by a former or retired employee to a private health services plan that covers for example medical or dental costs do not constitute a