Are Energy Saving Home Improvements Tax Deductible The Inflation Reduction Act amended the credit to be worth up to 1 200 per year for qualifying property placed in service on or after January 1 2023 and before January 1 2033 and gave it a new name the Energy Efficient Home Improvement Credit

Through December 31 2022 the energy efficient home improvement credit is a 500 lifetime credit As amended by the IRA the energy efficient home improvement credit is increased for years after 2022 with an annual credit of generally up to 1 200 Announcement 2024 19 provides that amounts received from the Department of Energy DOE home energy rebate programs funded through the IRA will be treated as a reduction in the purchase price or cost of

Are Energy Saving Home Improvements Tax Deductible

Are Energy Saving Home Improvements Tax Deductible

https://genstone.com/wp-content/uploads/2018/10/How-to-Make-Your-Home-More-Energy-Efficient-Infographic-1920x4145.jpg

5 Home Improvements That Boost Your Home s Energy Efficiency

https://www.rogersroofing.com/wp-content/uploads/2017/07/image.jpg

Are Home Improvements Tax Deductible Home Logic

https://www.homelogic.co.uk/wp-content/uploads/2017/04/are-home-improvements-tax-deductible-2.jpg

The energy efficient home improvement credit for 2023 is 30 of eligible expenses up to a maximum of 3 200 You can only claim expenses made in 2023 on your 2024 return Which projects Making Our Homes More Efficient Clean Energy Tax Credits for Consumers UPDATED JULY 2024 Visit our Energy Savings Hub to learn more about saving money on home energy upgrades clean vehicles and more Q

You may claim the energy efficient home improvement credit for improvements to your main home where you live most of the time Your home must be in the U S and it must be an existing home that you improve or add onto The energy efficient home improvement credit is allowed to offset regular income tax reduced by the foreign tax credit plus alternative minimum tax Sec 26 a Energy efficient building envelope components

Download Are Energy Saving Home Improvements Tax Deductible

More picture related to Are Energy Saving Home Improvements Tax Deductible

Energy Saving Home Improvements Increase Efficiency Move IQ

https://www.moveiq.co.uk/wp-content/uploads/2021/01/Energy-Saving-Home-Improvements-scaled.jpg

Blog Carbon Valley Home Services Firestone Frederick Etc Handyman

http://carbonvalleyhome.com/wp-content/uploads/2016/01/Home-energy-efficiency.jpg

Are Home Improvements Tax Deductible Capital One

https://ecm.capitalone.com/WCM/learn-grow/card/lgc986_hero_are-home-improvements-tax-deductible_v1.jpg

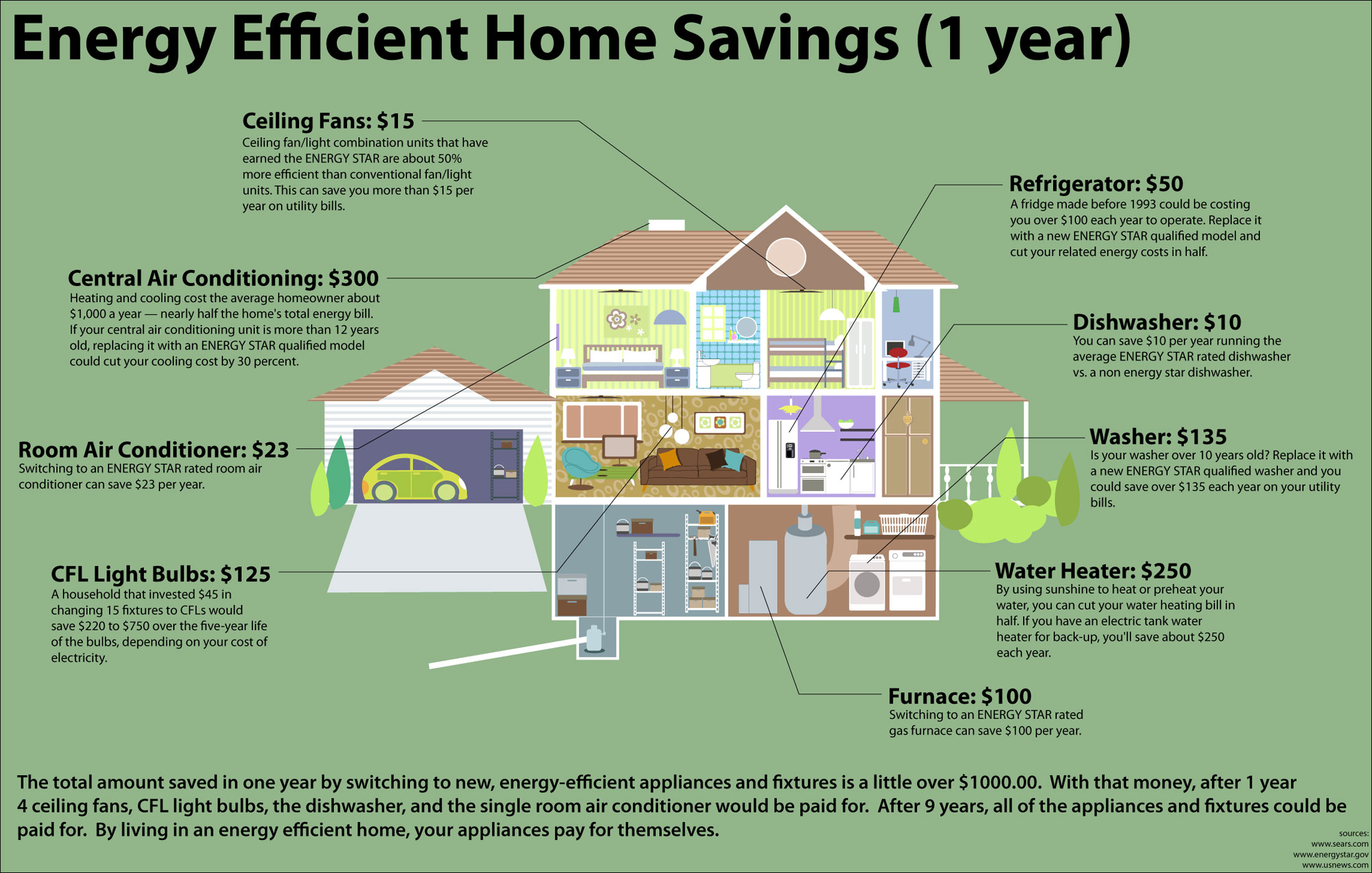

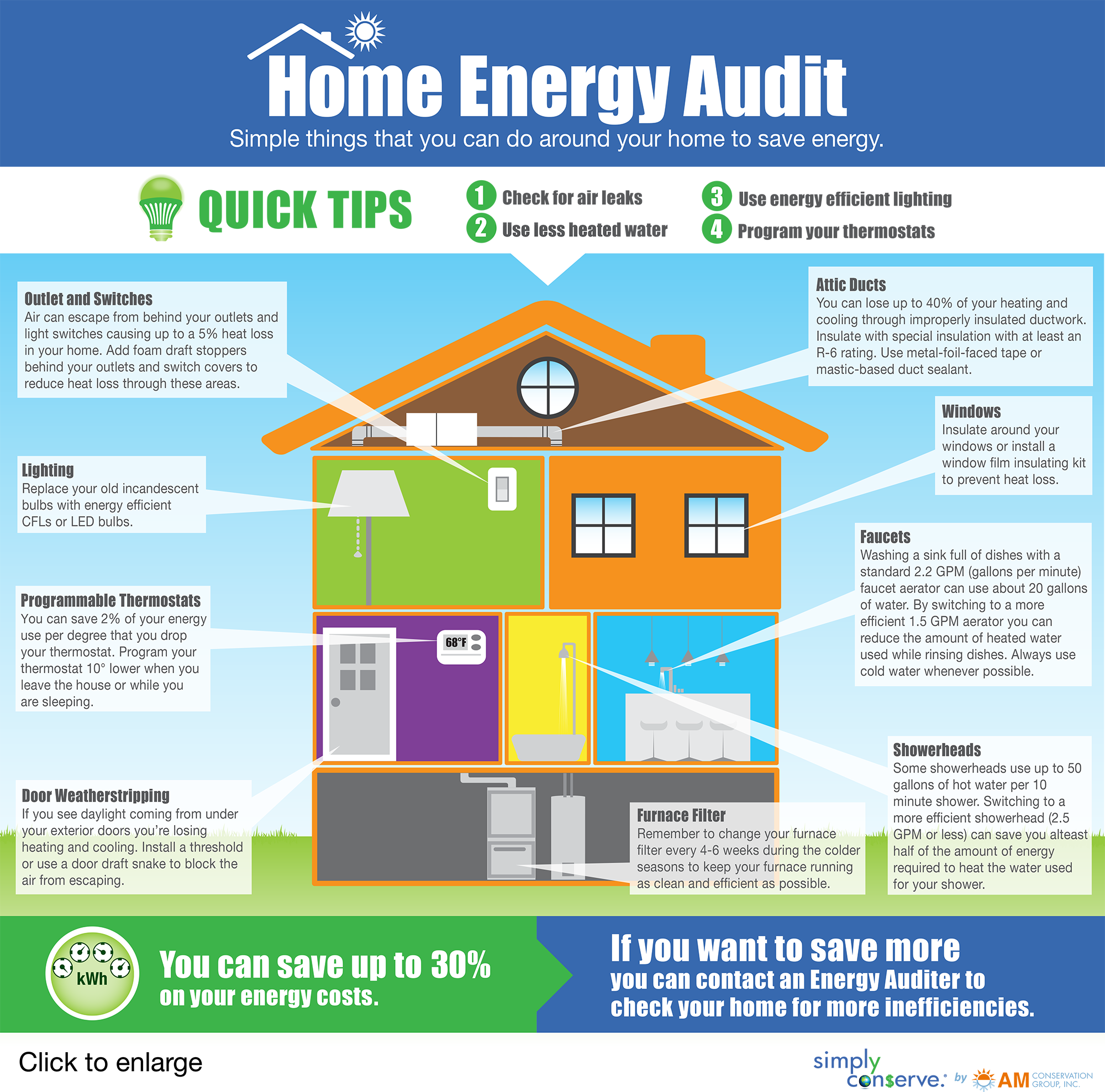

Home improvements add value style and safety to your home but most home improvements do not qualify for tax deductions There are a few exceptions such as energy efficiency So if you made any qualifying home improvements to your primary residence after December 31 2021 you may be eligible to claim them on your taxes when you file for 2022 The federal tax credits for energy efficiency were extended as part of the Inflation Reduction Act IRA of 2022

Beginning with the 2023 tax year tax returns filed now in early 2024 the credit is equal to 30 of the costs for all eligible home improvements made during the year It is also expanded to A home energy assessment can help you determine the best path Identify areas in your home you should prioritize upgrading in order to save energy and lower your utility bill Home energy assessments are also eligible for a

What Home Improvements Are Tax Deductible

https://www.serviceseeking.com.au/blog/wp-content/uploads/2019/11/service-seeking-au-what-home-improvement-tax-deductible.jpg

5 Tax Deductible Home Improvements And Repairs

https://www.budgetdumpster.com/blog/wp-content/uploads/2017/03/home-improvements-tax-deductions.jpg

https://turbotax.intuit.com › tax-tips › home...

The Inflation Reduction Act amended the credit to be worth up to 1 200 per year for qualifying property placed in service on or after January 1 2023 and before January 1 2033 and gave it a new name the Energy Efficient Home Improvement Credit

https://www.irs.gov › credits-deductions › frequently...

Through December 31 2022 the energy efficient home improvement credit is a 500 lifetime credit As amended by the IRA the energy efficient home improvement credit is increased for years after 2022 with an annual credit of generally up to 1 200

Tax Deductible Home Improvements Maplewood Plumbing

What Home Improvements Are Tax Deductible

Are Home Improvements Tax Deductible Rayne Water

Home Energy Improvements Heating Cooling

Are Home Improvements Tax Deductible Evergreen Realty

Tax Deductible Home Improvements For 2021 Budget Dumpster

Tax Deductible Home Improvements For 2021 Budget Dumpster

Are Home Improvements Tax Deductible LendingTree

Neighbors Embrace Relief Foundation

Are Home Improvements Tax Deductible Banks

Are Energy Saving Home Improvements Tax Deductible - You may claim the energy efficient home improvement credit for improvements to your main home where you live most of the time Your home must be in the U S and it must be an existing home that you improve or add onto