Are Expense Reimbursements Taxable In California Which work related expenses are reimbursable in California California law only requires reimbursement of expenses that are necessary to perform your work duties Your

Keep in mind that some states like California and Illinois require employers to reimburse employees reasonable work related expenses Make sure that you understand and follow the applicable California employees have an explicit right to be reimbursed for business related expenses such as equipment materials training business travel and uniforms

Are Expense Reimbursements Taxable In California

Are Expense Reimbursements Taxable In California

https://www.flokzu.com/wp-content/uploads/2016/03/Workflow_Expense_Report.png

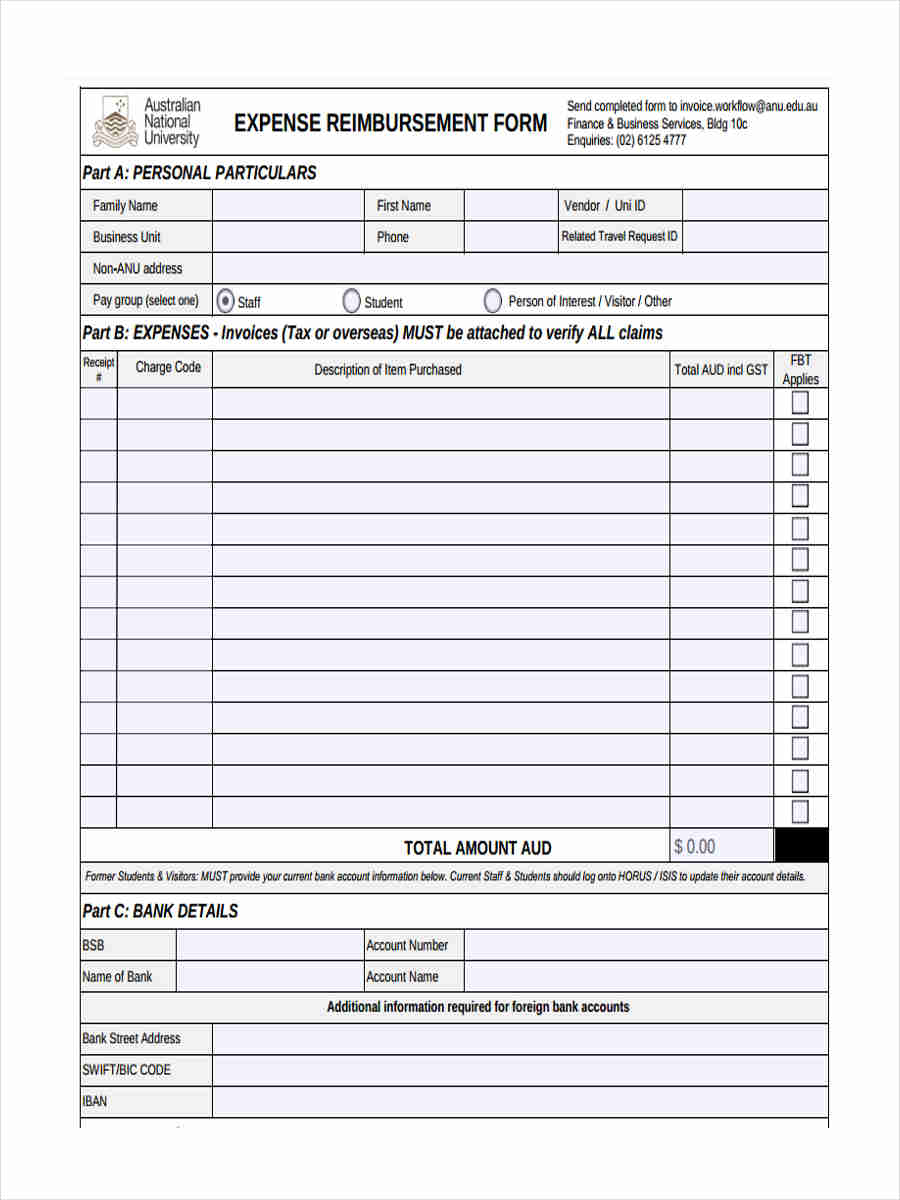

Reimbursement Of Personal Funds Spent For Travel Expenses

https://www.fec.gov/resources/cms-content/images/Travel_reimbursement_fe308.original.jpg

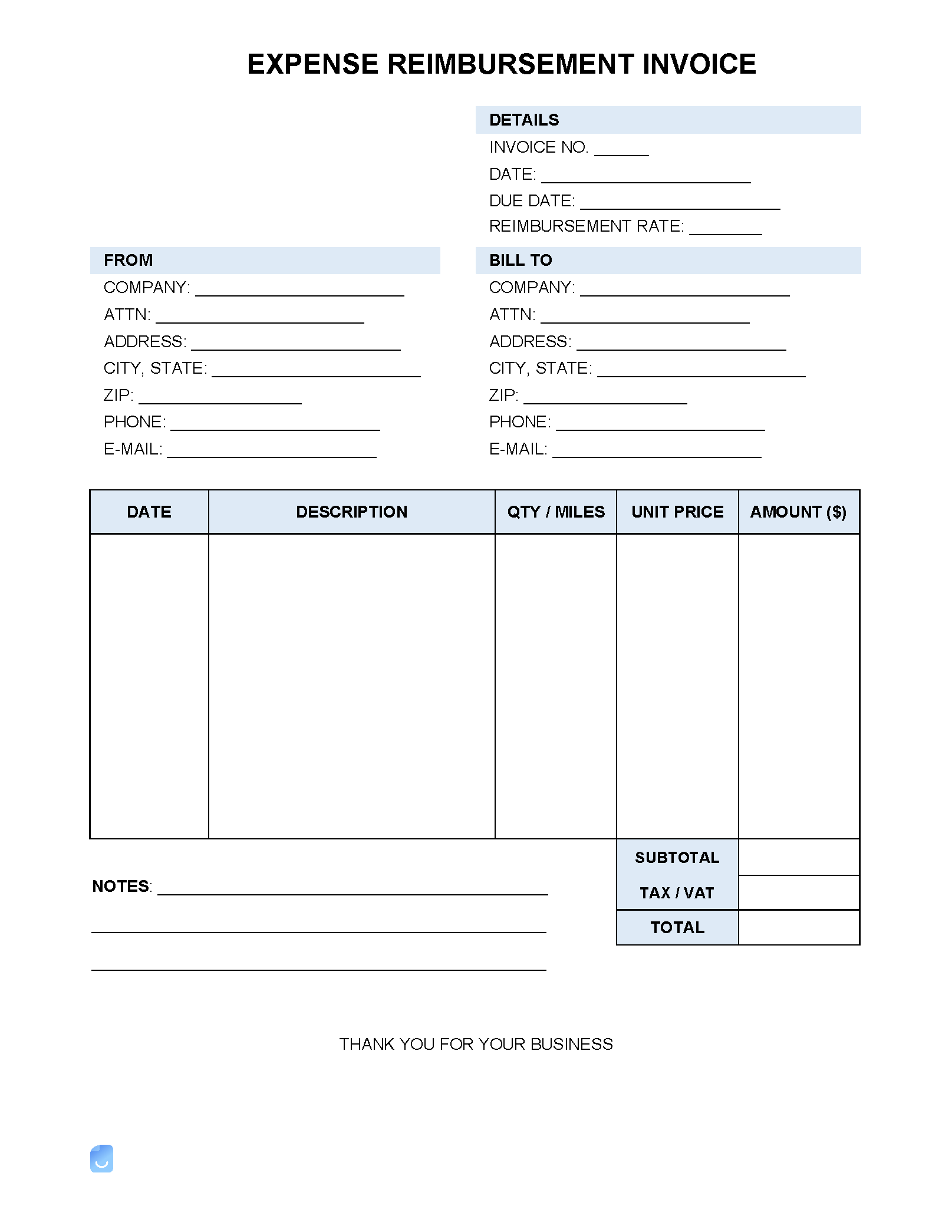

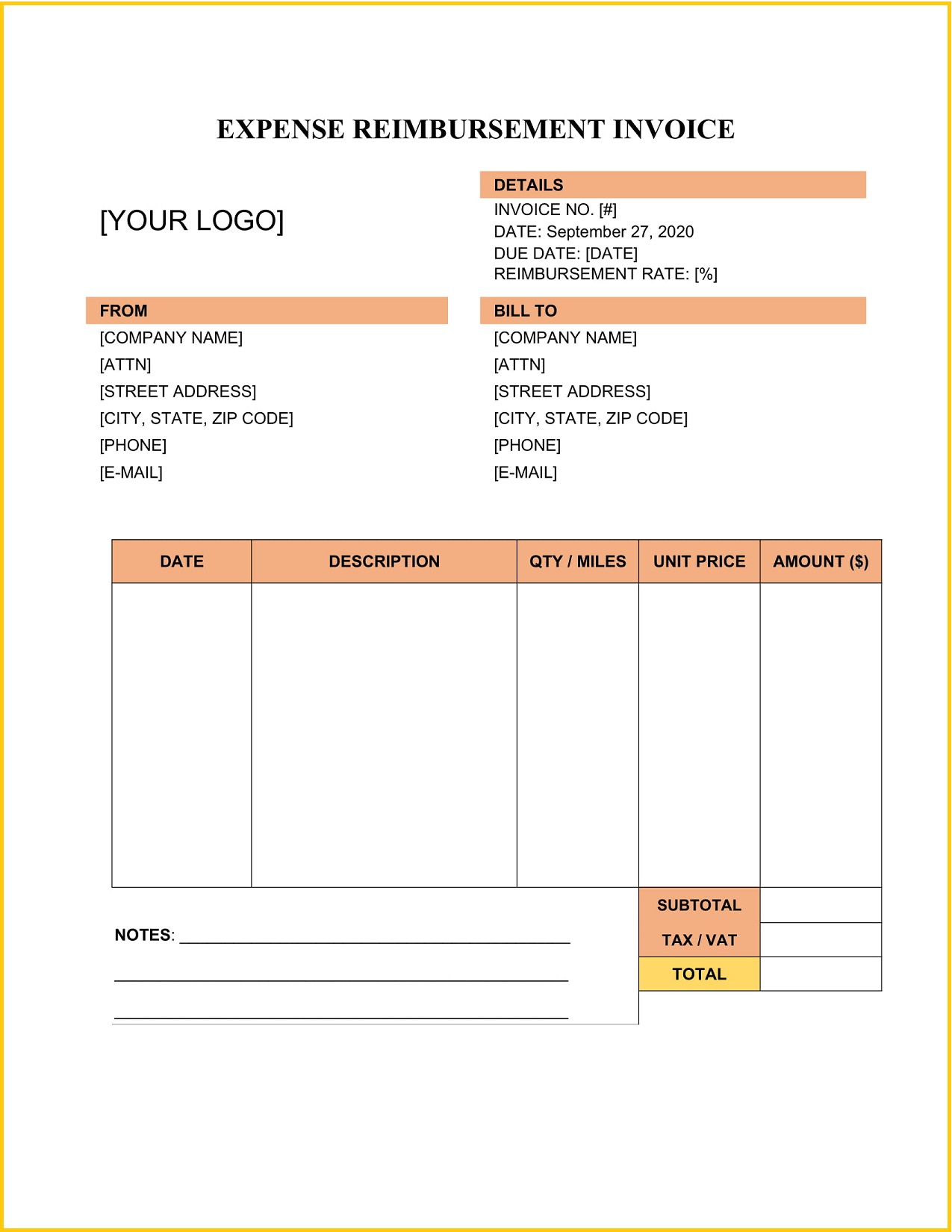

Expense Reimbursement Invoice Template Invoice Maker

https://im-next-wp-prod.s3.us-east-2.amazonaws.com/uploads/2022/11/Expense-Reimbursement-Invoice-Template.png

California labor laws trump employer policies employers cannot require an employee to pay out of pocket for any costs incurred while performing their jobs Typically an employee is expected to submit an expense California Labor Code section 2802 requires employers to reimburse employees for all necessary expenditures or losses incurred in discharging their duties The statute is

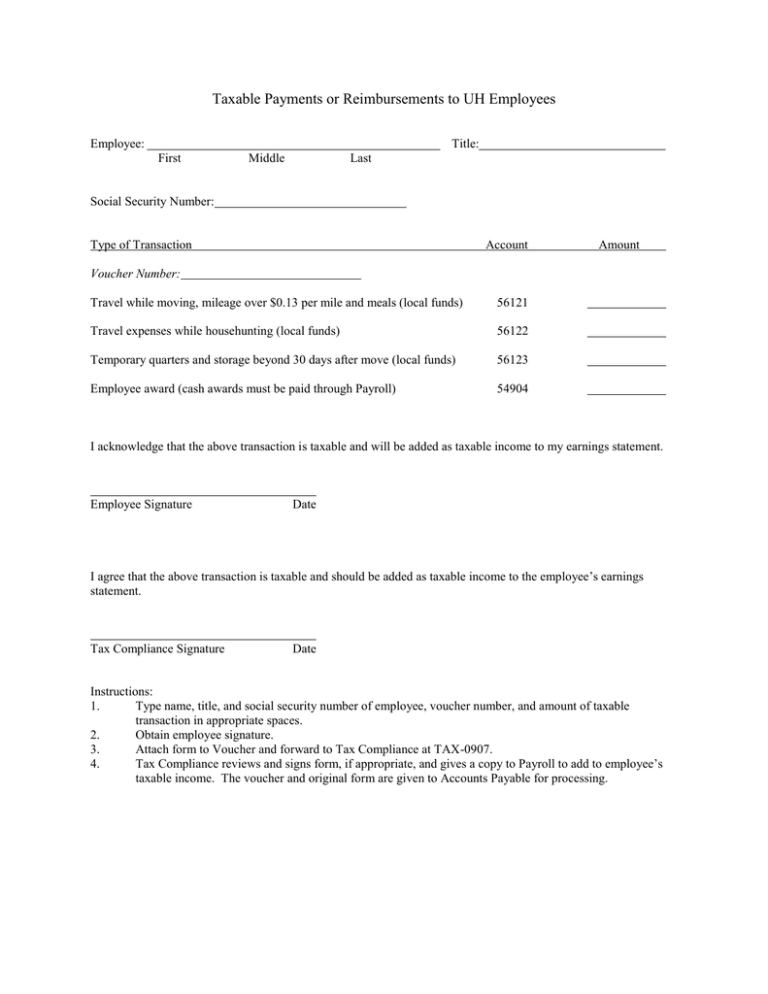

Are reimbursements taxable for the employee Generally speaking employees are not required to report reimbursements as income or wages and therefore are not taxable Benefits are generally included in the employee s wage for tax purposes except those benefits that qualify for exclusion A table describing the taxability of common employee

Download Are Expense Reimbursements Taxable In California

More picture related to Are Expense Reimbursements Taxable In California

Mileage Reimbursement Form Excel Excel Templates

https://www.wordexceltemplates.com/wp-content/uploads/2017/08/Travel-expense-reimbursement-form.jpg

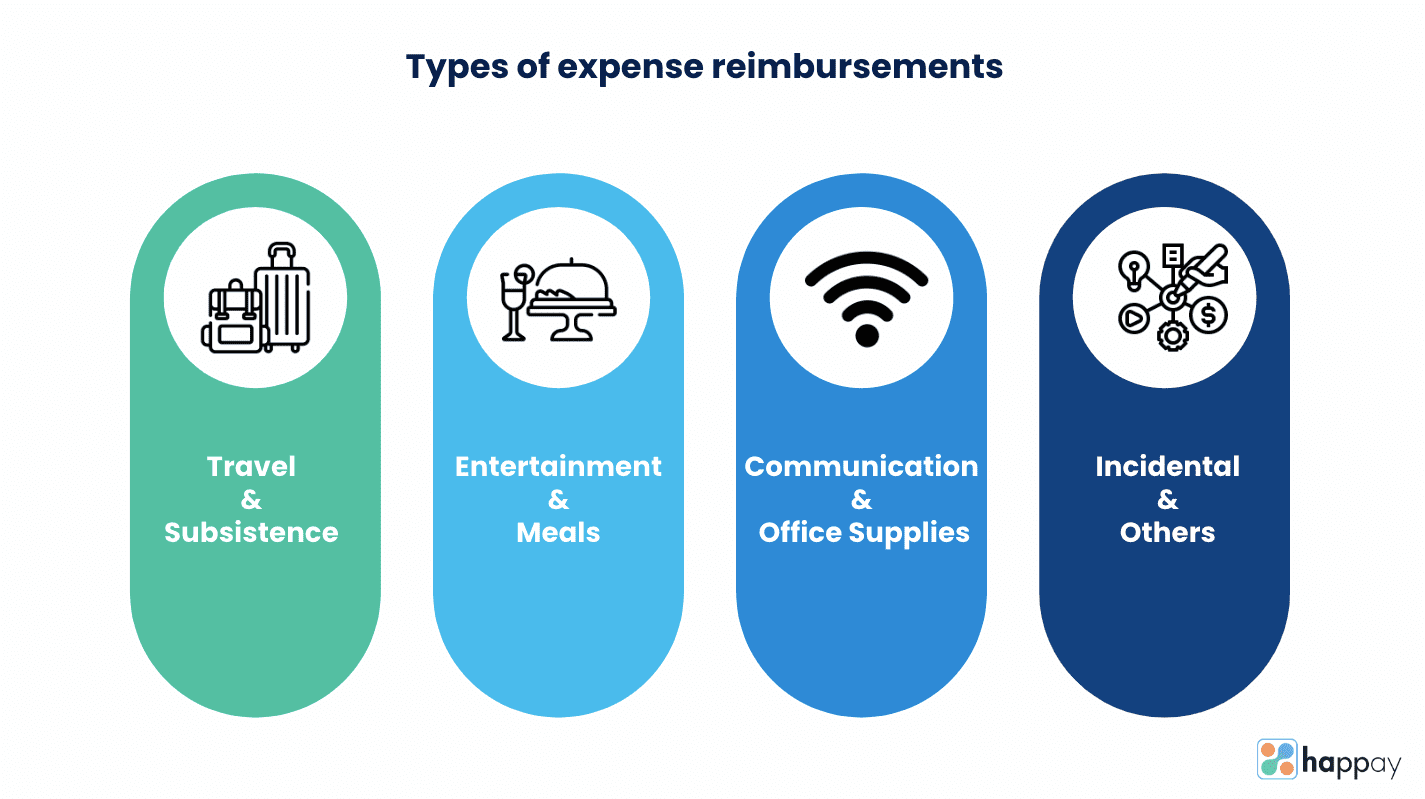

Types Of Employee Reimbursements

https://www.peoplekeep.com/hubfs/All Images/Featured Images/Types of employee reimbursements_fb.jpg#keepProtocol

Are Expense Reimbursements Taxable Paper Trails HR Payroll

https://www.papertrails.com/wp-content/uploads/2022/09/Blog-Post-Background-59-768x384.png

While not mandatory in every state California employers are required to reimburse their employees for reasonable business expenses This means employers must pay back employees who spend their own money for In most cases expense reimbursements are not taxable However there are exceptions The best way to comply with the IRS rules is to have a professional accountant create

Labor Code section 2802 requires employers to reimburse employees for all necessary expenditures or losses incurred by the employee in the discharge of their duties or In short no But that s provided your employer completes the pay stub accurately as part of their expense reimbursement process If they incorrectly lump the reimbursed amount

We Answer What Are Expense Reimbursements And Other FAQs SAP Concur

https://www.concur.com/sites/g/files/sqenrx226/files/2023-01/275692_275692_l_srgb_s_gl.jpg

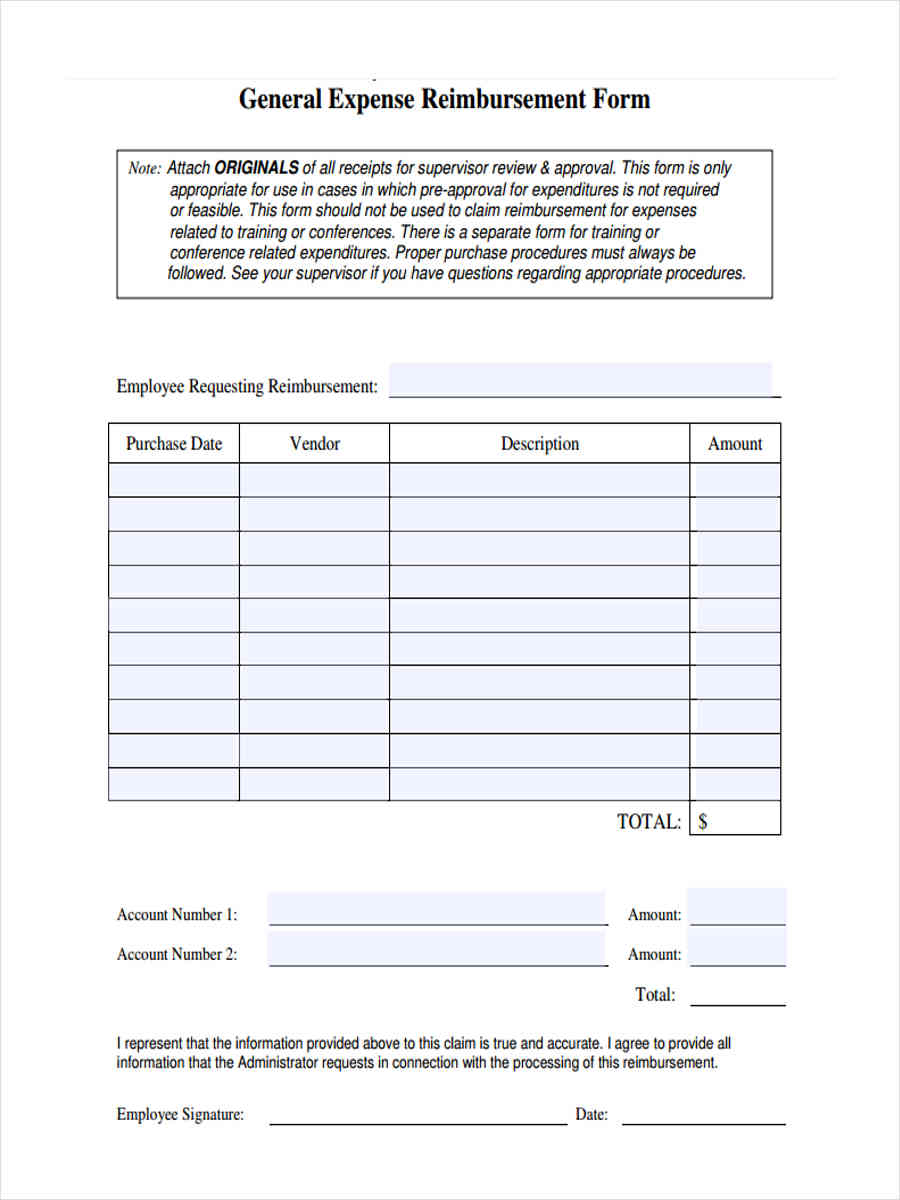

PDF Pwc Cfa Reimbursement PDF T l charger Download

https://images.sampleforms.com/wp-content/uploads/2017/06/General-Expense-Reimbursement.jpg

https://wemploymentlaw.com/blog/work-related...

Which work related expenses are reimbursable in California California law only requires reimbursement of expenses that are necessary to perform your work duties Your

https://www.justworks.com/blog/expens…

Keep in mind that some states like California and Illinois require employers to reimburse employees reasonable work related expenses Make sure that you understand and follow the applicable

A Primer On Employee Expense Reimbursements In California Lewis

We Answer What Are Expense Reimbursements And Other FAQs SAP Concur

Guide To Simplify Your Employee Expense Reimbursement Process

Taxable Payments Or Reimbursements To UH Employees

Are Expense Reimbursements Taxable Workest

10 Tips On California Law Expense Reimbursement Time Limit Nakase Law

10 Tips On California Law Expense Reimbursement Time Limit Nakase Law

Expense Reimbursement Invoice Template Sample

Expense Reimbursement Form Example Sample Templates Vrogue

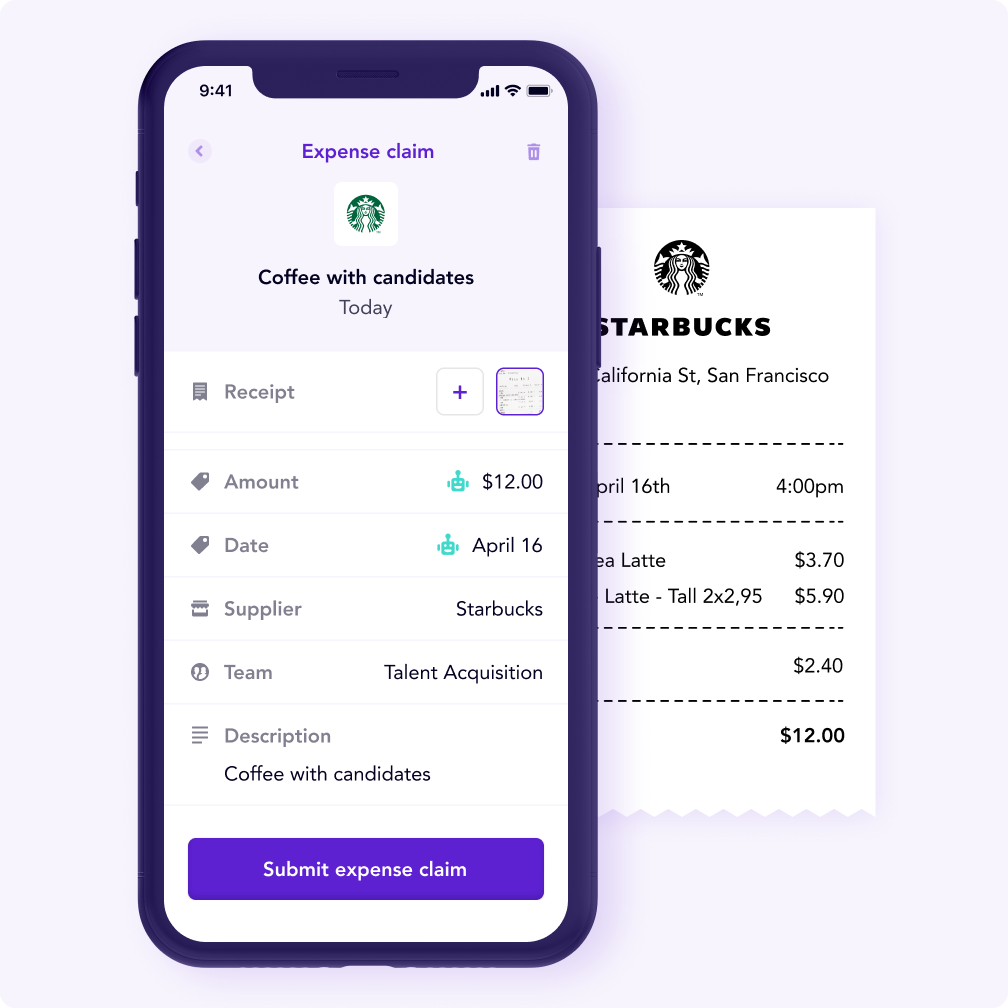

Spendesk Fast Employee Expense Reimbursements

Are Expense Reimbursements Taxable In California - Under California labor laws your employer has to reimburse you for all work required losses and expenses If your employer has failed to reimburse you for work related