Are Expense Reimbursements Taxable Deferred compensation contribution limit increased If you participate in a 401 k 403 b or the federal government s Thrift Savings Plan TSP the total annual amount you can

Sometimes an employee might pay for a business expense out of their own pocket When that happens you can reimburse the employee An employee expense Reimbursements Tax Dilemmas Explained 5 Overview of relevant legal 3 provisions A Direct Tax 3 5 In this context the Central Board of Direct Taxes CBDT has issued a

Are Expense Reimbursements Taxable

Are Expense Reimbursements Taxable

https://www.papertrails.com/wp-content/uploads/2022/09/Blog-Post-Background-59-1024x512.png

Are Employee Reimbursements Taxable Accounting Portal

https://www.accountingportal.com/wp-content/blogs.dir/13/files/2020/09/Employee-_Reimbursements-_Taxation.png

Are Expense Reimbursements Taxable Rydoo

https://www.rydoo.com/app/uploads/2020/03/Are-expense-reimbursement-taxable.png

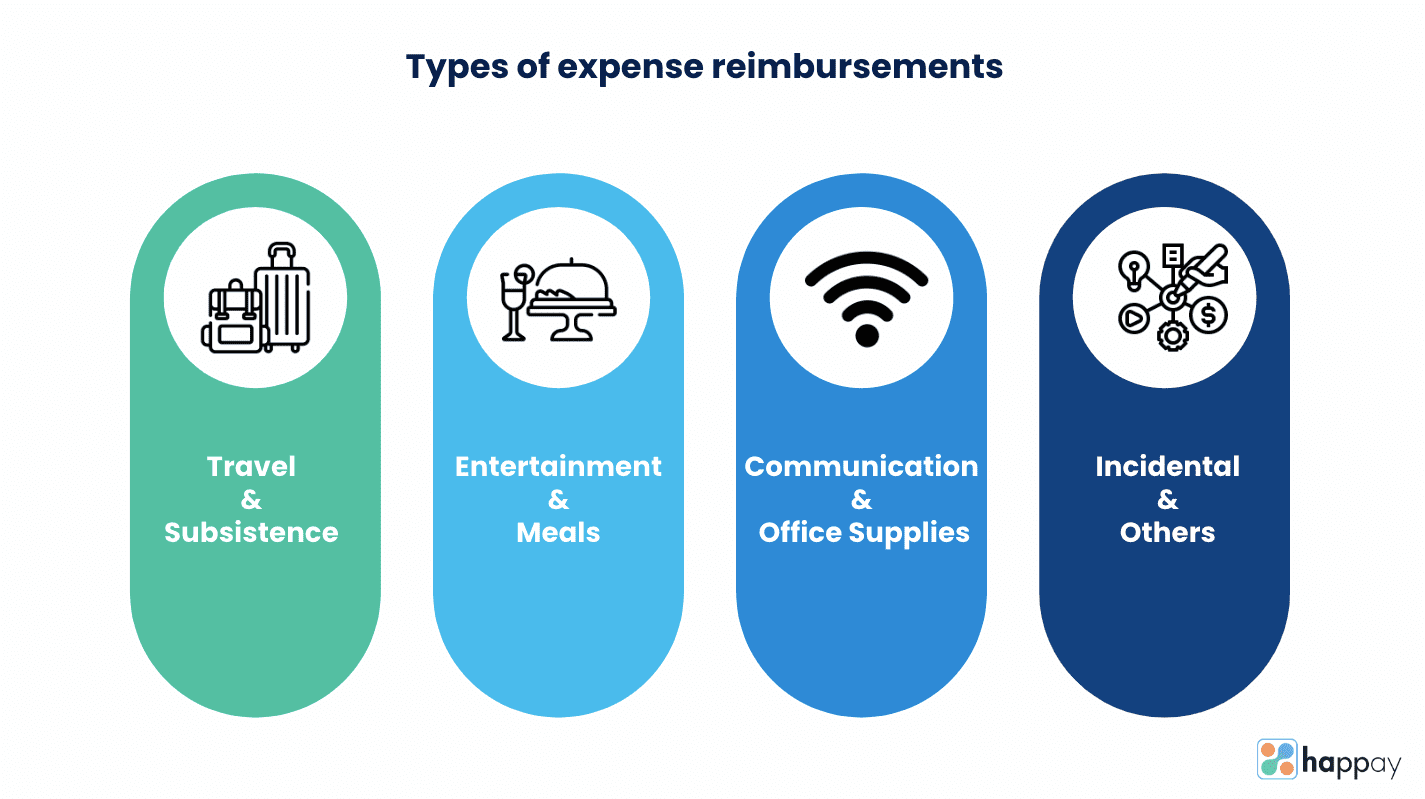

Reimbursement Compensation paid by an organization for out of pocket expenses incurred or overpayment made by an employee customer or other party Reimbursement of business expenses What Types of Expenses Aren t Always Reimbursable Beyond understanding which expenses are most commonly reimbursable employees and

Moving expense reimbursements P L 115 97 Tax Cuts and Jobs Act suspends the exclusion for qualified moving expense reimbursements from your employee s income Employee expense reimbursement is an area that s sometimes overlooked by business owners Employees who spend their own money on job related items often

Download Are Expense Reimbursements Taxable

More picture related to Are Expense Reimbursements Taxable

Are Reimbursements Taxable How To Handle Surprise Employee Expenses

https://www.patriotsoftware.com/wp-content/uploads/2019/12/reimbursements_low.jpg

Are Expense Reimbursements Taxable Workest

https://www.zenefits.com/workest/wp-content/uploads/2018/12/bigstock-196386001-e1545066824111-790x444.jpg

Guide To Simplify Your Employee Expense Reimbursement Process

https://blog.happay.com/wp-content/uploads/2022/08/types-of-expense-reimbursements.png

Blog Tax Group Purchasing a capital asset Consider buying it now to advance your tax savings September 30 2023 If you are considering purchasing an asset to use in your business in early SAP Concur is committed to reinventing travel expense and invoice management with tools that simplify everyday processes and create better experiences

When is an expense reimbursement not taxable Tax and Treasury Services Under tax law all payments are taxable unless there is an exception or exclusion This includes The Internal Revenue Service clearly defines the differences between taxable income and reimbursable expenses but many companies may not know the

What Are Substantiated Employee Business Expense Reimbursements

https://images.ctfassets.net/mnc2gcng0j8q/4FzDkYdFDO6aSY6KAO4KiW/cb787dd04f71d673f4da9bb3a8d5a90d/Expenses_101__Proper_Substantiation_of_Business_Expenses.png?w=1800&

Flat Dollar Reimbursements Considered Taxable By The IRS

https://www.payrollpartners.com/wp-content/uploads/2019/04/expense-policies-and-controls.jpg

https://www.irs.gov/publications/p525

Deferred compensation contribution limit increased If you participate in a 401 k 403 b or the federal government s Thrift Savings Plan TSP the total annual amount you can

https://www.patriotsoftware.com/blog/payroll/are-reimbursements-taxabl…

Sometimes an employee might pay for a business expense out of their own pocket When that happens you can reimburse the employee An employee expense

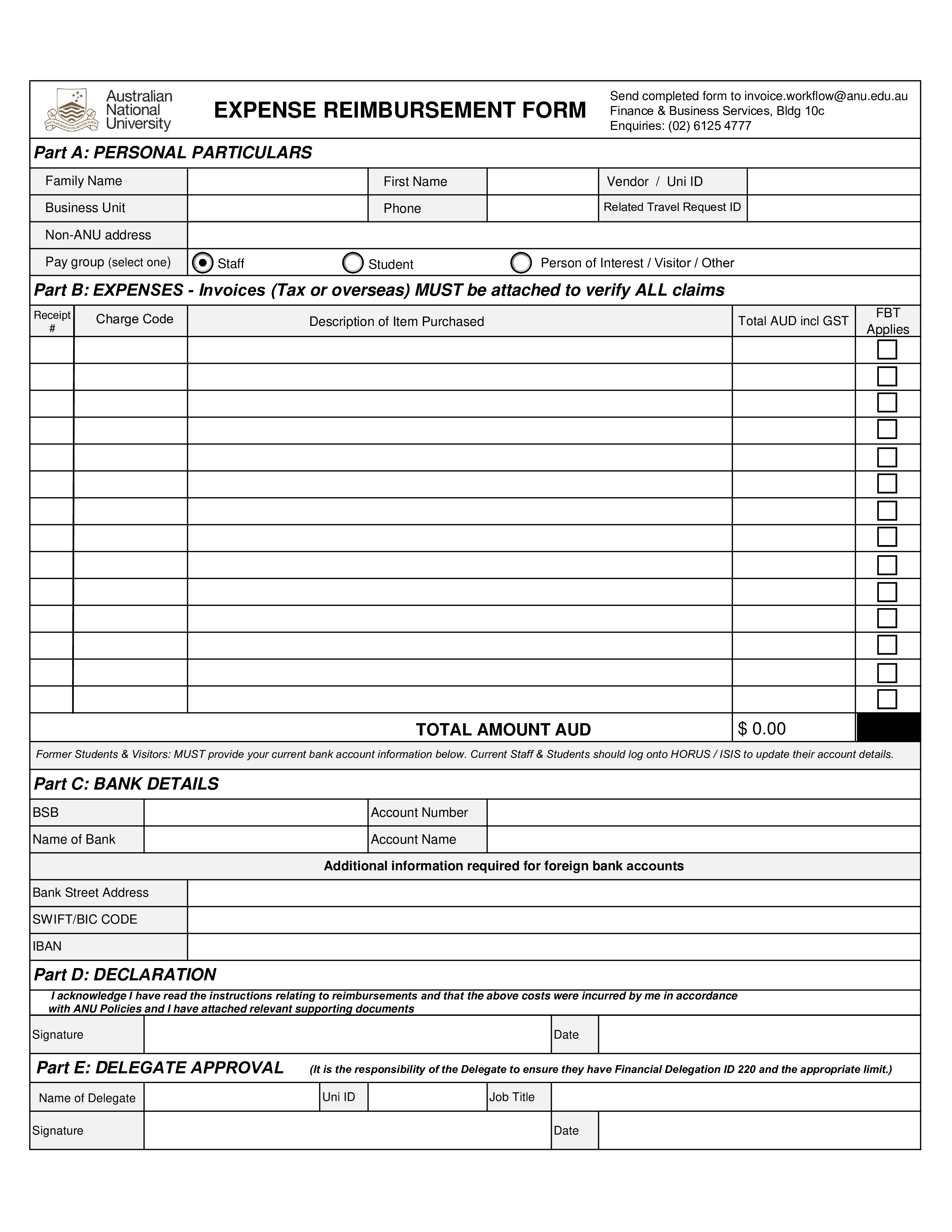

FREE 9 Sample Reimbursement Forms In PDF MS Word Excel

What Are Substantiated Employee Business Expense Reimbursements

.png)

Expense Management With Digital HRMS Discover A Seamless Way To Manage

Expense Reimbursement Form Templates At Allbusinesstemplates

PPT RELOCATION POLICY PowerPoint Presentation ID 1163639

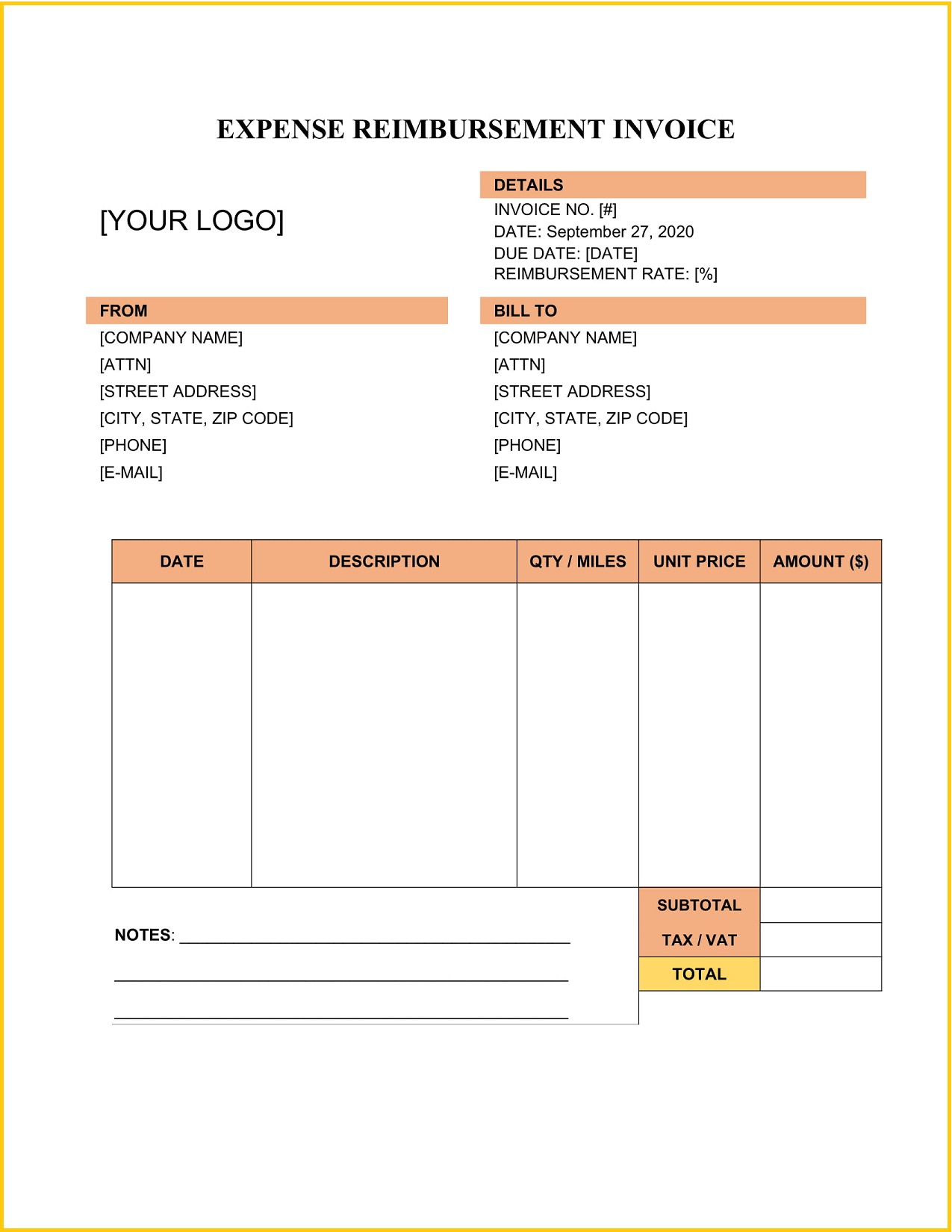

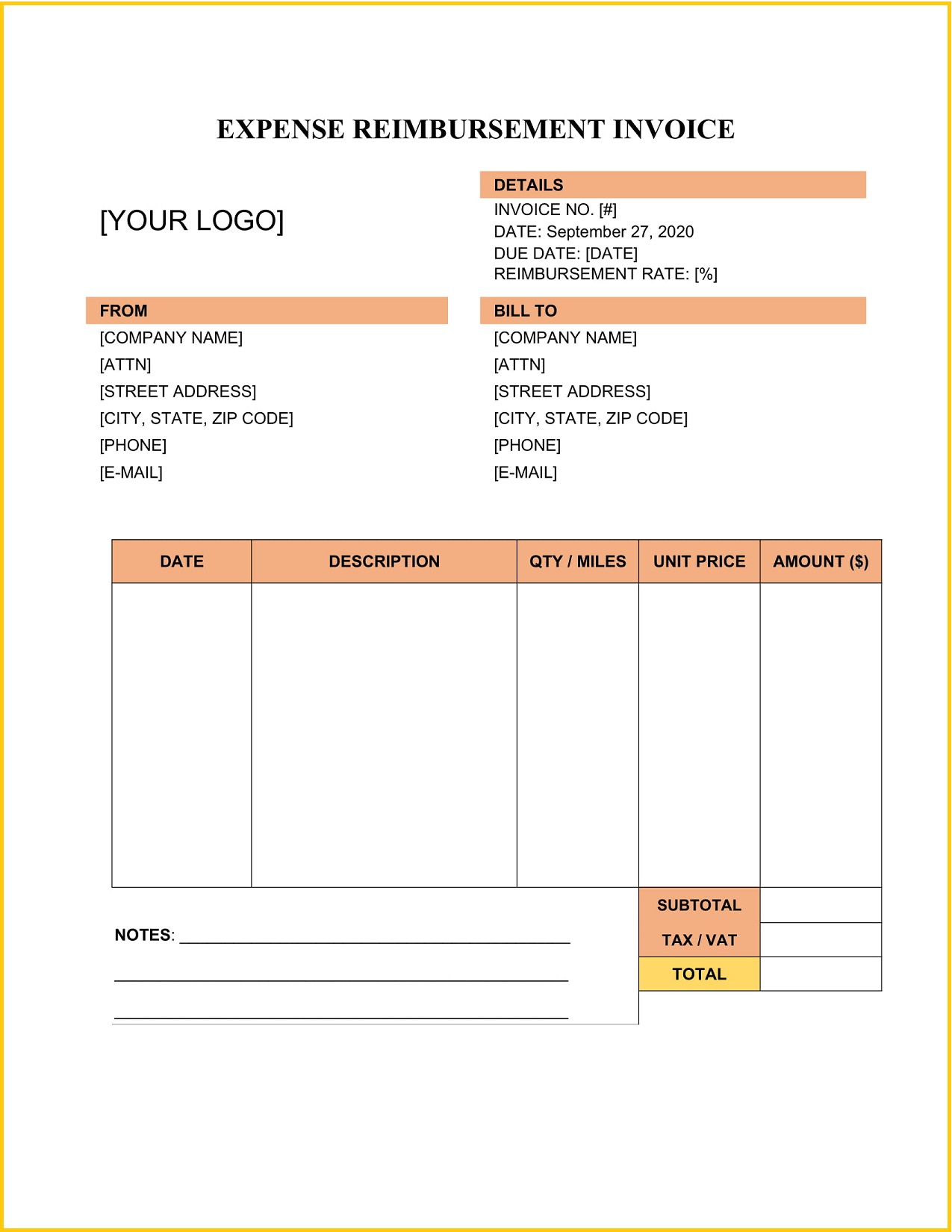

Expense Reimbursement Invoice Template Sample

Expense Reimbursement Invoice Template Sample

Automation Of Employee Expense Reimbursement Cflow

Expense Reimbursements Accountable Plan Vs Non accountable Plan

9 Employee Expense Reimbursement Form Template Sample Templates

Are Expense Reimbursements Taxable - Payers need to know the correct withholding for allowances and the differences between allowances and reimbursements