Are Franking Credits Refundable For Companies Last updated 28 April 2022 Print or Download You may be eligible for a refund of franking credits for either franked dividends from companies or entitlements to franked

Franking credits Franking credits attached to franked dividends received by the following organisations may be refundable provided the eligibility criteria are For the relevant income year your organisation can apply for a refund of franking credits for franked dividends from companies entitlements to franked

Are Franking Credits Refundable For Companies

Are Franking Credits Refundable For Companies

https://www.chan-naylor.com.au/wp-content/uploads/2021/03/Franked-Dividends-and-Franking-Credits-Explained.jpg

How To Use A Franking Machine Officeology

https://officeology.com/wp-content/uploads/2021/07/franking-machine.jpg

Franking Credits What Are They Why Are They Important To You

https://solveaccounting.com.au/wp-content/uploads/2021/12/franking-credits-what-are-they.jpg

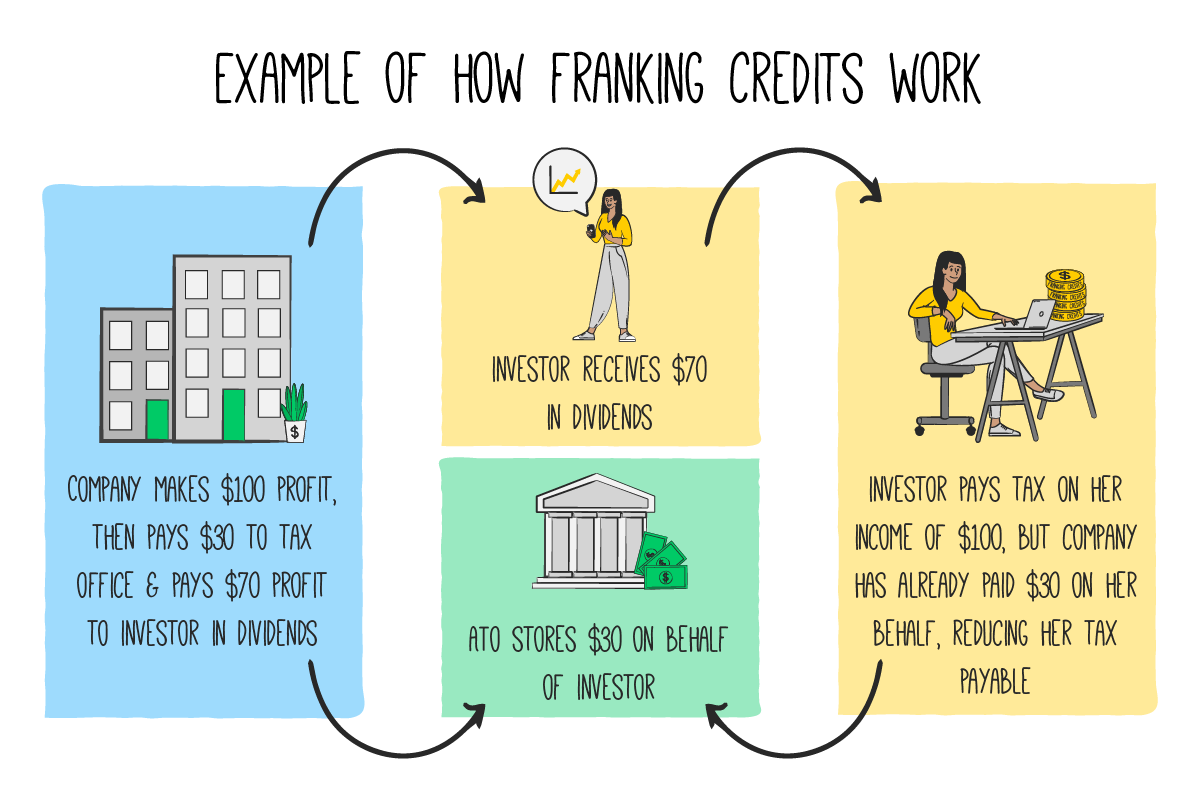

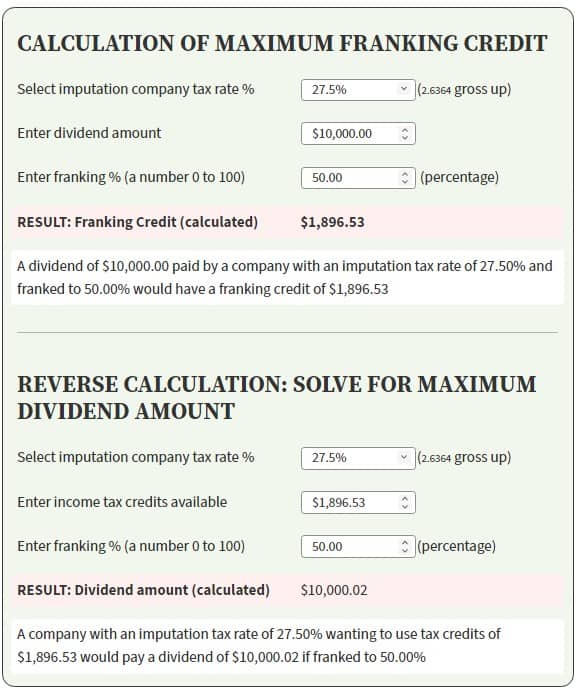

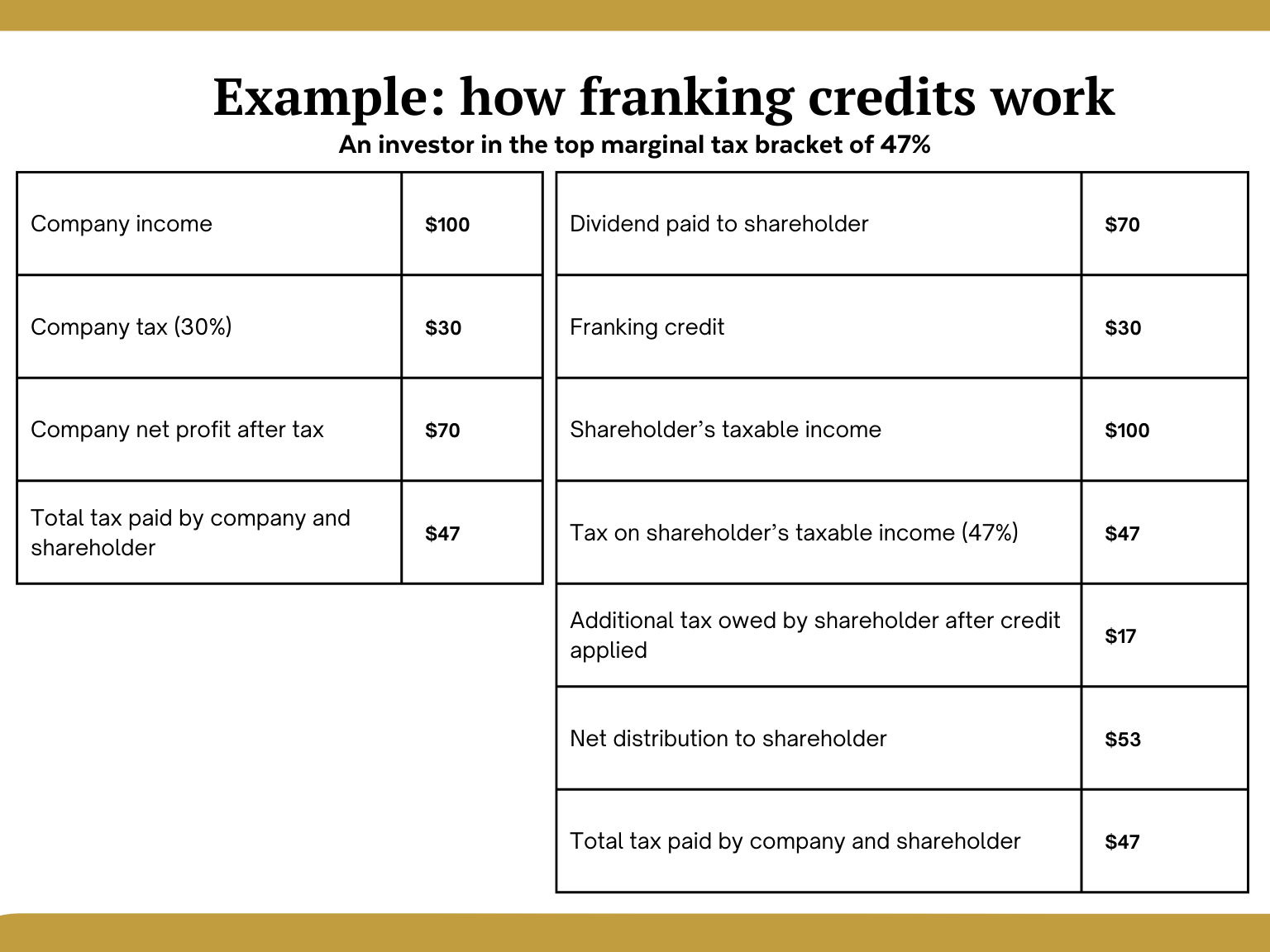

In 2000 franking credits were made fully refundable making them a factor in an individual s investment strategy How to Calculate Franking Credits To illustrate the Franking credits attached to franked dividends paid to your organisation or attached to an entitlement to a franked distribution are refundable This is provided

Depending on their tax bracket investors who receive a franking credit may get a reduction in their income taxes or a tax refund Franking credits help promote long term equity ownership and Finally in the last scenario if an investor s tax rate is 0 they will receive all these credits as a refund Essentially these are tax credits that a company pays for

Download Are Franking Credits Refundable For Companies

More picture related to Are Franking Credits Refundable For Companies

How Do Franking Credits Work For Dividends YouTube

https://i.ytimg.com/vi/fNYl-BUPW3k/maxresdefault.jpg

Franking Credits Explained Plus 1 Group

https://plus1group.com.au/wp-content/uploads/2021/10/franking-credit.png

ETF Tax Distributions DRPs And Franking Credits EVERYTHING Explained

https://www.bestetfs.com.au/wp-content/uploads/2022/07/franking-credits-tax-rask.png

For a company excess franking credits are not refundable but may be converted into an equivalent tax loss and carried forward to use in a subsequent For complying funds integration is to label E1 item 12 in the fund return EF and item 13 in the self managed fund return MS For non complying funds franking credits are

If there is no trust income for tax purposes excess franking credits may not be refunded Generally the net income of a trust for tax purposes is the total Companies are not entitled to a refund of franking tax offsets however they may be able to convert them to carried forward losses in subsequent years

Franking Credits Explained Where Are We Now

https://www.elliotwatson.com.au/wp-content/uploads/2019/04/Franking-Credits-Explained-image-768x513.jpg

What Are Franking Credits And How Do They Work Financial Autonomy

https://financialautonomy.com.au/wp-content/uploads/2022/10/Tax-2.jpg

https://www.ato.gov.au/.../franking-credit-refunds

Last updated 28 April 2022 Print or Download You may be eligible for a refund of franking credits for either franked dividends from companies or entitlements to franked

https://www.ato.gov.au/.../franking-credits

Franking credits Franking credits attached to franked dividends received by the following organisations may be refundable provided the eligibility criteria are

Refundable Franking Credits And Retirees YouTube

Franking Credits Explained Where Are We Now

Franking Credit Refund 2023 Atotaxrates info

Franking Credits Explained What Are They And How Do They Work

Franking Credits Guidelines Expat US Tax

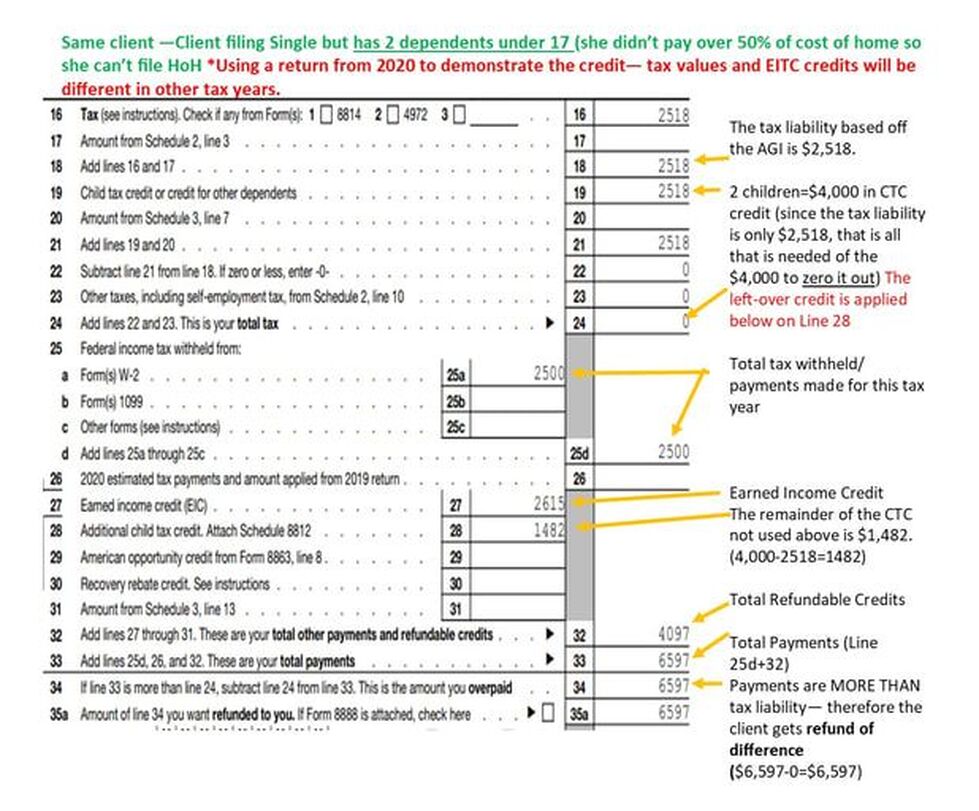

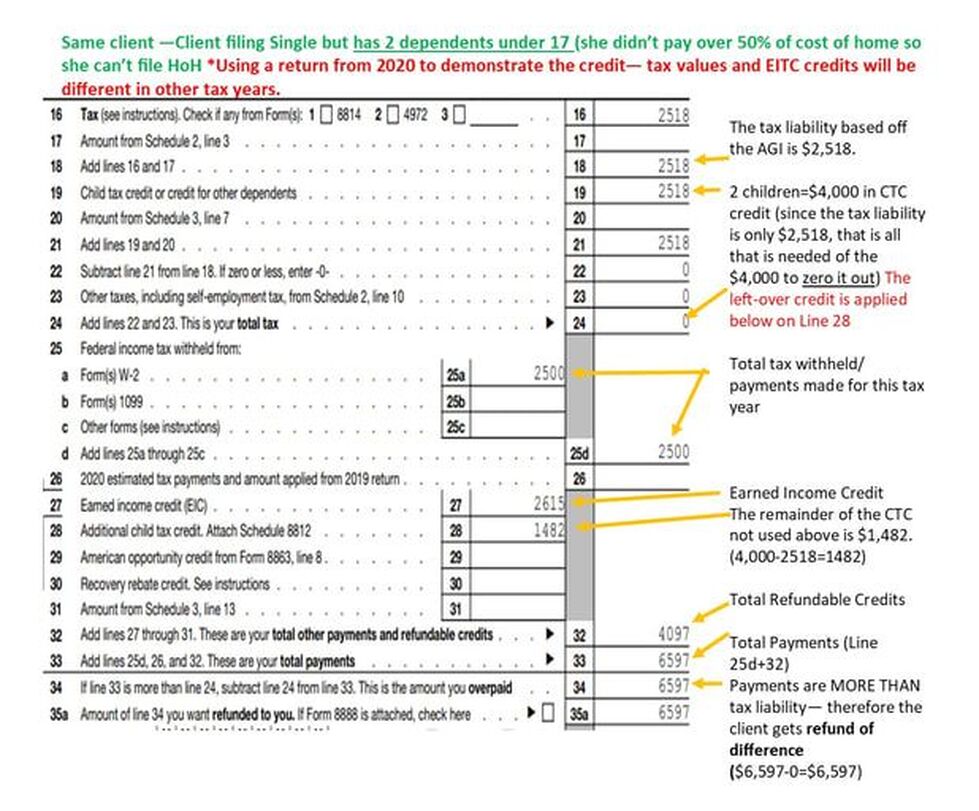

Refundable Credits

Refundable Credits

.png)

The Divide nd Of Income How To Invest For Franking Credits Sara

Are Education Credits Refundable AZexplained

What Are Franking Credits HD YouTube

Are Franking Credits Refundable For Companies - Depending on their tax bracket investors who receive a franking credit may get a reduction in their income taxes or a tax refund Franking credits help promote long term equity ownership and