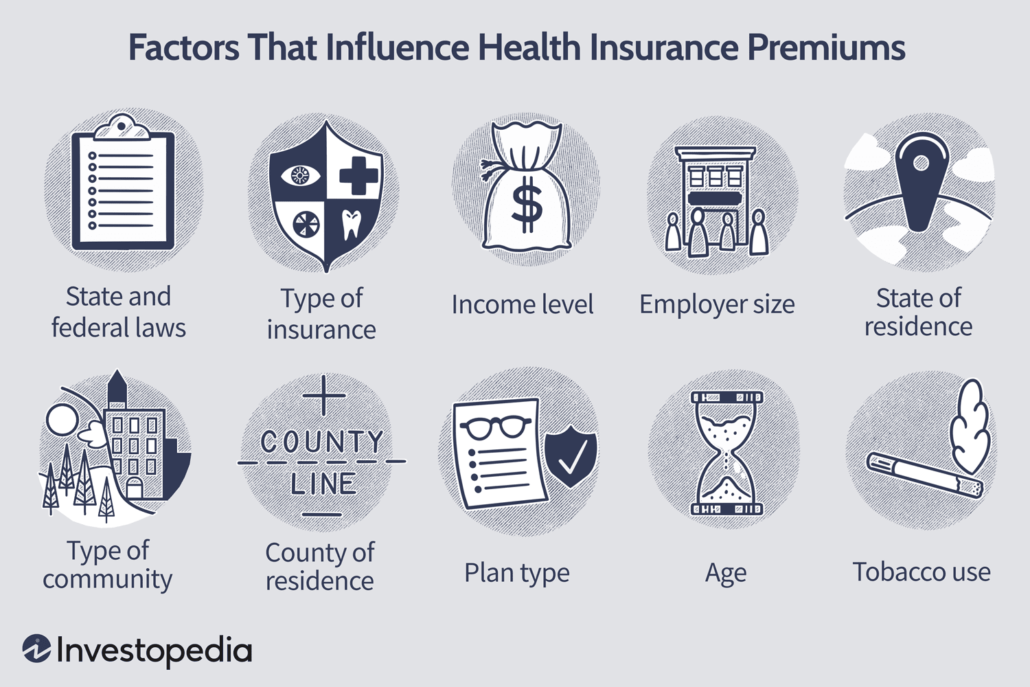

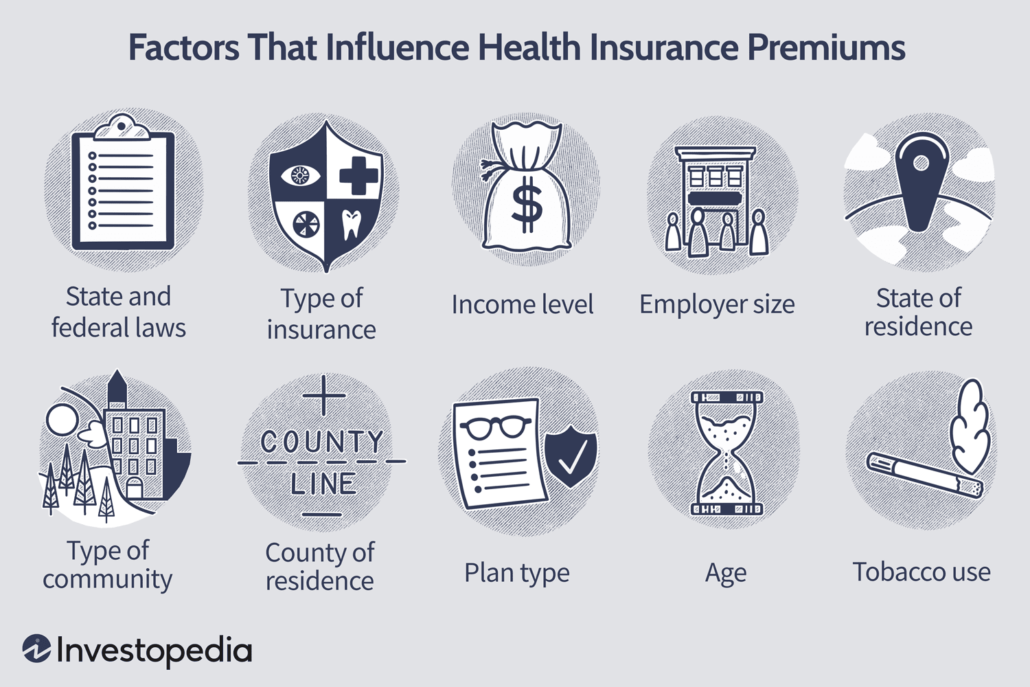

Are Health Insurance Premiums Tax Deductible For Llc Eligible premiums include those for medical and dental coverage and all kinds of Medicare including Parts B C and D Premiums for long term care plans also may be

Health insurance premiums and costs may be tax deductible but whether you should deduct health care from your taxes depends on how much you spent on medical care If you are self employed and have a workforce you can deduct dental and medical insurance premiums including qualified LTC insurance and HSA contributions paid on behalf

Are Health Insurance Premiums Tax Deductible For Llc

Are Health Insurance Premiums Tax Deductible For Llc

https://www.investingbb.com/wp-content/uploads/2020/09/Untitled1.png

Which Is Better Paying Health Insurance Premiums Pre Tax Or Post Tax

https://i1.wp.com/goneonfire.com/wp-content/uploads/2019/12/014b_Which-is-Better_-Paying-Health-Insurance-Premiums-Pre-Tax-or-Post-Tax_.png?fit=1920%2C1280&ssl=1

Are Health Insurance Premiums Deductible On Tax Returns Nj

https://www.nj.com/resizer/ywScgnYtzaC8_-bOYaIbrKfdikU=/1280x0/smart/cloudfront-us-east-1.images.arcpublishing.com/advancelocal/3LHNFVZR5JBGTJXG56K4FSPNFA.jpg

Deducting health insurance premiums lowers taxable income for single member LLC owners resulting in potential tax savings Conclusion If you want to keep your business and health Are health insurance premiums tax deductible Yes they are deductible if you have qualifying insurance and if you re an eligible self employed individual Qualifying health insurance includes medical insurance qualifying long term

Deduct health insurance One of the perks of self employment through an LLC is that healthcare premiums and other medical expenses including vision and dental are The self employed health insurance deduction can ensure you re covered while leading to significant tax savings Is health insurance tax deductible for self employed Yes there is a

Download Are Health Insurance Premiums Tax Deductible For Llc

More picture related to Are Health Insurance Premiums Tax Deductible For Llc

Is Health Insurance Tax Deductible Get The Answers Here

https://help.taxreliefcenter.org/wp-content/uploads/2018/10/health-insurance-application-forms-banknote-stethoscope-is-health-insurance-tax-deductible-ss-Feature.jpg

Are Health Insurance Premiums Tax Deductible For Retirees Vim Ch i

https://www.vimchi.info/wp-content/uploads/2021/09/are-health-insurance-premiums-tax-deductible-for-retirees-768x768.png

Qualified Business Income Deduction And The Self Employed The CPA Journal

https://www.nysscpa.org/cpaj-images/CPA.2022.92.5.006.t001.jpg

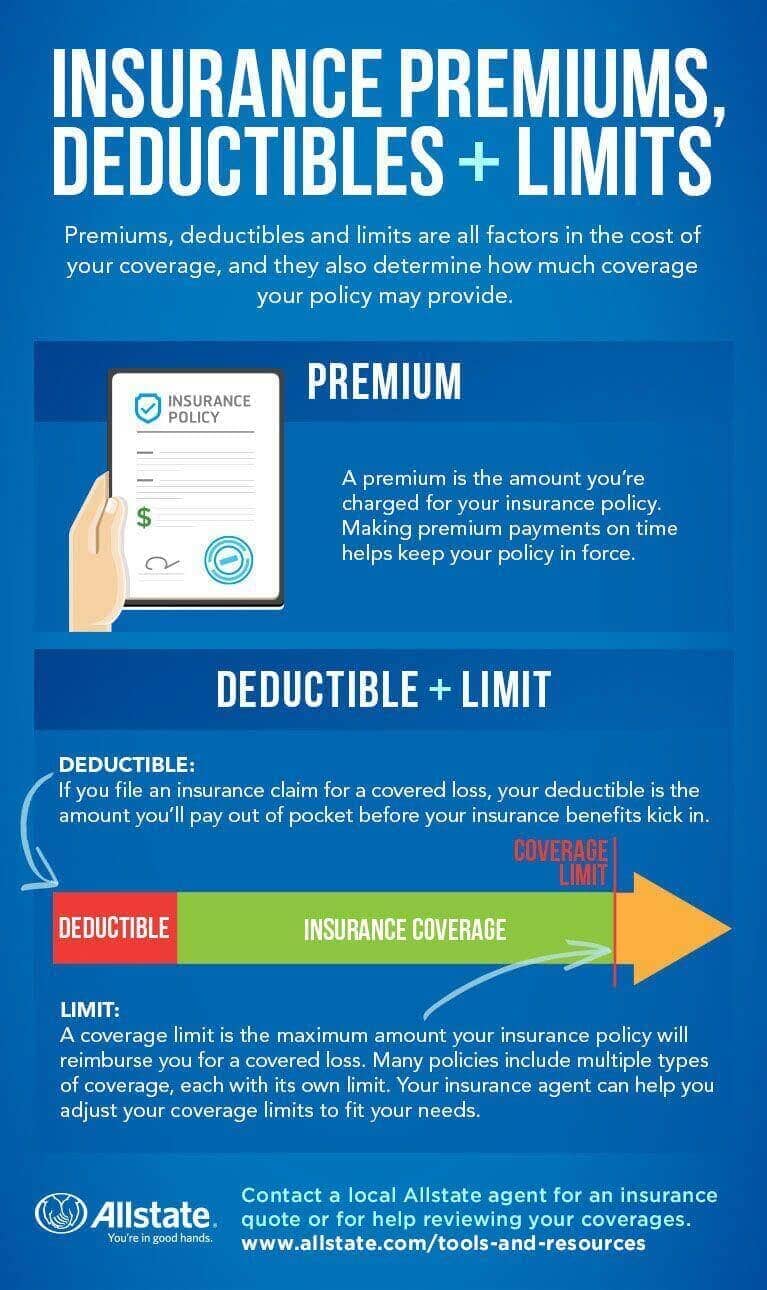

For the 2022 and 2023 tax years you re allowed to deduct any qualified unreimbursed healthcare expenses you paid for yourself your spouse or your dependents but only if they exceed 7 5 of You can either pay the premiums yourself or the partnership can pay them and report the premium amounts on Schedule K 1 in box 13 with a code M Follow these steps to

If you are asking yourself are health insurance premiums tax deductible the answer is usually yes When you enroll in group health insurance you will likely pay at least The deduction which you ll find on Form 1040 Line 29 allows self employed people to reduce their adjusted gross income by the amount they pay in health insurance

Health Insurance 101 IATSE 26

https://www.iatse26.org/wp-content/uploads/2022/07/premiums-1030x687.png

Premiums Deductibles Copay s How It All Works

https://static.wixstatic.com/media/7a2cc6_dfd9416089244ffa9cf2b23290eb98fd~mv2.png/v1/fill/w_640,h_640,al_c,q_90/7a2cc6_dfd9416089244ffa9cf2b23290eb98fd~mv2.png

https://smartasset.com/insurance/how-to-deduct...

Eligible premiums include those for medical and dental coverage and all kinds of Medicare including Parts B C and D Premiums for long term care plans also may be

https://www.forbes.com/advisor/health-insurance/is...

Health insurance premiums and costs may be tax deductible but whether you should deduct health care from your taxes depends on how much you spent on medical care

Are Health Insurance Premiums Tax Deductible For Retirees Vim Ch i

Health Insurance 101 IATSE 26

Canonprintermx410 25 Images Auto Insurance Deductible Explained

Tax Deductions You Can Deduct What Napkin Finance

Are Health Insurance Premiums Tax Deductible In The USA WikiMonday

Are Health Insurance Premiums Tax Deductions In Canada

Are Health Insurance Premiums Tax Deductions In Canada

Are Health Insurance Premiums Tax Deductible EINSURANCE

Insurance From Employer Dealer Dan Kredit Info

Can I Deduct Health Insurance Premiums Insurance Noon

Are Health Insurance Premiums Tax Deductible For Llc - Nonetheless IF you do have employees and provide any health insurance benefits in part or in full you can deduct the health insurance premiums you pay for your