Are Home Insurance Premiums Tax Deductible Overall while there are specific cases where you can write off your premiums such as if you own a rental property or manage a home office home insurance is typically not

Under most circumstances you cannot deduct your homeowners insurance premiums from your taxes However if you work from home rent out your home or have a Please note though Rev Proc 2021 47 provides for the possible deduction of home mortgage insurance premiums you cannot deduct any home mortgage insurance premiums you paid after December 31 2021 For more details

Are Home Insurance Premiums Tax Deductible

Are Home Insurance Premiums Tax Deductible

https://www.chan-naylor.com.au/wp-content/uploads/2023/03/Top-10-Tax-Deductions-for-Small-Businesses-scaled.jpg

Are Health Insurance Premiums Tax Deductible Triton Health Plans

http://static1.squarespace.com/static/623b48a3293e2847ebe155cc/625e95a79c5ec522c5f3c38d/628632b30484eb3b330be95b/1654612213254/are-health-insurance-premiums-tax-deductible.png?format=1500w

What Is Insurance Premium Insurance Premium Definition Meaning And

https://www.maxlifeinsurance.com/content/dam/corporate/what-is-insurance-premium.png

Here s the skinny You can only deduct homeowner s insurance premiums paid on rental properties Homeowner s insurance is never tax deductible your main home It s possible that Is your homeowners insurance tax deductible Homeowners insurance premiums generally aren t tax deductible if the home is your primary residence This is true whether

Although home insurance premiums are typically not tax deductible there are three common scenarios where other types of homeowners insurance costs may be deductible Generally homeowners cannot deduct their home insurance premiums on their taxes unless the premiums are for a rental property or they have a home office that qualifies says Debra Cope CPA an accredited tax preparer and adviser

Download Are Home Insurance Premiums Tax Deductible

More picture related to Are Home Insurance Premiums Tax Deductible

Are Insurance Premiums Tax Deductible AZexplained

https://azexplained.com/wp-content/uploads/2022/05/are-insurance-premiums-tax-deductible_58.jpg

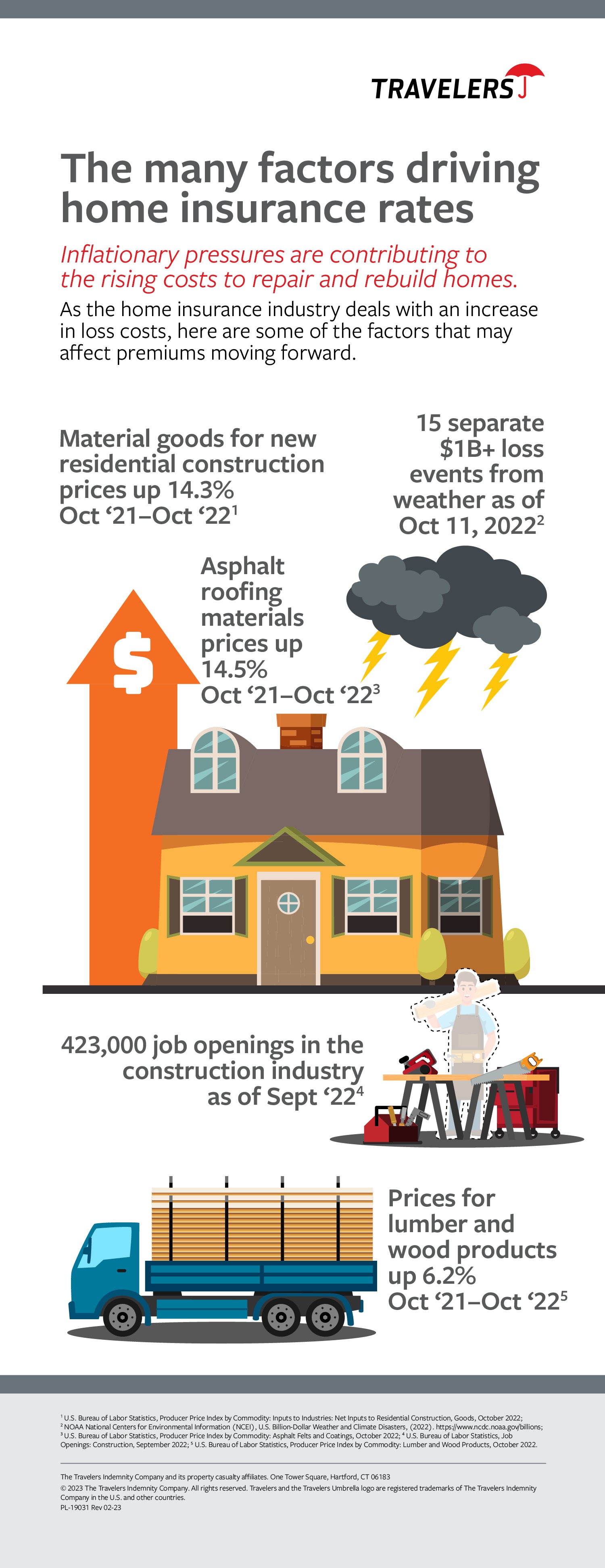

Why Homeowners Insurance Premiums Are Rising And What You Can Do

https://www.travelers.com/iw-images/resources/Individuals/Large/home/insuring/pi-home-severity-trends-infographic.jpg

Are Health Insurance Premiums Ever Tax Deductible My HST

https://myhst.com/wp-content/uploads/2022/11/Are_Health_Insurance_Premiums_Ever_Tax_Deductible__1077198.jpg

Key takeaways Homeowners insurance premiums and deductible are generally not tax deductible If you work from home you can deduct a portion of your homeowners insurance premiums Homeowners insurance The itemized deduction for mortgage insurance premiums was extended through 2021 and tax filers were able to the deduction on line 8d of Schedule A Form 1040 for

If the property in question is your main home the answer is no your home insurance is generally not deductible However REALTORS can educate homebuyers on instances where In short payments toward your personal home insurance policy are not tax deductible However there are some insurance related ways to receive a tax break Read on to learn

Are Insurance Premiums Tax Deductible Navigating The Intricacies Of

https://cosmoins.com/wp-content/uploads/2024/01/Blog-Images-70.png

Are Health Insurance Premiums Tax Deductible EINSURANCE

https://www.einsurance.com/wp-content/uploads/are-health-insurance-premiums-tax-deductible.jpg

https://www.bankrate.com/insurance/h…

Overall while there are specific cases where you can write off your premiums such as if you own a rental property or manage a home office home insurance is typically not

https://www.policygenius.com/homeowners-insurance/...

Under most circumstances you cannot deduct your homeowners insurance premiums from your taxes However if you work from home rent out your home or have a

Are Health Insurance Premiums Tax Deductible Insurance Deductible

Are Insurance Premiums Tax Deductible Navigating The Intricacies Of

Are Group Health Insurance Premiums Tax Deductible Loop

Are My Health Insurance Premiums Tax deductible TrueCoverage

Medicare Blog Moorestown Cranford NJ

Premiums Deductibles Copay s How It All Works

Premiums Deductibles Copay s How It All Works

Are Your Insurance Premiums Tax Deductible Merit Insurance Brokers

Are Long Term Care Premiums Tax Deductible A Complete Guide 2023

Long Term Care Insurance Cost Consumerpie

Are Home Insurance Premiums Tax Deductible - Home mortgage insurance premiums home mortgage interest and state and local property taxes are all tax deductible expenses that homeowners could potentially claim on