Are Hsa Contributions Tax Free You can receive tax free distributions from your HSA to pay or be reimbursed for qualified medical expenses you incur after you establish the HSA If you receive distributions for other reasons the amount you withdraw will be subject to income tax and may be subject to an additional 20 tax

No tax is levied on contributions to an HSA the HSA s earnings or distributions used to pay for qualified medical expenses An HSA owned by an employee can be funded by the employee Health savings accounts HSAs let you save and pay for qualified medical expenses with tax free dollars 1 But there are limits to how much you can contribute each year Overcontributing can lead to unexpected tax penalties Keep these rules for HSA contributions in mind

Are Hsa Contributions Tax Free

Are Hsa Contributions Tax Free

https://media.cheggcdn.com/media/fe6/fe6cf4f9-c3e3-4770-baf5-d7f0f7bc1463/phpgsLCY8

Hsa Max Contribution 2025 Family Ulla Alexina

https://medcombenefits.com/images/uploads/blog/2023_HSA_Limits_Table.jpg

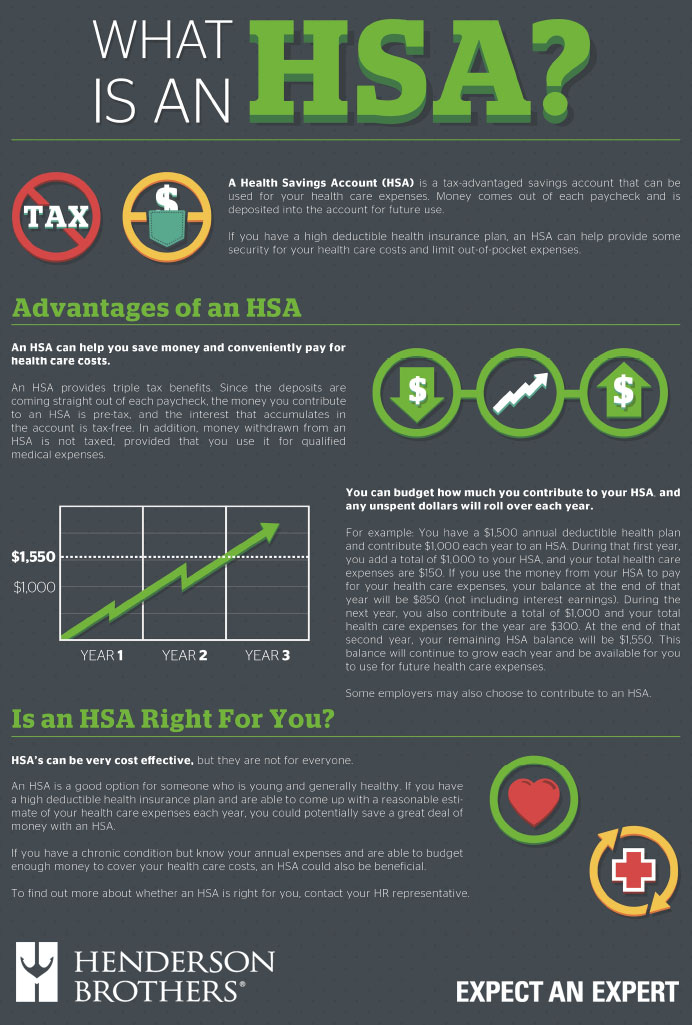

HSAs Health Savings Accounts Henderson Brothers

http://www.hendersonbrothers.com/wp-content/uploads/2017/09/HSA-inforgraphic.jpg

You won t get a tax deduction for your employer s contributions the amount your employer contributes will reduce what you can contribute for the year and employer contributions are excluded from your gross income but it s hard to For the 2022 tax year the maximum contribution amounts are 3 650 for individuals and 7 300 for family coverage For 2023 the maximum amounts are 3 850 for individuals and 7 750 for

If you re enrolled in this type of health plan you can make pre tax contributions to an HSA allowing you to pay for qualified medical expenses tax free This can help create a cash cushion to offset the higher deductibles that HSA eligible health plans typically have Health Savings Accounts offer a triple tax advantage deposits are tax deductible growth is tax deferred and spending is tax free All contributions to your HSA are tax deducible or if made through payroll deductions are pre tax which lowers your overall taxable income

Download Are Hsa Contributions Tax Free

More picture related to Are Hsa Contributions Tax Free

Understanding Your Tax Forms The W 2

https://imageio.forbes.com/blogs-images/kellyphillipserb/files/2014/02/W2.png?format=png&width=1200

Health Savings Accounts HSA Grant Smith Health Insurance Agency

https://grantsmith.com/wp-content/uploads/HSA-Graph-2019-.png

Health Savings Account HSA

http://www.floridainsurancebrokers.com/wp-content/uploads/2016/06/HSA-Enrollment-Tax-Saving-2016-FIT-FICA.png

The money you contribute to an HSA can be used to pay for qualified medical expenses tax free You can also invest the funds in your account and receive tax free earnings And depending on how you contribute money to your HSA you may be eligible to deduct the contributions on your tax return An HSA allows you to pay lower federal income taxes by making tax free deposits each year You can enroll in an HSA qualified high deductible health plan during open enrollment or a special enrollment period See HSA contribution limits for

[desc-10] [desc-11]

Understanding Tax Season Form W 2 Remote Financial Planner

http://www.remotefinancialplanner.com/wp-content/uploads/2017/02/word-image-3.png

[img_title-8]

[img-8]

https://www.irs.gov/publications/p969

You can receive tax free distributions from your HSA to pay or be reimbursed for qualified medical expenses you incur after you establish the HSA If you receive distributions for other reasons the amount you withdraw will be subject to income tax and may be subject to an additional 20 tax

https://www.investopedia.com/terms/h/hsa.asp

No tax is levied on contributions to an HSA the HSA s earnings or distributions used to pay for qualified medical expenses An HSA owned by an employee can be funded by the employee

[img_title-9]

Understanding Tax Season Form W 2 Remote Financial Planner

[img_title-10]

[img_title-11]

[img_title-12]

[img_title-13]

[img_title-13]

[img_title-14]

[img_title-15]

[img_title-16]

Are Hsa Contributions Tax Free - You won t get a tax deduction for your employer s contributions the amount your employer contributes will reduce what you can contribute for the year and employer contributions are excluded from your gross income but it s hard to