Are Hsa Distributions Taxable Income You can receive tax free distributions from your HSA to pay or be reimbursed for qualified medical expenses you incur after you establish the HSA If you receive distributions for other reasons

Contributions to HSAs and MSAs are tax deductible and the unspent balances can rollover indefinitely from year to year Distributions from HSAs and MSAs that are not used for qualified medical expenses are subject Qualified distributions from HSAs are tax free if used for eligible medical expenses These allow account holders to access funds without penalties The Internal Revenue Code

Are Hsa Distributions Taxable Income

Are Hsa Distributions Taxable Income

https://images.sftcdn.net/images/t_app-cover-l,f_auto/p/6a37306e-ca1e-4462-a7fb-69b6c2867c91/4148399948/super-income-v2-screenshot.png

Filling Tax Form Tax Payment Financial Management Corporate Tax

https://static.vecteezy.com/system/resources/previews/025/022/780/original/filling-tax-form-tax-payment-financial-management-corporate-tax-taxable-income-concept-composition-with-financial-annual-accounting-calculating-and-paying-invoice-3d-rendering-png.png

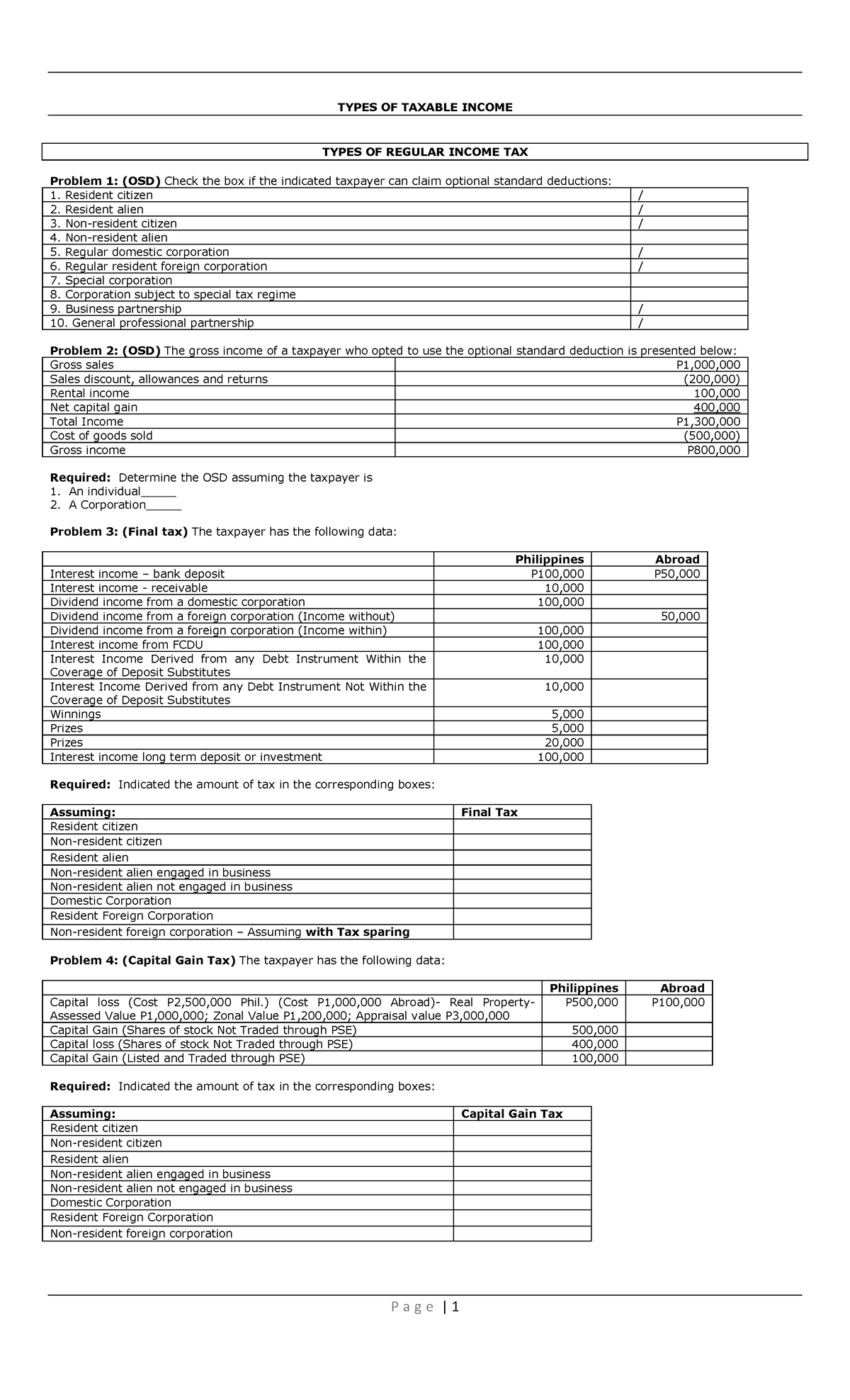

10 Types Of Taxable Income Student TYPES OF TAXABLE INCOME TYPES OF

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/b7a872ad0a19b88c31effcac3e87cba0/thumb_1200_1976.png

Those distributions known as RMDs are included in your income and can lead to a hefty tax bill though there are ways to reduce the tax burden HSAs never require HSA distributions taken to pay for eligible medical expenses are not taxable but they still must be reported to the Internal Revenue Service IRS

Contributions made toward your HSA through payroll deductions are excluded from your gross income In addition contributions made to your HSA by your employer may be excluded from your employment taxes like Social Security Contributions to an HSA reduce your taxable income If contributions are made through payroll deductions they are pre tax reducing Social Security and Medicare taxes as

Download Are Hsa Distributions Taxable Income

More picture related to Are Hsa Distributions Taxable Income

Selecting The Correct IRS Form 1099 R Box 7 Distribution Codes Ascensus

http://static1.squarespace.com/static/59c529e3cd0f689fe65fe62d/59c53ff3cd39c39d4b3ce369/639a1e57ee683d6837a3922d/1671109478175/2022+1099R+with+callout+1000px.jpg?format=1500w

Qualified Vs Non Qualified Roth IRA Distributions

https://www.carboncollective.co/hs-fs/hubfs/Roth_IRA_Distributions.png?width=3840&name=Roth_IRA_Distributions.png

Health Savings Account HSA Tax Forms And Tax Reporting Explained YouTube

https://i.ytimg.com/vi/Bi4oWopz_UM/maxresdefault.jpg

Interest earned by HSAs is not taxable There s no use it or lose it rule like with an FSA If you don t use all the money in the year it rolls over from year to year and continues earning interest In other words you can reduce your income with HSA contributions throughout the year and further reduce your income by either taking the standard deduction or itemizing

Ed Zurndorfer discusses the tax savings when HSA distributions are made to pay medical expenses including which expenses are qualified IRS reporting requirements and state tax treatment Tax free HSA distributions Non qualified HSA distributions such as those used for account fees are subject to income tax In 2024 federal income tax rates range from 10 to 37 depending on

1040 Distributions In Excess Of Basis From 1120S

https://kb.drakesoftware.com/Site/Uploads/Images/16511 image 2.jpg

90k Salary Effective Tax Rate V s Marginal Tax Rate BI Tax 2024

https://bi.icalculator.com/img/og/BI/100.png

https://www.irs.gov › publications

You can receive tax free distributions from your HSA to pay or be reimbursed for qualified medical expenses you incur after you establish the HSA If you receive distributions for other reasons

https://turbotax.intuit.com › tax-tips › health-care

Contributions to HSAs and MSAs are tax deductible and the unspent balances can rollover indefinitely from year to year Distributions from HSAs and MSAs that are not used for qualified medical expenses are subject

How Much Taxes For Married Filing Jointly Dollar Keg

1040 Distributions In Excess Of Basis From 1120S

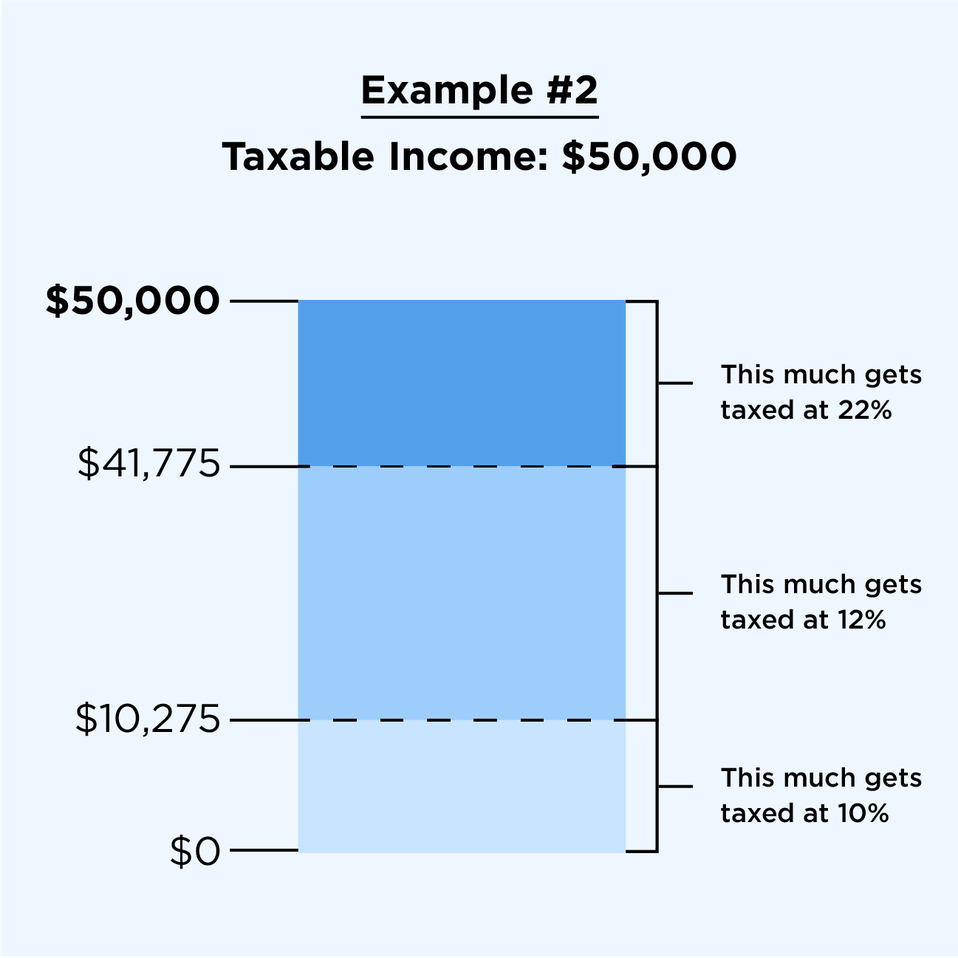

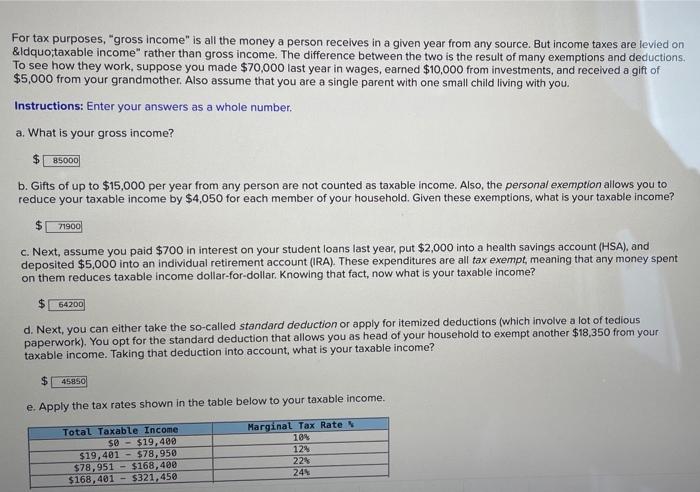

Solved For Tax Purposes gross Income Is All The Money A Chegg

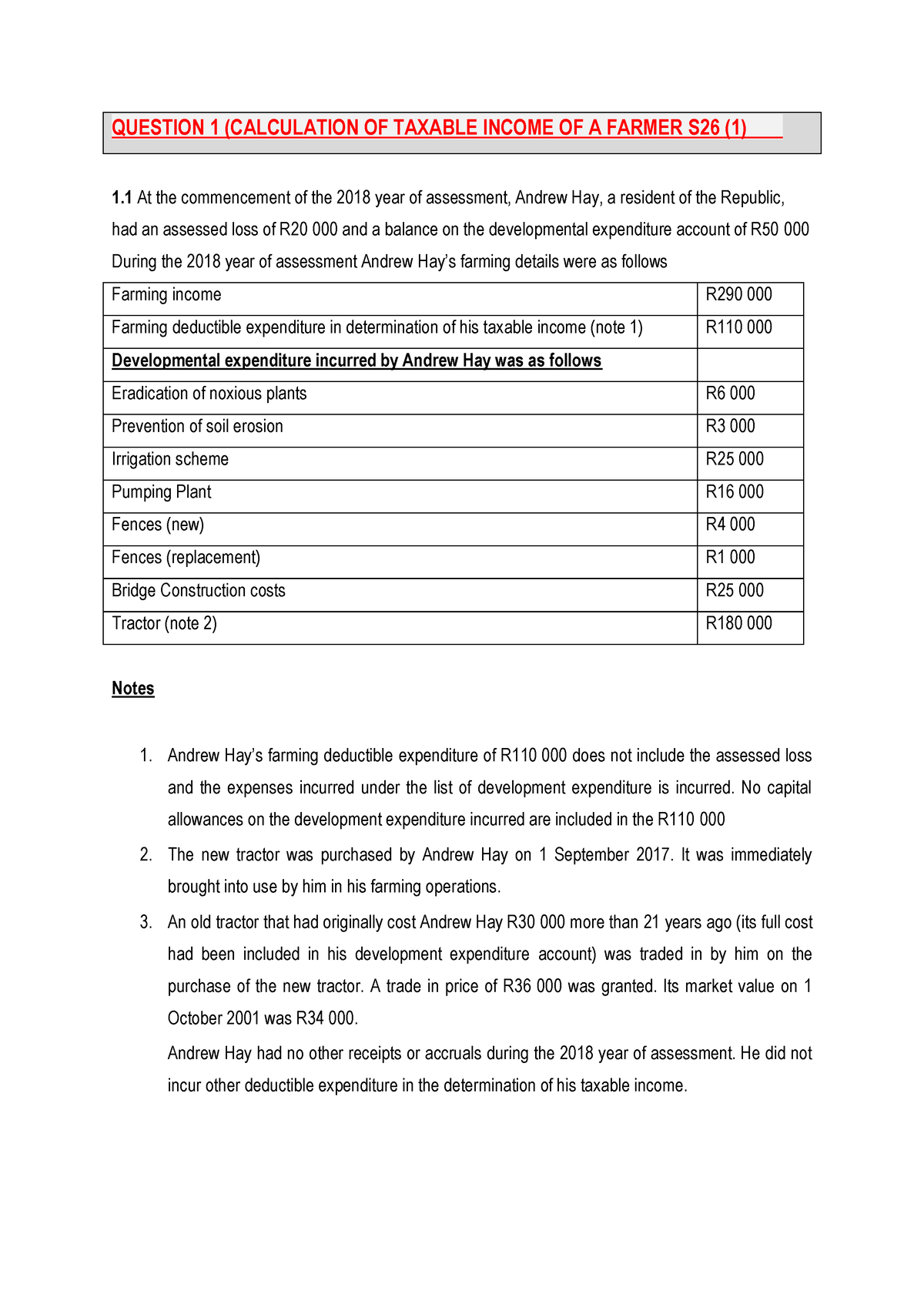

Calculation OF Taxable Income OF A Farmer Section 26 1 QUESTION 1

Transportation Funding EClips Extra

Income Tax Calculator 2023 24 Calculate Online Your Income Tax Under

Income Tax Calculator 2023 24 Calculate Online Your Income Tax Under

What Is A Distribution From A Retirement Plan

What Is Pre Tax Commuter Benefit

No Taxable Income Why You Should Still File ITR

Are Hsa Distributions Taxable Income - Contributions made toward your HSA through payroll deductions are excluded from your gross income In addition contributions made to your HSA by your employer may be excluded from your employment taxes like Social Security