Are Idaho Property Taxes Paid In Arrears Ada County charges property taxes in arrears When you receive a tax bill in November the taxes owing are for that current year Property owners may view the current year s

If you re paying a property tax in arrears it means you re postpaying the bill It shouldn t be confused with being in arrears on taxes which means you re late with paying your dues All non exempt property including personal property is subject to property taxation Any non exempt furniture fixtures equipment or machinery used in a

Are Idaho Property Taxes Paid In Arrears

Are Idaho Property Taxes Paid In Arrears

https://media.marketrealist.com/brand-img/ez9902DsJ/0x0/are-property-taxes-paid-in-advance-1646972118878.jpg

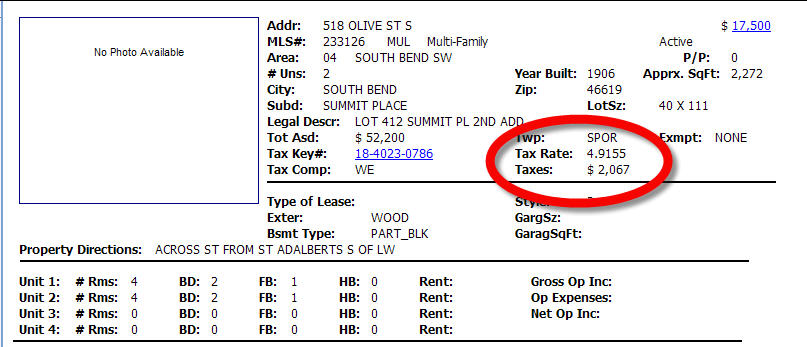

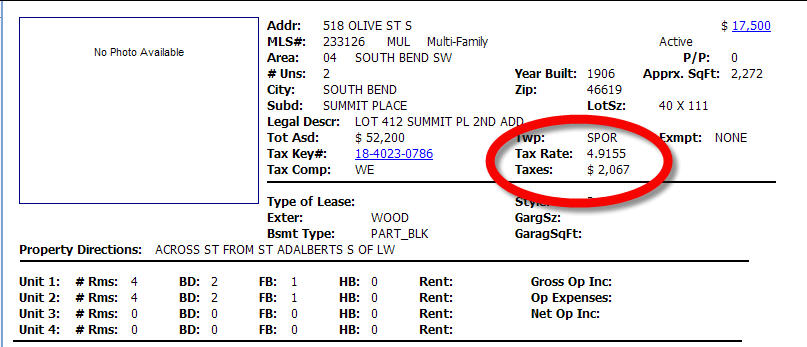

Indiana Property Taxes Paid In Arrears

http://realst8.com/images/518-olive-taxes.jpg

Are Property Taxes Paid In Arrears In Texas YouTube

https://i.ytimg.com/vi/T0Yb5GhHTBE/maxresdefault.jpg

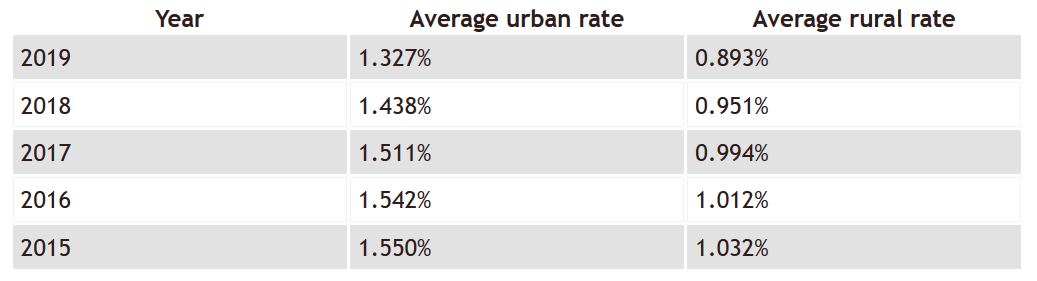

Most homes farms and businesses are subject to property tax Taxes are determined according to a property s current market value minus any exemptions For Property taxes are a local tax based on where you live None of those dollars are allocated to the State of Idaho unlike income or sales tax Instead the dollars fund things like schools roads

Idahoans will receive an additional estimated 76 5 million in property tax relief moving forward on top of the hundreds of millions in property tax relief they have States and counties impose property taxes on property owners in their jurisdiction These are annual taxes based on a valuation of the property Some states

Download Are Idaho Property Taxes Paid In Arrears

More picture related to Are Idaho Property Taxes Paid In Arrears

The Union Role In Our Growing Taxocracy California Policy Center

https://californiapolicycenter.org/wp-content/uploads/2017/05/Top_State_Marginal_Tax_Rates.jpg

Alaska Property Taxes Ranked Alaska Policy Forum

https://alaskapolicyforum.org/wp-content/uploads/Property-taxes_22.jpg

Hecht Group How To Pay Your Idaho Property Taxes

https://img.hechtgroup.com/1665796114635.png

If you don t pay your real property taxes in Idaho the county will eventually get title to your home through a tax deed process and then sell the property to a new BOISE Idaho Property tax bills are hitting Idahoans mailboxes this week and the governor s office said taxpayers may see significant reductions in their year over year taxes as a

Idaho homeowners received their property tax notices in November and this week is the deadline to pay those taxes Under Idaho law taxpayers can split their If you qualify the State of Idaho pays all or part of the property taxes on your primary residence and up to one acre of land The benefit is calculated based on a sliding scale

Are Property Taxes Paid In Advance Or Arrears

https://media.marketrealist.com/brand-img/9psdwt5W9/768x402/capture-1646972214949.PNG

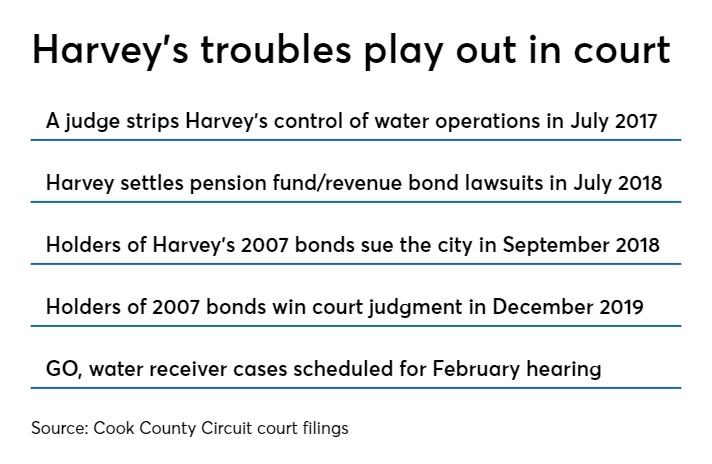

Illinois Property Taxes Paid In Arrears

https://sourcemedia.brightspotcdn.com/01/ac/d5941d56433380d3450456ac4ae1/bb-012920-trend-1.jpeg

https://adacounty.id.gov/treasurer/calculation-of...

Ada County charges property taxes in arrears When you receive a tax bill in November the taxes owing are for that current year Property owners may view the current year s

https://marketrealist.com/p/are-property-ta…

If you re paying a property tax in arrears it means you re postpaying the bill It shouldn t be confused with being in arrears on taxes which means you re late with paying your dues

Property Taxes By State County Median Property Tax Bills Tax

Are Property Taxes Paid In Advance Or Arrears

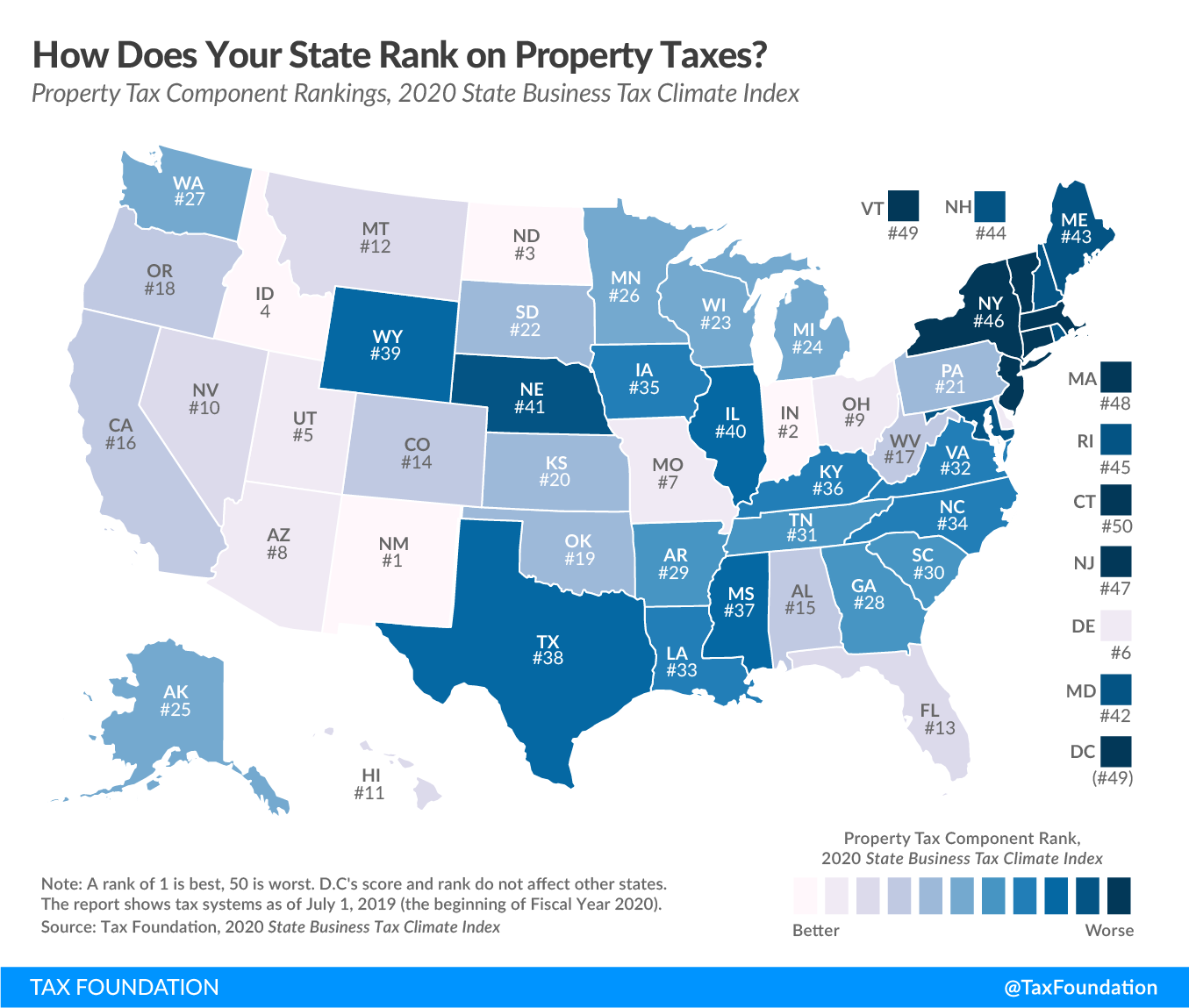

Ranking Property Taxes On The 2020 State Business Tax Climate Index

View Are Property Taxes Paid In Arrears Pics

Idaho Property Tax The Complete Guide To Rates Assessments And

Understanding Idaho Property Taxes Idaho Statesman

Understanding Idaho Property Taxes Idaho Statesman

Are Property Taxes Paid In Advance In Ohio YouTube

Radical Changes Coming For Idaho Property Taxes

Illinois Property Taxes Paid In Arrears

Are Idaho Property Taxes Paid In Arrears - In November Idaho homeowners will know how much of a break they will get on their property taxes through a new state law The savings will be calculated for