Are Insurance Rebates Taxable Because it appears that you deducted the premium payments on Schedule A of your 2020 Form 1040 the MLR rebate that you received in 2021 is taxable to the extent that

In the case of health insurance rebates there are different scenarios for when the rebates are taxable and when they are not These include If no itemized deduction was claimed for the premiums the rebate is not taxable If an If you have a fully insured group health plan through your employer and paid the premium with pre tax dollars as most employees do the rebate will generally be taxable If you happen to

Are Insurance Rebates Taxable

Are Insurance Rebates Taxable

https://www.dentalatkeys.com.au/wp-content/uploads/2017/10/time2switch-health-insurance-rebate.png

Are Insurance Claim Checks Taxable Income The Oasis Firm Credit

https://www.theoasisfirm.com/wp-content/uploads/2022/04/Are-Insurance-Claim-Checks-Taxable-Income.png

Safety Sign The Prices Of All Taxable Items Include Sales Tax

https://media.compliancesigns.com/media/catalog/product/p/a/payment-policies-sign-nhe-33994_1000.gif

In most cases an amount included in your income is taxable unless it is specifically exempted by law Income that is taxable must be reported on your return and is subject to tax Income that ACA rebates are taxable if you pay your health insurance premiums with pre tax dollars or you your employer receive tax benefits after deducting premiums on your tax return If you did receive tax benefits in the previous year the rebate

For individual market consumers who purchased their coverage with after tax dollars a rebate is not taxable income However if an individual deducted the prior year s premium payments on Health insurance rebates from insurance companies also referred to as rebates of the medical loss ratio may or may not be taxable If no itemized deduction was claimed for the

Download Are Insurance Rebates Taxable

More picture related to Are Insurance Rebates Taxable

SIP Law Firm Latest Tax Regulation 5 Taxable Services Subject

https://siplawfirm.id/wp-content/uploads/2022/12/tax.jpg

Are The Montana Property And Income Tax Rebates We Got Taxable

https://townsquare.media/site/119/files/2023/01/attachment-featured-image-2023-01-27T161932.687.jpg?w=980&q=75

What Amount Is Subject To VAT

https://blog.taxworld.ie/hubfs/taxable amount.jpg#keepProtocol

In general rebates are taxable if you pay health insurance premiums with pre tax dollars or you received tax benefits by deducting premiums you paid on your tax return Talk with your tax Under the Affordable Care Act health insurers that fail to meet minimum medical loss ratios MLR must provide annual rebates to policyholders beginning in 2012 These rebates can be

Premium rebates and refunds on personal auto policies are not taxable income to the policyholder In general insurance companies will not be required to issue Form 1099 to The courts have generally not allowed a non seller to exclude a rebate reasoning that only the seller can agree to a price adjustment There is a line of cases on insurance agents who had

Tax Reductions Rebates And Credits

https://sb.studylib.net/store/data/008702919_1-5fc3b4877f75d05a02ea5cfa273ba161-768x994.png

Are Buyer Agent Commission Rebates Taxable In NYC YouTube

https://i.ytimg.com/vi/aJwAZbWrXb4/maxresdefault.jpg

https://ttlc.intuit.com › community › taxes › discussion › ...

Because it appears that you deducted the premium payments on Schedule A of your 2020 Form 1040 the MLR rebate that you received in 2021 is taxable to the extent that

https://donotpay.com › learn › are-rebates-taxable

In the case of health insurance rebates there are different scenarios for when the rebates are taxable and when they are not These include If no itemized deduction was claimed for the premiums the rebate is not taxable If an

85k Salary Effective Tax Rate V s Marginal Tax Rate KR Tax 2024

Tax Reductions Rebates And Credits

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TBIJNDL557HLDK6BPVXRLNCNTI.jpg)

The Best Investments For Taxable Accounts Morningstar

90k Salary Effective Tax Rate V s Marginal Tax Rate BI Tax 2024

Are State Tax Refunds And Rebates Federally Taxable It Depends Https

Savings Rebates Application BWFL

Savings Rebates Application BWFL

Commercial Anaheim CA Official Website

Which Of These Two Tax Tips Is Best For A Retiree Ant Book

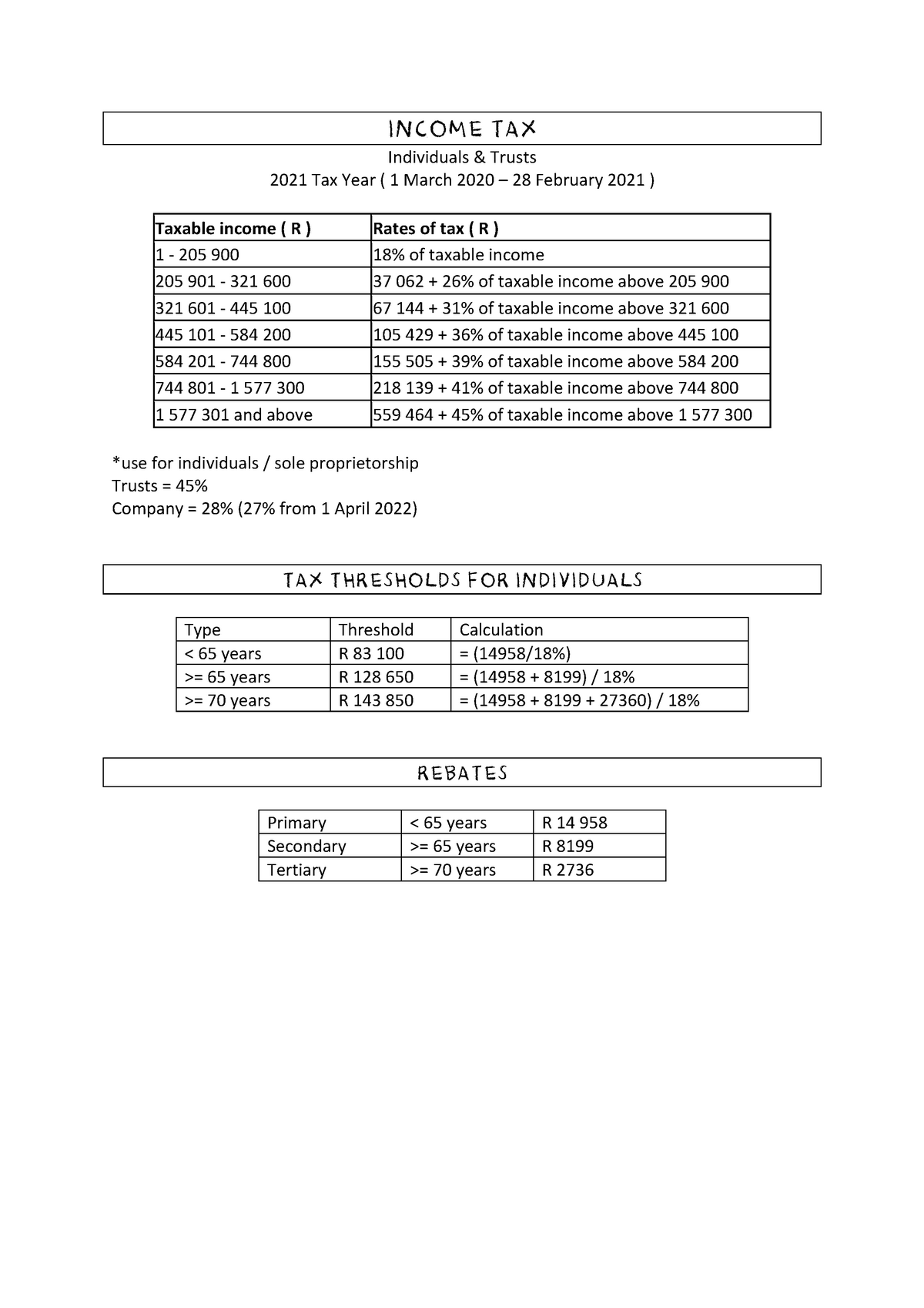

Income Tax Framework Calculations Rebates Income Tax Individuals

Are Insurance Rebates Taxable - For individual market consumers who purchased their coverage with after tax dollars a rebate is not taxable income However if an individual deducted the prior year s premium payments on