Are Medical Expense Benefits Taxable You can deduct on Schedule A Form 1040 only the part of your medical and dental expenses that is more than 7 5 of your adjusted gross income AGI This publication also explains how to treat

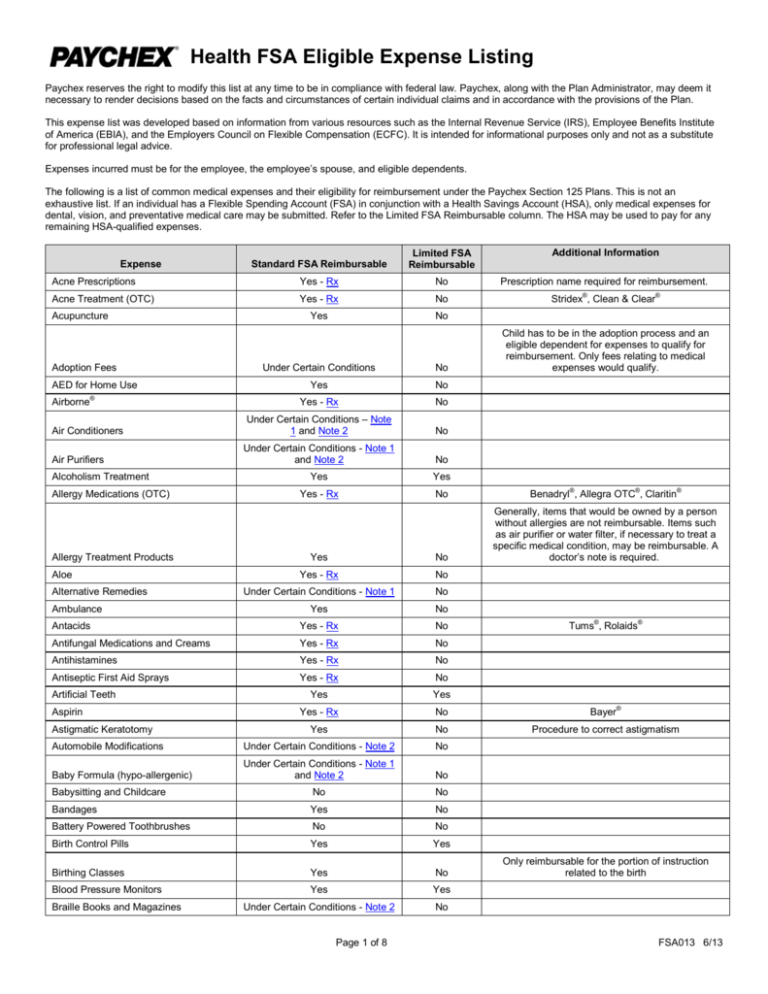

Fortunately if you have medical bills that aren t fully covered by your insurance you may be able to take a deduction for those to reduce your tax bill We ll If your employer provides a health FSA that qualifies as an accident or health plan the amount of your salary reduction and reimbursements of your medical care expenses in

Are Medical Expense Benefits Taxable

Are Medical Expense Benefits Taxable

https://s3.studylib.net/store/data/008371439_1-a364ef52e5a4a49d1b2f7a34f7f0892e-768x994.png

Tax Q A Medical Expenses TaxBuzz

https://tbz-prd.s3.us-west-2.amazonaws.com/9633/medical-expense-form-for-income-tax-640.jpg

Infographic The Medical Expense Tax Credit The Globe And Mail

https://www.theglobeandmail.com/resizer/obuUGNXgYa8P4xp1I1HCKqrDCJY=/1200x583/filters:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/tgam/HCJ4OZTH7RECFJEV6AXE36UNHY

If you itemize deductions and you have unreimbursed expenses for necessary medical or dental care you may be able to claim a tax deduction if they You can deduct qualifying medical expenses that exceed 7 5 of your adjusted gross income You must itemize your deductions to be able to claim medical expenses on your tax return

Medical expenses are deductible only to the extent the total exceeds 7 5 of your adjusted gross income AGI For example if you itemize your AGI is 100 000 As an employer providing medical or dental treatment or insurance to your employees you have certain tax National Insurance and reporting obligations

Download Are Medical Expense Benefits Taxable

More picture related to Are Medical Expense Benefits Taxable

Learn About The Tax Benefits Of Medical Expenses ACT Blogs

https://www.actblogs.com/wp-content/uploads/2022/12/Medical-Expenses.webp

Are You Eligible For A Medical Expense Tax Deduction Somerset CPAs

https://somersetcpas.com/wp-content/uploads/2022/01/Are-You-Eligible-for-a-Medical-Expense-Tax-Deduction-2048x512.png

Foreign Social Security Taxable In Us TaxableSocialSecurity

https://i0.wp.com/cdn2.hubspot.net/hub/109376/file-1514722889-jpg/images/SocialSecurityWorksheet.jpg

Employer paid premiums for health insurance are exempt from federal income and payroll taxes Additionally the portion of premiums employees pay is typically excluded For the 2022 and 2023 tax years you re allowed to deduct any qualified unreimbursed healthcare expenses you paid for yourself your spouse or your dependents but only if they exceed 7 5 of

When an HRA complies with federal rules employers can reimburse medical expenses such as health insurance premiums with money free of payroll To benefit from medical expense deductions your total itemized deductions deductible medical expenses state and local taxes home mortgage interest and

What Is Pre Tax Commuter Benefit

http://www.remotefinancialplanner.com/wp-content/uploads/2017/02/word-image-3.png

Helpful Resources For Calculating Canadian Employee Taxable Benefits

https://www.artofaccounting.ca/wp-content/uploads/2020/01/TaxBenefits-1024x640.jpg

https://www.irs.gov/publications/p502

You can deduct on Schedule A Form 1040 only the part of your medical and dental expenses that is more than 7 5 of your adjusted gross income AGI This publication also explains how to treat

https://turbotax.intuit.com/tax-tips/health-care/...

Fortunately if you have medical bills that aren t fully covered by your insurance you may be able to take a deduction for those to reduce your tax bill We ll

Fundraiser By Liam Cannon I Need Help With Medical Expenses

What Is Pre Tax Commuter Benefit

Healthcare Medical Expense Money Health Expenditure Stock Vector

Don t Dread The IRS Three Part Guide To Tackle Your Taxes Financial

Apply For Your EHIC To Get Claim Of Your Medical Expense

Medical Expense Deductions When A Swimming Pool Turns Into A Tax

Medical Expense Deductions When A Swimming Pool Turns Into A Tax

What Are Medical Expense Benefits In Car Insurance Nursa

MEDICAL EXPENSES DEDUCTIONS

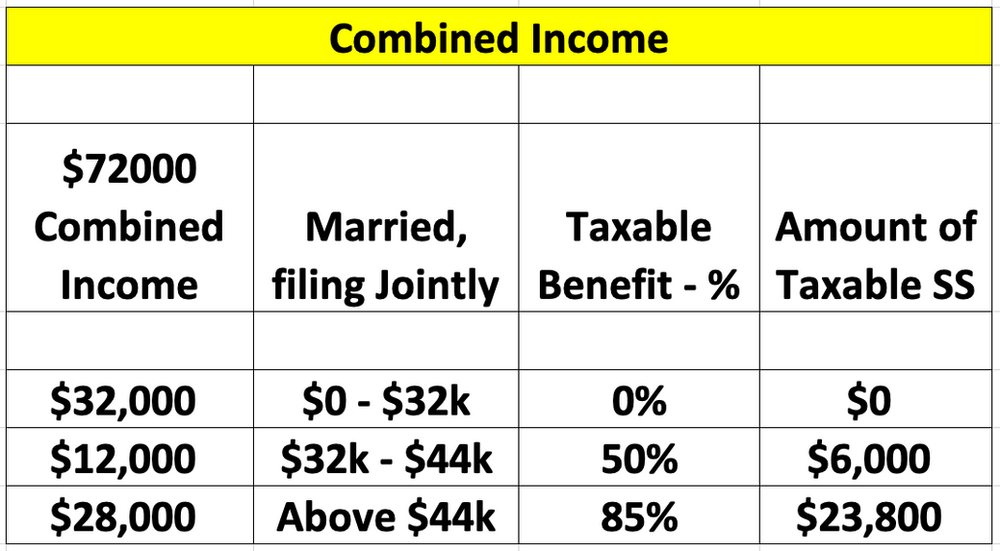

What Is The Taxable Amount On Your Social Security Benefits

Are Medical Expense Benefits Taxable - Medical expenses are deductible only to the extent the total exceeds 7 5 of your adjusted gross income AGI For example if you itemize your AGI is 100 000

/cloudfront-us-east-1.images.arcpublishing.com/tgam/HCJ4OZTH7RECFJEV6AXE36UNHY)