Are Medical Expenses Tax Deductible 2022 Learn how to deduct medical expenses that exceed 7 5 of your adjusted gross income subject to certain conditions and limitations Find out what qualifies as a medical expense who can receive

For 2023 tax returns filed in 2024 taxpayers can deduct qualified unreimbursed medical expenses that are more than 7 5 of their 2023 adjusted gross income The 7 5 threshold used to be 10 See this IRS list of common but nondeductible medical expenses Be sure to document each medical expense you claim with receipts credit card statements mileage records

Are Medical Expenses Tax Deductible 2022

Are Medical Expenses Tax Deductible 2022

https://hp-prod-wp-data.s3.us-west-1.amazonaws.com/content/uploads/02x.jpeg

Common Health Medical Tax Deductions For Seniors In 2024

https://www.seniorliving.org/app/uploads/2017/05/Senior-Taxes-Medical-Expenses.png

Are Medical Expenses Tax Deductible PayStubCreator

https://www.paystubcreator.net/cms-uploads/media/cache/blog_article_banner/files/cms/standalone-content/thumbnail/6125f1e4d9ca9368777868.jpg

Some medical expenses are tax deductible at the federal level under two general conditions Your qualifying medical expenses for the year exceed 7 5 of your adjusted gross income AGI which is Each taxpayer is afforded a 12 950 standard deduction for married joint filers that number is 25 900 for the 2022 tax year This means that your itemized deductions need to exceed 12 950 if you re a

The 7 5 federal threshold for medical expenses is high for many taxpayers This means that medical deductions only begin to lower your taxable income once they ve passed 7 5 of your AGI for the File your taxes claim your medical expenses and get every credit and deduction you deserve Are medical expenses deductible in the year paid or incurred OBTP B13696 2022 HRB Tax Group Inc When

Download Are Medical Expenses Tax Deductible 2022

More picture related to Are Medical Expenses Tax Deductible 2022

Are Medical Expenses Tax Deductible Capital Benchmark Partners

https://capitalbenchmarkpartners.com/wp-content/uploads/2022/11/Medical-Expenses-Tax-Deductible.jpg

Claim Medical Expenses On Taxes Income Tax Preparation Us Tax

https://i.pinimg.com/originals/7b/37/05/7b37052b2fb0ea107a6dd3af15498805.jpg

Deducting Medical Dental Expenses On Your Tax Return PPL CPA

https://www.pplcpa.com/wp-content/uploads/2023/03/MEDICAL-EXPENSE-DEDUCTIBLE.png

You generally receive tax relief for health expenses at your standard rate of tax 20 Nursing home expenses are given at your highest rate of tax up to 40 What medical expenses are tax deductible The IRS provides a list of approved medical and dental expenses that you can claim on your tax return You re

The deduction for tax year 2022 covers expenses that exceed 7 5 of your adjusted gross income AGI Medical and Dental Expenses You can deduct You can claim only eligible medical expenses on your tax return if you or your spouse or common law partner paid for the medical expenses in any 12 month period ending in

Are Medical Expenses Tax Deductible

https://www.eztaxreturn.com/blog/wp-content/uploads/2023/06/shutterstock_302172866blog.jpg

Sars 2022 Weekly Tax Tables Brokeasshome

https://cdn.ymaws.com/www.thesait.org.za/resource/resmgr/docs/01.jpg

https://www.thebalancemoney.com/medical-e…

Learn how to deduct medical expenses that exceed 7 5 of your adjusted gross income subject to certain conditions and limitations Find out what qualifies as a medical expense who can receive

https://www.nerdwallet.com/article/taxes/me…

For 2023 tax returns filed in 2024 taxpayers can deduct qualified unreimbursed medical expenses that are more than 7 5 of their 2023 adjusted gross income The 7 5 threshold used to be 10

Investment Expenses What s Tax Deductible Charles Schwab

Are Medical Expenses Tax Deductible

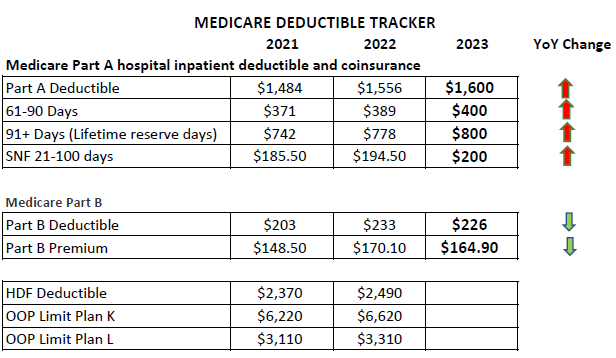

2023 Medicare Parts A B Premiums And Deductibles

Medical Expense Deduction How To Claim A Tax Deduction For Medical

Qualified Business Income Deduction And The Self Employed The CPA Journal

Deductible Business Expenses For Independent Contractors Financial

Deductible Business Expenses For Independent Contractors Financial

When We Can Have Tax Deduction Medical Expenses Sinyaliti

Are Medical Expenses Tax Deductible The TurboTax Blog

Can I Deduct Medical Expenses Ramsey

Are Medical Expenses Tax Deductible 2022 - With the tax season upon us many people are looking for deductions One category of expenses that could lead to tax savings is healthcare The average