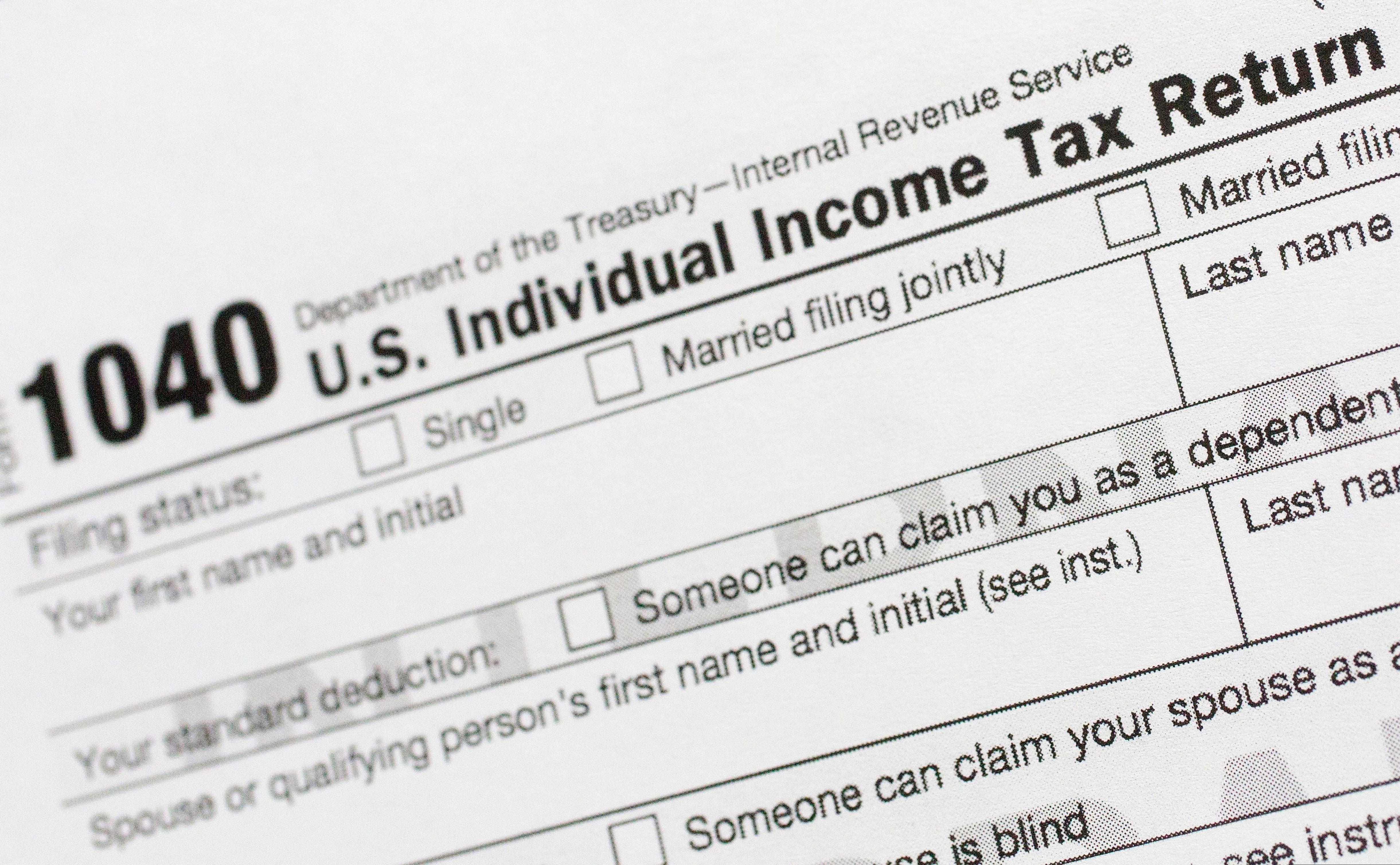

Are Medical Expenses Tax Deductible For Self Employed Yes If you re self employed you may be eligible to deduct up to 100 of the premiums you pay for coverage Let s say you pay 300 a month for health insurance out of your own pocket each year You may

If you re new to filing taxes as a 1099 worker you have a lot of options when it comes to saving on health insurance and medical expenses The primary ways of doing this are using the self employed The bottom line If you qualify the deduction for self employed health insurance premiums is a valuable tax break With the rising cost of health insurance a tax deduction can help

Are Medical Expenses Tax Deductible For Self Employed

Are Medical Expenses Tax Deductible For Self Employed

https://i.pinimg.com/originals/9b/eb/16/9beb16c1bad30aa0dea779d8c5c50b3c.jpg

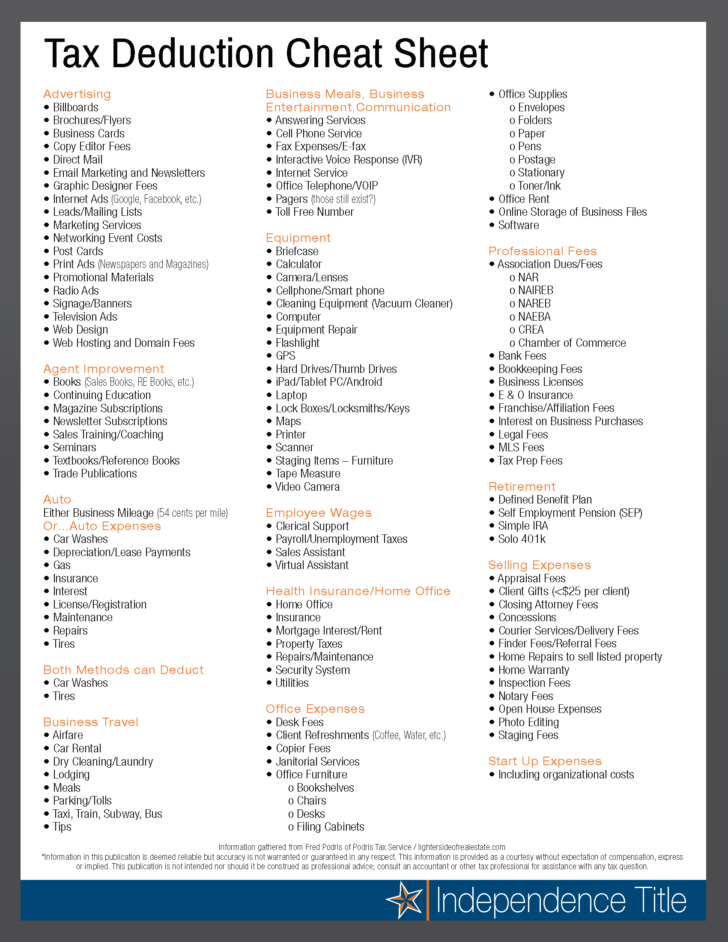

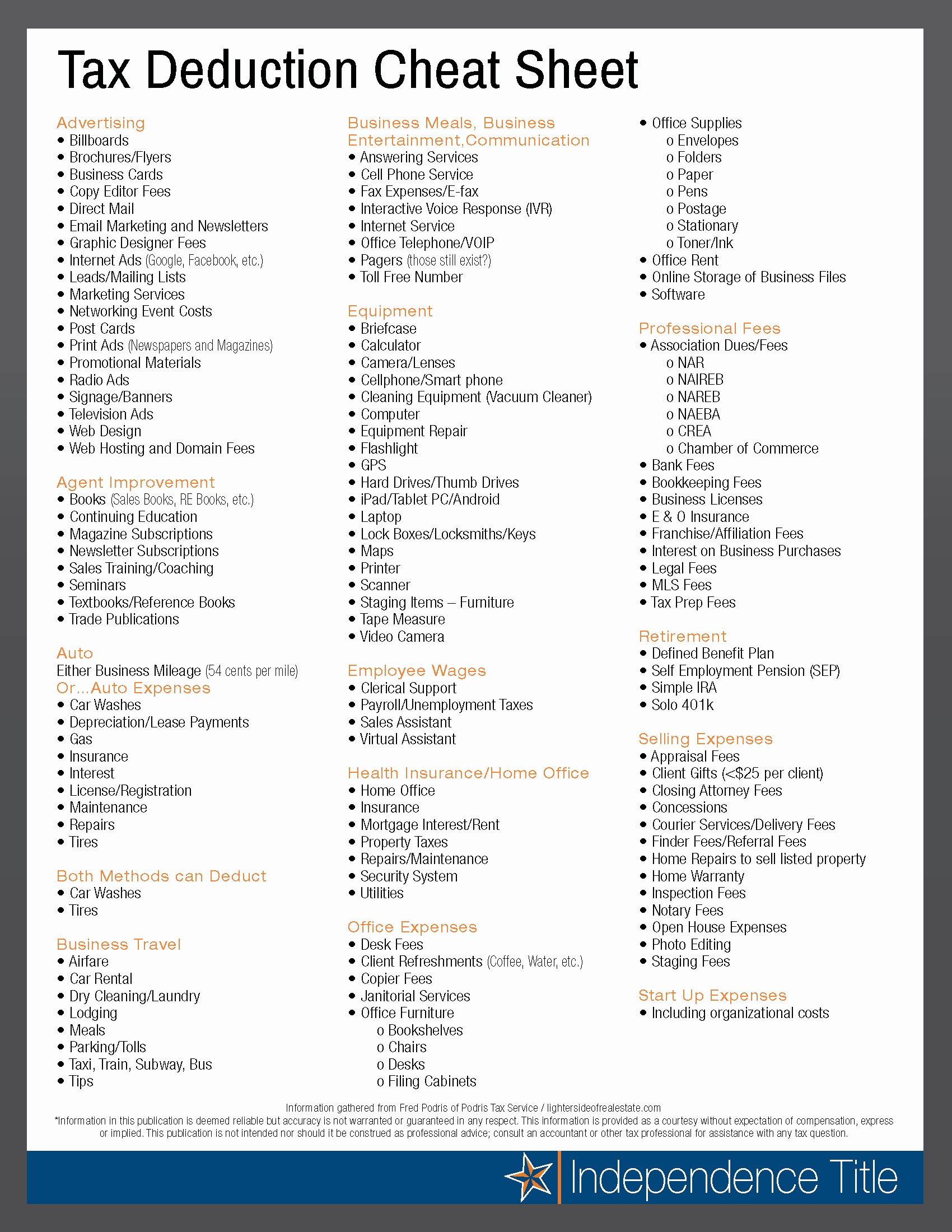

The Master List Of All Types Of Tax Deductions INFOGRAPHIC Business

https://i.pinimg.com/originals/15/a6/2e/15a62e57e3086db232425ae452a797e3.jpg

Solved Tax Deductible Expenses EBIT Less Interest Expense Chegg

https://d2vlcm61l7u1fs.cloudfront.net/media/704/70444e3b-7c78-46d7-ae3a-2611351e9927/php4wdxhd.png

Medical expenses can be deducted if you itemize your deductions on Schedule A Form 1040 You can deduct medical expenses that add up to more than 7 5 of your adjusted gross income The For the self employed health insurance premiums are deductible as an ordinary expense at tax time Whether you purchase the policy in your name or have

Since self employment tax is based on your gross revenue minus tax deductions you ll also pay less in taxes overall depending on the number of eligible But there s an even better way to deduct your medical costs You can write off out of pocket medical expenses as a business deduction if you own a small business or are

Download Are Medical Expenses Tax Deductible For Self Employed

More picture related to Are Medical Expenses Tax Deductible For Self Employed

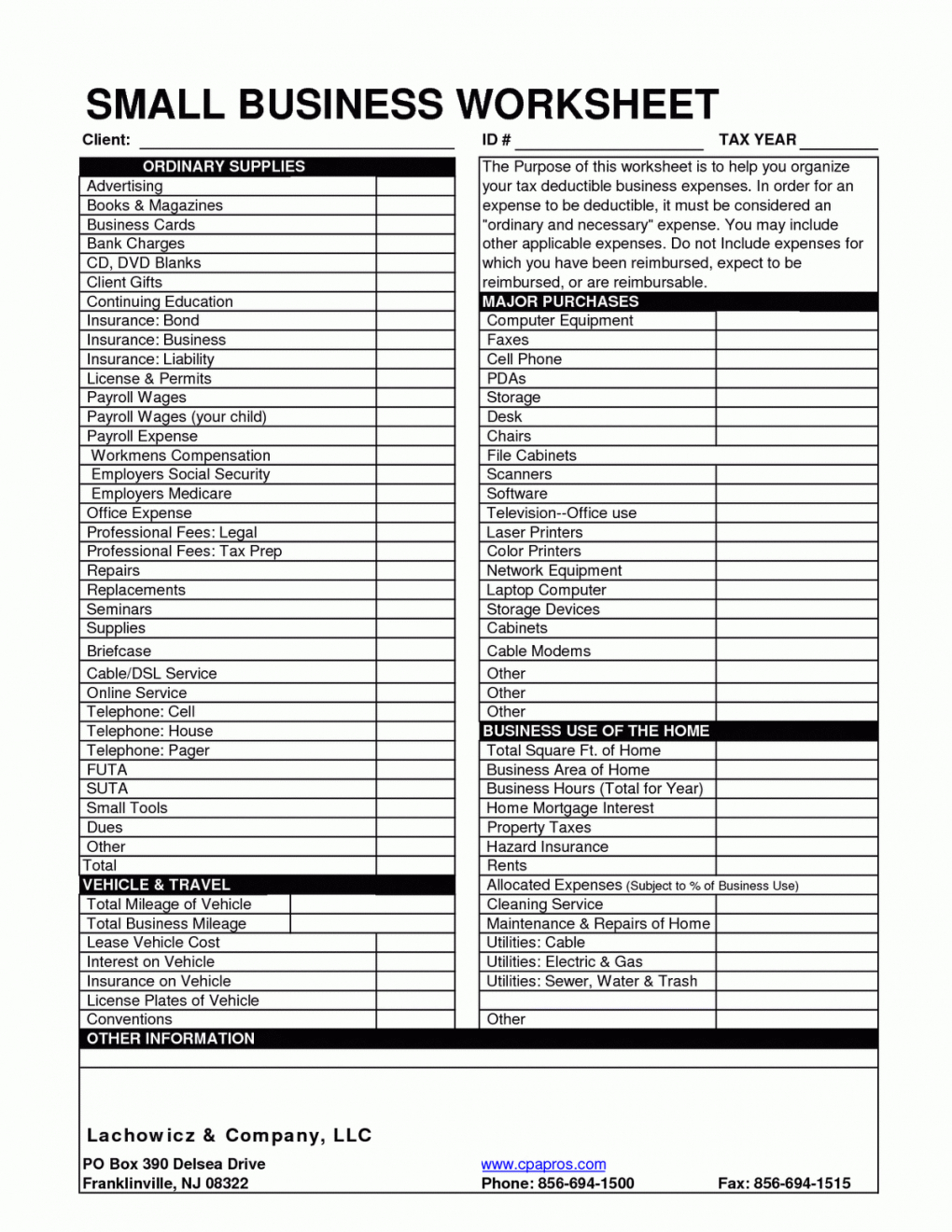

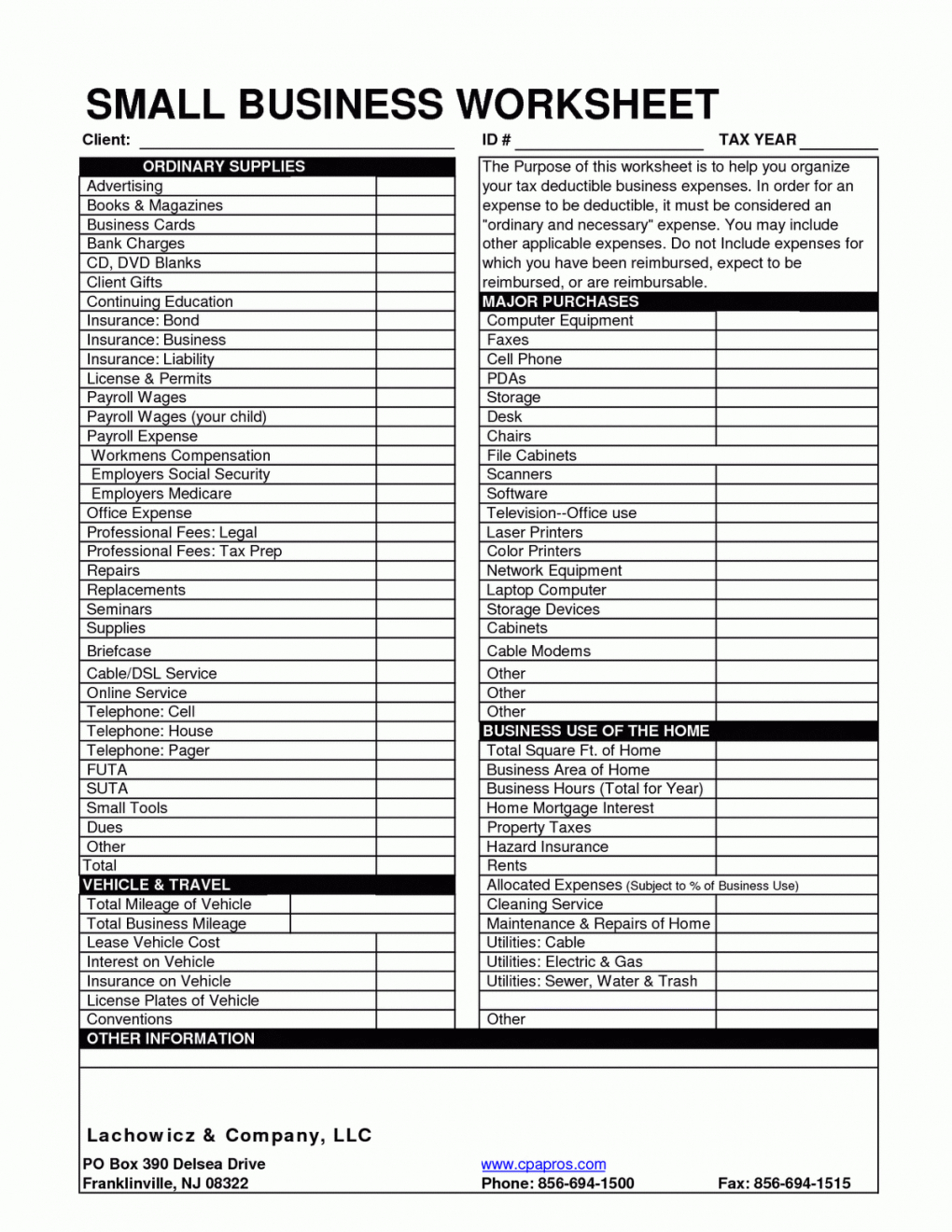

Printable Tax Deduction Worksheet Db excel

https://db-excel.com/wp-content/uploads/2019/09/tax-deduction-cheat-sheet-for-real-estate-agents-728x942.png

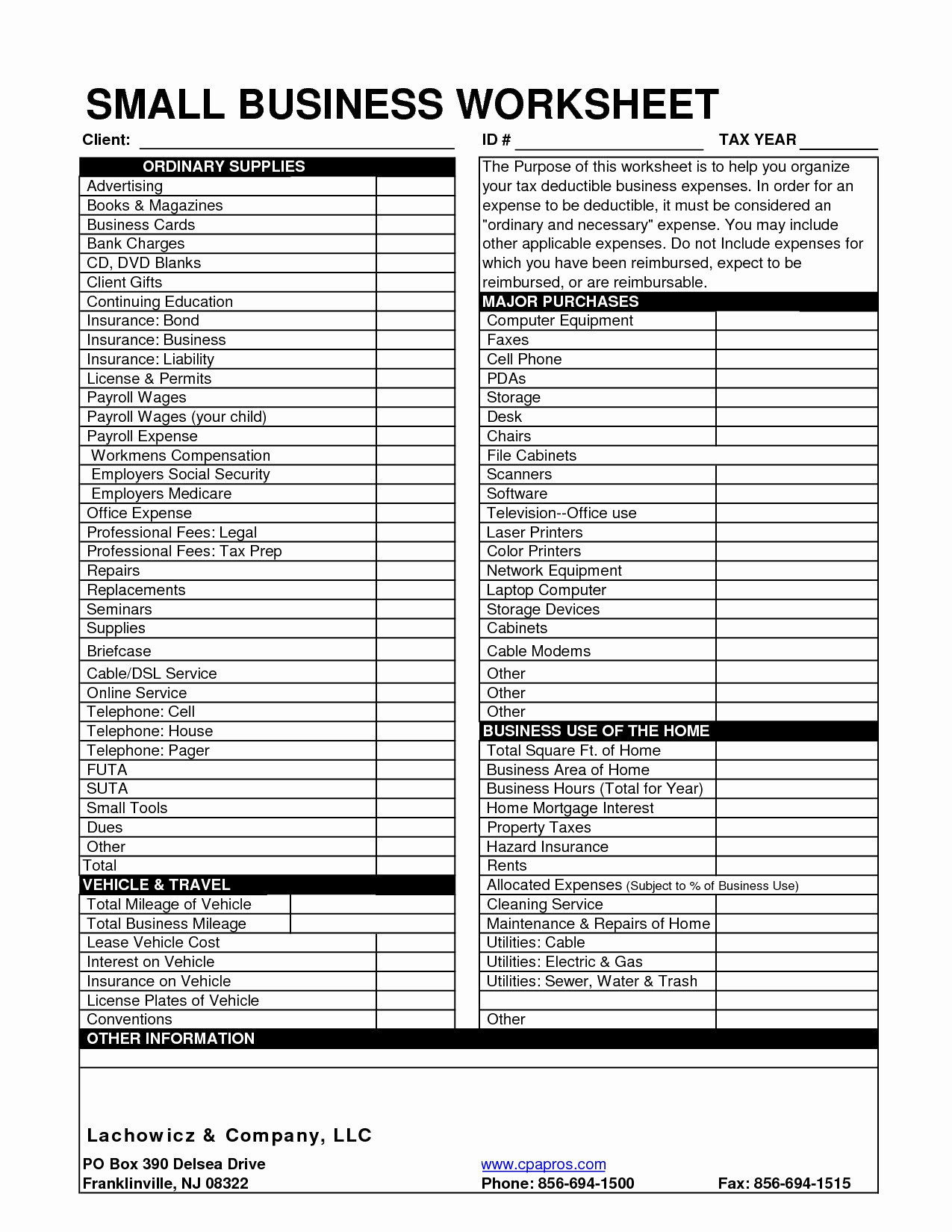

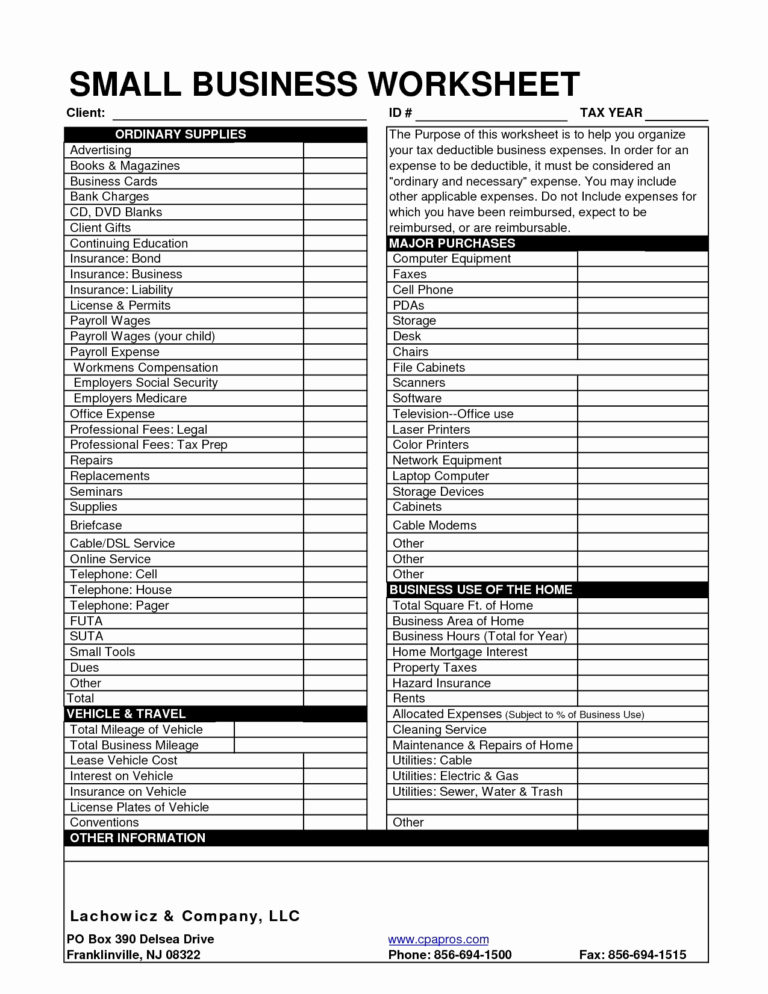

Tax Deduction Spreadsheet Then Small Business Tax Deductions Db excel

https://db-excel.com/wp-content/uploads/2019/09/tax-deduction-spreadsheet-then-small-business-tax-deductions.jpg

Tax Deductable Business Expenses SA Institute Of Taxation

https://cdn.ymaws.com/www.thesait.org.za/resource/resmgr/docs/01.jpg

You cannot claim expenses if you use your 1 000 tax free trading allowance Contact the Self Assessment helpline if you re not sure whether a business cost is an allowable Yes you can deduct your Medicare premiums if you re self employed There are two ways to do this within TurboTax As a self employed health insurance deduction To enter

No deduction can normally be permitted under Section 336 ITEPA 2003 for surgical hospital or other medical expenses incurred by an employee Such expenses will generally not Table of Contents 1 The home office deduction 2 Health insurance maybe deduction 3 Continuing education deduction 4 Mileage deduction 5

Tax Deductions You Can Deduct What Napkin Finance

https://napkinfinance.com/wp-content/uploads/2020/12/NapkinFinance-TaxDeductions-Napkin-10-13-20-v05-1.jpg

Business Itemized Deductions Worksheet Beautiful Business Itemized For

https://db-excel.com/wp-content/uploads/2018/11/business-itemized-deductions-worksheet-beautiful-business-itemized-for-business-expense-deductions-spreadsheet.jpg

https://www.goodrx.com/insurance/taxes/tax...

Yes If you re self employed you may be eligible to deduct up to 100 of the premiums you pay for coverage Let s say you pay 300 a month for health insurance out of your own pocket each year You may

https://blog.stridehealth.com/post/deducting...

If you re new to filing taxes as a 1099 worker you have a lot of options when it comes to saving on health insurance and medical expenses The primary ways of doing this are using the self employed

Tax Deductible Business Expenses Under Federal Tax Reform CCG

Tax Deductions You Can Deduct What Napkin Finance

The Ultimate List Of Tax Deductions For Online Sellers In 2020 Gusto

Non Allowable Expenses For Corporation Tax Malaysia Are Medical

Business Expense Deductions Spreadsheet Db excel

Tax Spreadsheet For Small Business Spreadsheet Downloa Tax Worksheet

Tax Spreadsheet For Small Business Spreadsheet Downloa Tax Worksheet

Qualified Business Income Deduction And The Self Employed The CPA Journal

Do You Qualify For A Home Office Tax Deduction While Working At

Http www anchor tax service financial tools deductions medical

Are Medical Expenses Tax Deductible For Self Employed - Since self employment tax is based on your gross revenue minus tax deductions you ll also pay less in taxes overall depending on the number of eligible