Are Medical Insurance Premiums Deductible On Federal Taxes You can deduct on Schedule A Form 1040 only the part of your medical and dental expenses that is more than 7 5 of your adjusted gross income AGI This publication also explains how to treat

You can deduct your health insurance premiums and other healthcare costs if your expenses exceed 7 5 of your adjusted gross income AGI Self employed individuals who meet certain Health insurance premiums are tax deductible but only if your total health care expenses including premiums exceed 7 5 of

Are Medical Insurance Premiums Deductible On Federal Taxes

Are Medical Insurance Premiums Deductible On Federal Taxes

https://images.ctfassets.net/4f3rgqwzdznj/342XhWwcP0pDkvbIwaPtrE/07d1bb691cc4d0722c889a8e4dcc27d5/health-insurance-low-deductible.jpg

/171106288_Aslan-Alphan_E-_GettyImages-56a6361f3df78cf7728bd97e.jpg)

Are Health Insurance Premiums Tax Deductible

https://www.investopedia.com/thmb/MlLHZTpP13VHUZz-t-fGGQ9EC7c=/2122x1415/filters:fill(auto,1)/171106288_Aslan-Alphan_E-_GettyImages-56a6361f3df78cf7728bd97e.jpg

Are Health Insurance Premiums Deductible On Tax Returns Nj

https://www.nj.com/resizer/ywScgnYtzaC8_-bOYaIbrKfdikU=/1280x0/smart/cloudfront-us-east-1.images.arcpublishing.com/advancelocal/3LHNFVZR5JBGTJXG56K4FSPNFA.jpg

Most forms of medical spending from insurance premiums to treatment are tax deductible if you meet the IRS requirements To claim this deduction you must Feb 7 2022 at 1 30 p m Getty Images You may be eligible for tax benefits to offset some of your health insurance premiums or medical expenses Health insurance is expensive but

Is health insurance tax deductible Health insurance premiums are deductible on federal taxes in some cases as these monthly payments are classified Health insurance premiums as well as expenditures for medical and dental care such as doctor visits and prescriptions may be deductible if you itemize deductions on your tax returns You also may

Download Are Medical Insurance Premiums Deductible On Federal Taxes

More picture related to Are Medical Insurance Premiums Deductible On Federal Taxes

What Is A Deductible Insurance Shark

https://myinsuranceshark.com/wp-content/uploads/2020/03/what-is-a-deductible.png

Which Is Better Paying Health Insurance Premiums Pre Tax Or Post Tax

https://i1.wp.com/goneonfire.com/wp-content/uploads/2019/12/014b_Which-is-Better_-Paying-Health-Insurance-Premiums-Pre-Tax-or-Post-Tax_.png?fit=1200%2C800&ssl=1

Are Health Insurance Premiums Deductible On Federal Taxes Pre Tax Vs

https://cdn.ramseysolutions.net/daveramsey.com/media/blog/insurance/health-insurance/health-insurance-deductible.jpg

Health insurance premiums are deductible if you itemize your tax return Whether you can deduct health insurance premiums from your tax return also depends on when For example you could not deduct your premiums if your AGI was 60 000 and you paid 4 500 in health insurance premiums over the course of the tax year

Since there s no double dipping allowed you can t deduct your health insurance premiums on your tax return if they were already paid with pre tax money No health coverage You had no health coverage for all or most of 2023 You must file a tax return if enrolled in Health Insurance Marketplace plan Get details on tax forms

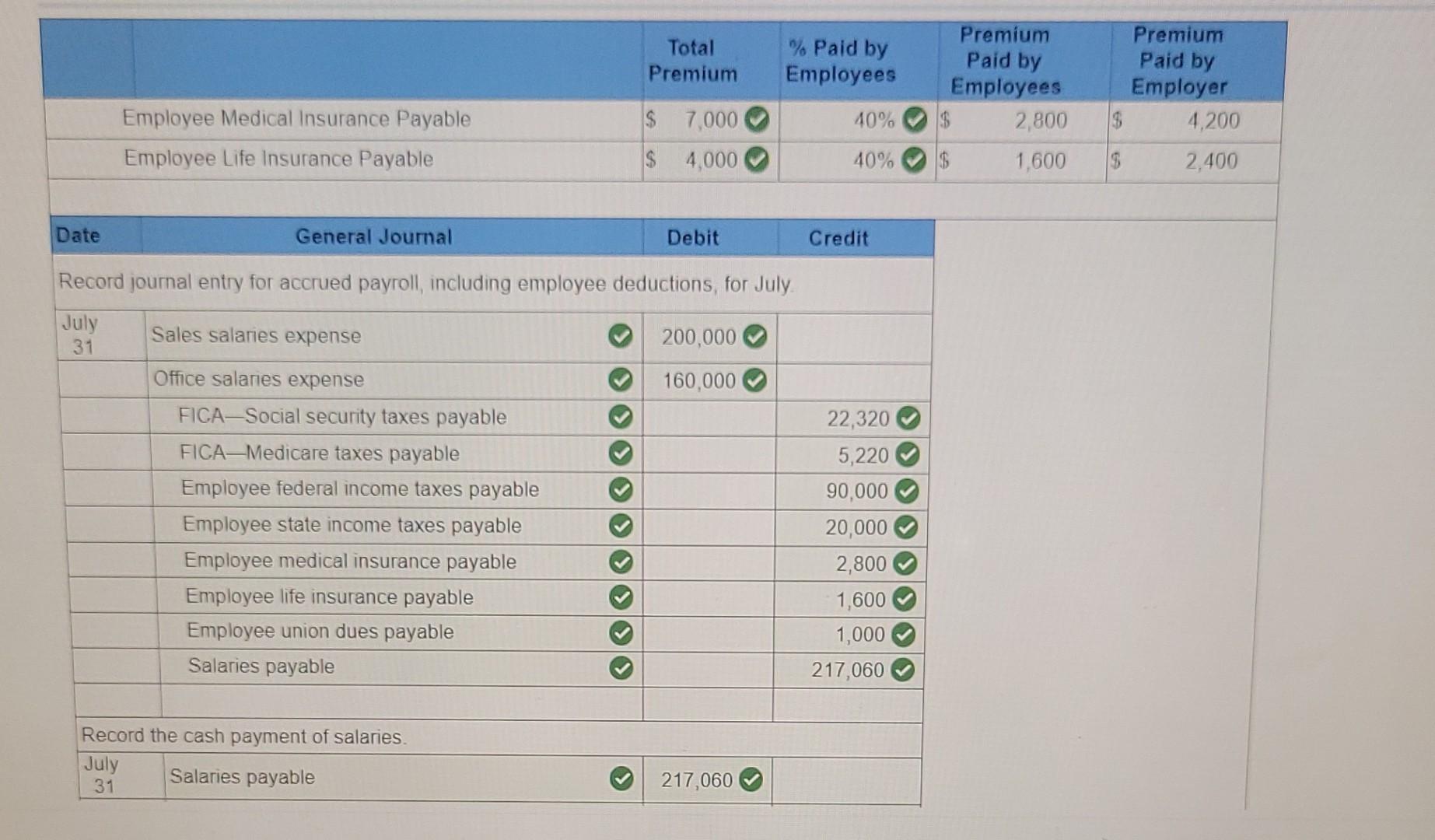

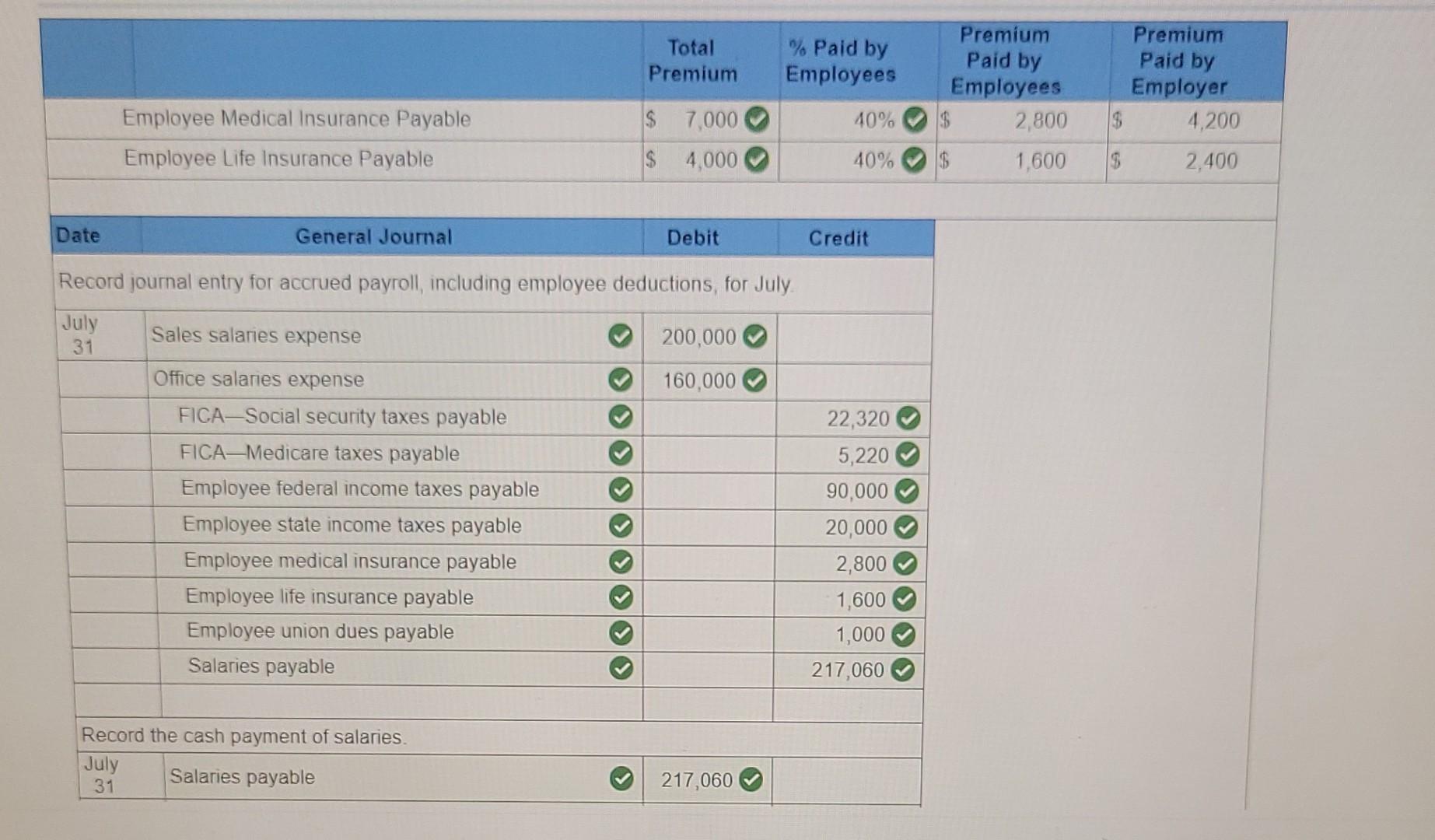

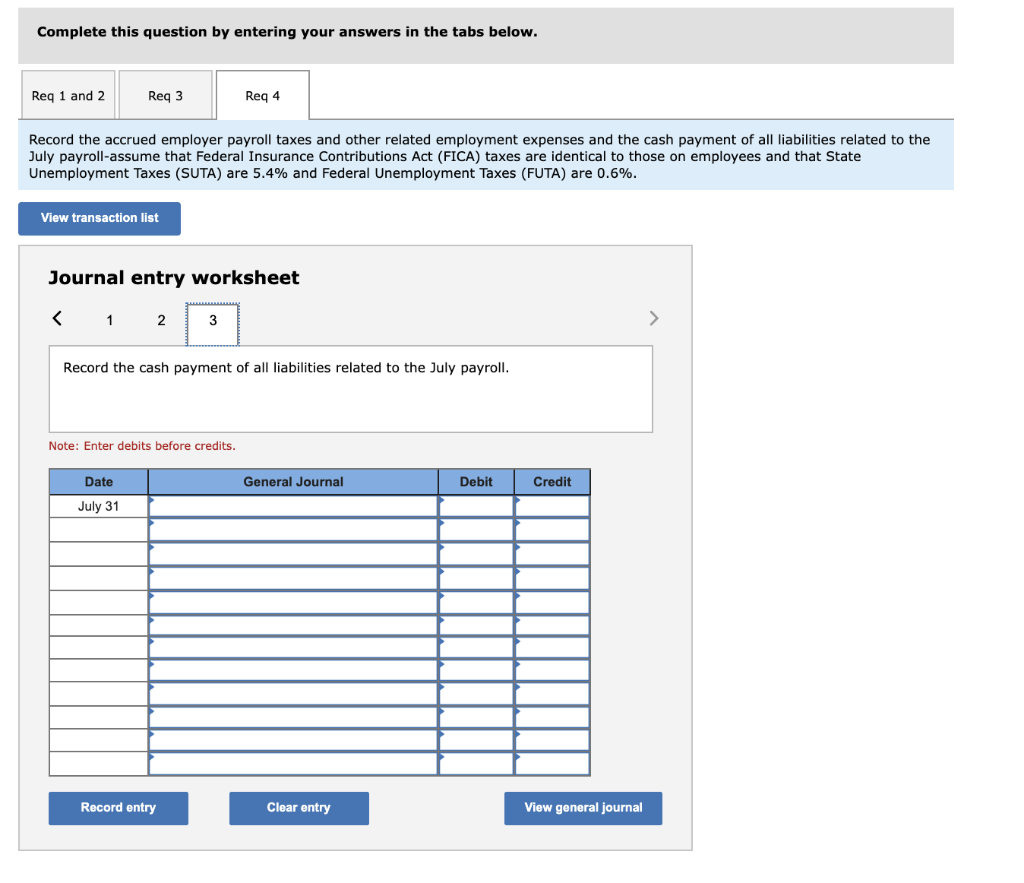

Solved The Following Monthly Data Are Taken From Ramirez Chegg

https://media.cheggcdn.com/study/8f5/8f54150a-9305-4c7b-b6af-ac32c493b593/image.jpg

Definitions And Meanings Of Health Care And Health Insurance Terms

https://blog.cdphp.com/wp-content/uploads/2015/01/vignettes_deductible.jpg

https://www.irs.gov/publications/p502

You can deduct on Schedule A Form 1040 only the part of your medical and dental expenses that is more than 7 5 of your adjusted gross income AGI This publication also explains how to treat

/171106288_Aslan-Alphan_E-_GettyImages-56a6361f3df78cf7728bd97e.jpg?w=186)

https://www.investopedia.com/are-hea…

You can deduct your health insurance premiums and other healthcare costs if your expenses exceed 7 5 of your adjusted gross income AGI Self employed individuals who meet certain

Are Premiums For Health Insurance Paid With Pre Tax Dollars Finance

Solved The Following Monthly Data Are Taken From Ramirez Chegg

Premiums Deductibles Copay s How It All Works

Qualified Business Income Deduction And The Self Employed The CPA Journal

Solved The Following Monthly Data Are Taken From Ramirez Chegg

Tax Deductions You Can Deduct What Napkin Finance

Tax Deductions You Can Deduct What Napkin Finance

Health Insurance Costs Premiums Deductibles Co Pays Co Insurance

Solved On January 8 The End Of The First Weekly Pay Period Of The

Are Health Insurance Premiums Deductible On Federal Income Tax Tax Walls

Are Medical Insurance Premiums Deductible On Federal Taxes - Health insurance premiums are deductible but only in certain instances Self employed workers especially those who start a small business or who work as