Are Medical Supplies Tax Exempt In this blog we will explore the important points about tax exemptions on medical supplies including specific medical supplies that may be eligible how to determine if your medical supplies are exempt and what you

For example in most states you would pay sales tax when purchasing a medical supply like a reusable thermometer but reusable thermometers are tax exempt in Florida Minnesota New Jersey New York Supplies that must be exempt include activities in the public interest such as medical care and social services as well as most financial and insurance services and certain supplies of land

Are Medical Supplies Tax Exempt

Are Medical Supplies Tax Exempt

https://www.signnow.com/preview/497/332/497332566/large.png

IRS Tax Exemption Letter Peninsulas EMS Council

https://www.pemsc.org/images/Tax_Exempt_Page_2.jpg

VAT In UAE What Are The Zero rated Exempt Supplies By Dubai

https://miro.medium.com/max/1200/1*HLXF2vcp2-g5oCt0ULPDSA.png

Finnish Customs to front page Individuals Businesses Statistics Go to eServices When a bundled transaction includes drugs durable medical equipment mobility enhancing equipment over the counter drugs prosthetic devices or medical supplies special rules apply The sale may or may not be taxable The sale is

Some of the products on the shelves of medical supply store may be tax exempt As always state sales tax laws vary from place to place so check out the rules in your area Medical devices are federally taxed at 2 3 While devices can be tax deductible medical expenses only medical costs above 7 5 of one s adjusted gross income are deductible Serocki 2009 Most states exempt at

Download Are Medical Supplies Tax Exempt

More picture related to Are Medical Supplies Tax Exempt

State Tax Exemption Map National Utility Solutions

https://nationalutilitysolutions.com/wp-content/uploads/2019/01/State-Tax-Exemption-Map.png

Exempt Supply Invoice Reachaccountant

http://www.reachaccountant.com/sg/wp-content/uploads/2018/06/exempt-supp-ms-apaint.jpg

Sd Tax Exempt Form Fill And Sign Printable Template Online US Legal

https://www.pdffiller.com/preview/5/506/5506066/large.png

Shortly before the 2021 year end the new circular letter on the VAT exemption for medical care by determined individuals and hospital care was published This circular letter In general most states provide a blanket exemption for all medical devices or a tax exemption for medical devices prescribed by a licensed provider However there are some

VAT exemption on medical equipment purchase How to order with free VAT on medical equipment for disabled or elderly user in care home Medical supplies that are essential for patient care and treatment often enjoy VAT exemptions or are zero rated Here are the criteria and examples for each Medical supplies are exempt from

Exempt Supply Under GST Regime Shah Doshi Chartered Accountants

https://shahdoshi.com/wp-content/uploads/EXEMPTED-SUPPLY-UNDER-GST-1.jpg

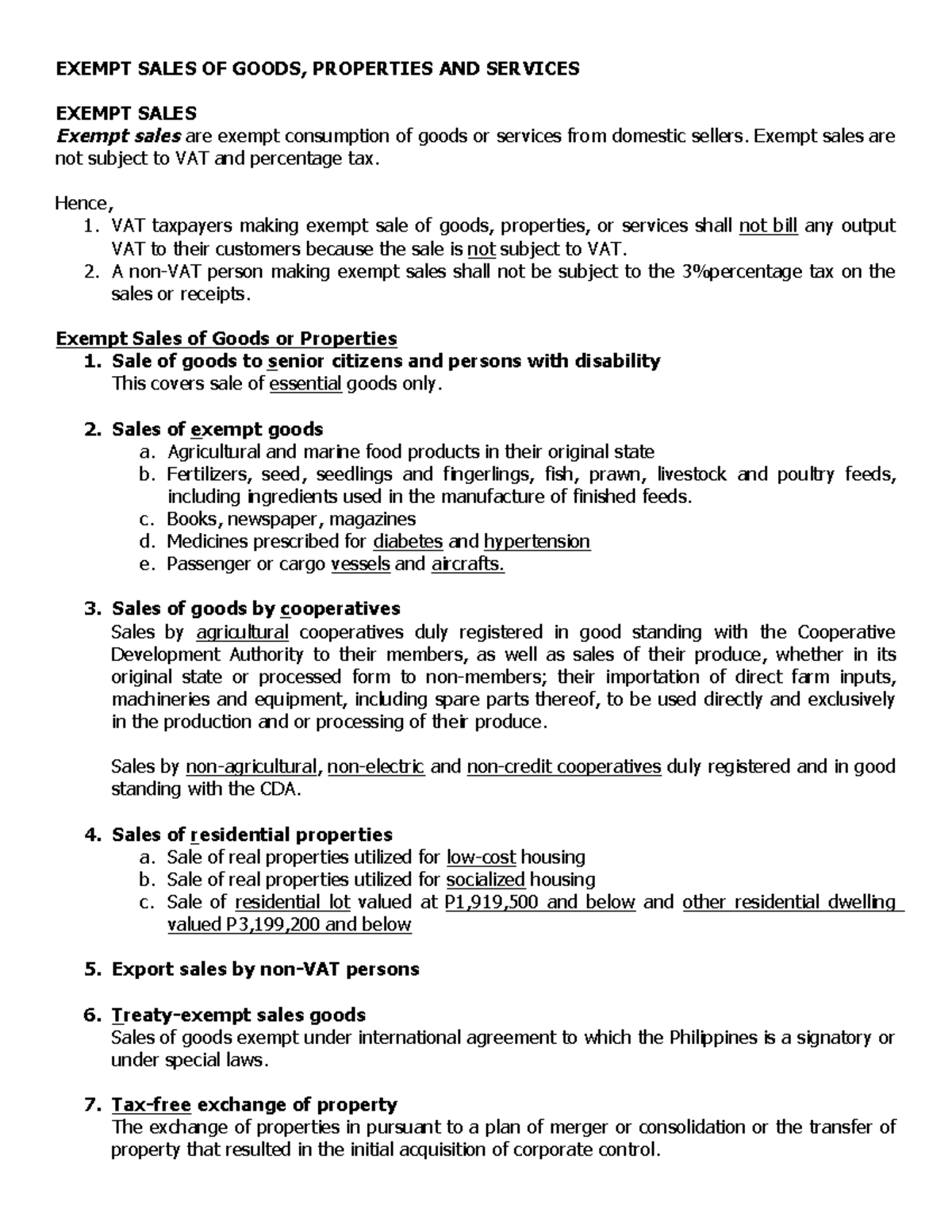

Difference Between Zero Rated Vs Exempt Supplies FBR Exempt Supply

https://i.ytimg.com/vi/0xqB7sjwEY0/maxresdefault.jpg

https://www.allstarmedicalllc.com › blog › tax...

In this blog we will explore the important points about tax exemptions on medical supplies including specific medical supplies that may be eligible how to determine if your medical supplies are exempt and what you

https://www.taxjar.com › blog › medical

For example in most states you would pay sales tax when purchasing a medical supply like a reusable thermometer but reusable thermometers are tax exempt in Florida Minnesota New Jersey New York

Chap 4 Tax EXEMPT SALES OF GOODS PROPERTIES AND SERVICES EXEMPT

Exempt Supply Under GST Regime Shah Doshi Chartered Accountants

Whats The Difference Between Exempt Items And Zero Rated Vat Items

GST Exempt Vs Taxable Supplies Virtual Heights Accounting

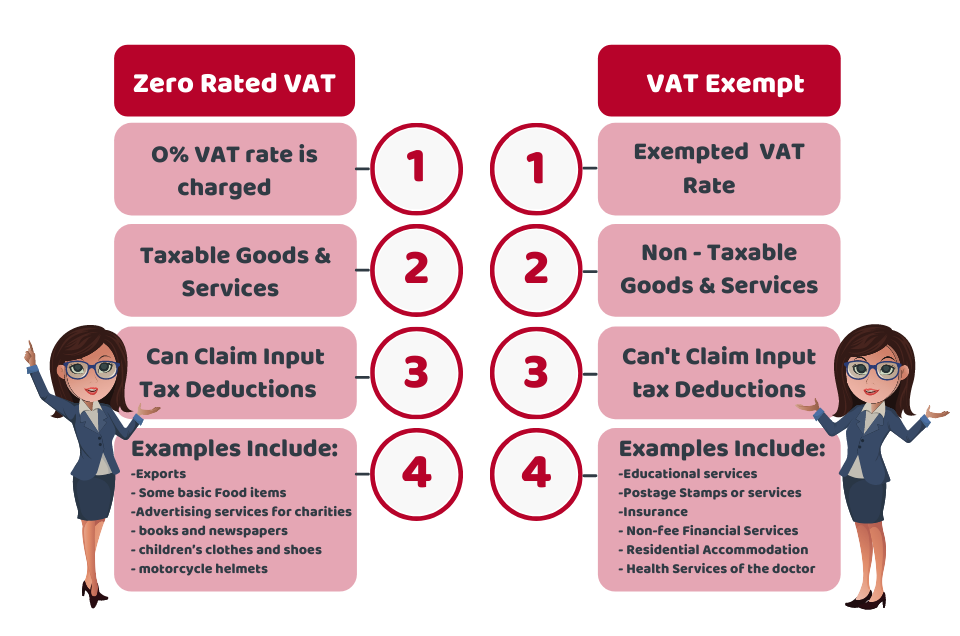

Texas Tax Exempt Certificate Fill Online Printable Fillable Blank

Can You Deduct The Cost Of Incontinence Supplies As A Medical Expense

Can You Deduct The Cost Of Incontinence Supplies As A Medical Expense

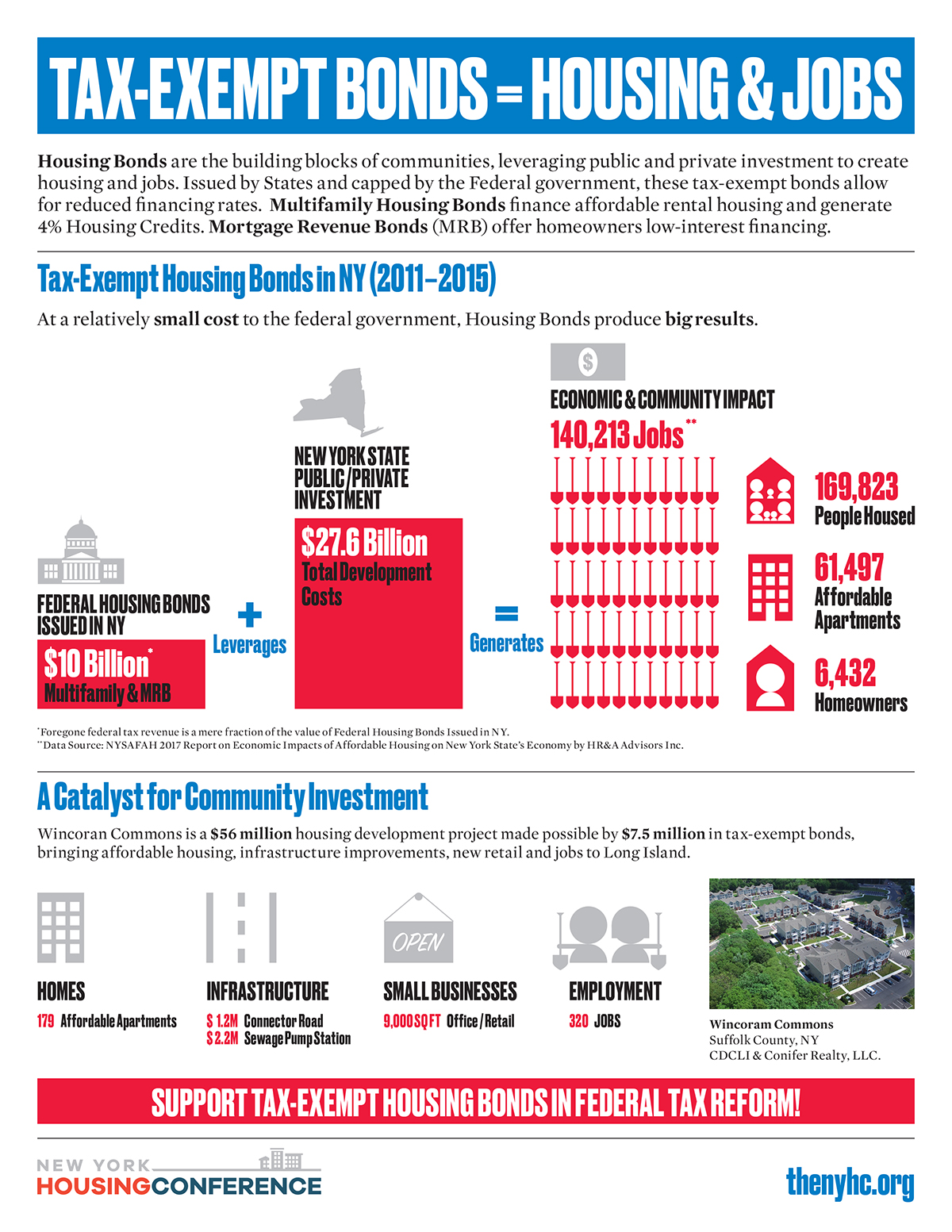

Full Tax Exempt Bond Infographic NYHC

Louisiana Hotel Tax Exempt Form Fill Online Printable Fillable

Zero rated And Exempt Supplies

Are Medical Supplies Tax Exempt - Medical devices suppliers conducting agreements for allowing hospitals to use free of charge their equipment might face both VAT and corporate tax adverse implications