Are Medicare Part B Premiums Tax Deductible In 2021 You can withdraw money tax free from a health savings account HSA to pay Medicare premiums after you turn 65 including premiums for Medicare Part A Part B Part D prescription drug plans and Medicare Advantage However the IRS doesn t allow tax free HSA withdrawals for Medigap premiums

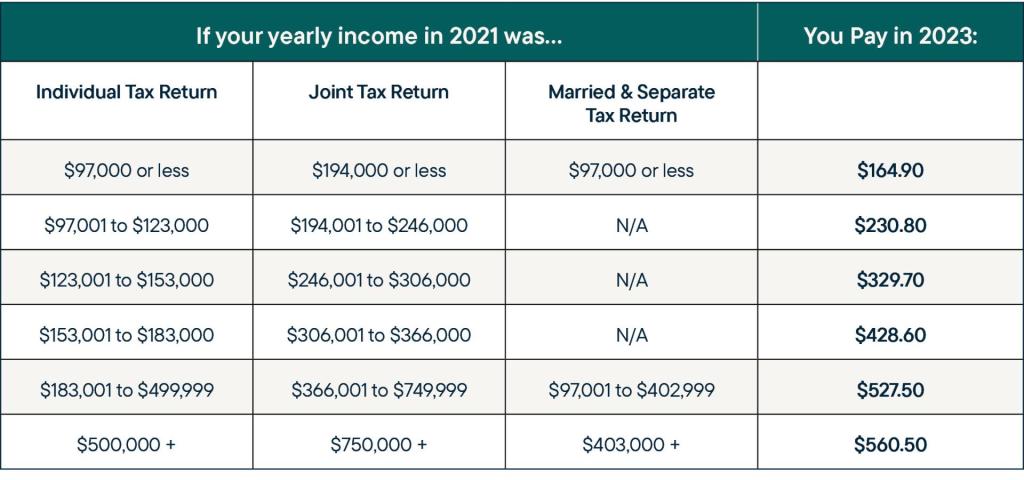

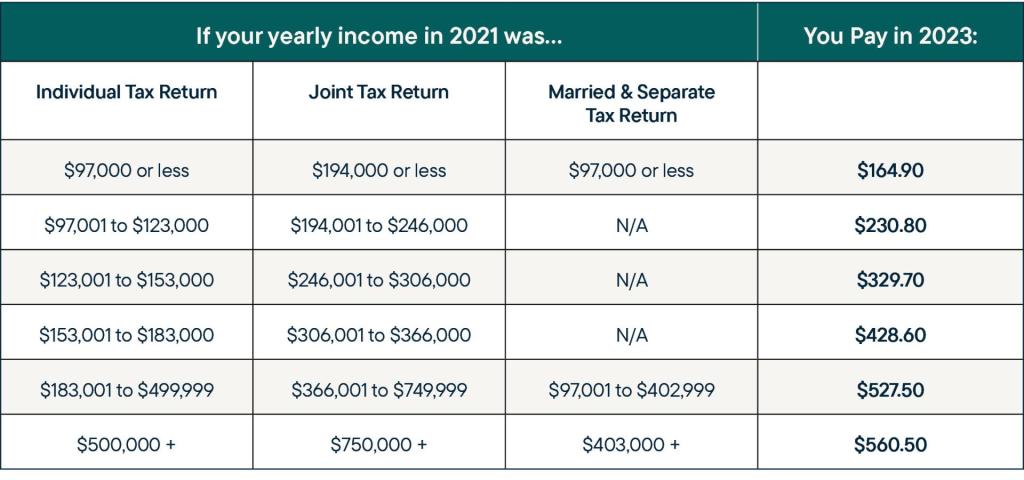

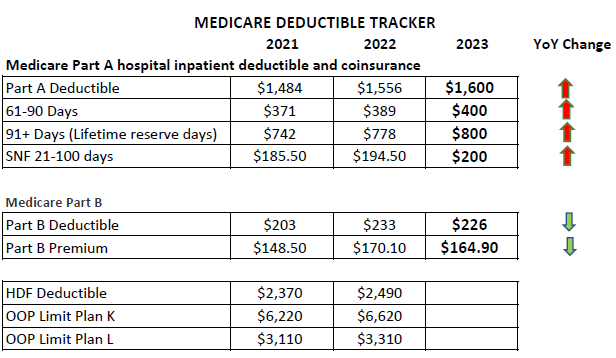

The annual deductible for all Medicare Part B beneficiaries is 203 in 2021 an increase of 5 from the annual deductible of 198 in 2020 The Part B premiums and deductible reflect the provisions of the Continuing Appropriations Act 2021 and Other Extensions Act H R 8337 Medicare premiums are tax deductible if they exceed 7 5 of your annual adjusted gross income for the current tax year However this does not only apply to Medicare premiums You can also include any unreimbursed medical

Are Medicare Part B Premiums Tax Deductible In 2021

Are Medicare Part B Premiums Tax Deductible In 2021

https://www.medicaretalk.net/wp-content/uploads/highmark-health-insurance-direct-stores-faqs.png

What Is Medicare Part B Your 2023 Costs Coverage Simplified RetireMed

https://www.retiremed.com/sites/default/files/styles/half/public/2022-11/RetireMed_New Brand_IRMAA Chart-Part B 2021 Income.jpg?itok=UmXlfMwe

Are Health Insurance Premiums Tax Deductible Investing BB

https://www.investingbb.com/wp-content/uploads/2020/09/Untitled1.png

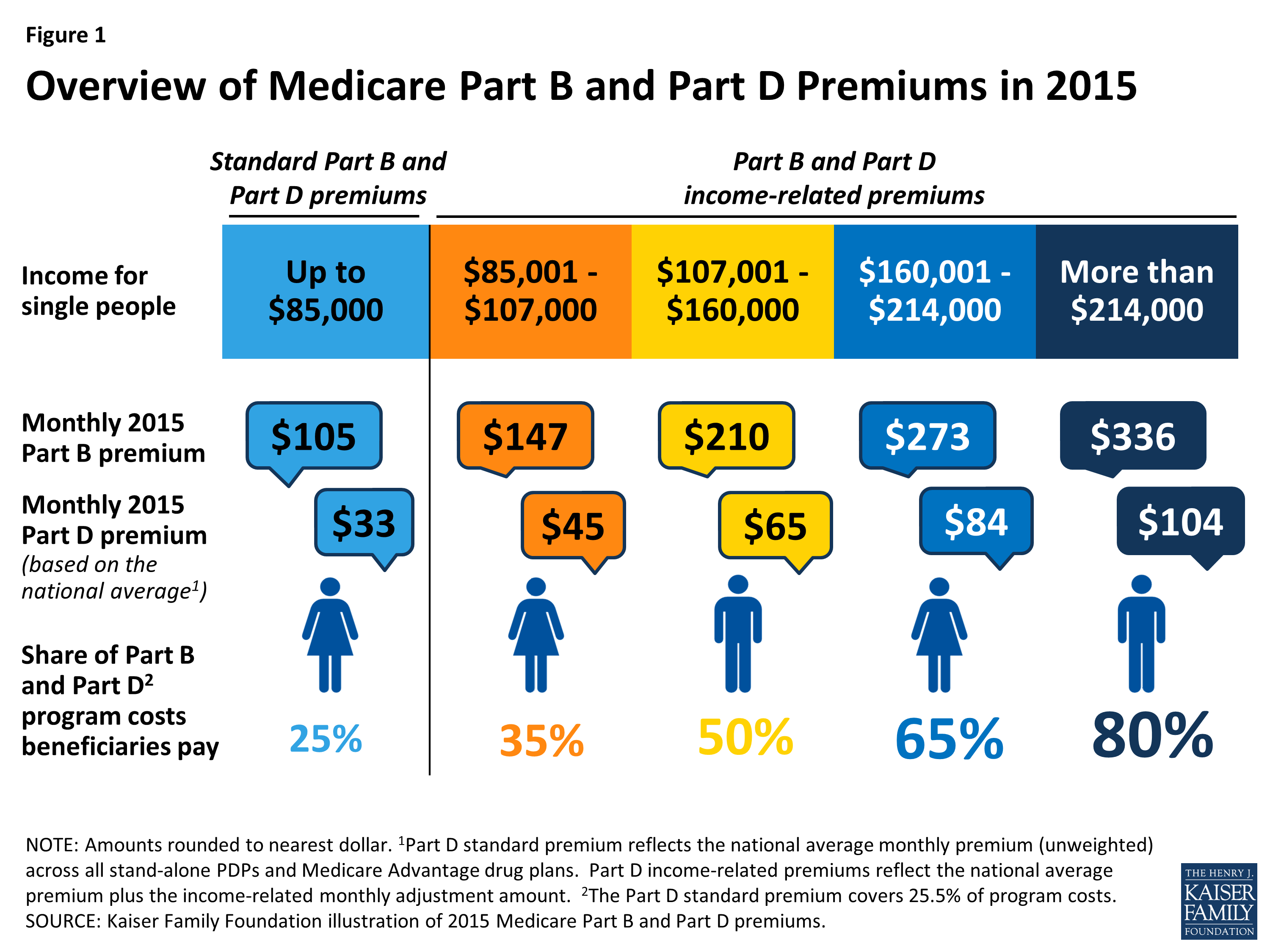

Medicare premiums are tax deductible if you itemize deductions although there may be restrictions Part A premiums are tax deductible if you meet certain requirements Medicare Part B costs include a standard monthly premium deductible and coinsurance The deductible and coinsurance may vary if a person has a Medicare Advantage plan

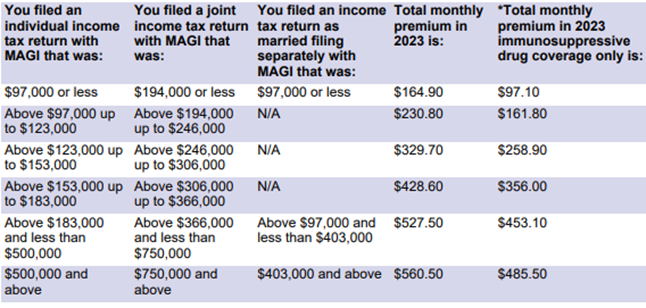

Premiums for all Medicare Parts A B D Medicare Advantage and Medigap are tax deductible but there are some rules about who is paying who is covered and where the deduction is Part B premiums are 174 70 per month 174 70 multiplied by 12 months is 2 096 40 If a person has surgery it would involve the Part A deductible of 1 632 for the hospital stay

Download Are Medicare Part B Premiums Tax Deductible In 2021

More picture related to Are Medicare Part B Premiums Tax Deductible In 2021

What Are The 2024 Medicare Part B Premiums And IRMAA Independent

https://help.ihealthagents.com/hc/article_attachments/16628776683415

Formulario Ssa 1099 Actualizado Septiembre 2023

https://unformulario.com/wp-content/uploads/2021/12/formulario-ssa-1099.gif

How Much Is Medicare Deductible For 2021 MedicareTalk

https://www.medicaretalk.net/wp-content/uploads/2020-part-b-premiums-archives-medicare-life-health.jpeg

Expenses Visits to doctors dentists surgeons chiropractors psychiatrists psychologists and nontraditional medical practitioners Inpatient hospital care or The annual deductible for all Medicare Part B beneficiaries is 233 in 2022 an increase of 30 from the annual deductible of 203 in 2021 The increases in the 2022 Medicare Part B premium and deductible are due to

Many health insurance premiums are tax deductible including the ones you pay for Medicare Premiums are one of the many medical expenses the IRS allows you to deduct from your yearly taxes Generally premiums you pay for Medicare Part B Part D and Medicare supplement plans are considered allowable Most Medicare enrollees do not pay a premium for Medicare Part A if they paid Medicare taxes for 40 qualifying quarters 10 years during their working years

Are Medigap Premiums Tax Deductible 65Medicare

https://65medicare.org/wp-content/uploads/2017/04/Man-doing-taxes.jpg

Are Insurance Premiums Tax Deductible AZexplained

https://azexplained.com/wp-content/uploads/2022/05/are-insurance-premiums-tax-deductible_58.jpg

https://www.aarp.org/health/medicare-qa-tool/are...

You can withdraw money tax free from a health savings account HSA to pay Medicare premiums after you turn 65 including premiums for Medicare Part A Part B Part D prescription drug plans and Medicare Advantage However the IRS doesn t allow tax free HSA withdrawals for Medigap premiums

https://www.cms.gov/newsroom/fact-sheets/2021...

The annual deductible for all Medicare Part B beneficiaries is 203 in 2021 an increase of 5 from the annual deductible of 198 in 2020 The Part B premiums and deductible reflect the provisions of the Continuing Appropriations Act 2021 and Other Extensions Act H R 8337

Medicare Blog Moorestown Cranford NJ

Are Medigap Premiums Tax Deductible 65Medicare

2023 Medicare Parts A B Premiums And Deductibles

Are Medicare Premiums Tax Deductible Medicare Insurance

Medicare Open Enrollment Is Here How Are Costs Changing For 2023

Medicare Part B Premiums For 2021

Medicare Part B Premiums For 2021

Medicare Costs 2023 Chart Hot Sex Picture

2021 Medicare Part B Overview

Medicare s Income Related Premiums A Data Note KFF

Are Medicare Part B Premiums Tax Deductible In 2021 - Medicare premiums are tax deductible if you itemize deductions although there may be restrictions Part A premiums are tax deductible if you meet certain requirements