Are Military Exempt From Sales Tax Is the US military sales tax exempt January 4 2024 by Wayne Fletcher The US military is not exempt from sales tax However certain military personnel may

Diplomatic tax exemption cards can generally be used to obtain exemption in person and at point of sale from sales taxes and other similarly imposed taxes on purchases of most Members of the U S Armed Forces have special tax situations and benefits Understand how that affects you and your taxes Get general information about how to file and pay

Are Military Exempt From Sales Tax

Are Military Exempt From Sales Tax

https://www.sanpatricioelectric.org/sites/sanpatricioelectric/files/inline-images/SPEC SALES TAX FORM Example.jpg

Taxact Online Fillable Tax Forms Printable Forms Free Online

https://www.signnow.com/preview/100/313/100313563/large.png

California Sales Tax Exemption Certificate Video Bokep Ngentot

http://pafpi.org/wp-content/uploads/2017/07/2017-PAFPI-Certificate-of-TAX-Exemption.jpg

2 3 1 Inserting the appropriate tax clauses in contracts 2 3 2 Soliciting prices on a tax exclusive basis when it is known that the Federal Government as a whole or the Armed IRS Tax Tip 2022 44 March 22 2022 Members of the military may qualify for tax benefits not available to civilians For example they don t have to pay taxes on some types of

In most cases the Defense Department and its industry partners can be exempt from paying VAT Exemption may apply whenever substantive spending occurs on defense related purchases within a Disabled Veteran Sales Tax Exemption While states that charge sales tax don t have blanket disabled veteran sales tax exemptions some states waive excise taxes registration and other

Download Are Military Exempt From Sales Tax

More picture related to Are Military Exempt From Sales Tax

Exempt hotel form By Jones Higher Way UMC Issuu

https://image.isu.pub/160617052838-53397783cf944ab1862389c9a37e03ec/jpg/page_1.jpg

Sales Exemption Certificate TUTORE ORG Master Of Documents

https://www.cdtfa.ca.gov/lawguides/images/sutr/1533-2.jpg

Sales Tax Exemption Request Letter Malayagif

https://groupraise.zendesk.com/hc/article_attachments/360002290207/IRS_Tax_Exempt_Letter-Examples.jpg

The Military Services or activities are responsible for any needed application for tax refunds for any other fuel purchases The Tax Reform Act of 1986 eliminated tax free sales to Provisions Excludable Income You can exclude the following income related to military compensation Basic Pay All for every month you are present in a

Military members must pay sales tax on purchases just like everyone else What gets a little tricky is that the sales tax is based on and paid to the state in which the Yes active duty military members are typically exempt from paying sales tax on purchases made on base However this exemption may not apply to all states

Georgia Sales Tax Exemption Form St 5 ExemptForm

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/fillable-form-st-5-sales-and-use-tax-certificate-of-exemption-georgia-10.png

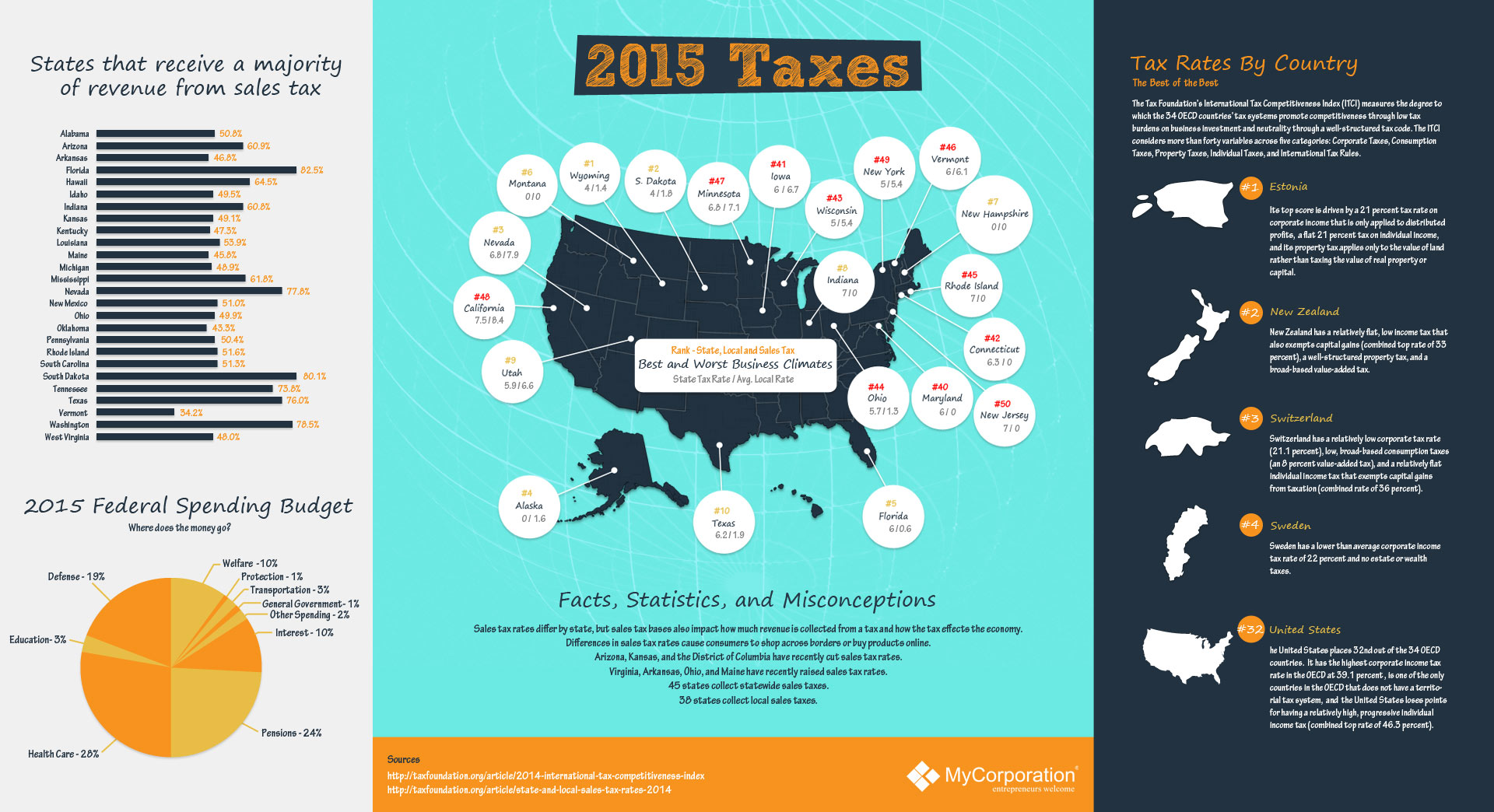

2015 Tax Stats An Infographic

http://blog.mycorporation.com/wp-content/uploads/2015/04/taxstats2015_new1.jpg

https://thegunzone.com/is-the-us-military-sales-tax-exempt

Is the US military sales tax exempt January 4 2024 by Wayne Fletcher The US military is not exempt from sales tax However certain military personnel may

https://www.state.gov/sales-tax-exemption

Diplomatic tax exemption cards can generally be used to obtain exemption in person and at point of sale from sales taxes and other similarly imposed taxes on purchases of most

Online Tax Online Tax Exemption Certificate

Georgia Sales Tax Exemption Form St 5 ExemptForm

Tax Exempt Letter Sample Fill Out Sign Online DocHub

FREE 10 Sample Tax Exemption Forms In PDF

Missouri Sales Tax Exemption Ebenezer Lutheran Church

Filing Exempt On Taxes For 6 Months How To Do This

Filing Exempt On Taxes For 6 Months How To Do This

State Tax Exemption Map National Utility Solutions

Sales Use Tax Exempt Form 2023 North Carolina ExemptForm

2023 Sales Tax Exemption Form Texas ExemptForm

Are Military Exempt From Sales Tax - In most cases the Defense Department and its industry partners can be exempt from paying VAT Exemption may apply whenever substantive spending occurs on defense related purchases within a