Are Military Members Exempt From State Taxes SCRA rules for state income taxes apply only to the service member s military income Income from other sources including second jobs and rental property

Of the 17 states that we randomly selected only two exempt military pay income from taxes exempting all compensation earned by servicemen including States that Fully Exempt Military Income some states require conditions be met Arizona Arkansas Colorado Resident living outside the 50 U S states for 305 days of the

Are Military Members Exempt From State Taxes

Are Military Members Exempt From State Taxes

https://www.achance2talk.com/wp-content/uploads/2022/12/military-exempt-from-state-taxes_65e720b42.jpg

Veterans Should Pay State Taxes On Pensions

https://compote.slate.com/images/4e694c08-552e-43ea-9c04-45b6dc5bcebb.jpg?crop=590%2C421%2Cx0%2Cy0

Military Exempt From State Taxes AChance2Talk

https://i0.wp.com/www.veteransunited.com/assets/craft/images/blog/VeteranPropertyTaxExemptions_Mobile4.png?strip=all

The rules governing where and in many cases if military members and their spouses pay state income taxes are changing thanks to a new law signed early this year The Veterans Auto and ALERT Kentucky New Mexico Minnesota and Oklahoma instituted new tax guidelines in 2010 exempting certain military pay from state taxes for legal residents

While all pays are taxable most allowances are tax exempt The primary allowances for most individuals are BAS and BAH which are tax exempt Conus COLA is one Most states fully exempt military retirement income from state income tax As mentioned however when it comes to tax treatment some states don t favor

Download Are Military Members Exempt From State Taxes

More picture related to Are Military Members Exempt From State Taxes

Sample Letter Tax Exemption Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/497/332/497332566/large.png

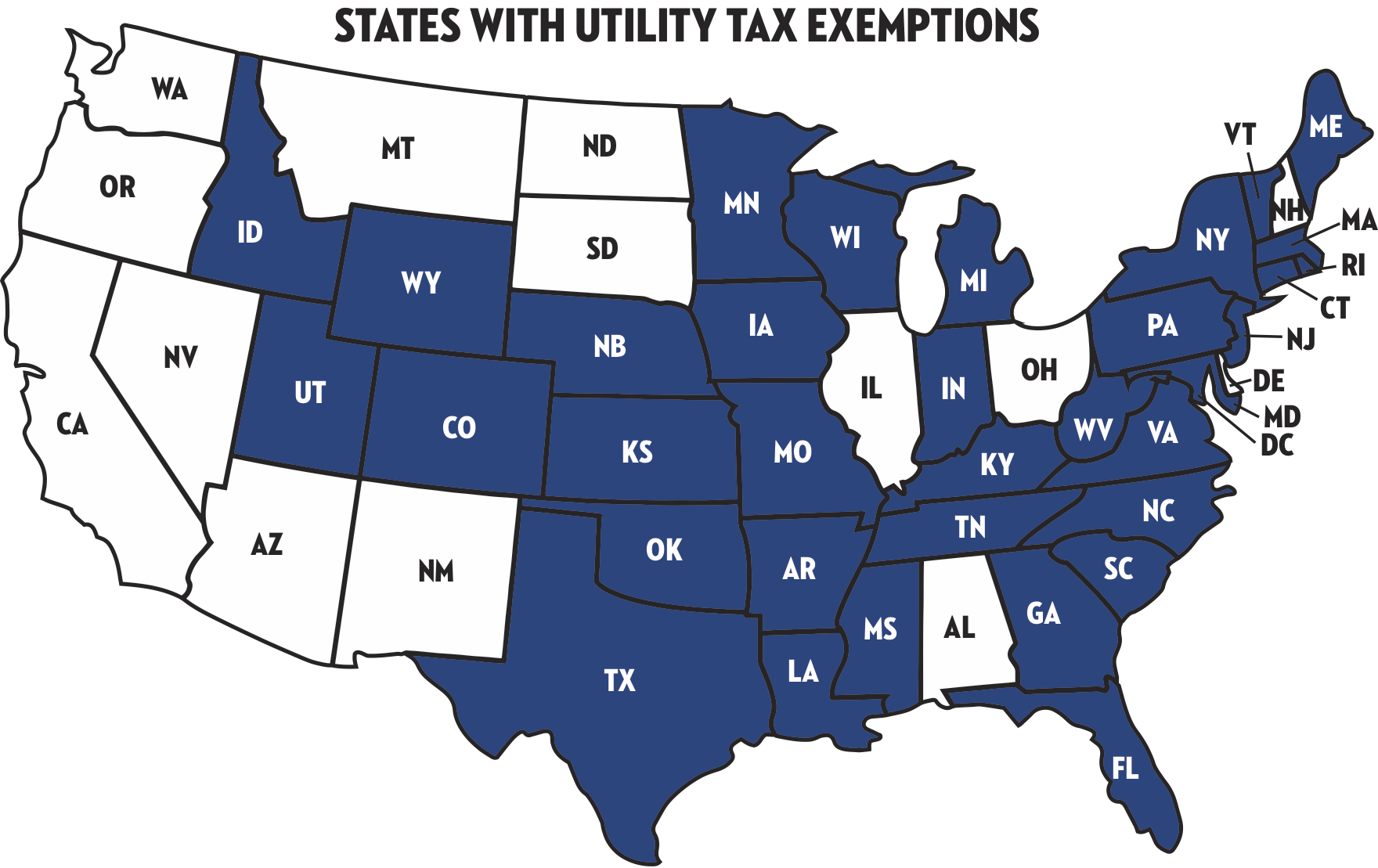

State Tax Exemption Map National Utility Solutions

https://nationalutilitysolutions.com/wp-content/uploads/2019/01/State-Tax-Exemption-Map.png

Student Loan Forgiveness In NY Would Be Formally Exempt From State

https://d1qbemlbhjecig.cloudfront.net/prod/filer_public/nynow-wmht/5fb610f66a_2ED2EBE8-55FD-4053-B3E6-ACFB376255BA.png

What MSRRA does not do MSRRA does not permit military spouses to maintain a legal residence in a state different than their active duty service members Members of the U S Armed Forces have special tax situations and benefits Understand how that affects you and your taxes Get general information about how to file and pay

New Mexico is becoming a less expensive place for retired military members but it s still more expensive than most states in the U S For 2023 Veterans Tax Tip 2022 44 March 22 2022 Members of the military may qualify for tax benefits not available to civilians For example they don t have to pay taxes on some types of

Social Security Cost Of Living Adjustments 2023

https://i2.wp.com/financialsamurai.com/wp-content/uploads/2021/10/wage-and-tax-statement.png

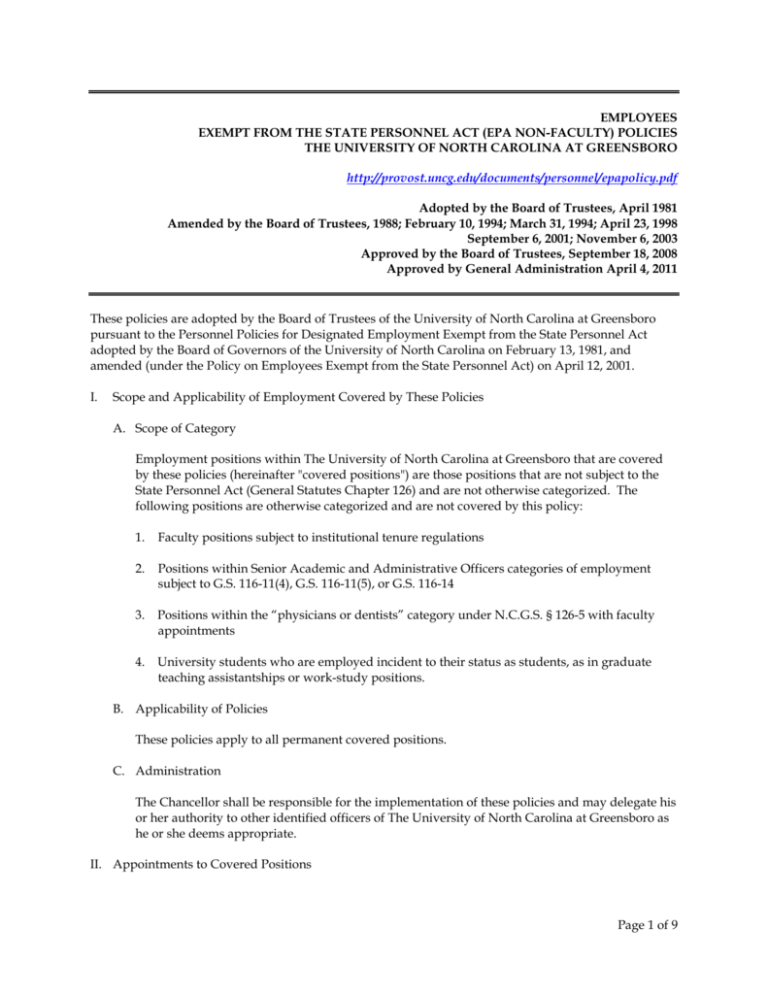

Employees Exempt From The State Personnel Act

https://s3.studylib.net/store/data/008442017_1-b95fc52c6bf8326a4d884406857e6dcb-768x994.png

https://www.militaryonesource.mil/financial-legal/...

SCRA rules for state income taxes apply only to the service member s military income Income from other sources including second jobs and rental property

https://www.cga.ct.gov/2005/rpt/2005-r-0123.htm

Of the 17 states that we randomly selected only two exempt military pay income from taxes exempting all compensation earned by servicemen including

Printable Exemption Form From Garnishment Printable Forms Free Online

Social Security Cost Of Living Adjustments 2023

Tax File Number Declaration Form Pdf Withholding Tax Payments Vrogue

Cancelled Student Debt May Now Be Exempt From State Taxes In

State Taxes State Taxes Exempt Military

Are Churches Exempt From State Unemployment Taxes

Are Churches Exempt From State Unemployment Taxes

Ultimate Soldier Submitted Photos Page 2540b

EXEMPT From Military Service YouTube

Evansville Veteran Reacts To Elimination Of Military Income Tax

Are Military Members Exempt From State Taxes - While all pays are taxable most allowances are tax exempt The primary allowances for most individuals are BAS and BAH which are tax exempt Conus COLA is one