Are Military Pensions Tax Free Some don t tax military pensions at all while some exempt the first few thousand dollars from taxation For example Hawaii doesn t tax military retirement pay but West Virginia waives up to

Every year no later than the 25th of January DFAS CL will send you an Internal Revenue Service IRS Form 1099 R which will show all the taxable retired pay paid and the amount of tax withheld A military retiree can either use myPay or send an IRS Form W 4 to alter the amount DFAS withholds for federal income taxes from their military retired pay An

Are Military Pensions Tax Free

Are Military Pensions Tax Free

https://www.policyed.org/sites/default/files/news/thumbs/istock-623096374.jpg

Pensions Comprehensive Advice Required Logic Wealth Planning

https://ml0paw3ytsiq.i.optimole.com/r5ov51c-Dj6IzU57/w:auto/h:auto/q:90/https://logic-wp.com/wp-content/uploads/2016/08/pension-image.jpg

Are You Due A Huge Pension Tax Refund Which News

https://s3.eu-west-1.amazonaws.com/prod.news.product.which.co.uk/news/wp-content/uploads/2017/03/Pensions.jpg

Our retiree would have been receiving 2 500 per month for three years in fully taxable military compensation when 500 of that should have been tax free The IRS allows the retiree to amend Military retirement pay based on a person s age and service length is taxable and should be included as income for federal income taxes Meanwhile the amount a veteran pays to participate in the

Military retirement pay based on age or length of service is considered taxable income for Federal income taxes and most state income taxes However military disability retirement pay and Military retirement pay based on age or length of service is considered taxable income for Federal income taxes However military disability retirement pay and Veterans benefits

Download Are Military Pensions Tax Free

More picture related to Are Military Pensions Tax Free

Retiring These States Won t Tax Your Distributions

https://www.taxdefensenetwork.com/wp-content/uploads/2022/01/military-benefits-map-2500x1875.jpg

HMRC Demands Payments From Savers Who Broke Pension Rules

https://secure.i.telegraph.co.uk/multimedia/archive/03558/Pension_pay_241625_3558696b.jpg

It s Time To Reform Lavish Military Pensions Foundation For Economic

https://fee.org/media/21779/military-pensions.jpg?anchor=center&mode=crop&width=1920&rnd=131370854120000000

Military Retirement Pay According to H R Block s Monica Welsh If you receive military retirement pay based on age or length of service this income is Retirees and annuitants can request a 1099 R reissue online The online 1099 R reissue tool also accepts international addresses The Affordable Care Act 1095 B C statements

Some states don t charge income tax on military retired pay In all states U S Department of Veterans Affairs disability payments are tax free Payments you receive as a member of a military service generally are taxed as wages except for retirement pay which is taxed as a pension If your retirement pay is based

States That Don t Tax Military Retirement Pay Discover Here

https://www.thesoldiersproject.org/wp-content/uploads/2023/04/military-retirement-tax-exemption.png

Pensions Montgomeryfc

http://montgomeryfc.co.uk/wp-content/uploads/2019/06/iStock-924108718-min.jpg

https://money.howstuffworks.com/per…

Some don t tax military pensions at all while some exempt the first few thousand dollars from taxation For example Hawaii doesn t tax military retirement pay but West Virginia waives up to

https://www.military.com/benefits/milit…

Every year no later than the 25th of January DFAS CL will send you an Internal Revenue Service IRS Form 1099 R which will show all the taxable retired pay paid and the amount of tax withheld

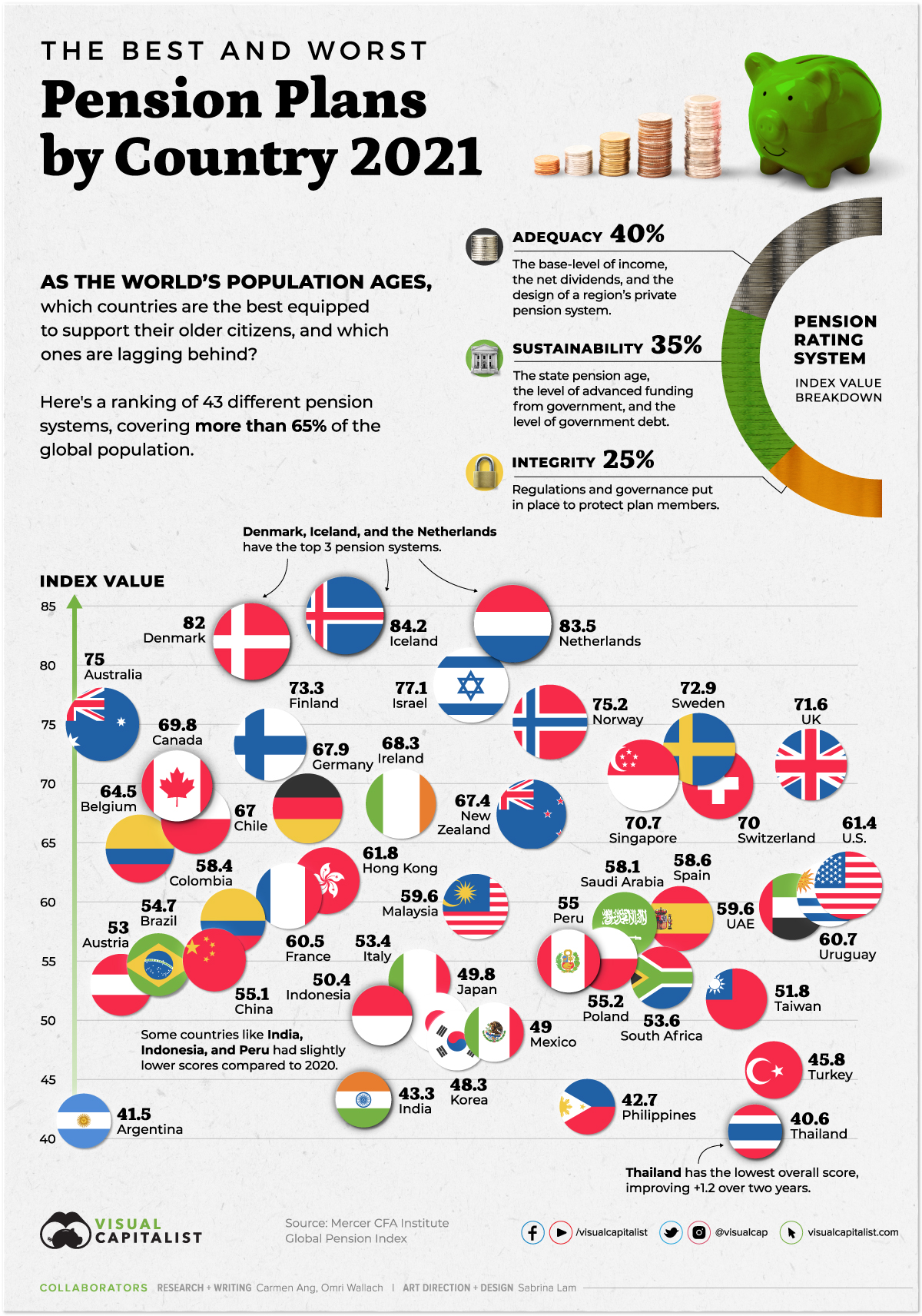

Ranked The Best And Worst Pension Plans By Country

States That Don t Tax Military Retirement Pay Discover Here

UKAEA Pension Scheme Useful Resources

States That Don t Tax Military Retirement A Detailed List

Pension Clipart Clipground

Pensions More Than Just A Tax efficient Way To Save For Retirement

Pensions More Than Just A Tax efficient Way To Save For Retirement

Cashing In Your Pension At 50 Ireland Everything You Need To Know

Pensions Rmt

Changes In NHS Pension Contributions Are You A Winner Or Loser

Are Military Pensions Tax Free - Military retirement pay based on age or length of service is considered taxable income for Federal income taxes However military disability retirement pay and Veterans benefits