Are Monthly Bank Fees Tax Deductible Common banking fees such as monthly service fees overdraft fees check writing fees and ATM fees are not tax deductible

The IRS allows you to write off bank service charges related to running your business Deductible bank charges include overdraft fees monthly service fees and transfer fees For most taxpayers bank fees are not deductible However taxpayers who operate their own business may be able to deduct bank fees

Are Monthly Bank Fees Tax Deductible

Are Monthly Bank Fees Tax Deductible

https://www.wikihow.com/images/e/e6/Determine-Whether-Your-Legal-Fees-Are-Tax-Deductible-Step-15.jpg

Are Bank Fees Tax Deductible

https://media.marketrealist.com/brand-img/8BpdsVhCz/0x0/are-bank-fees-tax-deductible-1646315190148.jpg

Bank Fees Tax Deduction

https://falconexpenses.com/blog/wp-content/uploads/2022/02/bank-fees-tax-deduction-complete-guide-768x432.png

Payment processing fees are generally considered to be a necessary business expense and are tax deductible in many jurisdictions including the United States This includes Many ask themselves are bank fees tax deductible for business In this article we explain when bank fees are tax deductible for businesses and how to write off bank fees

To claim a deduction for a transaction fee you incur you must meet all of the following conditions you incur the transaction fee you use the item or service the transaction fee Are Credit Card Fees Tax Deductible The short answer is it depends It largely depends on whether any credit card fees are incurred for business purposes or if the card was for

Download Are Monthly Bank Fees Tax Deductible

More picture related to Are Monthly Bank Fees Tax Deductible

A Comprehensive Guide To Tax Deductible Bank Fees

https://thebookkeepingstudio.com.au/wp-content/uploads/pexels-tima-miroshnichenko-5708232-scaled.jpg

Tax Deduction Letter PDF Templates Jotform

https://files.jotform.com/jotformapps/tax-deduction-letter-c1c1da39f77a424f295c2df1cb0f2b87.png

Are Credit Card Fees Tax Deductible Discover The Truth

https://paymentcloudinc.com/blog/wp-content/uploads/2022/01/are-credit-card-fees-tax-deductible.jpg

Tax deductible bank fees include service charges and monthly maintenance fees However overdraft fees fall into a different category and may not be eligible for tax Some interest can be claimed as a deduction or as a credit To deduct interest you paid on a debt review each interest expense to determine how it qualifies and where to take the

If your bank or credit card company charges annual or monthly service charges transfer fees or overdraft fees these are deductible You can also deduct merchant or transaction fees paid to a third party payment Monthly bank fees are considered an ordinary and necessary expense and therefore tax deductible Some banks charge a monthly fee depending on the bank and your account

/Legal_Fees_Deductible_GettyImages-1311044678-5f86299dd0074651a9ef31e66295441e.jpg)

Are Legal Fees Tax Deductible

https://www.thebalancemoney.com/thmb/rdM5cat9QkTg4ggdqo0NMU9sswQ=/2121x1414/filters:fill(auto,1)/Legal_Fees_Deductible_GettyImages-1311044678-5f86299dd0074651a9ef31e66295441e.jpg

:max_bytes(150000):strip_icc()/tax-preparation-prices-and-fees-3193048_color2-HL-8b4b5382e1a44aa0864ed504d4ca5414.gif)

How Much Does It Cost To File Taxes

https://www.thebalancemoney.com/thmb/VPYC4hYEu1RXePul529f8zEH9w8=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/tax-preparation-prices-and-fees-3193048_color2-HL-8b4b5382e1a44aa0864ed504d4ca5414.gif

https://www.mybanktracker.com/news/ban…

Common banking fees such as monthly service fees overdraft fees check writing fees and ATM fees are not tax deductible

https://marketrealist.com/p/are-bank-fees-tax-deductible

The IRS allows you to write off bank service charges related to running your business Deductible bank charges include overdraft fees monthly service fees and transfer fees

Are Bookkeeping Fees Tax Deductible Visory

/Legal_Fees_Deductible_GettyImages-1311044678-5f86299dd0074651a9ef31e66295441e.jpg)

Are Legal Fees Tax Deductible

Are Sexual Harassment Settlement Payments And Attorney Fees Tax

Are Bank Fees Tax Deductible

Are Bank Fees Tax Deductible Banks

No Monthly ACH Or Overdraft Fees Bluevine

No Monthly ACH Or Overdraft Fees Bluevine

Is A Bank Guarantee Fee Tax Deductible Aug 14 2023 Johor Bahru JB

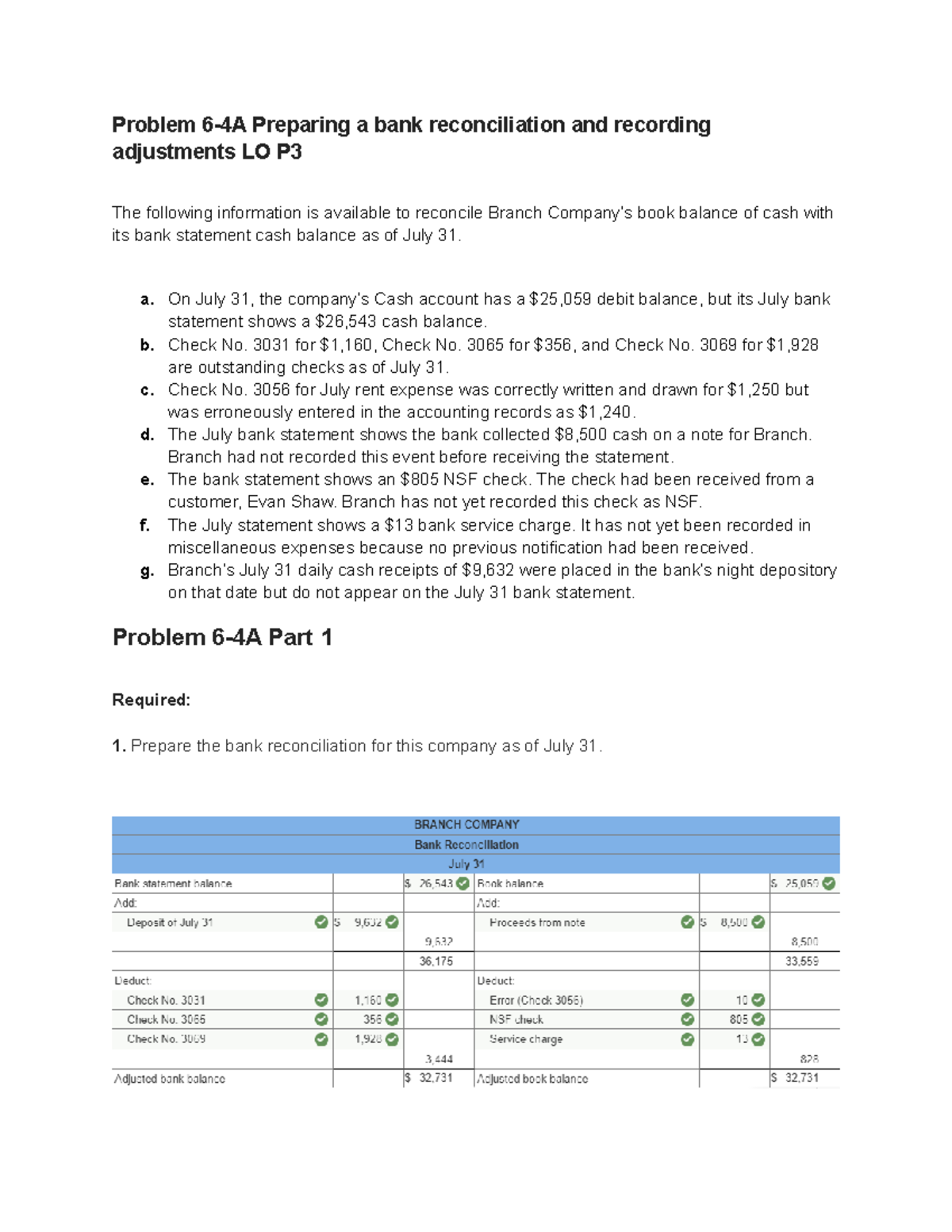

Bank Conciliation Practice Question 2021 2022 Problem 6 4A Preparing

5 Common Bank Fees And How To Avoid Them Forbes Advisor

Are Monthly Bank Fees Tax Deductible - Bank Fees and Interest Payments There are a variety of fees and expenses you might incur as a small business and some are tax deductible Bank fees interest on credit