Are Mutual Funds Taxable Mutual fund taxes typically include taxes on dividends and earnings while the investor owns the mutual fund shares as well as

Mutual funds are not tax free except for ELSS equity linked savings schemes or tax saving funds and some retirement funds As per the Income Tax Act under Section 80C you can claim a Just as with individual securities when you sell shares of a mutual fund or ETF exchange traded fund for a profit you ll owe taxes on that realized gain But you may also owe

Are Mutual Funds Taxable

Are Mutual Funds Taxable

https://weinvestsmart.com/wp-content/uploads/2020/03/Mutual-funds.jpg

The Best Guide To Mutual Funds Funds US News

http://media.beam.usnews.com/87/72/2488841a4ebe9a82abe704fd2761/gettyimages-157281690.jpg

How Mutual Funds Are Better Than Stock Investing

https://www.sipfund.com/images/blog/How-mutual-funds-are-better-than-stock-investing.jpg

If you are investing in mutual funds be prepared to pay taxes at multiple points First you ll need to pay taxes on any dividends you receive from the fund while you hold it And of course you ll need to pay Learn how mutual funds distribute income to shareholders and how to report and pay taxes on them Find out the types of distributions tax rates and tax strategies for different

Mutual funds generate three types of investment income interest dividends or capital gains Any fund that is held in a retail account will be taxed as ordinary For example assume you make 80 000 and receive 1 000 in investment income from the sale of stock If you have held the investment for a year or more you are only required to pay 15 or

Download Are Mutual Funds Taxable

More picture related to Are Mutual Funds Taxable

Why You Should Invest In Mutual Funds Moneyview

https://d31bgfoj87qaaj.cloudfront.net/blog/wp-content/uploads/why_invest_mutual_funds-main.jpg

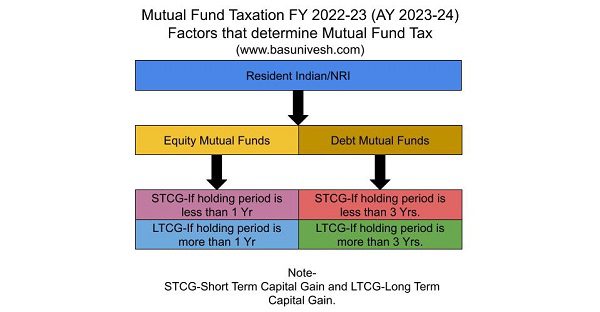

Mutual Fund Taxation FY 2022 23 AY 2023 24 BasuNivesh

https://b2382649.smushcdn.com/2382649/wp-content/uploads/2022/02/Mutual-Fund-Tax.jpg?lossy=1&strip=1&webp=1

4 Is Mutual Funds TAXABLE YouTube

https://i.ytimg.com/vi/K41vSKmPr78/maxresdefault.jpg

However mutual funds are required to distribute all net profits each year to avoid paying income taxes on those earnings A fund that receives interest or dividend Mutual funds that generate a lot of taxable income such as dividends can be bought within a tax advantaged account to defer taxation Some funds generate little to no taxable income making them

In other words if you have 1 000 in long term gains and 600 in long term losses you only have to pay tax on a net long term gain of 400 Should your losses exceed your Taxation on mutual funds can be explained further by pointing out the factors influencing it Here are the essential factors that affect the taxes levied on

New To Equity Mutual Funds Start With ELSS Funds

http://www.spews.org/wp-content/uploads/2020/01/mfp27e47de4-90e0-4f07-a351-f1b739fabf63.jpg

How Mutual Fund Companies Make Money Explained Seeking Alpha

https://static.seekingalpha.com/cdn/s3/uploads/getty_images/170141153/image_170141153.jpg?io=getty-c-w1536

https://www.nerdwallet.com/.../taxes-on-mut…

Mutual fund taxes typically include taxes on dividends and earnings while the investor owns the mutual fund shares as well as

https://www.etmoney.com/.../taxation-in-mut…

Mutual funds are not tax free except for ELSS equity linked savings schemes or tax saving funds and some retirement funds As per the Income Tax Act under Section 80C you can claim a

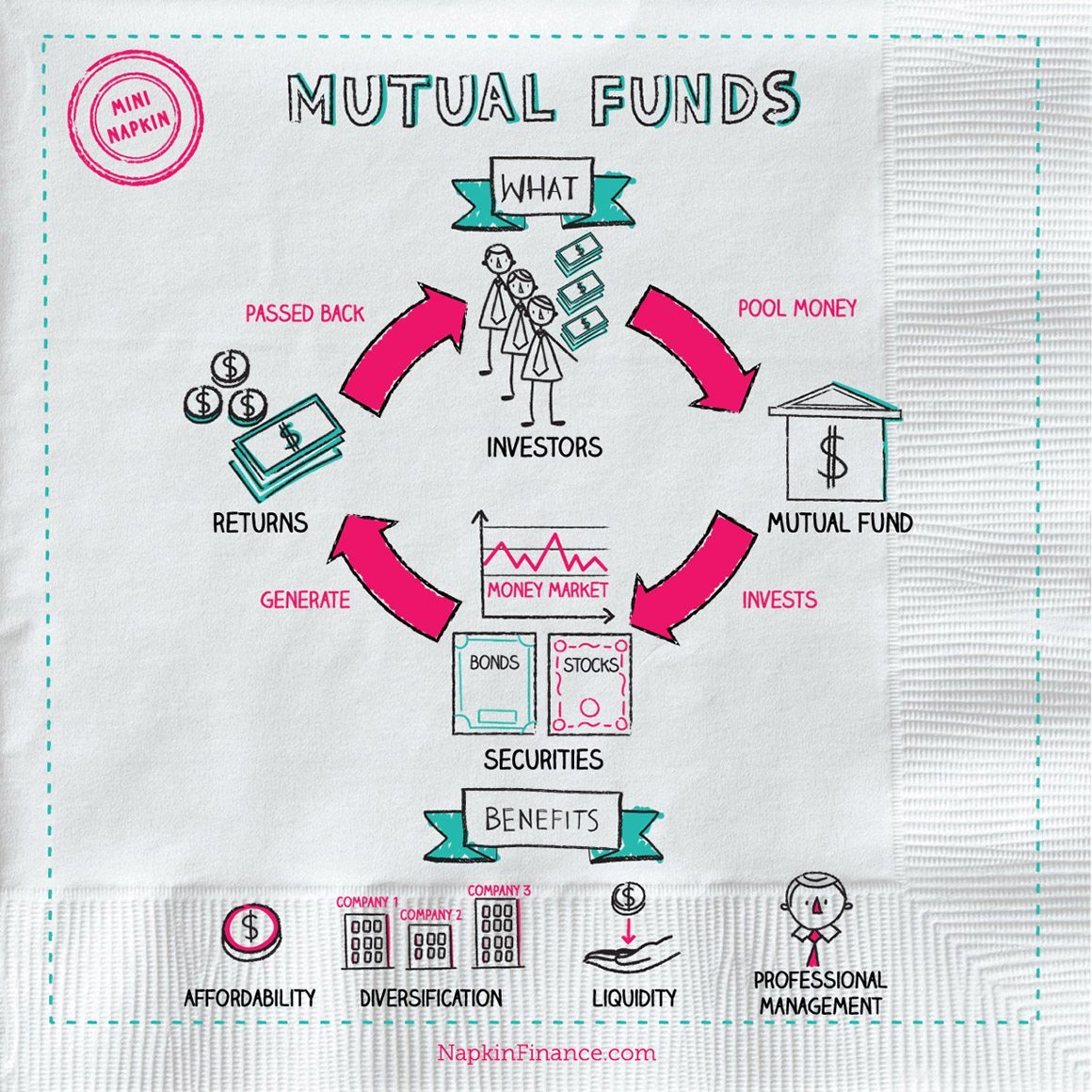

Mutual Fund Definition Investing Stock Hedge Fund Napkin Finance

New To Equity Mutual Funds Start With ELSS Funds

How Are Mutual Funds Regulated In India IPleaders

Benefits Of Investing In Debt Mutual Funds Fintoo Blog

Things You Should Know Before You Start Investing In Mutual Funds 2

ALL ABOUT MUTUAL FUNDS Ask Anand Srinivasan

ALL ABOUT MUTUAL FUNDS Ask Anand Srinivasan

Top 10 Best Tax Free Municipal Bond Mutual Funds HubPages

Mutual Funds Add 4 Lakh Folios In Oct Investors Positive On Market

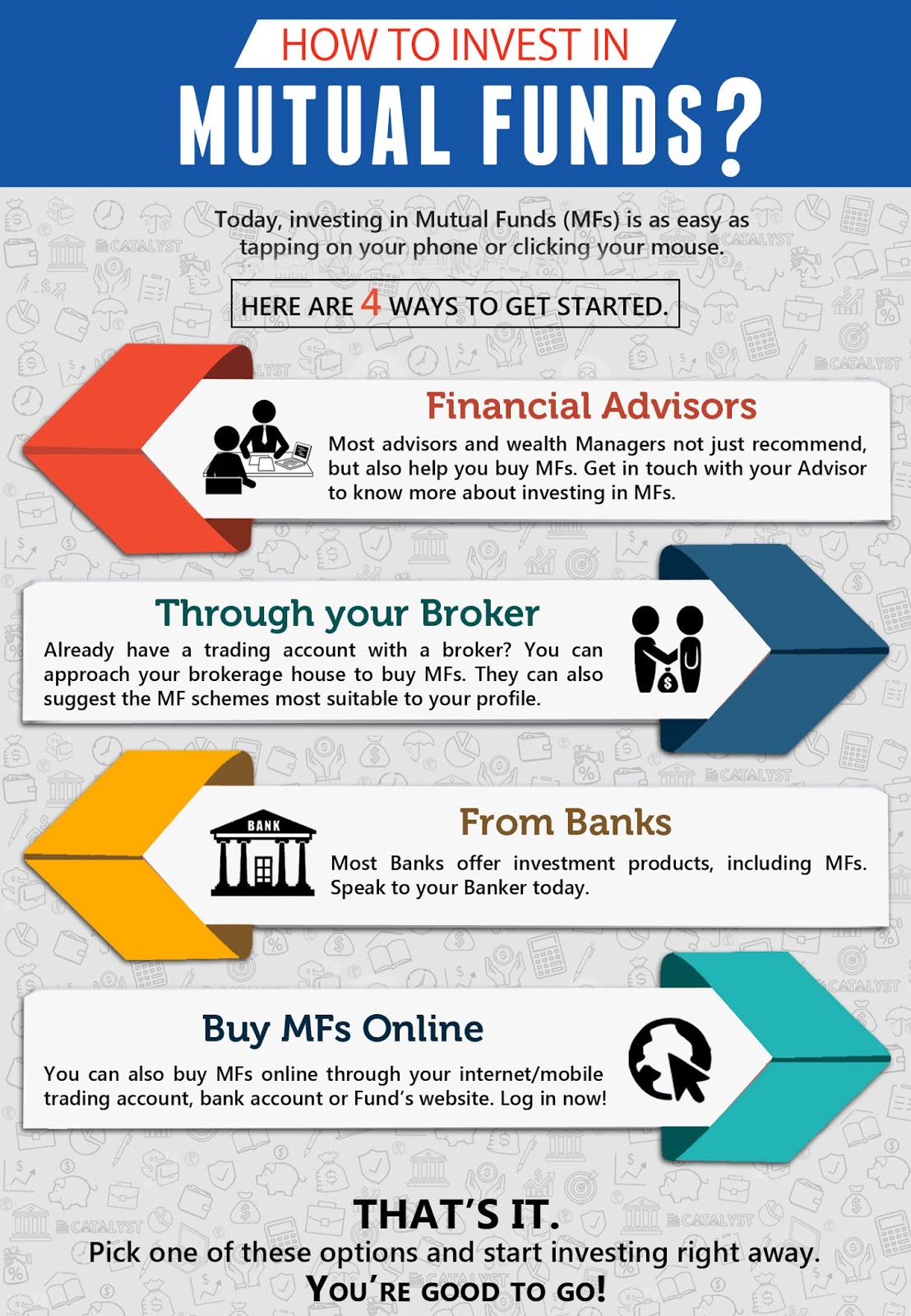

How To Invest In Mutual Funds by FinVise India

Are Mutual Funds Taxable - Even when you still own the fund taxes on mutual fund shares can be triggered in two ways Dividends and interest If the fund holds securities that pay