Are Natives Exempt From Gst Section 87 also exempts from the federal Goods and Services Tax GST the goods and services bought by Status Indians at businesses located on reserve Goods

GST APB 039 was recently amended and reissued in October 2020 and is a timely reminder of the evidentiary requirements that must be met by suppliers making When it comes to products and services sold on reserve First Nations Persons Bands and Band Empowered entities are generally not required to pay GST HST on those purchases pursuant to Section 87 of the federal

Are Natives Exempt From Gst

Are Natives Exempt From Gst

http://cdn.loanstreet.com.my/rich/rich_files/rich_files/000/000/224/original/1-05.png

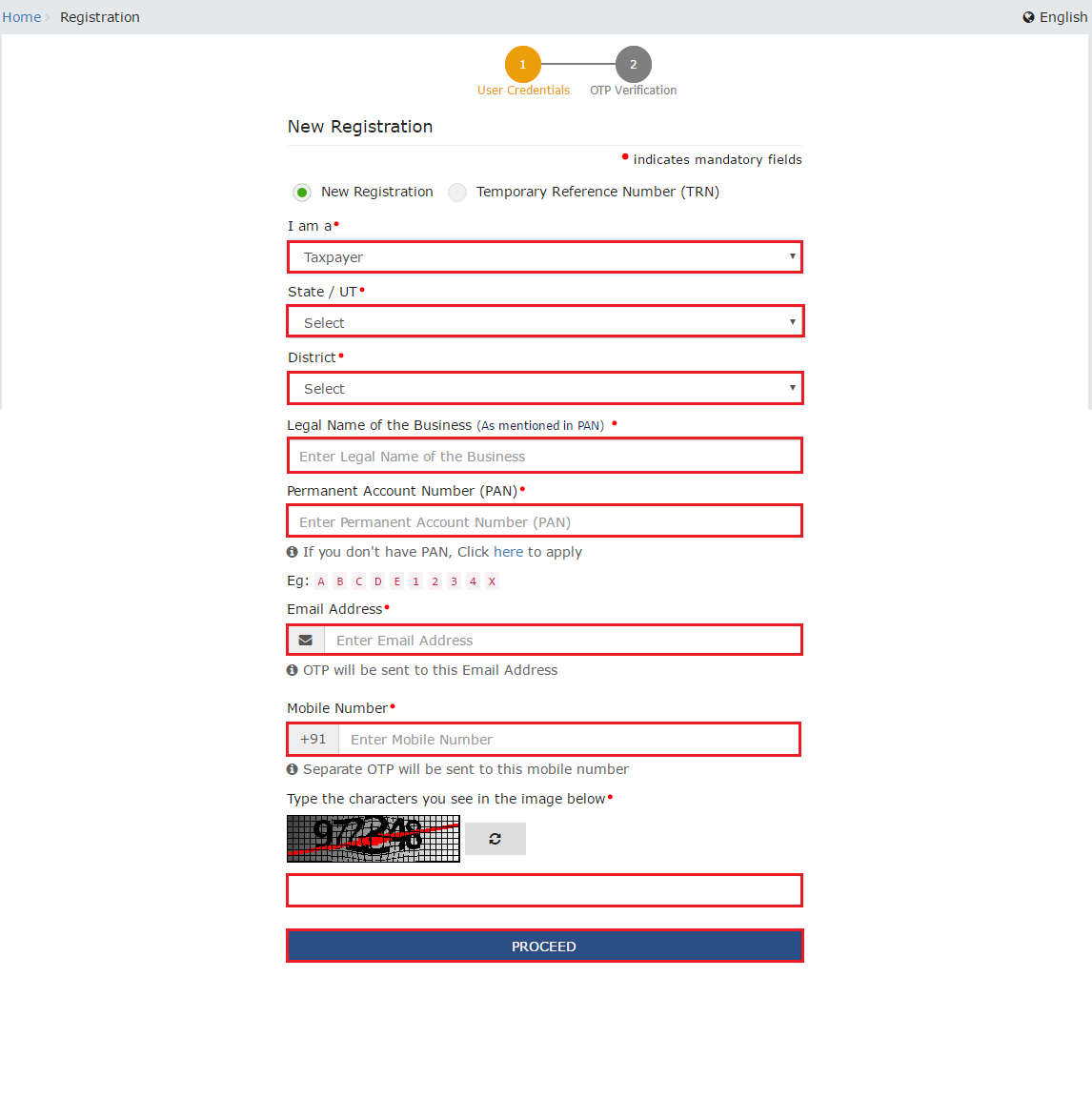

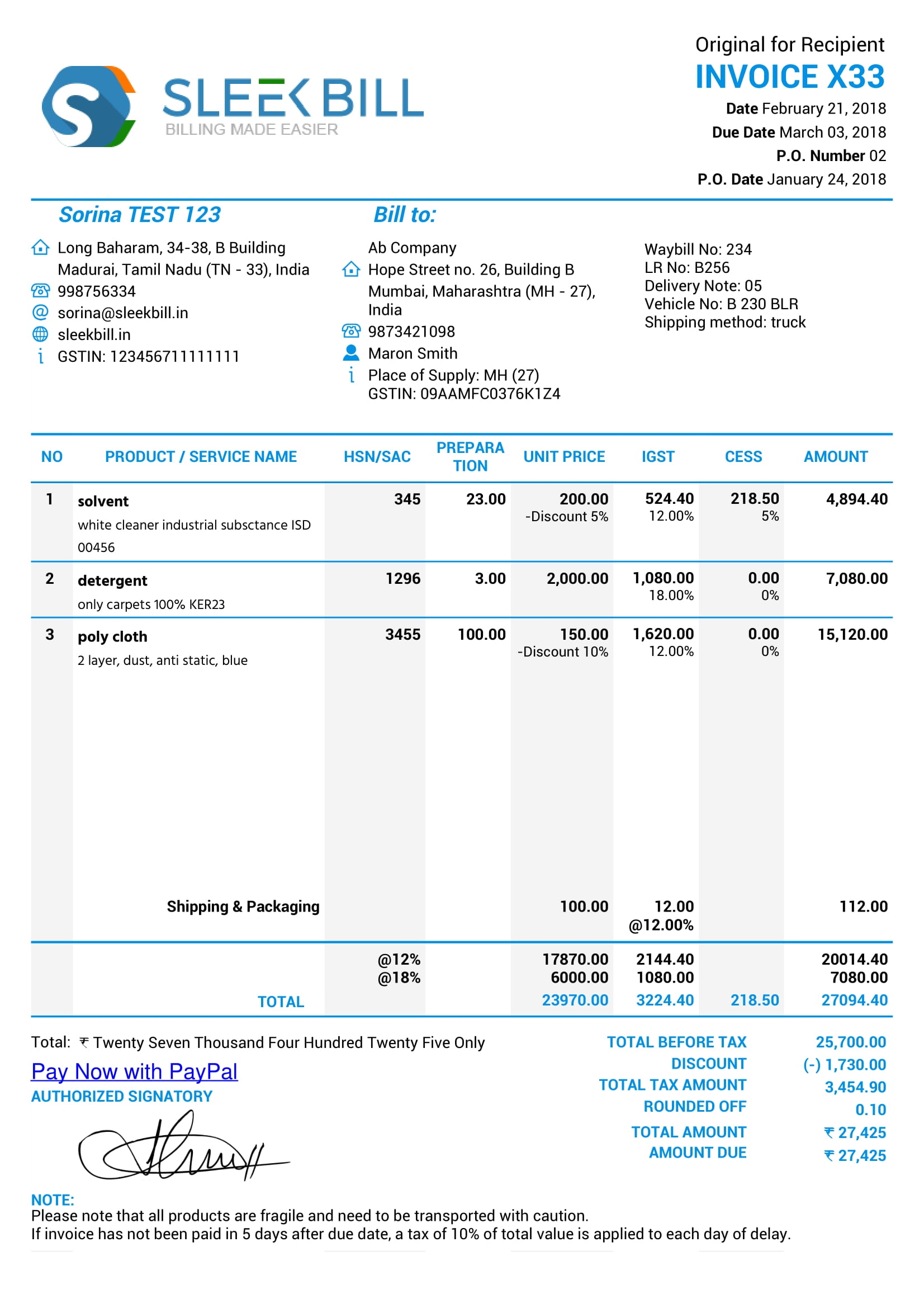

GST Registration Process Online On GST Portal Guide Learn By Quicko

https://learn.quicko.com/wp-content/uploads/2019/03/Select-Taxpayer.png

Goods Exempted Under GST

https://assets1.cleartax-cdn.com/s/img/20170606204600/imageedit_2_3474494621-437x1024.png

Canada s income tax exemption for eligible Bands and Indigenous Peoples Tax treatment of employees of Indigenous businesses Indigenous owned corporations GST HST generally First Nations individuals don t pay GST HST on property bought on a reserve or services performed entirely on a reserve If you paid

First Nations individuals and bands are generally exempt from BC s PST when they purchase goods or services on First Nations land To qualify for the exemption the goods purchased must be for the personal The Canada Revenue Agency CRA offers special tax exemptions to qualifying Aboriginal and Northern people If you qualify these exemptions can lower

Download Are Natives Exempt From Gst

More picture related to Are Natives Exempt From Gst

Exemptions Of Services Under GST

https://assets1.cleartax-cdn.com/s/img/2017/06/12124412/image11.jpg

The Untold Story Of The 1842 Cherokee Slave Revolt

https://allthatsinteresting.com/wordpress/wp-content/uploads/2020/04/native-american-slaves.jpg

Dispute Over ITC Claim On GST Cost For Intra Unit Gas Transmission

https://www.taxscan.in/wp-content/uploads/2022/12/ITC-claim-GST-Cost-Delhi-HC-Petition-GAIL-taxscan.jpg

People who are not status Indians are not exempt from paying GST HST even if they are making purchases on reserve Section 87 of the Indian Act which Insight Indigenous Services For an Indian Band or a Band Empowered Entity BEE making off reserve purchases normally subject to GST HST it can sometimes be

2024 02 27 Information on taxes and benefits for Indigenous peoples getting benefits and credits help with doing your taxes tax exempt income under section 87 of the Indian Under the Indian Act the personal property of an Indian or a band situated on a reserve as well as the interest of an Indian or band situated on a reserve or surrendered lands are

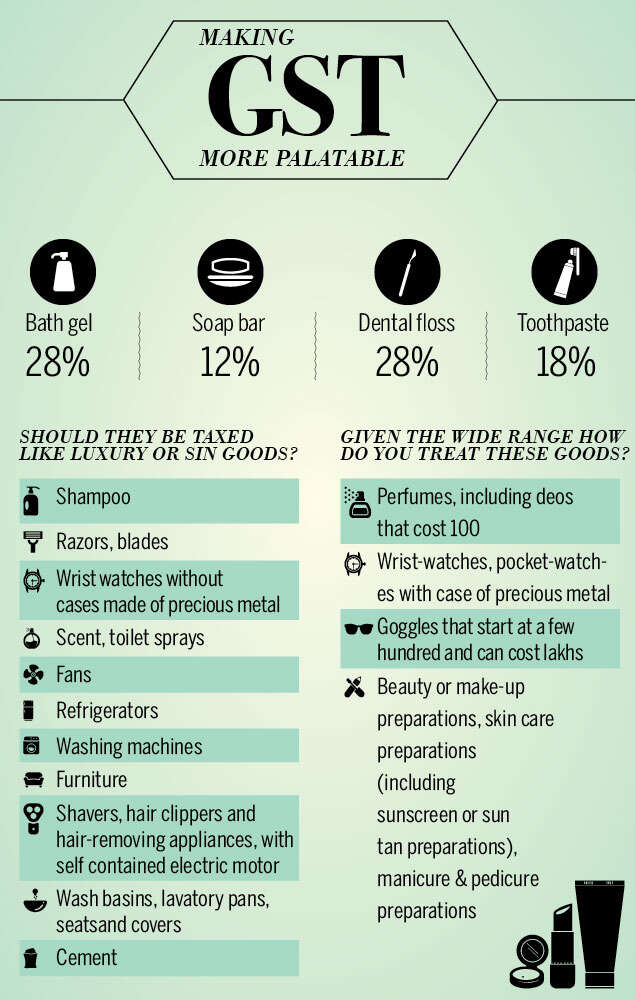

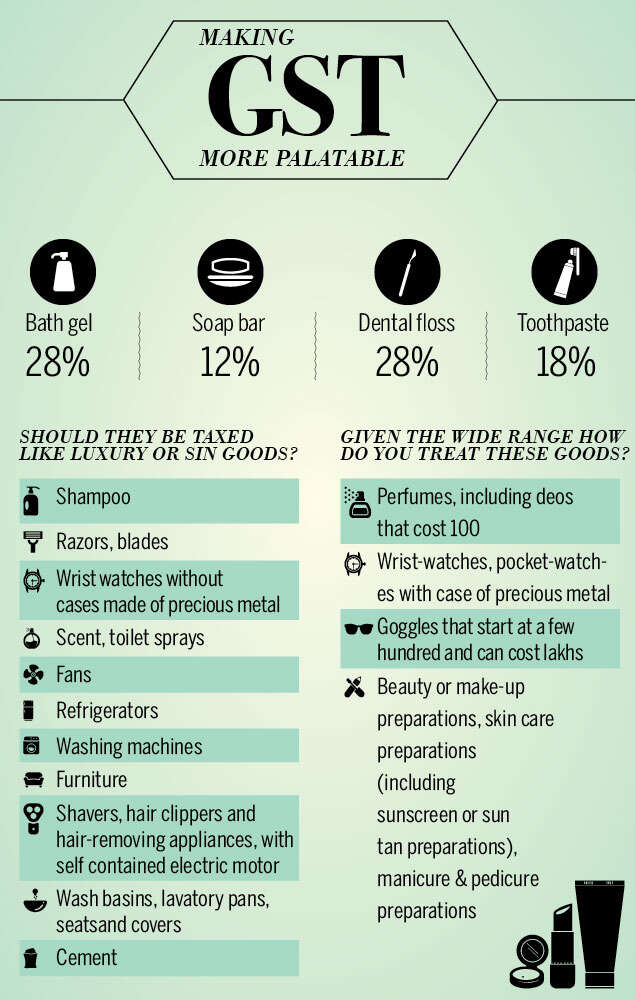

Gst graph

https://newsmobile.in/wp-content/uploads/2017/05/GST_graph.png

HST GST Remittances With CRA

https://lirp.cdn-website.com/e4c79904/dms3rep/multi/opt/cra-taxes-payroll-canada-1920w.jpg

https://www.ictinc.ca/blog/myth-status-indians...

Section 87 also exempts from the federal Goods and Services Tax GST the goods and services bought by Status Indians at businesses located on reserve Goods

https://www.taxandtradelaw.com/Tax-Trade-Blog/gst...

GST APB 039 was recently amended and reissued in October 2020 and is a timely reminder of the evidentiary requirements that must be met by suppliers making

UPSC Preparation Goods And Services Tax GST Bill Explained

Gst graph

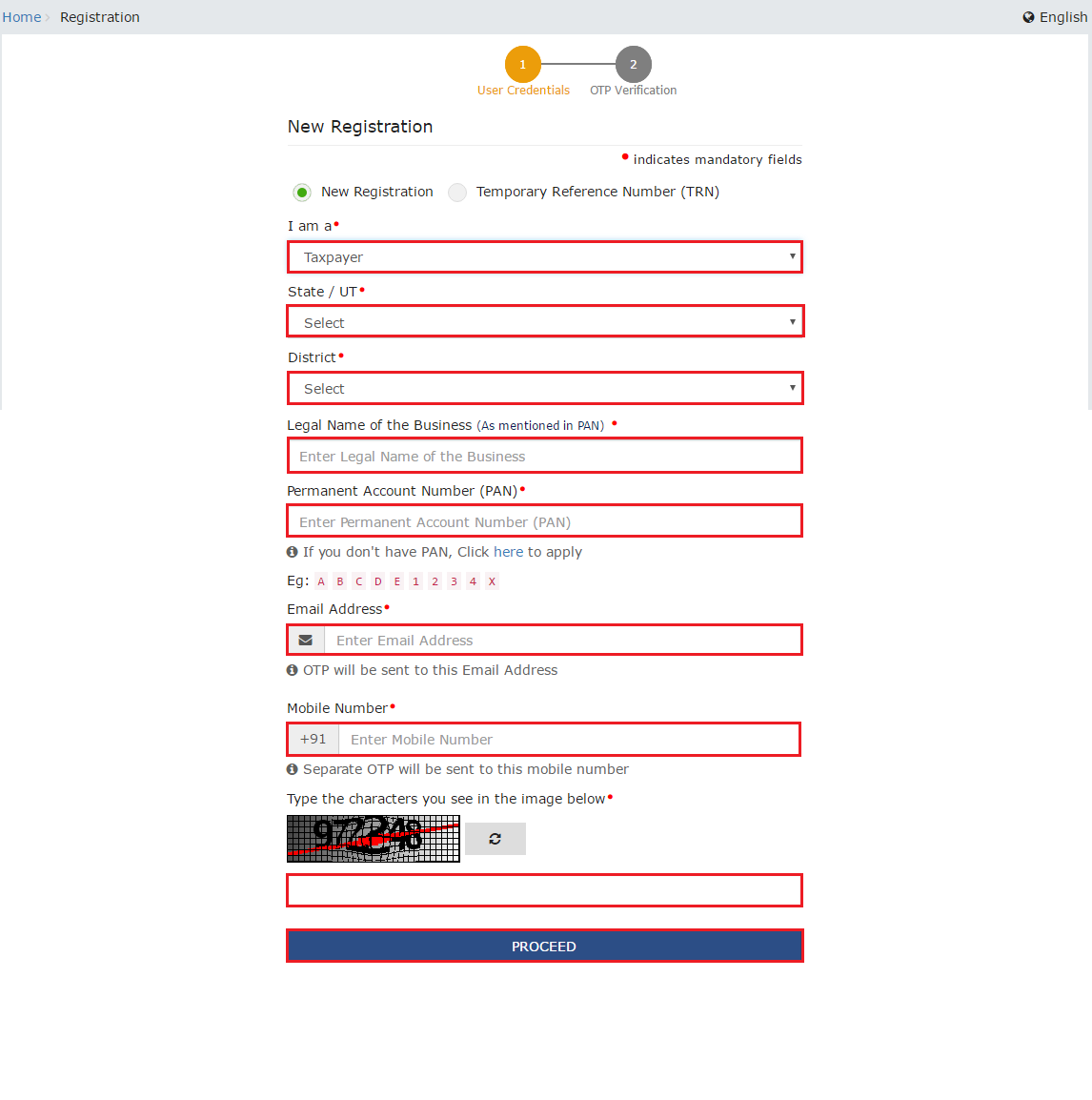

Difference Between Nil Rated Exempted Zero Rate And Non GST FAQ

R le Du Leader Les Sept Diff rents R les Dirigeants

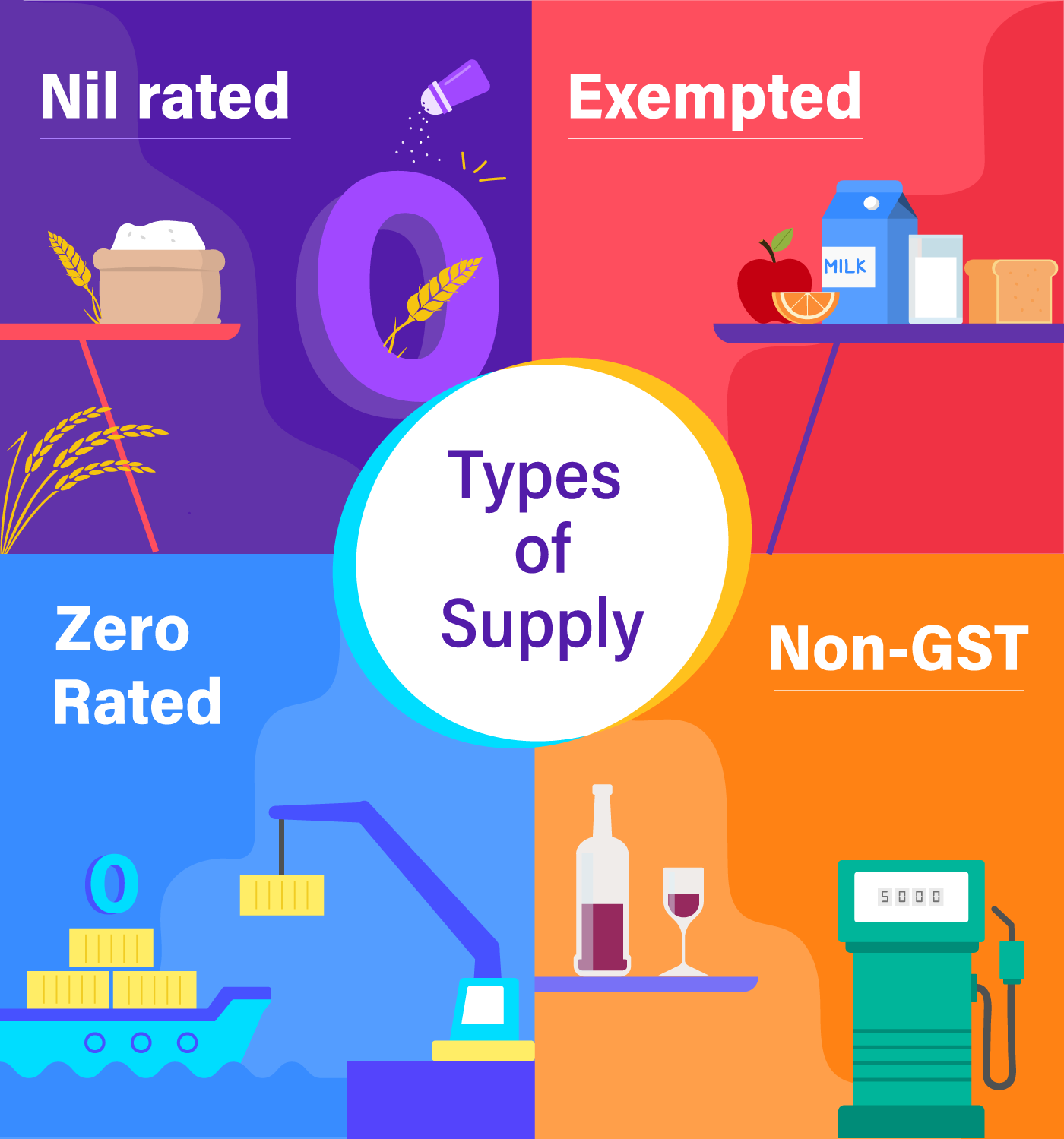

Example Pizza Business Invoice Process Model Weposa

GST Rates List Tax Rate On 178 Daily Items Reduced Eating Out Set To

GST Rates List Tax Rate On 178 Daily Items Reduced Eating Out Set To

Guidelines For Exempt Slaughter And Processing Operations Association

Services Provided By An Educational Institution To Students Faculty

GST LUT Form At Rs 3000 month In Faridabad ID 22350813830

Are Natives Exempt From Gst - Canada s income tax exemption for eligible Bands and Indigenous Peoples Tax treatment of employees of Indigenous businesses Indigenous owned corporations