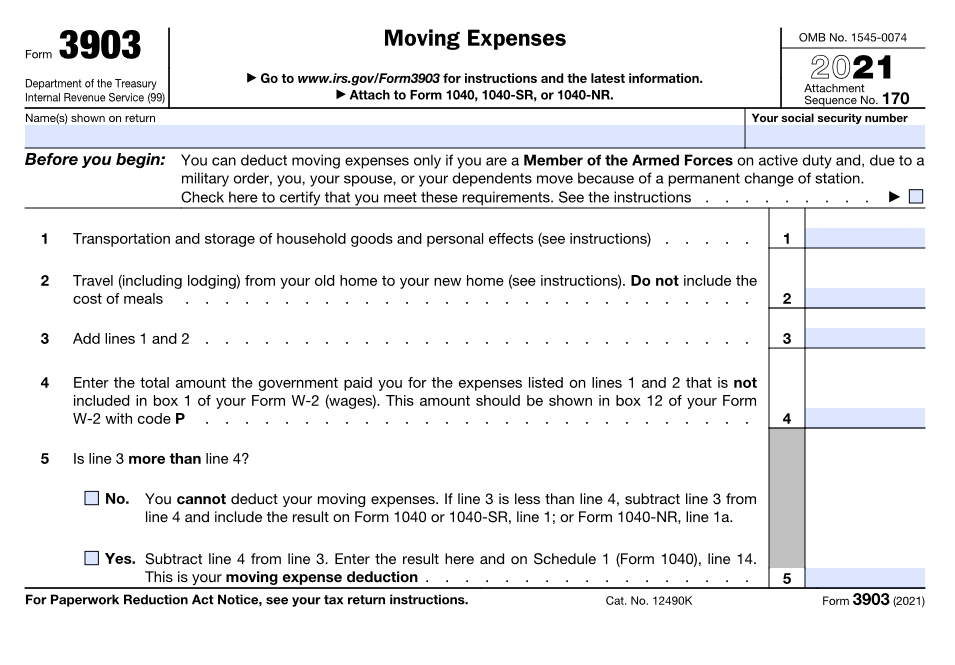

Are Non Military Moving Expenses Tax Deductible Moving expense deduction eliminated except for certain Armed Forces members For tax years beginning after 2017 you can no longer deduct moving expenses unless you

Many moving expenses are fully or partially covered by military allowances You cannot claim any expenses paid for by the military whether paid directly or You can deduct the expenses of moving your household goods and personal effects including expenses for hauling a trailer packing crating in transit storage and

Are Non Military Moving Expenses Tax Deductible

Are Non Military Moving Expenses Tax Deductible

https://static-ssl.businessinsider.com/image/5e14abc13deb4e03cd51fd35-1783/gettyimages-1091796958.jpg

Moving Expenses During And After College

https://byeuni.com/wp-content/uploads/2021/10/taxes.jpeg

Tax Deductible Moving Expenses Moving Expenses Tax Deductions Deduction

https://i.pinimg.com/736x/5d/d0/00/5dd000eecedf3e70430f4c04fcebf718--moving-expenses-tax-deductions.jpg

Can I deduct moving expenses for a military move You can only deduct expenses from your move if they were not fully reimbursed or directly paid for by the government Unreimbursed moving expenses At a Glance The tax deduction for moving expenses is suspended for non military taxpayers from 2018 2025 Active duty military members may be eligible to

For tax years after 2018 you can deduct moving expenses on your federal tax return if you re in the military and are Active duty military member and you permanently move to a new base pursuant to a military order The Most people s moving expenses aren t tax deductible since congress passed the Tax Cuts and Jobs Act in 2017 Some active duty military members and their

Download Are Non Military Moving Expenses Tax Deductible

More picture related to Are Non Military Moving Expenses Tax Deductible

Claim Medical Expenses On Taxes Income Tax Preparation Us Tax

https://i.pinimg.com/originals/7b/37/05/7b37052b2fb0ea107a6dd3af15498805.jpg

Deductible Expenses How To Pay Less Tax Legally

https://osome.com/content/images/2020/07/Scrabble-Deductible-Expenses-Singapore-Company.jpg

Are Moving Expenses Tax Deductible In Canada

https://www.movingwaldo.com/wp-content/uploads/2020/06/For-Moving-Waldo-Moving-Tax-min-1-2048x1365.jpg

You can deduct moving expenses if you are a member of the Armed Forces on active duty and due to a military order you move because of a permanent change of station Use Tax Topic 455 or see Form 3903 To deduct moving expenses you usually must meet certain time and distance tests However if you re a member of the armed forces on active duty and you move due to a

A move is considered tax deductible if you re either an active duty member of the U S armed forces and have moved permanently due to military orders or if you ve This interview will help you determine if you can deduct your moving expenses Information you ll need Types and amounts of moving expenses Amount of moving expense

Miami Moving Tax Deduction Terms I Orange Movers Miami

http://orangemover.com/wp-content/uploads/2017/09/moving-expenses-tax-deduct-orig.jpg

Everything You Need To Know About Moving Expenses And Tax

https://justmovein.com/storage/images/XsGjujSGTveiMjSYEAr0L5541DUJhnBZ3O8rdtBA.jpg

https://www.irs.gov/instructions/i3903

Moving expense deduction eliminated except for certain Armed Forces members For tax years beginning after 2017 you can no longer deduct moving expenses unless you

https://www.militaryonesource.mil/financial-legal/...

Many moving expenses are fully or partially covered by military allowances You cannot claim any expenses paid for by the military whether paid directly or

Can I Claim Apartment Expenses On My Taxes Leia Aqui Can You Claim

Miami Moving Tax Deduction Terms I Orange Movers Miami

.png)

Are Moving Expenses Tax Deductible In Canada

Did You Know Moving Expenses Can Be Tax Deductible Find Out If Your

Are Moving Expenses Tax Deductible GOBankingRates

Are My Moving Expenses Tax Deductible MIC S MOVING

Are My Moving Expenses Tax Deductible MIC S MOVING

Are Moving Expenses Tax Deductible

Are Moving Expenses Tax Deductible Next Moving

3 Times Moving Expenses Are Actually Tax Deductible

Are Non Military Moving Expenses Tax Deductible - For tax years after 2018 you can deduct moving expenses on your federal tax return if you re in the military and are Active duty military member and you permanently move to a new base pursuant to a military order The