Are Non Prescription Medical Supplies Tax Deductible Even though more than one third of taxpayers itemize deductions fewer than six percent claim medical expenses The rulings cover five subjects nonprescription drugs recommended by a

Non prescription medicine costs Cosmetic surgery costs In addition to non prescription medications the IRS also excludes nicotine gum and nicotine patches if they re not prescribed to you Minor medical expenses What medical expenses are not tax deductible You typically can t deduct the cost of nonprescription drugs except insulin or other purchases for general health such as

Are Non Prescription Medical Supplies Tax Deductible

Are Non Prescription Medical Supplies Tax Deductible

https://watsonshealth.com.ph/wp-content/uploads/2019/06/13-PRESCRIPTION-MEDICATIONS.jpg

Are Home Office Supplies Tax Deductible Borshoff Consulting

https://borshoffconsulting.com/wp-content/uploads/2022/07/Are-Home-Office-Supplies-Tax-Deductible-Borshoff-Consulting-Blog-Image-1200x630-1-1024x538.jpg

Customs Importation Of PPE Medical Supplies Tax free The Manila Times

https://www.manilatimes.net/uploads/imported_images/uploads/2020/03/XxjpbeE007318_20200321_PEPFN0A001.jpg

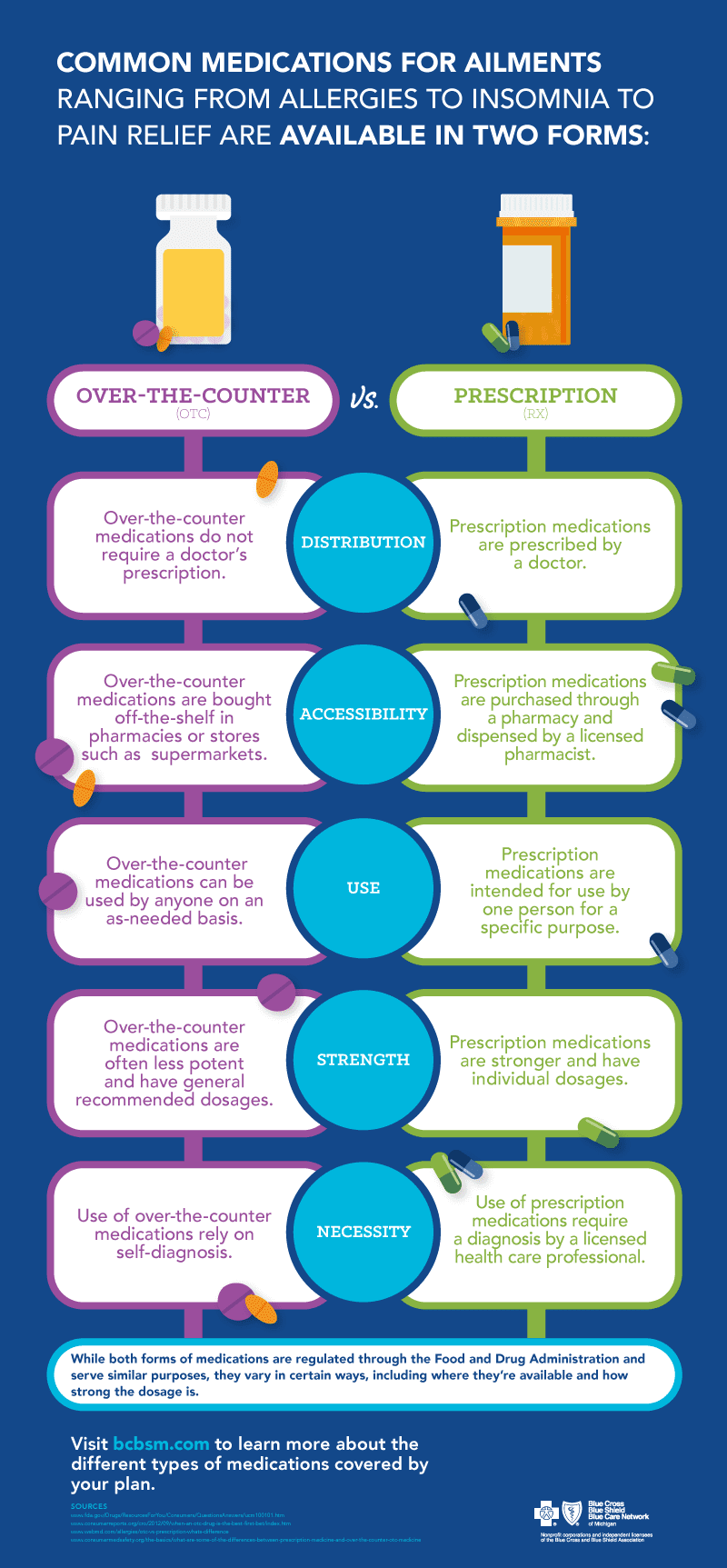

Prescription medications including prescribed drugs and insulin are deductible Over the counter medications generally do not qualify unless prescribed For example The medical expense tax deduction is available and may benefit you if you have purchased prescription medication or purchased medical supplies or paid for a nursing home during the tax year These expenses can be claimed for

The IRS allows you to deduct certain medical expenses from your taxes this year Here s what you need to know With the cost of US healthcare sharply rising you may wonder if you can deduct medical expenses to save money on your taxes this year The short answer is yes The IRS allows taxpayers

Download Are Non Prescription Medical Supplies Tax Deductible

More picture related to Are Non Prescription Medical Supplies Tax Deductible

Medical Grade Prescriptions Debra Tanner Abell MD

http://www.abelldermatology.com/wp-content/uploads/2018/09/prescriptions.jpeg

Why Prescription Drugs In The US Cost So Much

https://image.cnbcfm.com/api/v1/image/105349029-1532439541748gettyimages-501415374.jpeg?v=1604237599

Are Homeschool Expenses Tax Deductible Intrepid Eagle Finance

https://static.twentyoverten.com/5d5413591d304774fba39eb3/Sm4vJO2Dsor/Are-homeschool-expenses-tax-deductible-2.jpg

Medical expenses can be tax deductible but eligibility hinges on exceeding 7 5 of your AGI Deductible expenses cover diagnosis treatment and prevention of disease Non This article will offer some guidance on which medical supplies are tax deductible Often if a physician prescribes medical supplies you will be in line for some tax deductions

The net amounts you pay for this particular drug are deductible regardless of whether or not you have a prescription Other over the counter medications such as vitamins No You can t deduct most over the counter medications on your tax return According to IRS Publication 502 you can only deduct medications that require a prescription

Tax Deductible Medical Expenses

https://www.prestigeauditors.com/wp-content/uploads/2020/12/finance-and-medicine-health-insurance-concept-MT9W6DU-scaled.jpg

TAAG On Twitter Prescription Eyewear Is A Tax deductible Medical

https://pbs.twimg.com/media/FMOeFz0WYAAwrTj.jpg:large

https://www.irs.gov › pub › irs-news

Even though more than one third of taxpayers itemize deductions fewer than six percent claim medical expenses The rulings cover five subjects nonprescription drugs recommended by a

https://blog.turbotax.intuit.com › life

Non prescription medicine costs Cosmetic surgery costs In addition to non prescription medications the IRS also excludes nicotine gum and nicotine patches if they re not prescribed to you Minor medical expenses

The IRS And Incontinence Supplies Home Care Delivered

Tax Deductible Medical Expenses

Are Homeschool Supplies Tax Deductible Home Learning Kit

School Supplies Are Tax Deductible Wfmynews2

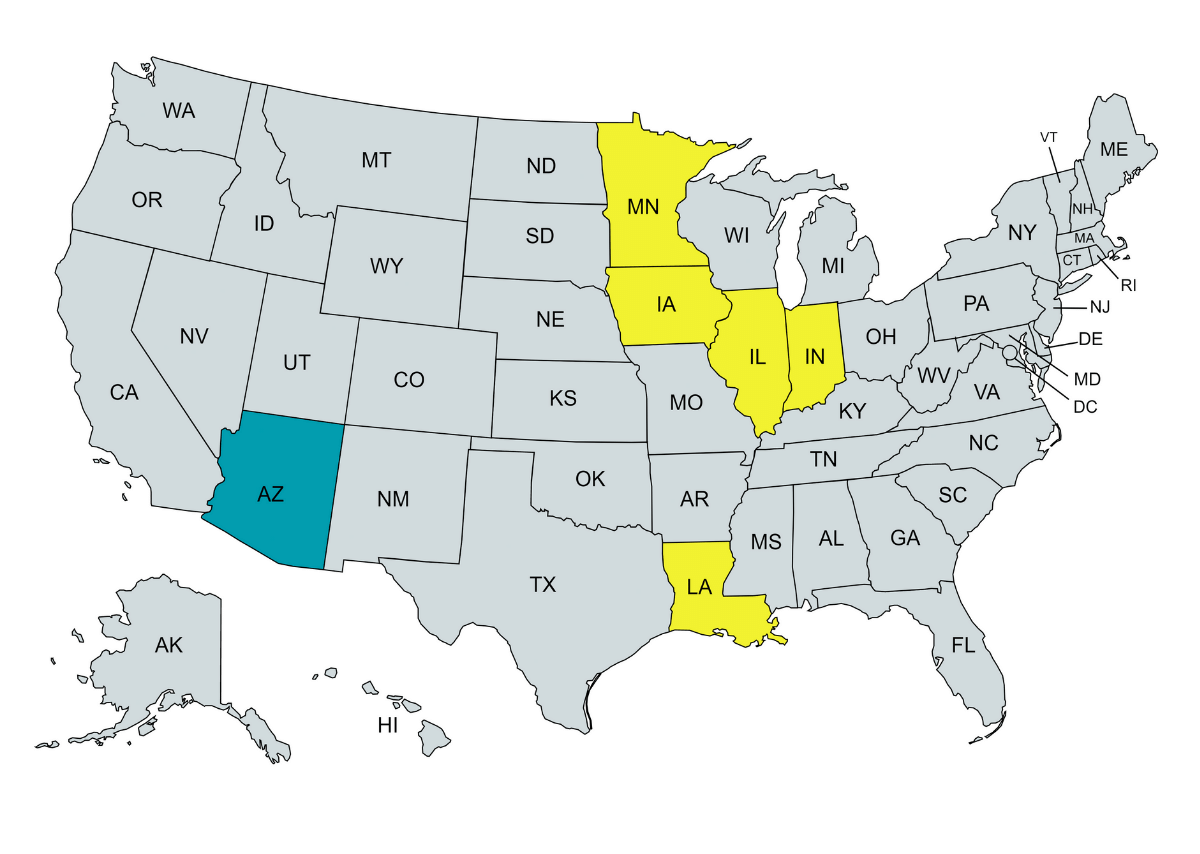

Glossary Of Latin Abbreviations Used In The Prescriptions Medical

Pledge Reminder Letter Template Editable Non Profit Fundraising Letter

Pledge Reminder Letter Template Editable Non Profit Fundraising Letter

Over the Counter Vs Prescription Medications Do You Know The

Medical Expenses You Can Deduct From Your Taxes Medical Tax Time

Are Office Supplies Tax Deductible For The Self Employed

Are Non Prescription Medical Supplies Tax Deductible - Prescription medications including prescribed drugs and insulin are deductible Over the counter medications generally do not qualify unless prescribed For example