Are Personal Moving Expenses Tax Deductible Deductible Moving Expenses Deductible moving expenses include costs associated with moving household goods and personal effects Non Deductible

You can deduct the expenses of moving your household goods and personal effects including expenses for hauling a trailer packing crating in transit This includes airfare lodging and car expenses However meals while traveling between cities are not eligible For car expenses you can deduct the actual

Are Personal Moving Expenses Tax Deductible

Are Personal Moving Expenses Tax Deductible

https://www.financialdesignsinc.com/wp-content/uploads/2020/11/Expenses-1.jpg

The U S Is A Mobile Society And A Move Related To New Employment Is

https://i.pinimg.com/originals/c4/a5/23/c4a523996f3290c81f24ab4d4e462b6c.png

Did You Know Moving Expenses Can Be Tax Deductible Find Out If Your

https://i.pinimg.com/736x/b0/f7/a8/b0f7a8d1266429db15ed66c2cd568360.jpg

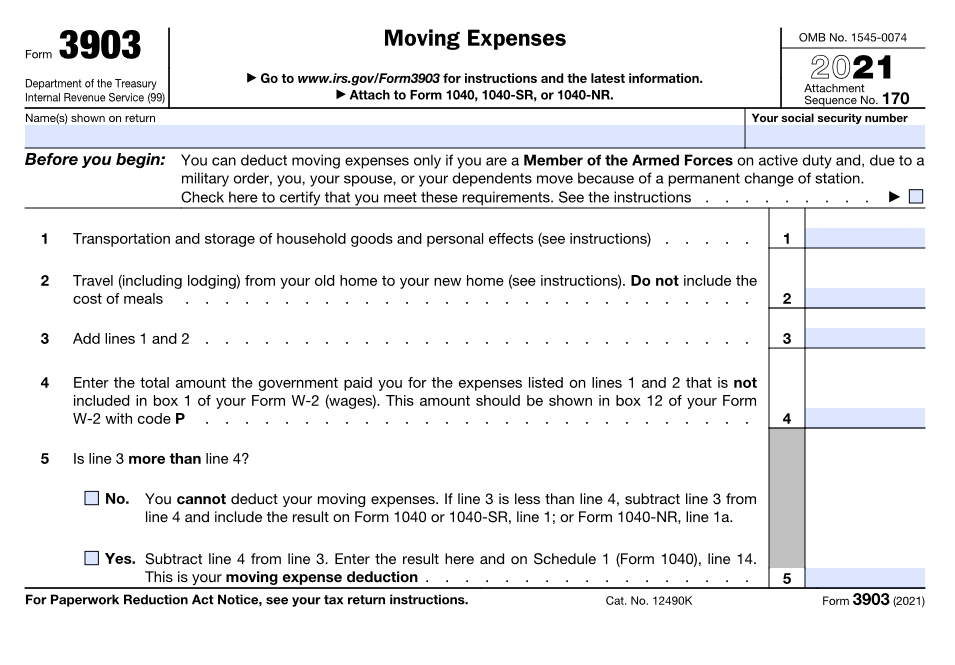

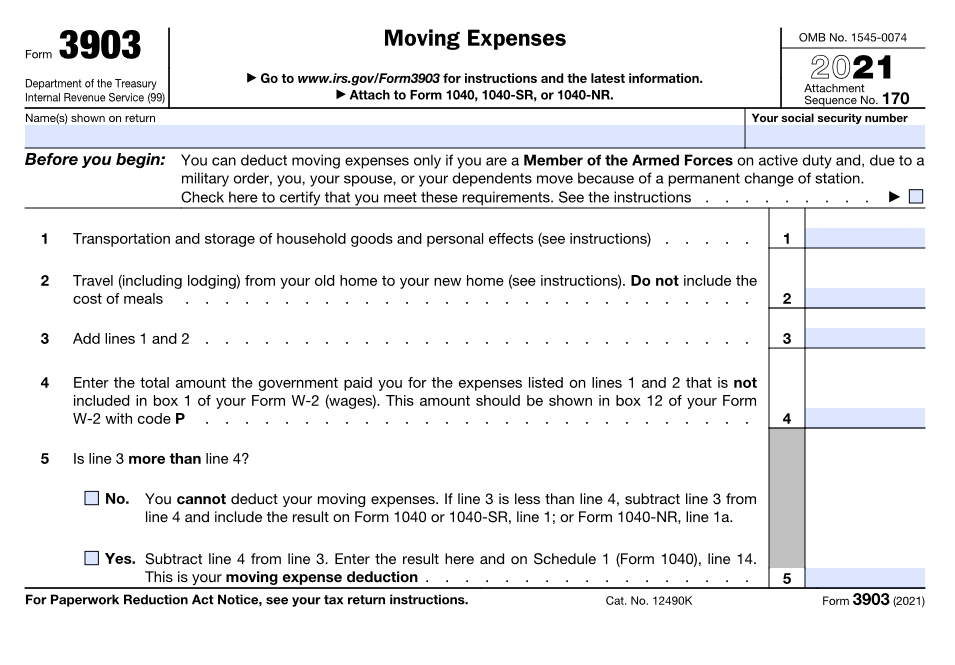

But only reasonable moving expenses are deemed deductible Expenses such as rental trucks gas short term storage packing materials and Moving expenses as tax deductible costs have been abolished for most of us but members of the U S military and their families may still qualify

The rules are pretty clear and not as strict as you might imagine The gist is that moving expenses can be deducted as long as the move is due to a new job or business You ll need more than just a Most people s moving expenses aren t tax deductible since congress passed the Tax Cuts and Jobs Act in 2017 Some active duty military members and their

Download Are Personal Moving Expenses Tax Deductible

More picture related to Are Personal Moving Expenses Tax Deductible

Moving Expenses During And After College

https://byeuni.com/wp-content/uploads/2021/10/taxes.jpeg

Are My Moving Expenses Tax Deductible MIC S MOVING

https://4.bp.blogspot.com/-SM1Z_lLgHkk/Vxq1u_HUiwI/AAAAAAAAGFM/4wNRl3Vo59wk1uizeCb6jvL3Y5PjtGUiQCLcB/s1600/moving_expenses_irs_federal_tax_deduction.jpg

Are Moving Expenses Tax Deductible Under The New Tax Bill

https://www.imperialmovers.com/wp-content/uploads/2018/01/moving-expense-tax-deduction-2018.jpg

Moving expenses aren t tax deductible unless you re active duty military Learn more about what moving expenses are eligible to be deducted on your taxes Under previous tax laws you could deduct approved costs associated with moving household goods and personal items along with the travel costs of moving to the new home excluding meals if you qualified

You can deduct lodging but not meals for yourself and household members while moving from your former home to your new home You can also deduct transportation According to the IRS you can claim the cost of moving household goods and personal effects storing those goods and effects and travel You are allowed to

Can I Claim Apartment Expenses On My Taxes Leia Aqui Can You Claim

https://www.cpapracticeadvisor.com/wp-content/uploads/sites/2/2022/05/Form_3903_IRS.627935caded63.png

What Kind Of Moving Expenses Are Tax Deductible WowMover Com

https://www.wowmover.com/wp-content/uploads/2020/06/Main-taxes.jpeg

https://www.taxfyle.com/blog/understanding-moving...

Deductible Moving Expenses Deductible moving expenses include costs associated with moving household goods and personal effects Non Deductible

https://www.irs.gov/instructions/i3903

You can deduct the expenses of moving your household goods and personal effects including expenses for hauling a trailer packing crating in transit

Investment Expenses What s Tax Deductible Charles Schwab

Can I Claim Apartment Expenses On My Taxes Leia Aqui Can You Claim

Moving Expenses Tax Deductions Where d They Go YouTube

Are Moving Expenses Tax Deductible Next Moving

How To Know If You Can Deduct Moving Expenses taxes CPA Moving

Are Moving Expenses Tax Deductible Starfleet Moving

Are Moving Expenses Tax Deductible Starfleet Moving

Are Moving Expenses Tax Deductible Clip Art Library

Tax Tip Find Out Which Moving Expenses Are Tax Deductible In

Are Moving Expenses Tax Deductible 2023 Guidelines Home Bay

Are Personal Moving Expenses Tax Deductible - Moving expenses as tax deductible costs have been abolished for most of us but members of the U S military and their families may still qualify