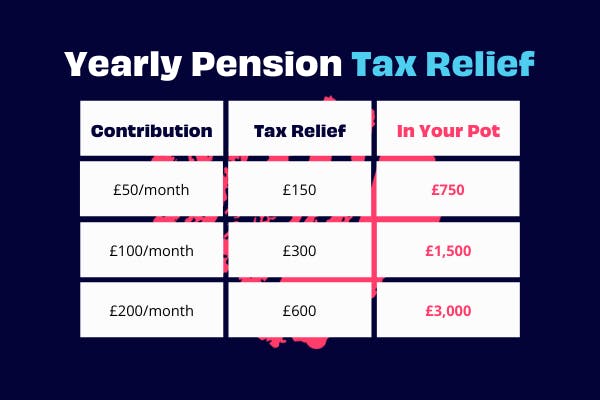

Are Personal Pension Contributions Tax Deductible Your pension contributions are deducted from your salary before income tax is paid on them and your pension scheme automatically claims back tax relief at your highest rate

When you pay your sole trader pension contributions you may be pleased to know that they are tax deductible That means if you earn 30 000 over the year and pay 1 500 into Pensions are taxable earnings Earnings related pensions the national pension and the guarantee pension are taxable income in Finland However pensioners housing

Are Personal Pension Contributions Tax Deductible

Are Personal Pension Contributions Tax Deductible

https://www.accountingpreneur.com/wp-content/uploads/2022/04/Pension-1080x675.jpg

Tax Deductions For Charitable Contributions Donations

https://www.moneycrashers.com/wp-content/uploads/2019/02/charitable-contributions-tax-deductions.jpg

Taxability Of Pension All You Need To Know

https://www.taxhelpdesk.in/wp-content/uploads/2022/06/taxability-of-pension.jpg

Most contributions to personal pension schemes are paid net of basic rate tax relief via a relief at source scheme so the only additional relief is through a claim on the self If your pension scheme uses the net pay arrangement method tax relief is instead given by deducting the gross pension contribution from your earnings before you pay tax Tax

This is because pension contributions are not a business cost and therefore can t be classified as a tax deductible expense in the self employed section of your tax return Are self employed pension contributions tax deductible You can deduct your pension contributions from your taxable income For example if your annual earnings were

Download Are Personal Pension Contributions Tax Deductible

More picture related to Are Personal Pension Contributions Tax Deductible

Tax Relief On Pension Contributions Chartered Accountants

https://www.fincrest.co.uk/wp-content/uploads/2023/03/60b-Tax-relief-on-pension-contribution-pic.png

Was Ist Ein Kontoauszug Die Grundlagen 2022

https://img.cs-finance.com/img/investing/is-my-pension-plan-contribution-tax-deductible.jpg

Are You Due A Huge Pension Tax Refund Which News

https://s3.eu-west-1.amazonaws.com/prod.news.product.which.co.uk/news/wp-content/uploads/2017/03/Pensions.jpg

Are my contributions to my pension pot taxable Your pension contributions are tax free up to a certain amount known as the allowance There s both a lifetime and an annual A Freedom of Information request revealed a startling 23 rise in workers falling into the tax trap from 436 000 to 537 000 between 2021 22 and 2022 23 With another year of

Tax relief on personal pensions is normally paid directly by HM Revenue and Customs to the pension scheme at a rate of 20 of the gross contribution for anyone below the In the UK the government encourages saving for retirement by offering tax relief on pension contributions However the eligibility for tax relief can vary depending on the

Self Employed Pension Tax Relief Explained Penfold Pension

https://images.prismic.io/penfold/d68abe56-2255-43f5-8412-5d0e13153a09_yearly-self-employed-pension-tax-relief.png?auto=compress

Pension Contributions In Ireland Pension Support Line

https://pensionsupportline.ie/wp-content/uploads/2021/08/Tax-advantages-of-pension-contributions.png

https://www.which.co.uk/money/pensions-and...

Your pension contributions are deducted from your salary before income tax is paid on them and your pension scheme automatically claims back tax relief at your highest rate

https://countingup.com/resources/how-do-sole...

When you pay your sole trader pension contributions you may be pleased to know that they are tax deductible That means if you earn 30 000 over the year and pay 1 500 into

Donation Letter For Taxes Template In PDF Word Set Of 10 Donation

Self Employed Pension Tax Relief Explained Penfold Pension

CHAP10 Compensation INC ALL Answers Chapter 10 Compensation Income

What Is Pension Tax Relief Moneybox Save And Invest

Pension Tax Relief How To Save More For Your Retirement

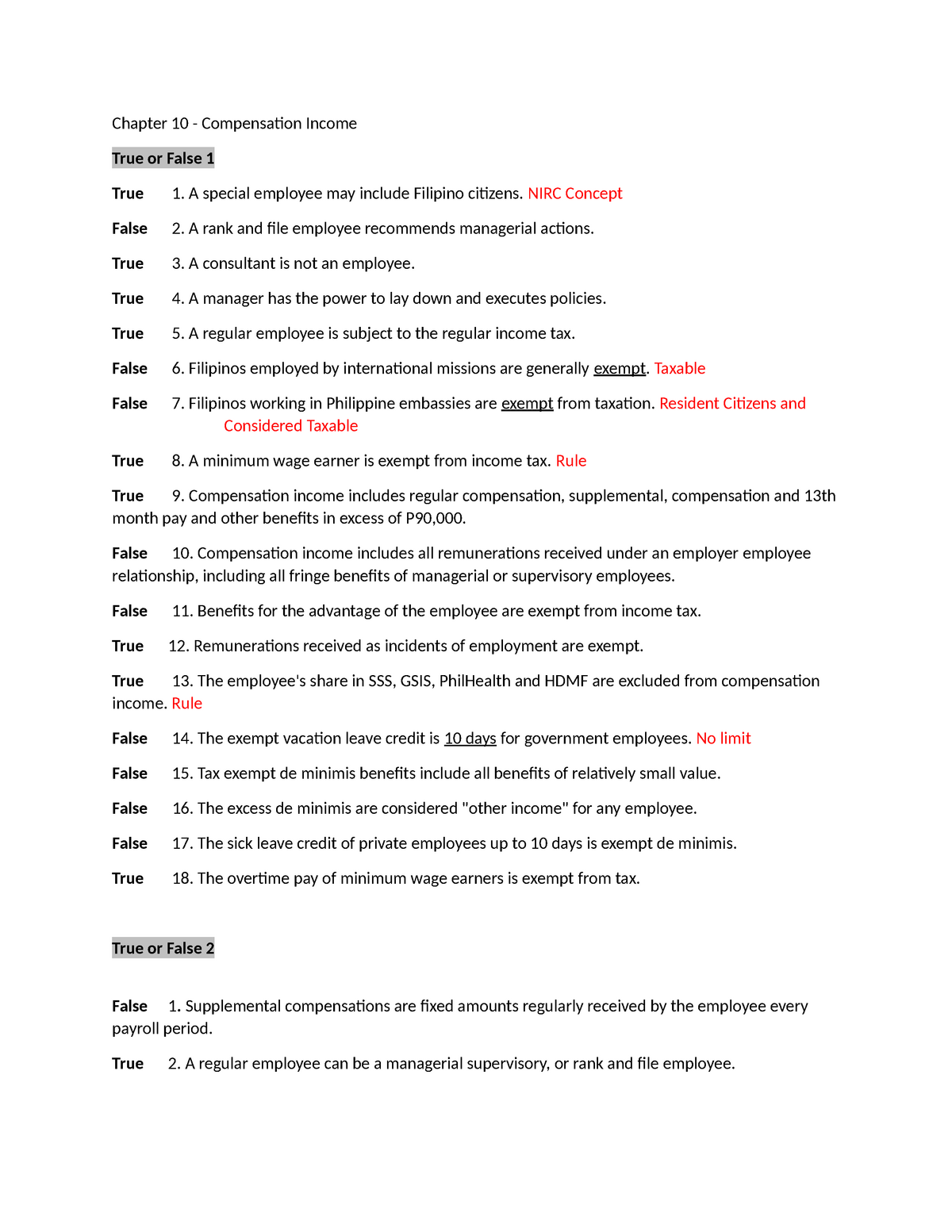

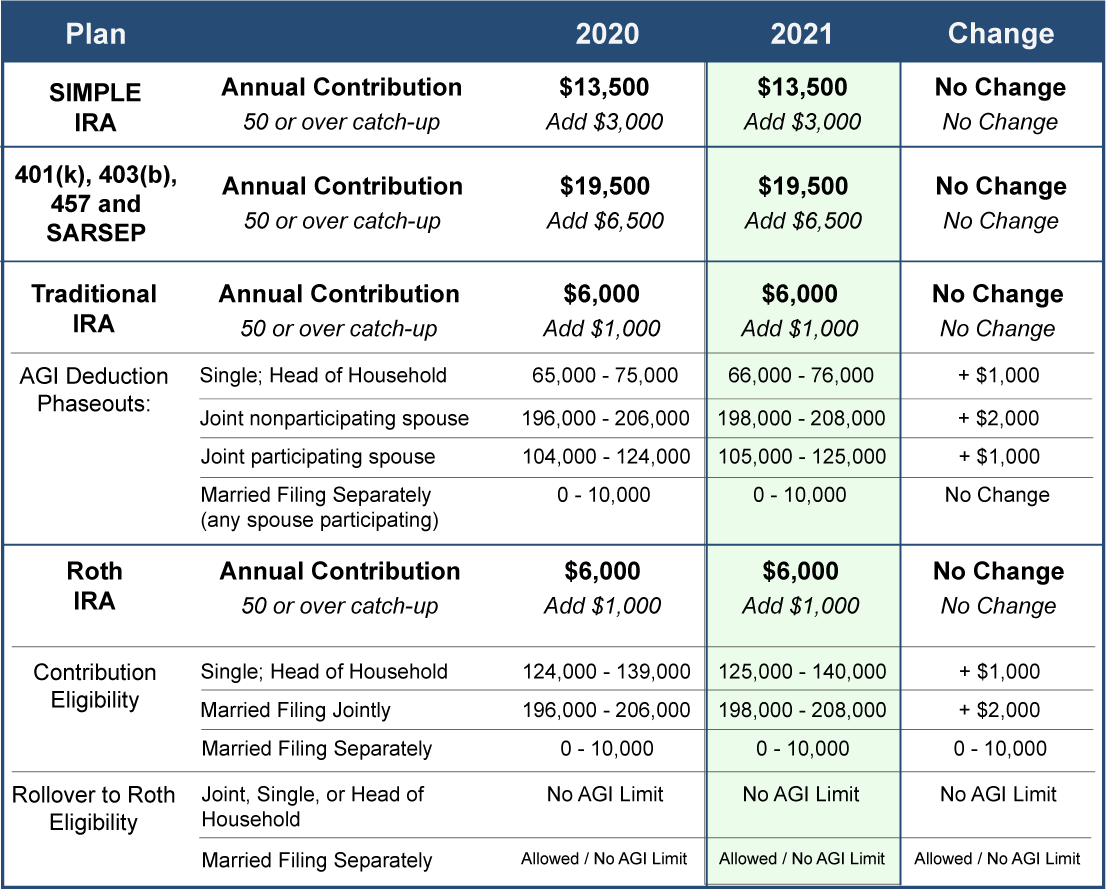

Plan Your 2021 Retirement Contributions Mangold Anker Phillips CPA

Plan Your 2021 Retirement Contributions Mangold Anker Phillips CPA

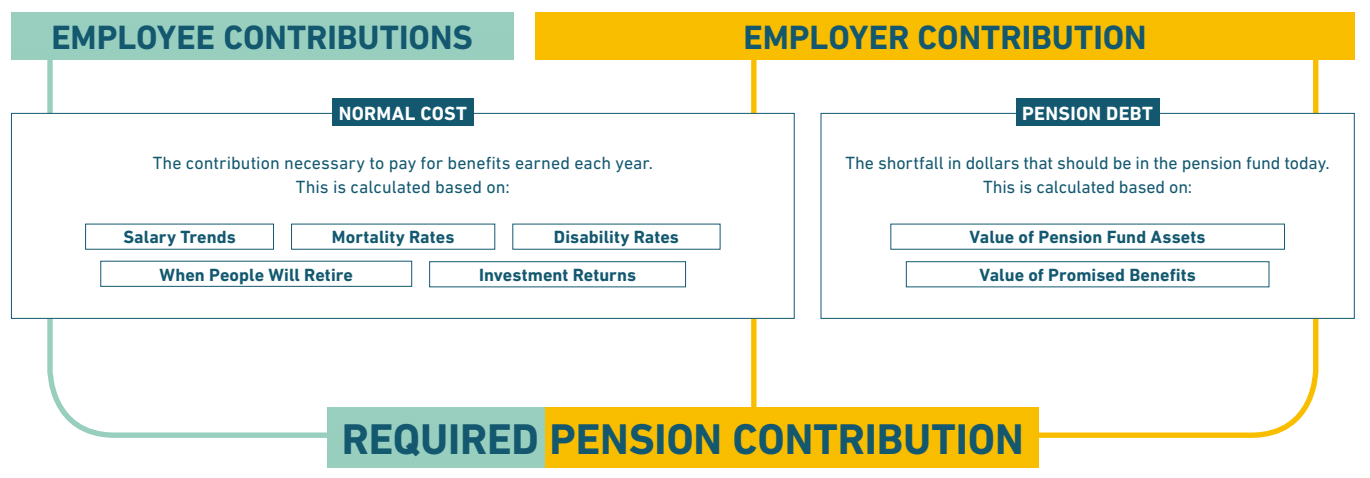

How Pension Contributions Work

Pension Calculation In Excel Of Govt Employees By Learning Center In

Pension Tax Relief In The United Kingdom UK Pension Help

Are Personal Pension Contributions Tax Deductible - However if you re covered by a pension plan make sure you know whether your personal contributions are tax deductible or not to avoid income tax filing problems