Are Rebates Subject To Sales Tax Verkko A rebate is not subject to tax it is considered a reduction of the item s price and works in the same way as a direct discount However if the reward is offered as a gift for taking

Verkko claim an input tax deduction in the tax period in which the credit note is issued to the recipient in respect of the rebate The recipient on the other side is liable to account Verkko Are sales taxes calculated before or after a rebate or incentive is applied The short answer is it depends on the state Please see What Fees Should You Pay for

Are Rebates Subject To Sales Tax

Are Rebates Subject To Sales Tax

https://www.cpapracticeadvisor.com/wp-content/uploads/sites/2/2022/07/19748/sales_tax_1_.55f831d675655.png

Rebates

https://cljgives.org/wp-content/uploads/2017/08/20170809-MM0000809-rebates.png

Tax Rebates Who Will Start Receiving Checks Of Up To 1 000 From Today

https://phantom-marca.unidadeditorial.es/b81c07780a4d77e2cf9e048c49546878/resize/1200/f/jpg/assets/multimedia/imagenes/2022/11/01/16673106591434.jpg

Verkko This means both you and your customer have greater flexibility for negotiations year over year even when price increases Rebates are a long term sales strategy whereas discounts are meant for the short Verkko Your sales for July exceed the specified amount and the manufacturer issues a check to you as agreed The rebate payment is not subject to tax Rebate based on the

Verkko 2 kes 228 k 2020 nbsp 0183 32 By Daan Arends amp Wouter Kolkman DLA Piper Netherlands On 28 May the Court of Justice of the European Union in the World Comm Trading case Case C Verkko The sale of intangibles and real property are generally not taxable The economic burden of the sales tax is generally borne by the consumer but the tax is collected and

Download Are Rebates Subject To Sales Tax

More picture related to Are Rebates Subject To Sales Tax

.jpg)

Earn Rebates How To Earn Money While Shopping The Sales Qwintry

https://qwintry.com/en/file/view/rebate (1).jpg

Do I Have Sales Tax Risk

https://media.licdn.com/dms/image/C4E12AQEc3gmQ18KMSg/article-cover_image-shrink_720_1280/0/1536079496381?e=2147483647&v=beta&t=_nxZ3A_sBfSDDee7MfGZbxjD5V5OEw05p24MjMRWW20

Are Rebates Important YouTube

https://i.ytimg.com/vi/fdKDvaa9AKw/maxresdefault.jpg

Verkko Generally speaking the sales tax issue is whether the rewards established through the loyalty program are considered part of the sales price and therefore are subject to Verkko 1 p 228 iv 228 sitten nbsp 0183 32 Models dropped from the list for 2024 include the Cadillac Lyriq Nissan Leaf Volkswagen ID 4 Tesla Model 3 Rear Wheel Drive BMW X5 xDrive50e and the

Verkko 3 marrask 2014 nbsp 0183 32 For example store issued coupons generally reduce the receipt subject to sales tax while manufacturers coupons do not See Tax Bulletin Coupons Verkko 3 lokak 2019 nbsp 0183 32 It seems to me that if you net it off against sales then it s a reduction of output tax If you show it as a cost then it s input tax On the limited information

Sales And Use Tax On Repair Of Tangible Personal Property

https://s3.studylib.net/store/data/008244818_1-407f2cd920d1379f19a9b74017f4de1c-768x994.png

CIS TAX REBATES EXPLAINED UK YouTube

https://i.ytimg.com/vi/kGjnnKvudc0/maxresdefault.jpg

https://donotpay.com/learn/are-rebates-taxable

Verkko A rebate is not subject to tax it is considered a reduction of the item s price and works in the same way as a direct discount However if the reward is offered as a gift for taking

https://assets.kpmg.com/content/dam/kpmg/ke/pdf/thought-l…

Verkko claim an input tax deduction in the tax period in which the credit note is issued to the recipient in respect of the rebate The recipient on the other side is liable to account

Understanding Income Tax Reliefs Rebates Deductions And Exemptions

Sales And Use Tax On Repair Of Tangible Personal Property

Seattle Isn t As Liberal As We Think

Rebates Short Term Incentives To Drive Sales

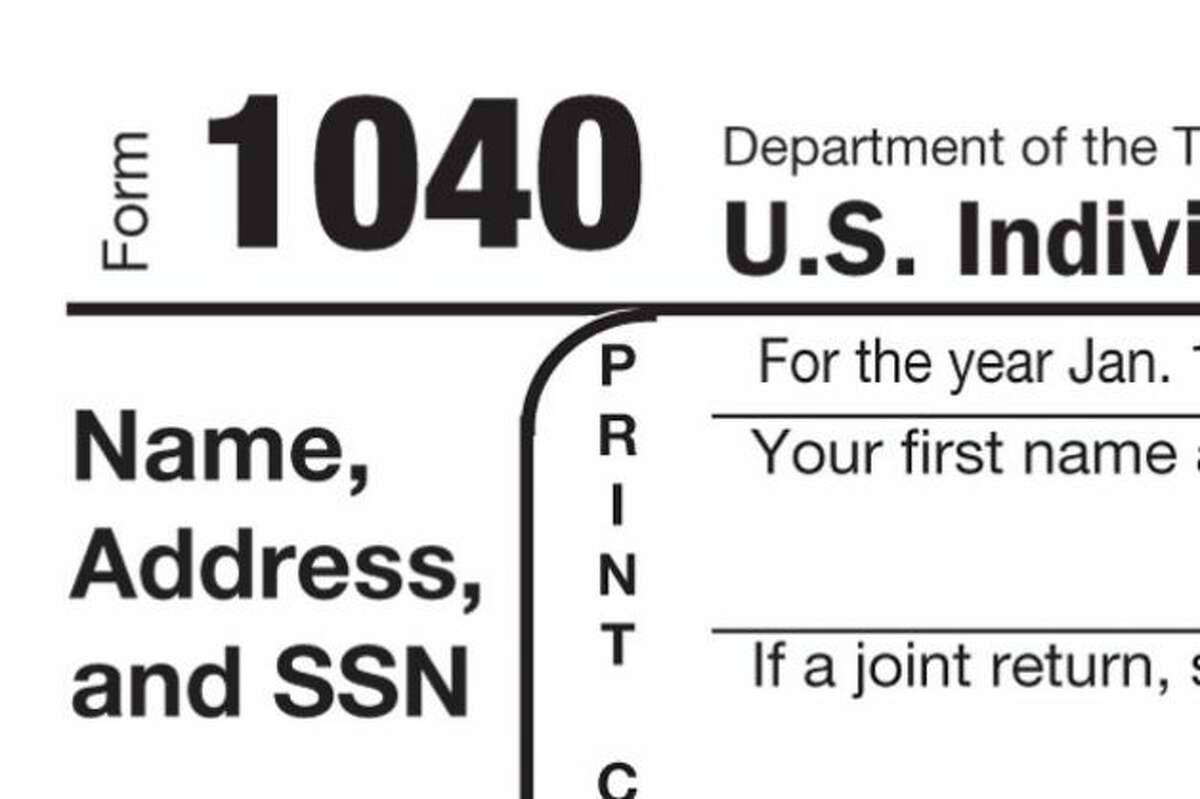

Rebate Calculations 101 How Are Rebates Calculated Enable

Connecticut Revenue Department Determines Labor To Install Fuel Cell

Connecticut Revenue Department Determines Labor To Install Fuel Cell

Rebate In Income Tax Ultimate Guide

New D365FO Rebate Management Functionality Sikich LLP

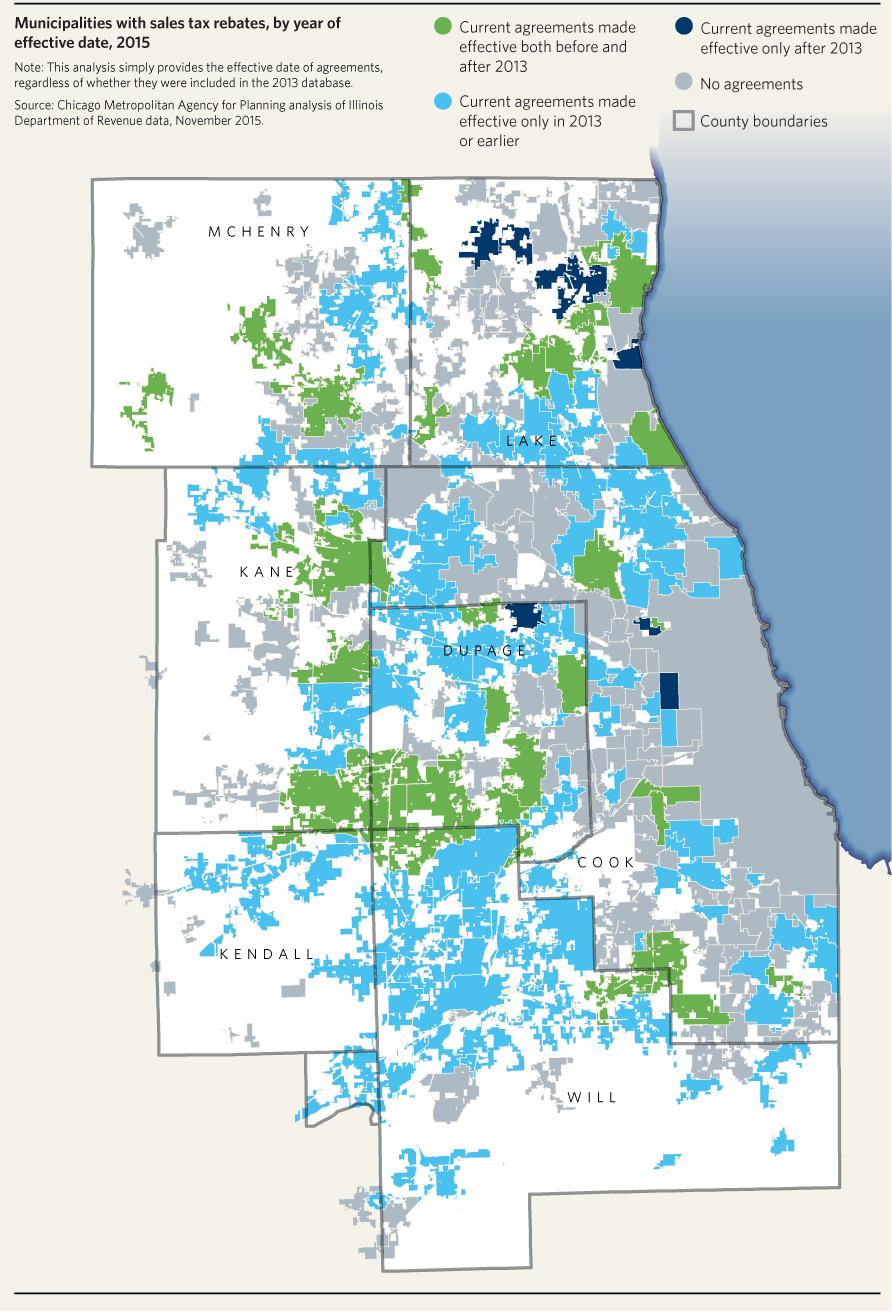

Sales Tax Rebates Remain Prevalent In Northeastern Illinois CMAP

Are Rebates Subject To Sales Tax - Verkko 2 kes 228 k 2020 nbsp 0183 32 By Daan Arends amp Wouter Kolkman DLA Piper Netherlands On 28 May the Court of Justice of the European Union in the World Comm Trading case Case C