Are Rebates Taxable Income Irs Accordingly the consumer that receives an IRA rebate will not be required to report the value of the rebate as income Additional information about energy related tax

The income tax treatment of rebates however has been a simmering dispute for more than 50 years leaving uncertainty for both payers and recipients as to characterization and timing Recently the IRS has taken steps to reduce Generally an amount included in your income is taxable unless it is specifically exempted by law Income that is taxable must be reported on your return and is subject to tax

Are Rebates Taxable Income Irs

Are Rebates Taxable Income Irs

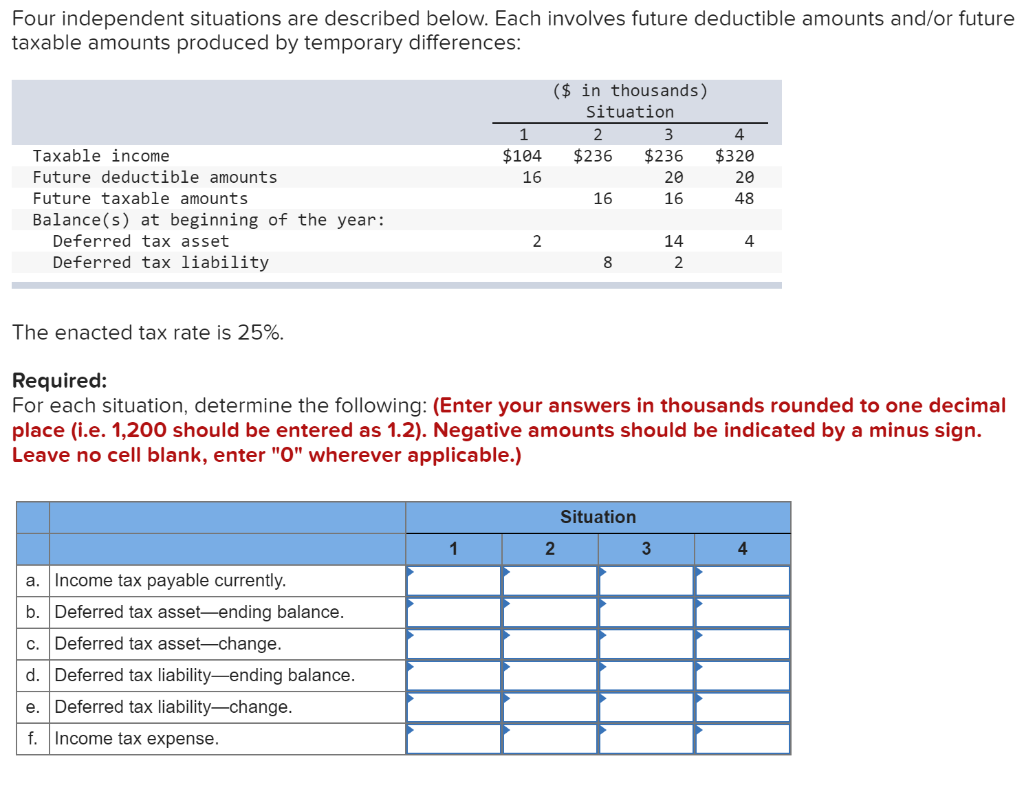

https://media.cheggcdn.com/media/0c4/0c4f6d2b-4b27-4f28-a061-b83200553416/phpXaXizV.png

Taxes 2023 IRS Says California Most State Tax Rebates Aren t

https://assets3.cbsnewsstatic.com/hub/i/r/2022/04/18/bc29efd4-8f27-4c87-90c8-747eac1fcd9e/thumbnail/1200x630/f8794c3cda3ff3cc4a04aac97f532fdb/hypatia-h_0d32f8ab1663c2148ee4151ae6500dae-h_f470ece42eb4c37c3d363bc8cefc94bf.jpg

2022 Tax Brackets DhugalKillen

https://www.nexia-sabt.co.za/wp-content/uploads/2021/03/Tax-Table-and-Rebates-2021-2022.jpg

The IRS stated in the announcement consistent with its practice up to that point that it would not assert that the receipt or personal use of frequent flyer miles or other in kind promotional benefits attributable to the taxpayer s If you earn rewards without using the card they re viewed by the IRS as a rebate and not taxable income Rewards provided as an incentive just for opening an account without you

Tax season is underway But the Internal Revenue Service is still figuring out whether taxpayers who received rebates last year should count them as taxable income The IRS could not in opposition to its long standing policy of treating credit card rewards for the purchase of products or services as nontaxable purchase rebates require taxpayers to include in income large

Download Are Rebates Taxable Income Irs

More picture related to Are Rebates Taxable Income Irs

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

Federal Income Tax Deduction Chart My XXX Hot Girl

https://www.investopedia.com/thmb/JjB8KxvTErLB2ZgozO3H_wkKoNA=/2338x2338/smart/filters:no_upscale()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg

Oct 19 Irs Here Are The New Income Tax Brackets For 2023 Free Nude

https://image.cnbcfm.com/api/v1/image/107136825-1666125851699-6clBX-marginal-tax-brackets-for-tax-year-2023-single-individuals_1.png?v=1666125859

2022 Tax Brackets Married Filing Jointly Irs Printable Form

https://i2.wp.com/financialsamurai.com/wp-content/uploads/2021/11/2022-income-tax-rates-married-filing-jointly.png?fit=1456,9999

No credit card cash back rewards are not taxable The IRS treats cash back rewards as a rebate on spending and not as income so you aren t required to pay income tax on these rewards The IRS has issued guidance providing that rebates for energy efficient improvements under two Department of Energy DOE programs will generally not be

If an employee uses his personal credit card for a business related purchase and is subsequently reimbursed for that purchase by his employer the IRS could consider the related cash back IRS says California most state tax rebates aren t considered taxable income Taxpayers in more than 20 states who received tax rebates last year got some guidance from

Rebate Calculations 101 How Are Rebates Calculated Enable

https://assets-global.website-files.com/61eee558e613794aa8a7f70c/63638715cda5ce39da72168b_Blog banners 2400x1348px3.png

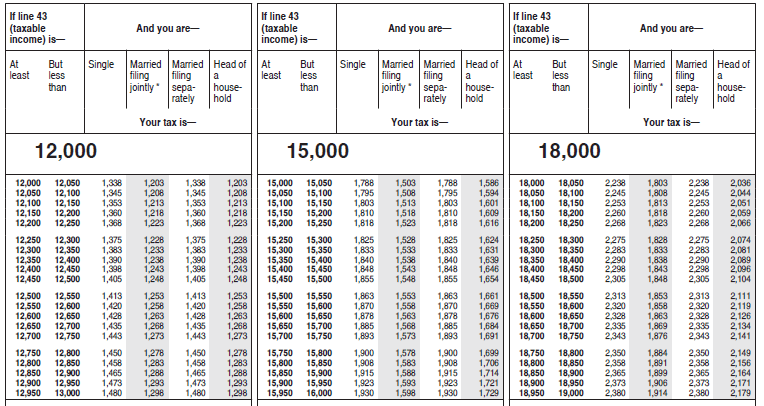

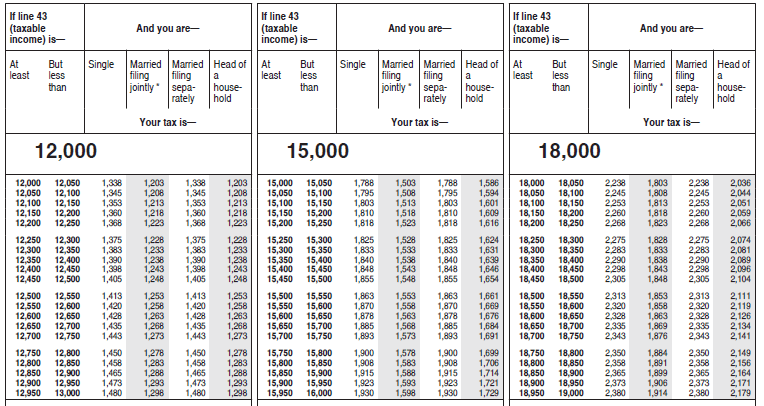

IRS Tax Tables Federal Withholding Tables 2021

https://federalwithholdingtables.net/wp-content/uploads/2021/07/irs-income-tax-irs-income-tax-tables-2015.png

https://www.irs.gov/newsroom/treasury-irs-issue...

Accordingly the consumer that receives an IRA rebate will not be required to report the value of the rebate as income Additional information about energy related tax

https://www.journalofaccountancy.co…

The income tax treatment of rebates however has been a simmering dispute for more than 50 years leaving uncertainty for both payers and recipients as to characterization and timing Recently the IRS has taken steps to reduce

Don t Dread The IRS Three Part Guide To Tackle Your Taxes Financial

Rebate Calculations 101 How Are Rebates Calculated Enable

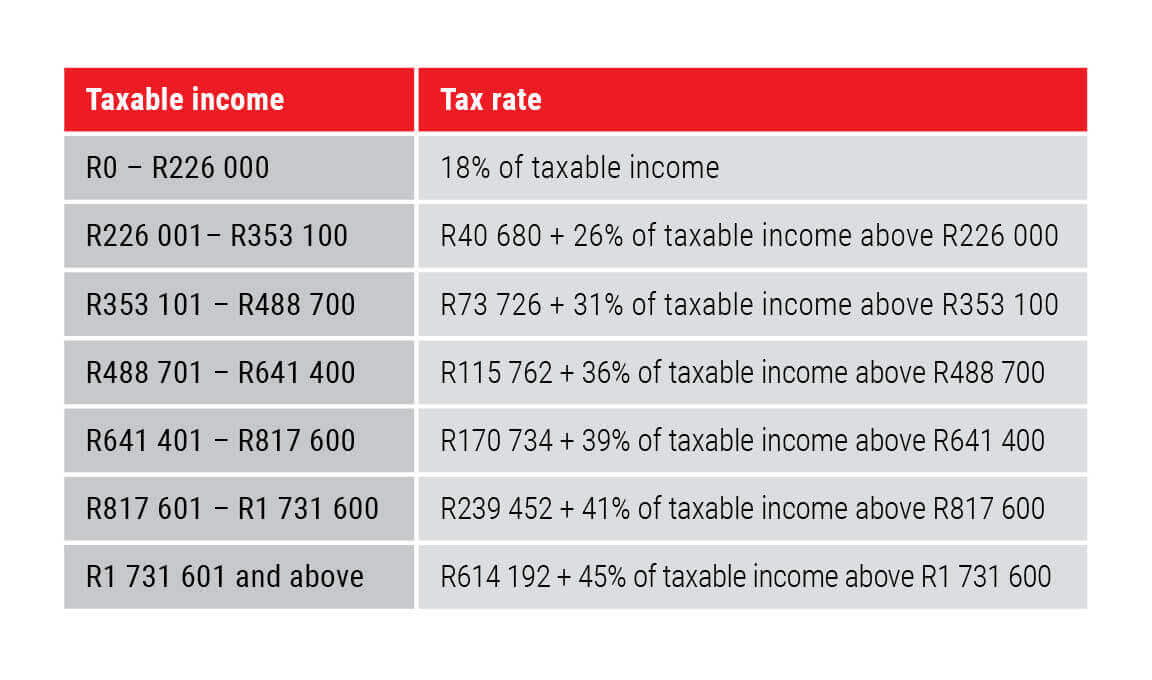

Income Tax Framework Calculations Rebates Income Tax Individuals

Taxable Payments Annual Report Bosco Chartered Accountants

New Income Tax Calculation Rebate 2018 19 Explained YouTube

Irs Tax Tables 2017 Calculator Awesome Home

Irs Tax Tables 2017 Calculator Awesome Home

How To Calculate Accounts Payable Formula Modeladvisor

Allan Gray 2022 Budget Speech Update

What Is Taxable Income Explanation Importance Calculation Bizness

Are Rebates Taxable Income Irs - If you earn rewards without using the card they re viewed by the IRS as a rebate and not taxable income Rewards provided as an incentive just for opening an account without you