Are Refunded Pension Contributions Taxable If you don t have a tax card for pensioners the pension provider that pays out your tax will withhold 40 per cent of your pension in tax Once you get your tax card the pension provider will either refund or take into account the excess tax they have withheld when they pay out your pension the next time

The payment of a refund of contributions validly held by a registered pension scheme is an authorised payment for tax purposes only if it meets the conditions for either a short service You ll get the amount you paid into the pension scheme back minus any tax that needs to be paid you won t pay tax on a refund of excess contributions lump sum 20 tax on the first 20 000 you re refunded 50 tax above this

Are Refunded Pension Contributions Taxable

Are Refunded Pension Contributions Taxable

https://nationalpensionhelpline.ie/wp-content/uploads/2022/08/Company-pension-overview-cover-.jpg

Mac Financial Making Pension Contributions Before The End Of The Tax

http://macfinancial.uk.com/wp-content/uploads/2016/02/pension1.jpg

How Pension Contributions Work

https://equable.org/wp-content/uploads/2019/08/GettyImages-1025271340-1024x1024.jpg

The refund is taxed at 20 if the refund is less than 20 000 and 50 on any amount above this level there will be extra national insurance contributions to pay This is only relevant to contracted out service prior to 6 April 2016 Although the general rule is that once contributions are paid into a pension plan they can t be refunded there are a few circumstances when they can Let s take a look at these Key facts When can there be a refund of contributions When a plan is cancelled within the cooling off period

You can get tax relief on private pension contributions worth up to 100 of your annual earnings You ll either get the tax relief automatically or you ll have to claim it yourself You can only receive tax relief on pension contributions up to the level of your taxable UK earnings or 3 600 if this is lower If you have made personal contributions in excess of 100 of relevant UK earnings for income tax purposes you may be able to get a refund of this excess

Download Are Refunded Pension Contributions Taxable

More picture related to Are Refunded Pension Contributions Taxable

Pension Fund Selection National Pension Helpline

https://nationalpensionhelpline.ie/wp-content/uploads/2022/09/Infographics_Page-4.jpg

Write Off An Employee s Loan Tax Tips Galley And Tindle

https://galleyandtindle.co.uk/wp-content/uploads/2020/06/employee-loans.jpg

Pension Highway Sign Image

http://www.picpedia.org/highway-signs/images/pension.jpg

Your pension contributions are tax free up to a certain amount known as the allowance There s both a lifetime and an annual allowance to consider You must be registered with HMRC to qualify for any tax relief If you re not registered then you might have to pay tax on any contributions you make to your pension Overview Your private pension contributions are tax free up to certain limits This applies to most private pension schemes for example workplace pensions personal and stakeholder

Only tax relief on an excess contribution of 500 000 or more will be spread The length of time the tax relief will be spread over depends on the size of the excess Read the further guidance Tax relief is paid on your pension contributions at the highest rate of income tax you pay So Basic rate taxpayers get 20 pension tax relief Higher rate taxpayers can claim 40 pension tax relief Additional rate taxpayers can claim 45 pension tax relief

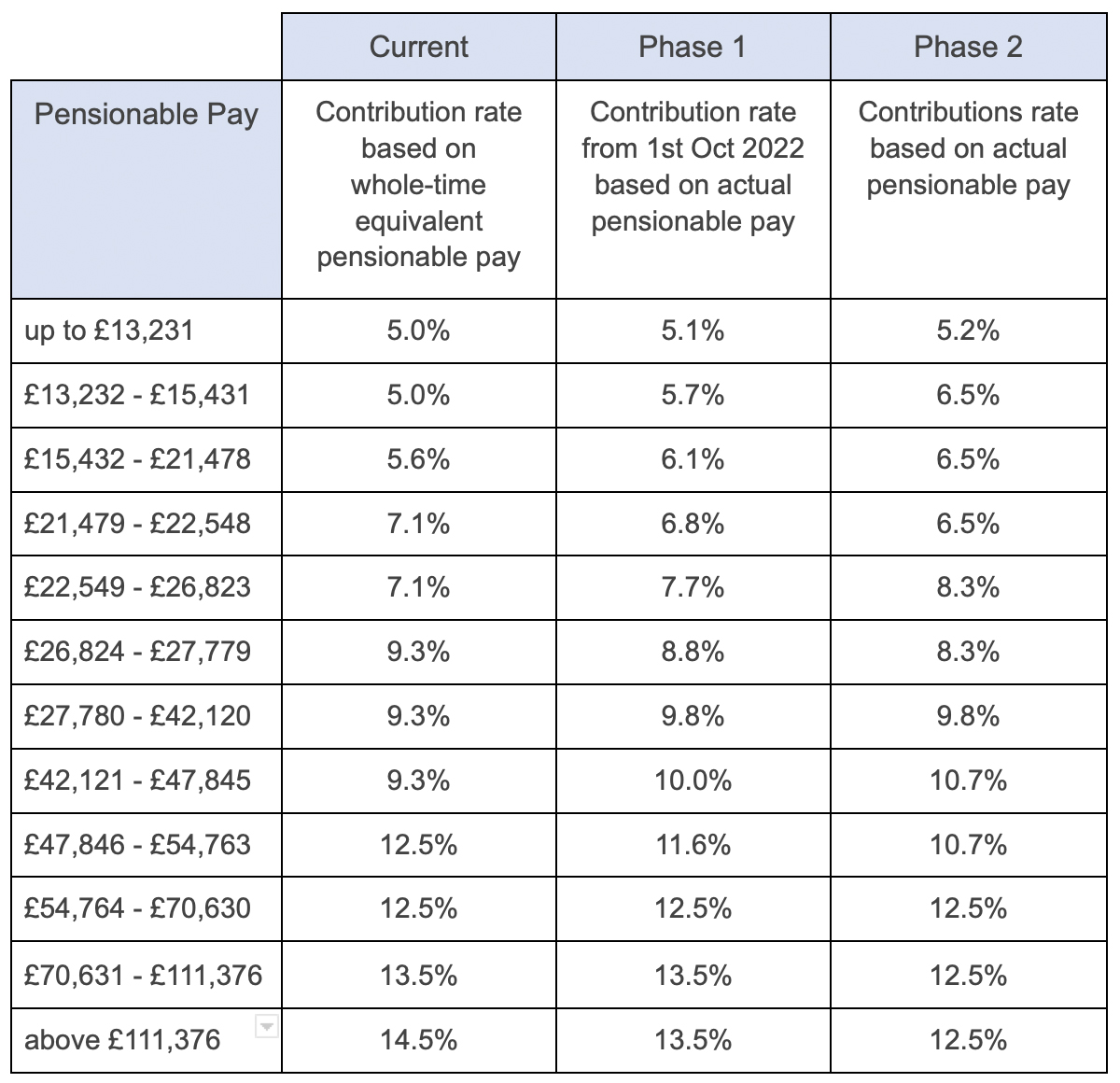

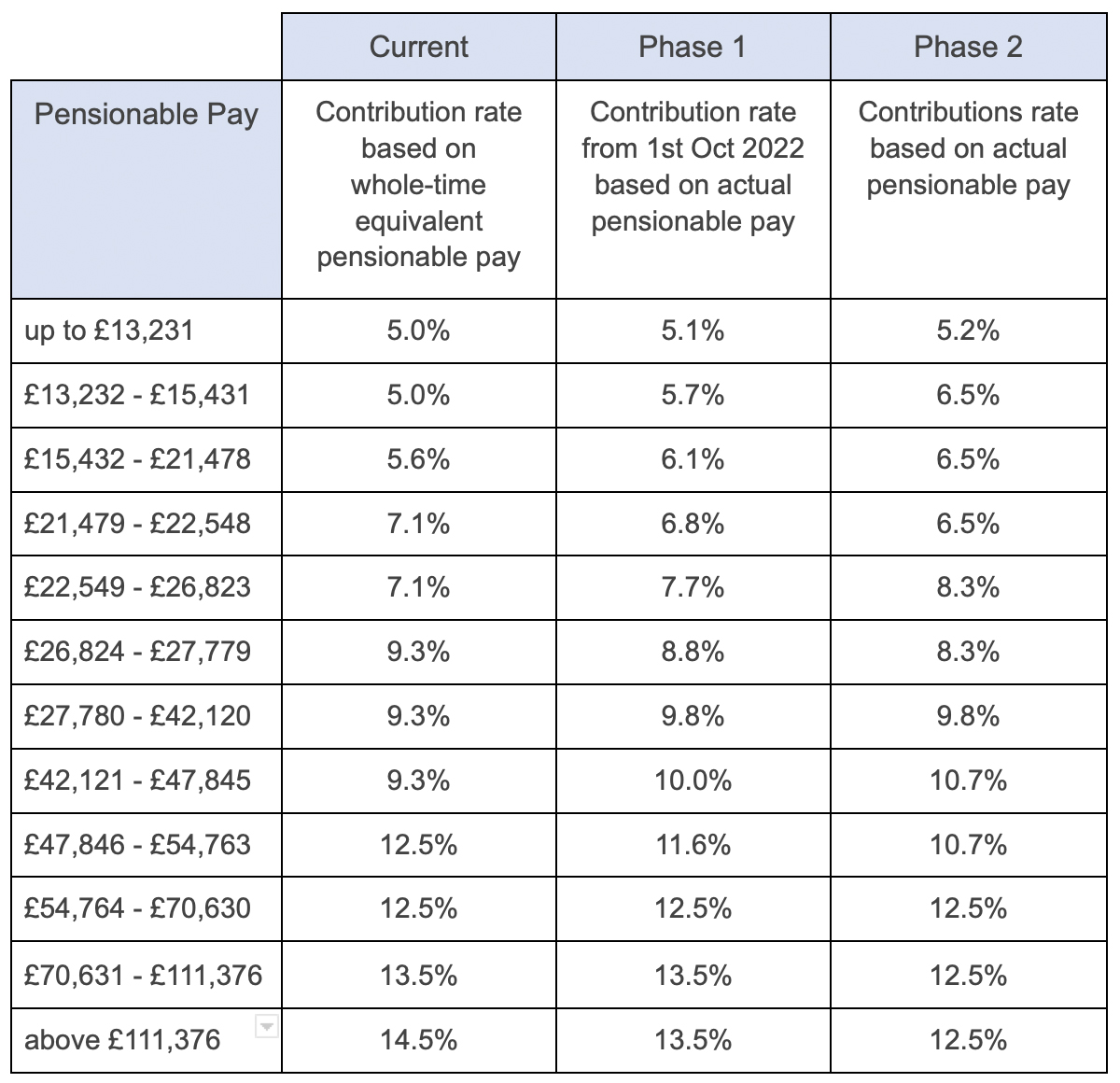

Changes In NHS Pension Contributions Are You A Winner Or Loser

https://www.legalandmedical.co.uk/wp-content/uploads/2022/07/Pensionable-pay1.jpg

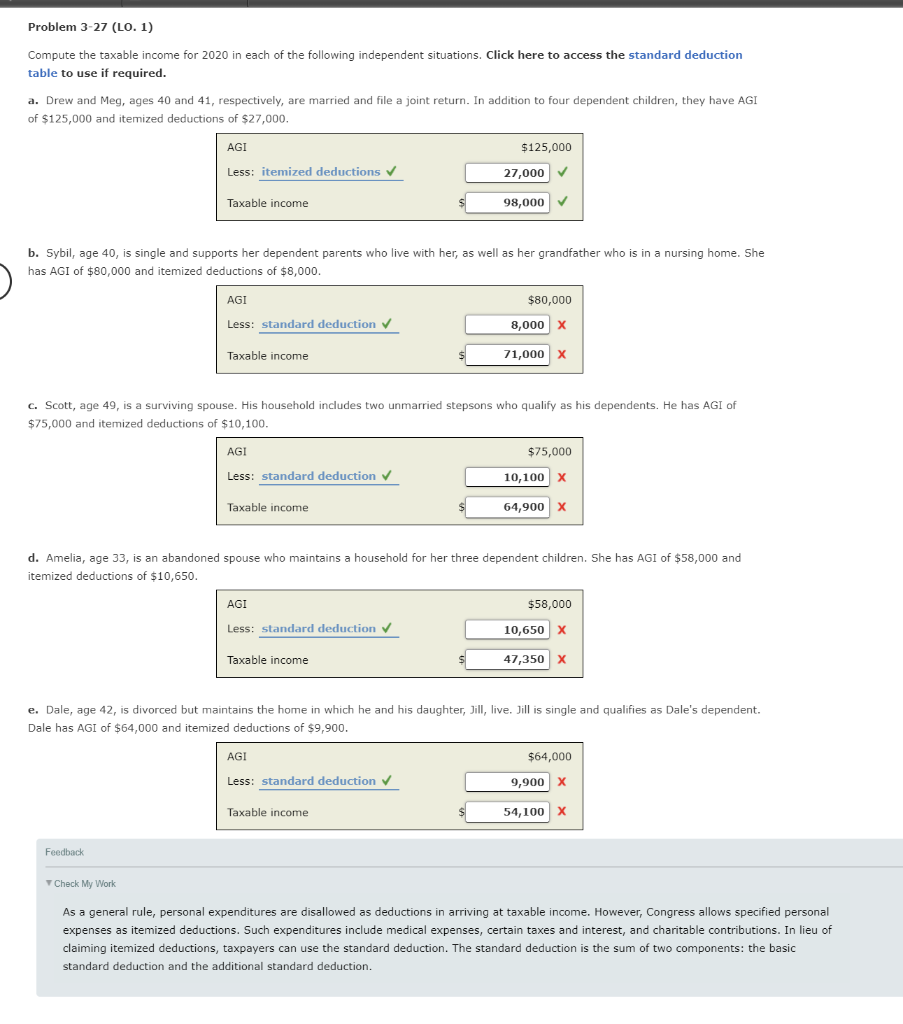

Solved Problem 3 27 LO 1 Compute The Taxable Income For Chegg

https://media.cheggcdn.com/media/b7d/b7d221bd-ac73-47cd-b797-c3fcc4660b9d/phpXiskta.png

https://www.tyoelake.fi/en/claim-your-pension/how...

If you don t have a tax card for pensioners the pension provider that pays out your tax will withhold 40 per cent of your pension in tax Once you get your tax card the pension provider will either refund or take into account the excess tax they have withheld when they pay out your pension the next time

https://www.gov.uk/hmrc-internal-manuals/pensions...

The payment of a refund of contributions validly held by a registered pension scheme is an authorised payment for tax purposes only if it meets the conditions for either a short service

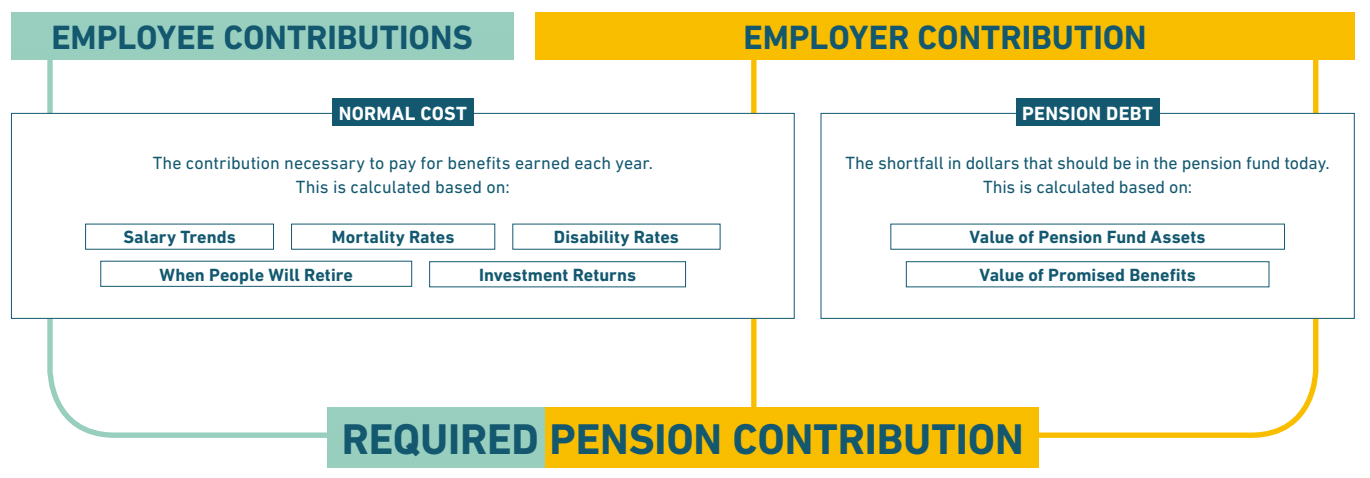

How Pension Contributions Work

Changes In NHS Pension Contributions Are You A Winner Or Loser

Le Fonds De Pension D Eskom Accuse Brian Molefe D avoir Utilis Des

Retirement Income Retirement Pension Retirement Advice Investing For

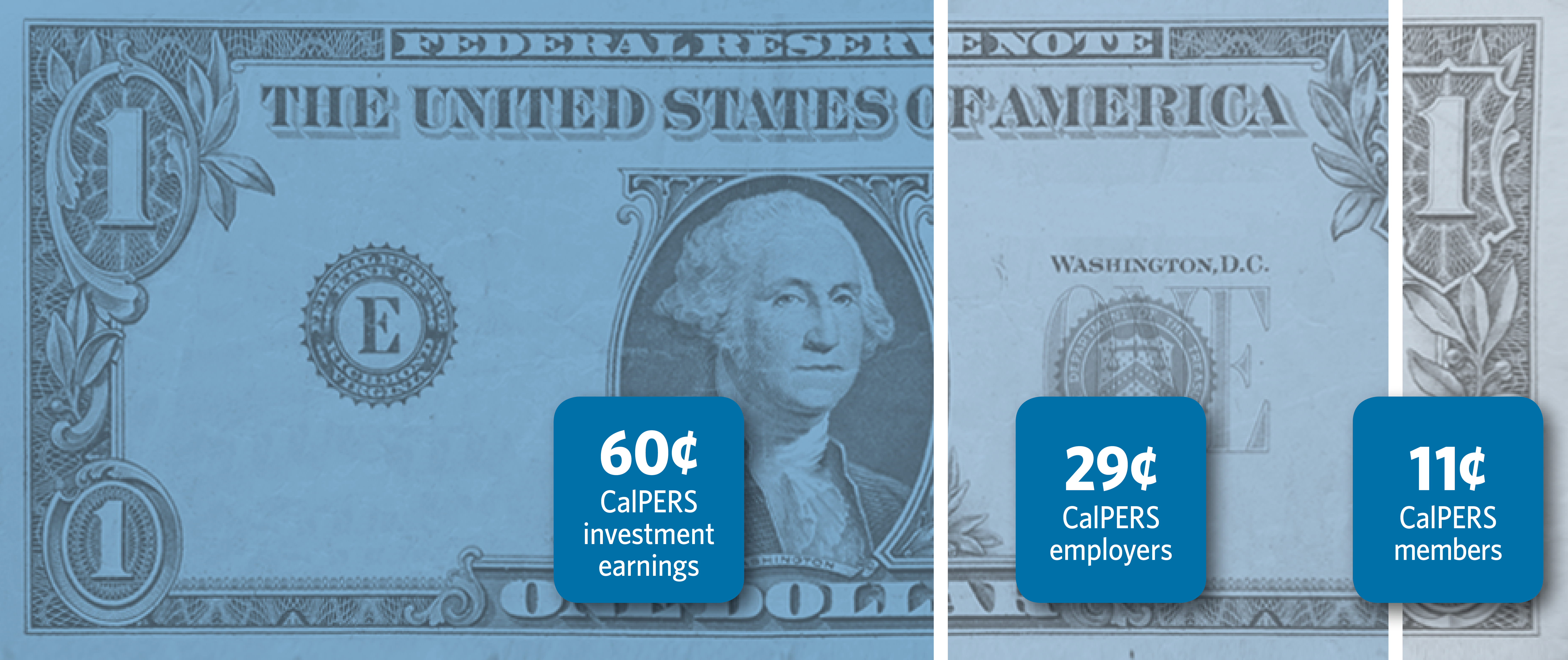

Who Pays For CalPERS Pensions CalPERS

Articles National Pension Helpline

Articles National Pension Helpline

Pension Analysis Scarborough Capital Management

Don t Dread The IRS Three Part Guide To Tackle Your Taxes Financial

Mind The Pensions Gap BTU

Are Refunded Pension Contributions Taxable - The refund is taxed at 20 if the refund is less than 20 000 and 50 on any amount above this level there will be extra national insurance contributions to pay This is only relevant to contracted out service prior to 6 April 2016