Are Schools Paid For By Property Taxes According to the Department of Education s National Center for Education Statistics property taxes contribute 30 or more of total public school funding in 29

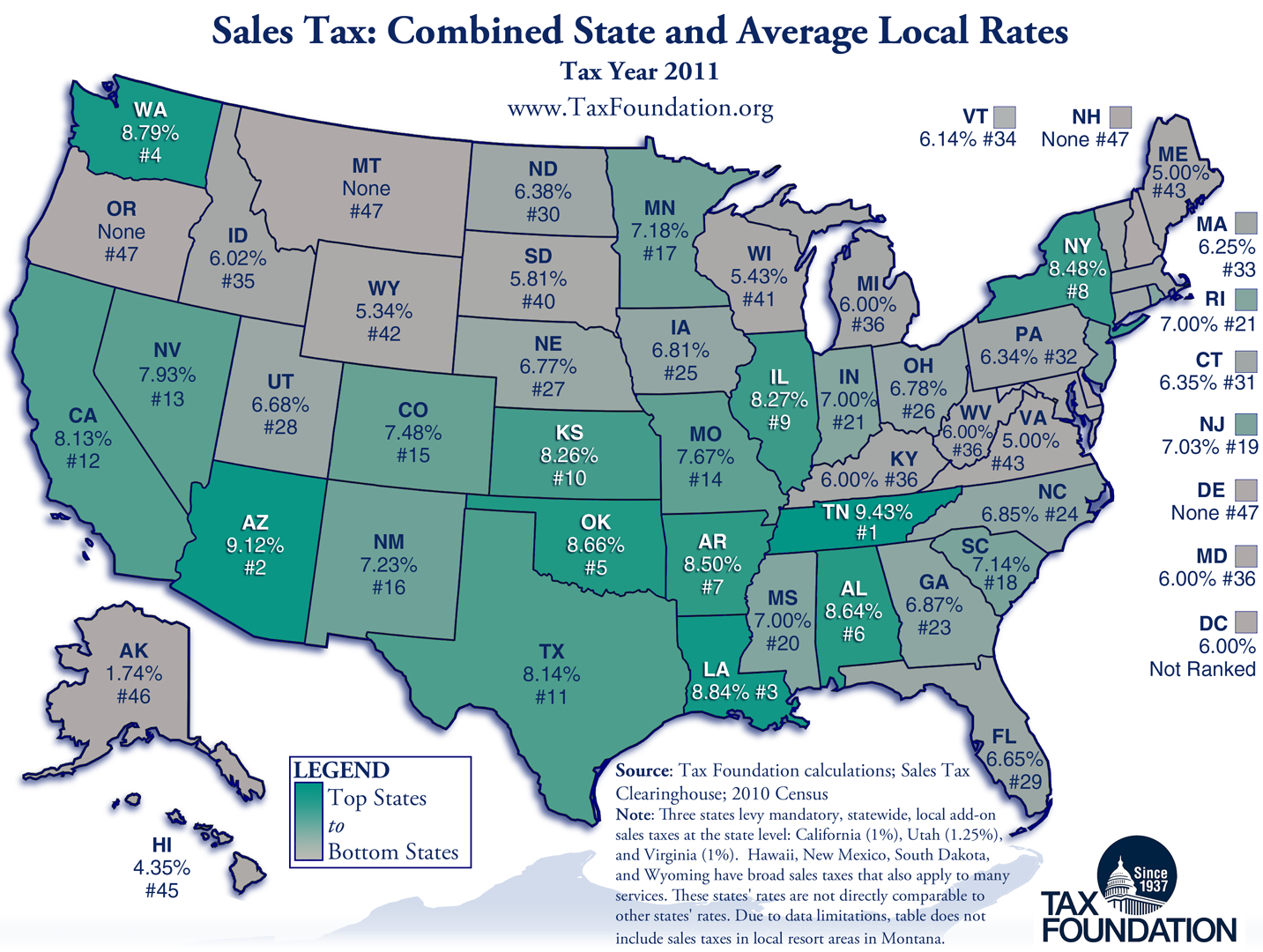

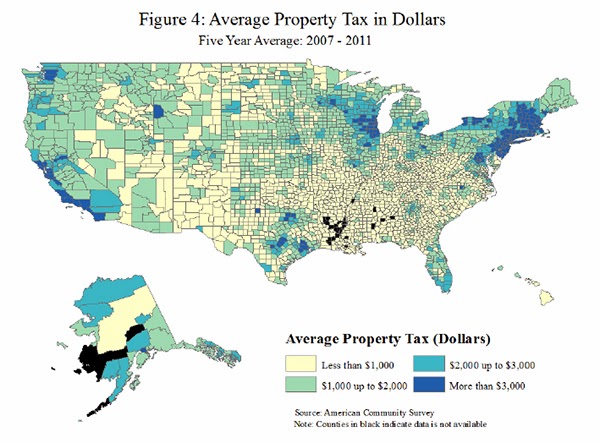

Public schools in the United States of America provide basic education from kindergarten until the twelfth grade This is provided free of charge for the students and parents but is paid for by taxes on property owners as well as general taxes collected by the federal government This education is mandated by the states With the completion of this basic schooling one obtains a high school diploma as certification of basic skills for employers A study done by Bowling Green University showed half of all property taxes went to support elementary and secondary schools and in Ohio the number was as high as 70 percent

Are Schools Paid For By Property Taxes

Are Schools Paid For By Property Taxes

https://townsquare.media/site/385/files/2020/01/Screen-Shot-2020-01-19-at-12.17.39-PM.png?w=980&q=75

Percentage Of Property Tax That Goes To School Funding School Walls

https://ed100.org/uploads/images/shares/CA-19-20-budget.png

Do Higher Property Taxes Lead To Better Public Schools Team Coyle

https://theteamcoyle.com/wp-content/uploads/2022/09/Property-Taxes-vs-school-ranks.jpg

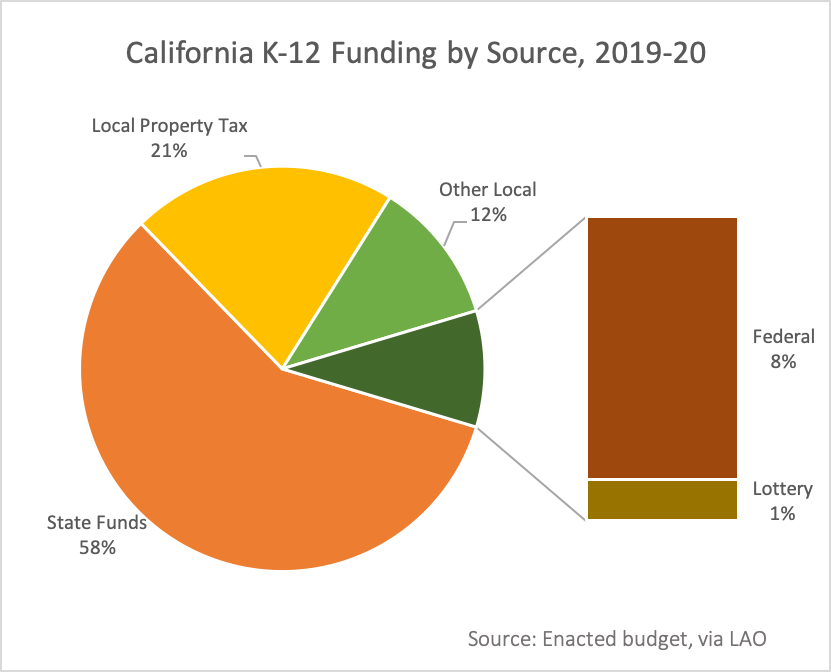

Property tax exemption for public schools Whereas public schools must contend with payroll tax and sometime sales tax there are tax types they don t have to The problem with a school funding system that relies so heavily on local property taxes is straightforward Property values vary a lot from neighborhood to

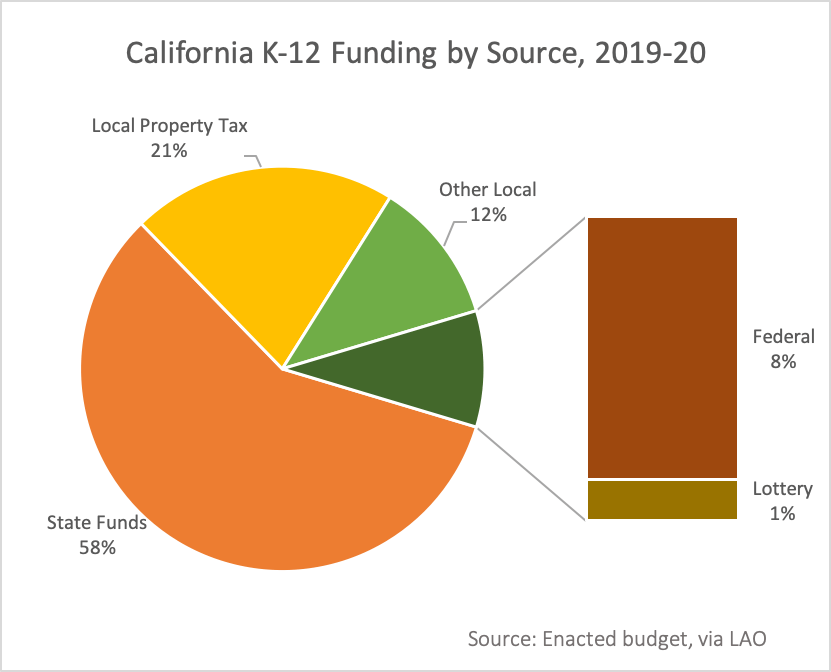

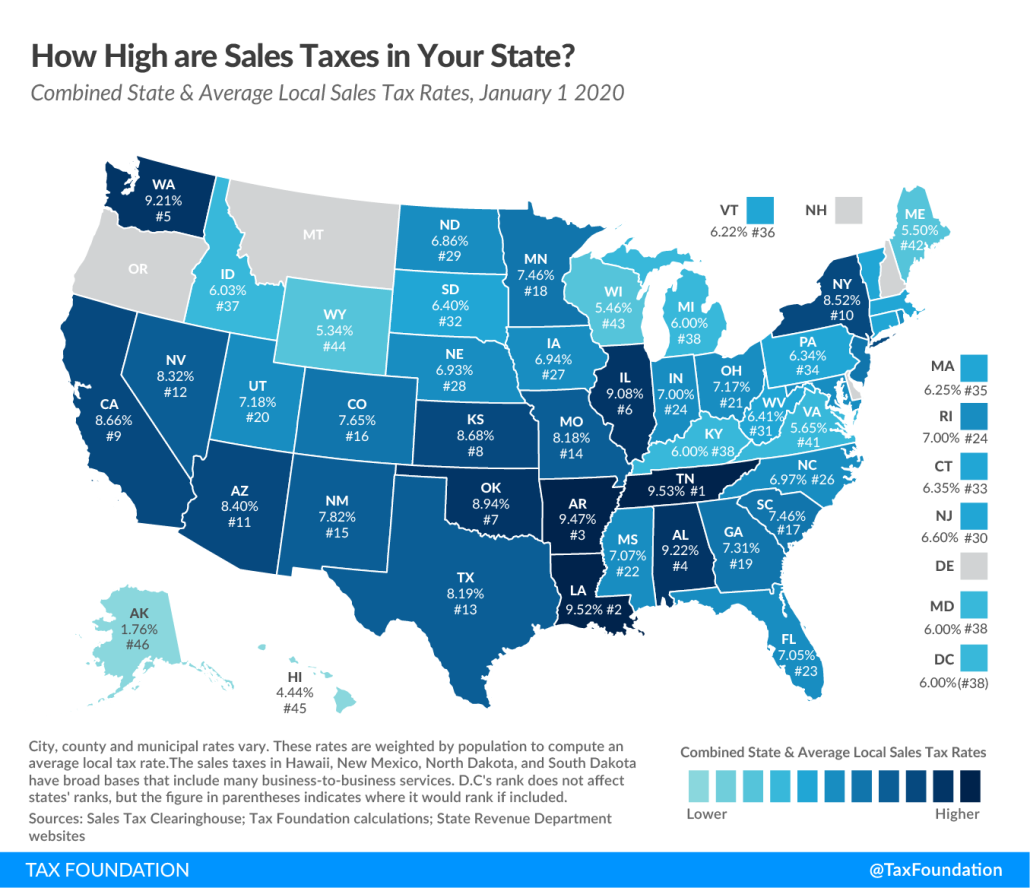

Most people assume local school funding is synonymous with property taxes But in roughly 10 states local sales or income taxes make up more than 5 percent of all local revenue for K 12 English This report seeks to correct common misconceptions surrounding the practice of relying on the proprety tax to fund public schools Through a comprehensive review of

Download Are Schools Paid For By Property Taxes

More picture related to Are Schools Paid For By Property Taxes

State Taxes Can Add Up Wealth Management

https://www.wealthmanagement.com/sites/wealthmanagement.com/files/uploads/2015/12/taxratechart.png

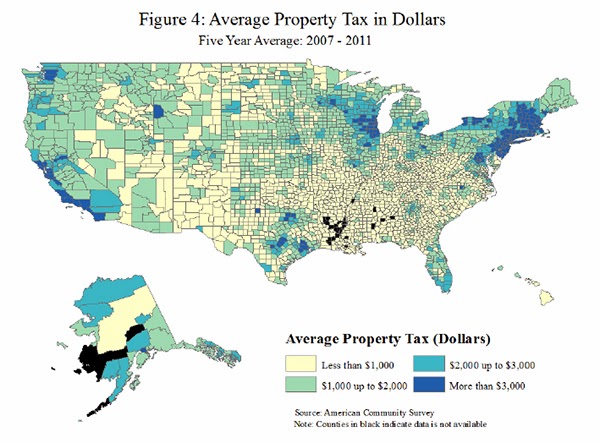

How High Are Property Taxes In Your State American Property Owners

https://propertyownersalliance.org/wp-content/uploads/2020/10/property-taxes-by-state-2020-FV-01-1024x868-1.png

/GettyImages-1190995919-bce27cedc8fa4274b70ffcd0062e6098.jpg)

A Brief History Of Taxes In The U S

https://www.investopedia.com/thmb/cHigOcnY9JPQ4CjU4oshzsrEVm4=/2152x1393/filters:fill(auto,1)/GettyImages-1190995919-bce27cedc8fa4274b70ffcd0062e6098.jpg

Since schools depend heavily on property taxes the state was supposed to use income tax revenue to help offset the effect of this new cap There s just one problem In tough economic times Overview Of The Current System Of Public School Funding Based On Property Taxes The current system of public school funding in the United States is largely based on

K 12 Local Schools Local Funding Today 44 6 percent of funding for public education in this country comes from local sources with most of this local money coming And states still left much of the funding of schools up to cities and towns which relied on property tax In 1890 property taxes accounted for 67 9 percent of

How High Are Property Taxes In Your State Tax Foundation

https://files.taxfoundation.org/20170110101027/PropertyTax.png

Hecht Group Homeschoolers And Property Taxes

https://img.hechtgroup.com/1665455467455.jpg

https://usafacts.org/articles/how-are-public-schools-funded

According to the Department of Education s National Center for Education Statistics property taxes contribute 30 or more of total public school funding in 29

https://en.wikipedia.org/wiki/Public_school...

Public schools in the United States of America provide basic education from kindergarten until the twelfth grade This is provided free of charge for the students and parents but is paid for by taxes on property owners as well as general taxes collected by the federal government This education is mandated by the states With the completion of this basic schooling one obtains a high school diploma as certification of basic skills for employers

Property Taxes By State County Median Property Tax Bills

How High Are Property Taxes In Your State Tax Foundation

Dividends Payable Accounting Journal Entry

Issues

Ranking State And Local Sales Taxes Tax Foundation Texas Sales Tax

Useful Map Of Property Tax Rates Across The Country with Some

Useful Map Of Property Tax Rates Across The Country with Some

Lehigh Valley Ramblings Campaign Signs On Gov t Property Illegal

ILLINOIS SALES TAX RATES AMONG THE HIGHEST IN THE COUNTRY Taxpayer

How To Increase The Value Of A Business By Paying More Taxes

Are Schools Paid For By Property Taxes - Most people assume local school funding is synonymous with property taxes But in roughly 10 states local sales or income taxes make up more than 5 percent of all local revenue for K 12