Are Solar Energy Payments Taxable Yes Generally you can claim a tax credit on the expenses related to the new solar PV system that already came installed on the house for the year in which you moved into the house assuming the builder did not claim the tax

Payment based on an amount of residential solar generating capacity In Year Taxpayer purchased a grid tied solar electric power system Residential Solar System from X for a that allows Taxpayer to convert sunlight into utility grade When you purchase not lease new solar powered equipment that generates electricity or heats water or purchase solar power storage equipment you generally can claim the Residential Clean Energy Credit to lower your tax bill

Are Solar Energy Payments Taxable

Are Solar Energy Payments Taxable

https://www.australiansolarquotes.com.au/wp-content/uploads/2016/03/13069166663_b4b22396d0_k.jpg

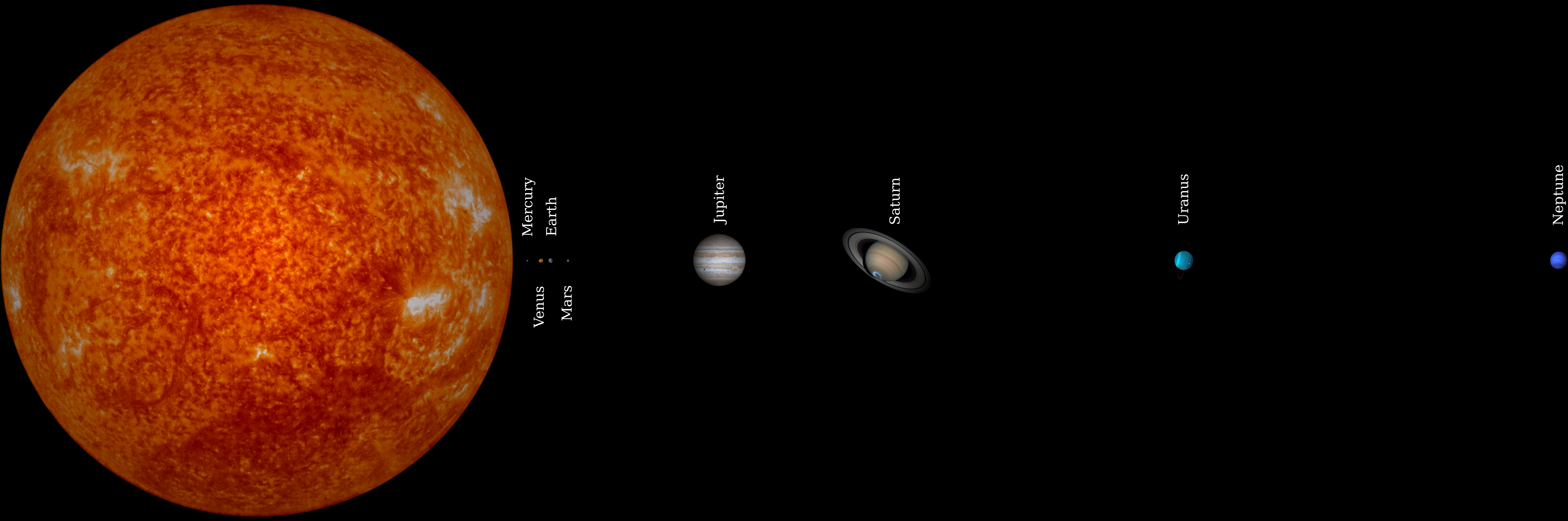

File Solar system png Wikipedia

http://upload.wikimedia.org/wikipedia/commons/8/82/Solar-system.png

I R S Decides Most Special State Payments Are Not Taxable The New

https://static01.nyt.com/images/2023/02/10/multimedia/10irs-gzbj/10irs-gzbj-videoSixteenByNine3000.jpg

Generally you can claim a tax credit on the expenses related to the new solar PV system that already came installed on the house for the year in which you moved into the house assuming the builder did not claim the tax credit in other words you may claim the The solar tax credit which is among several federal Residential Clean Energy Credits available through 2032 allows homeowners to subtract 30 percent of the cost of installing solar heating

The federal residential solar energy credit is a tax credit you can claim on your federal income taxes It is not a tax deduction that reduces your taxable income but rather the amount of Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed on or before December 31 2019 were also eligible for a 30 tax credit

Download Are Solar Energy Payments Taxable

More picture related to Are Solar Energy Payments Taxable

Federal Solar Tax Credit What It Is How To Claim It For 2024

https://www.ecowatch.com/wp-content/uploads/2022/10/Solar-Investment-Tax-Credit-5-1-2.png

Colorado Solar Energy Systems Eligible For Tax Exemptions

http://www.intermtnwindandsolar.com/wp-content/uploads/2017/11/Colorado-Solar-Energy-Systems-Eligible-for-Tax-Exemptions.jpg

Solar Stocks And Solar Flows

https://media.innovationorigins.com/2022/02/VXGJ4SjA-LV5iGzdc-WKvYMhQ4-DSC03549.jpg

Any excess of payments over heating costs is taxable as property income If you charge separately for the heat used by your tenant the payments received are chargeable as miscellaneous The 2024 federal solar tax credit also known as the Residential Clean Energy Credit is worth 30 of your total solar system cost for all installations in the U S completed through 2032

No capital allowances or other income tax relief can be claimed on the cost of the solar installation Any income from a domestic installation at one s home is tax free This includes both sales of exported electricity and any Feed in Tariff The solar tax credit is a non refundable credit worth 30 of the gross system cost of your solar project That means that if the gross system cost is 20 000 your tax credit would be 6 000 20 000 x 30 6 000 It s important to note that the solar tax credit is not a check the automatically comes in the mail when you install a solar

How To Sell Solar Energy Quick Guide For Solar Businesses Quick

https://go-scooter.com/2deffe48/https/40b8be/lirp.cdn-website.com/5cb12704/dms3rep/multi/opt/shutterstock_1934883920-1920w.jpg

What Is Taxable Income And How To Calculate Taxable Income

https://ebizfiling.com/wp-content/uploads/2022/04/Taxable-Income.png

https://www.energy.gov/sites/default/files/2023-03/...

Yes Generally you can claim a tax credit on the expenses related to the new solar PV system that already came installed on the house for the year in which you moved into the house assuming the builder did not claim the tax

https://www.irs.gov/pub/irs-wd/1035003.pdf

Payment based on an amount of residential solar generating capacity In Year Taxpayer purchased a grid tied solar electric power system Residential Solar System from X for a that allows Taxpayer to convert sunlight into utility grade

File Solar System jpg Wikimedia Commons

How To Sell Solar Energy Quick Guide For Solar Businesses Quick

Gratis Billeder Skrivning Retro Nummer Gammel M nster Linje

Easy Ways To Reduce Your Taxable Income In Australia Tax Warehouse

.png)

Payments For Regenerative Practices

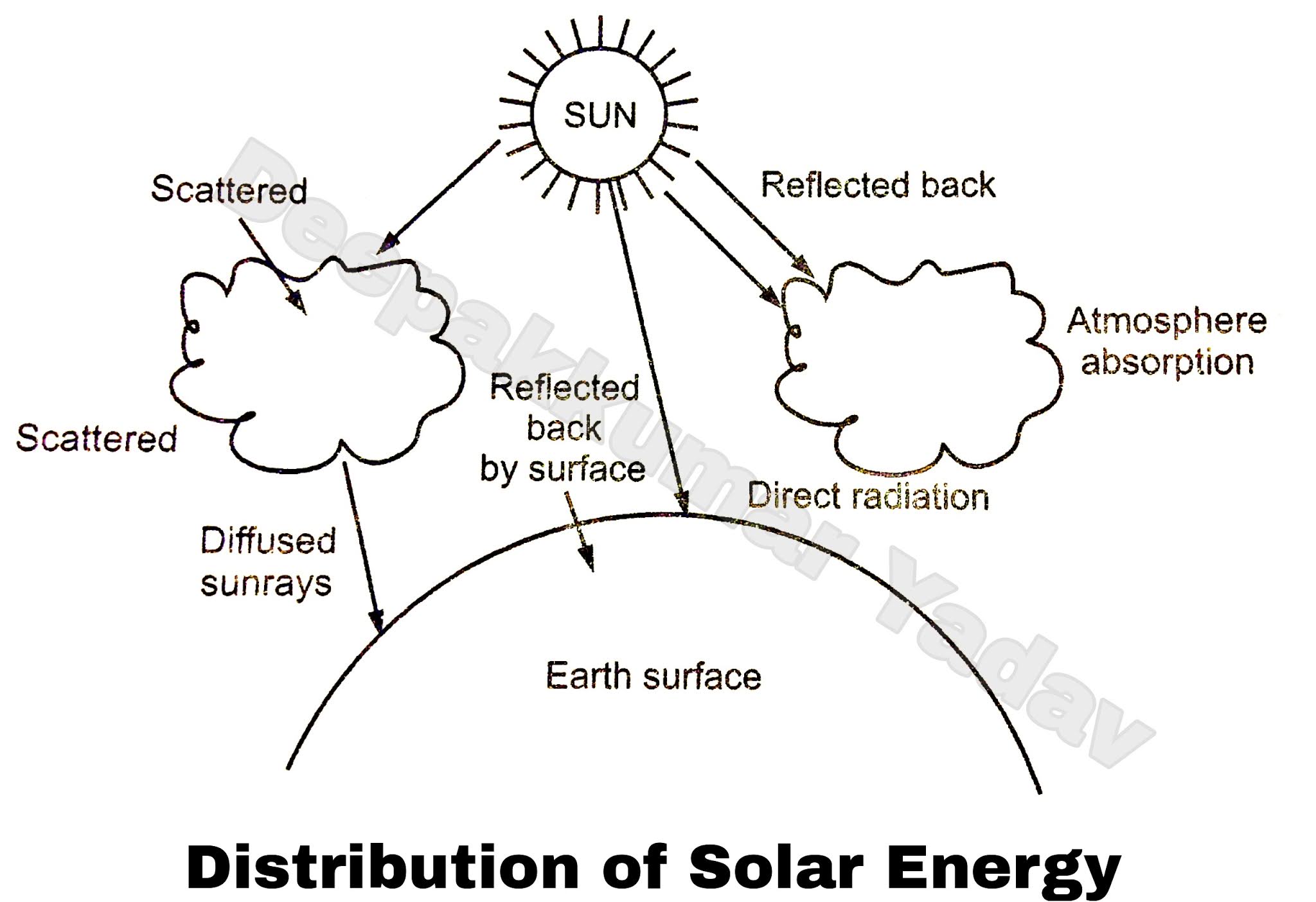

Definition And Diagram Of Solar Constant

Definition And Diagram Of Solar Constant

Open Payment Systems For EV Charging CCV EN

What Are Solar Bill Credits Net Metering Bill Credits And Solar

_1.png)

Income Tax Calculator

Are Solar Energy Payments Taxable - Generally you can claim a tax credit on the expenses related to the new solar PV system that already came installed on the house for the year in which you moved into the house assuming the builder did not claim the tax credit in other words you may claim the