Are State Taxes Deductible On Federal Return 1065 State and local income taxes may be deductible on your personal income tax return using Schedule A If your business is a corporation or partnership the business can deduct state and local

Beginning January 1 2024 partnerships are required to file Form 1065 and related forms and schedules electronically if they file 10 or more returns of any type during the tax Sales Tax IRS Clarifies Deductibility of State and Local Taxes for Partnerships and S Corps State and local income taxes imposed on and paid by a

Are State Taxes Deductible On Federal Return 1065

Are State Taxes Deductible On Federal Return 1065

https://assets-global.website-files.com/5ad551c41ca0c52724be6c55/6059e280542a77693a187cdc_Tax deductible.jpg

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at8.30.22AM-d7e4bd231b2148cea273c25d3656e946.png)

168 K 1 168

https://www.investopedia.com/thmb/W6GLzh84o8Vbv2Z7QBTqOnRkFw4=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/ScreenShot2021-02-07at8.30.22AM-d7e4bd231b2148cea273c25d3656e946.png

Credit Cards And Itemized Deductions What To Know Before Filing Your

https://www.creditonebank.com/content/dam/creditonebank/articles/2023/02/230043-CM-ItemizedDeductionsRefresh-SEOA-FINAL.jpg

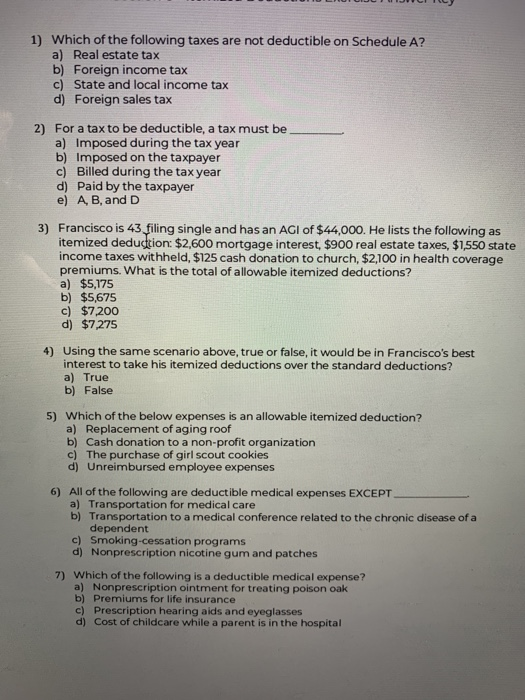

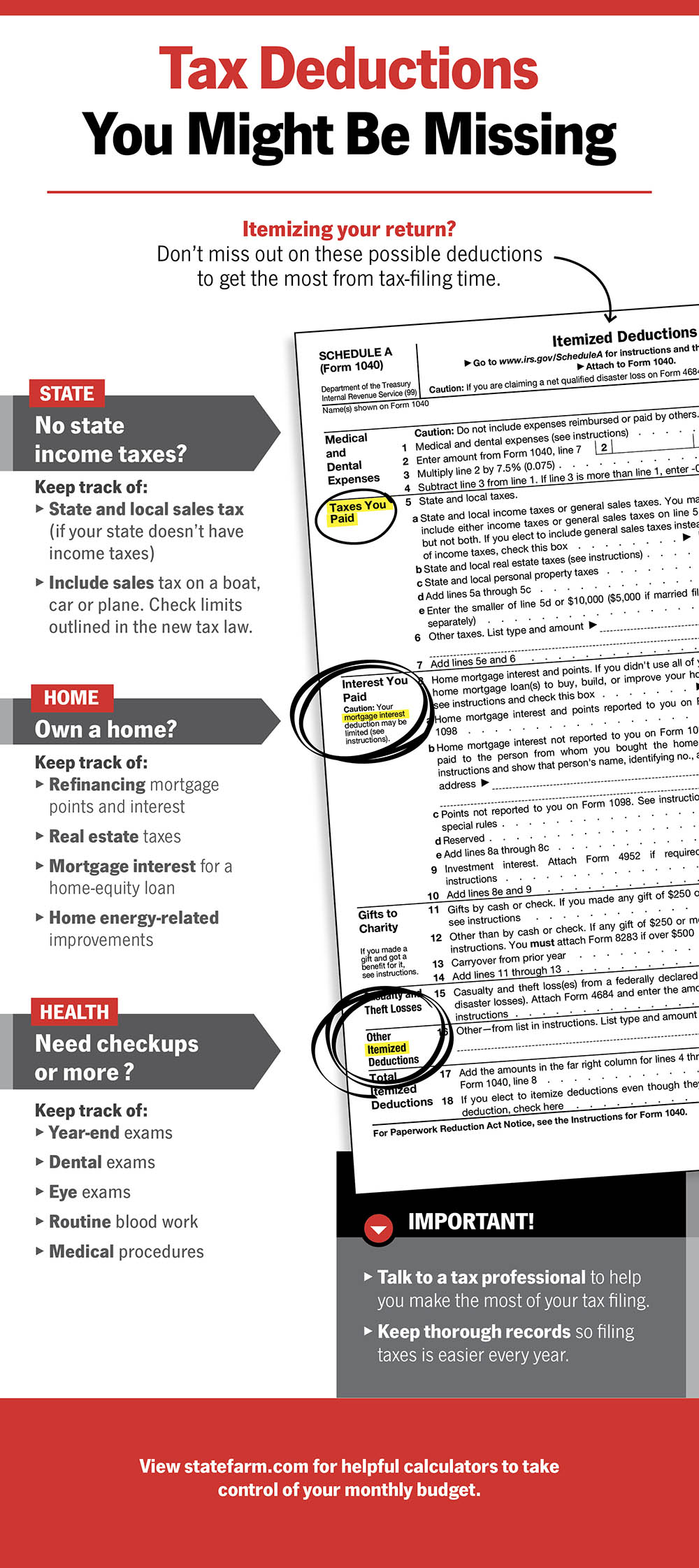

The deduction for state and local taxes is no longer unlimited At one time you could deduct as much as you paid in taxes but the Tax Cuts and Jobs Act TCJA limits the SALT deduction to 10 000 Partnerships file an information return to report their income gains losses deductions credits etc A partnership does not pay tax on its income but passes through any

Form 1065 requires partnerships to gather important year end financial statements including a profit and loss statement that shows net income and revenues deductible expenses and a balance Taxpayers who itemize deductions on their federal income tax returns can deduct state and local taxes specifically property taxes plus either income taxes or general sales

Download Are State Taxes Deductible On Federal Return 1065

More picture related to Are State Taxes Deductible On Federal Return 1065

Nh Car Tax Calculator Rosana Clapp

https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/6171daa562eb8e7ead0f74dc_is-buying-a-car-tax-deductible-schedule-a.png

Income Tax Worksheet Pdf

https://www.pdffiller.com/preview/391/382/391382225/large.png

Average Tax Refund In Every U S State Vivid Maps

https://vividmaps.com/wp-content/uploads/2019/02/Taxes.jpg

Key Takeaways IRS Form 1065 U S Return of Partnership Income is used to report the income deductions credits and other items of a partnership Partnerships are pass through entities You might be able to get a federal deduction for state or local income taxes you paid in 2023 even if they were for an earlier tax year To get this deduction you ll

Keep in mind that your state tax refund may be taxable on the next federal return you file This is because the IRS allows you to deduct your state tax payments Prior year losses are typically not allowed on a composite return By filing their own individual returns owners may be able to establish a position to take losses against

Tax Deductions You Can Deduct What Napkin Finance

https://napkinfinance.com/wp-content/uploads/2020/12/NapkinFinance-TaxDeductions-Napkin-10-13-20-v05-1.jpg

Federal Taxes Paid By State Vs Received Are You Giving Or Getting

https://cdn.howmuch.net/articles/federal-budget-receipts-and-expenditures-across-the-united-states-42f3.jpg

https://www.thebalancemoney.com/wha…

State and local income taxes may be deductible on your personal income tax return using Schedule A If your business is a corporation or partnership the business can deduct state and local

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at8.30.22AM-d7e4bd231b2148cea273c25d3656e946.png?w=186)

https://www.irs.gov/instructions/i1065

Beginning January 1 2024 partnerships are required to file Form 1065 and related forms and schedules electronically if they file 10 or more returns of any type during the tax

Solved 1 Which Of The Following Taxes Are Not Deductible On Chegg

Tax Deductions You Can Deduct What Napkin Finance

Standard Deduction 2020 Self Employed Standard Deduction 2021

T21 0294 Repeal 10 000 Limit On Deductible State And Local Taxes

Common Tax Deductions You Might Be Missing State Farm

How To Deduct Property Taxes On IRS Tax Forms

How To Deduct Property Taxes On IRS Tax Forms

Union Dues Deductible On State Taxes Not On Federal Taxes Hawai i

The Master List Of All Types Of Tax Deductions INFOGRAPHIC Business

How Much Gift Tax Do I Pay In Australia Tax 27950 Hot Sex Picture

Are State Taxes Deductible On Federal Return 1065 - The deduction for state and local taxes is no longer unlimited At one time you could deduct as much as you paid in taxes but the Tax Cuts and Jobs Act TCJA limits the SALT deduction to 10 000