Are Tax Deductions Dollar For Dollar Tax credit A tax credit gives you a dollar for dollar reduction in your tax bill For example if your federal tax bill is 10 000 and you are entitled to a 2 500 tax credit that credit cuts

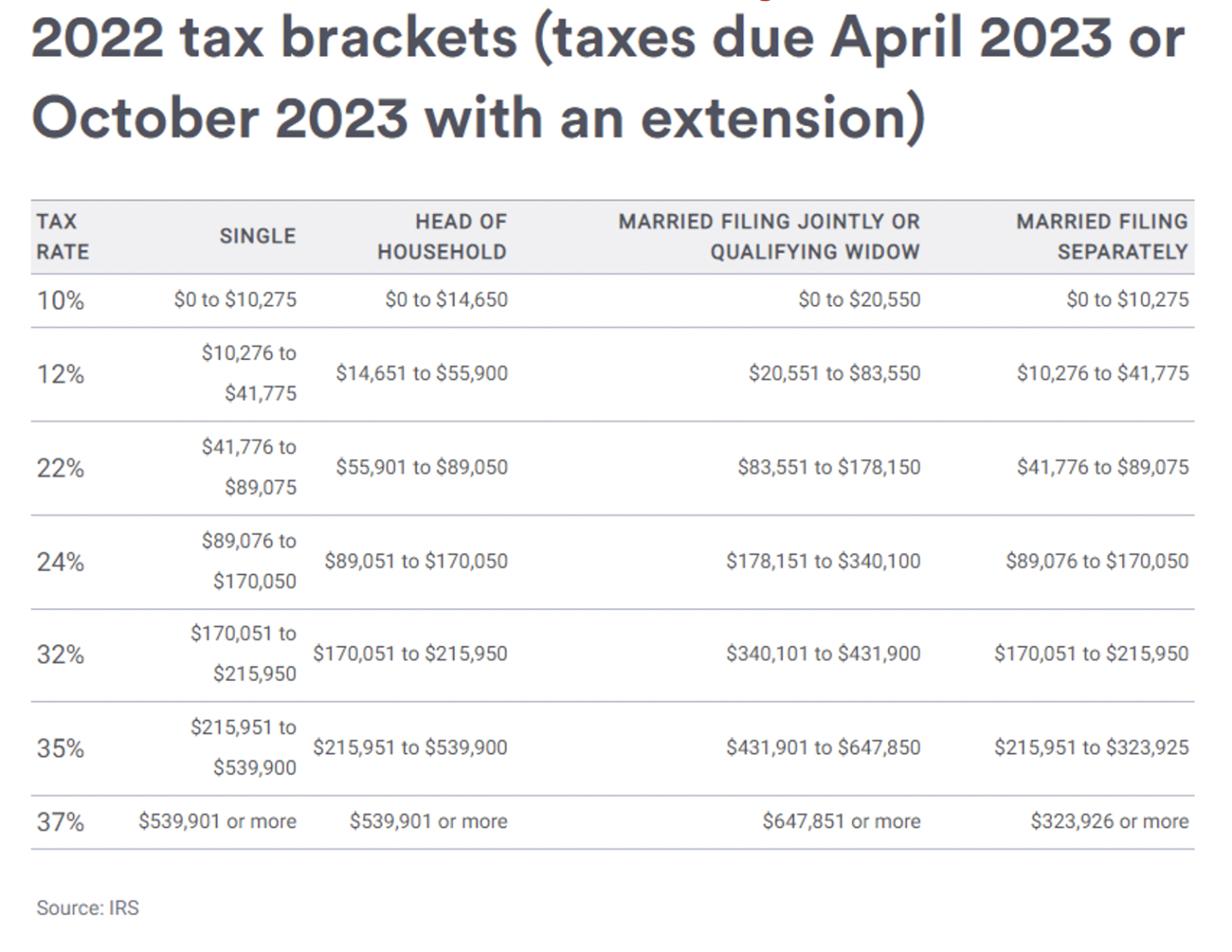

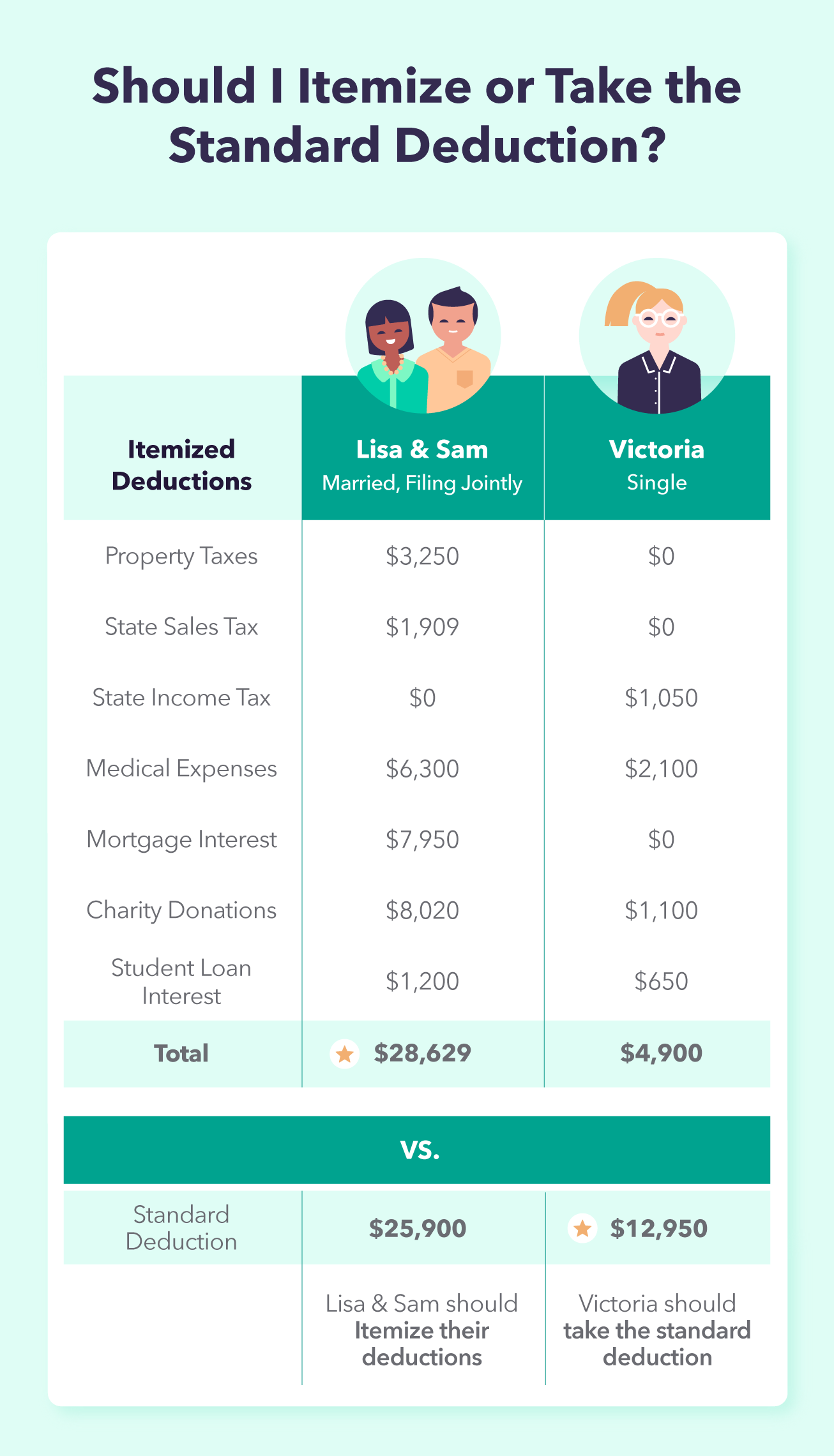

Tax credits reduce your tax liability dollar for dollar while tax deductions reduce your taxable income You can take some deductions before you calculate your adjusted gross While tax deductions lower your taxable income tax credits cut your taxes dollar for dollar So a 1 000 tax credit cuts your final tax bill by exactly 1 000 A tax deduction isn t as simple

Are Tax Deductions Dollar For Dollar

Are Tax Deductions Dollar For Dollar

https://www.pearsoncocpa.com/wp-content/uploads/2022/05/Screen-Shot-2022-05-17-at-11.22.53-PM-1536x1187.png

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

Federal Income Tax Deduction Chart My XXX Hot Girl

https://www.investopedia.com/thmb/JjB8KxvTErLB2ZgozO3H_wkKoNA=/2338x2338/smart/filters:no_upscale()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg

Legal Aspects On The Deductions From Income From Business And

https://blog.ipleaders.in/wp-content/uploads/2020/11/Tax-Deduction-blog-1.jpg

A tax credit is a dollar for dollar amount taxpayers claim on their tax return to reduce the income tax they owe Eligible taxpayers can use them to reduce their tax bill and potentially increase their refund As a reminder tax deductions are top line meaning they re deducted from your income before your taxes are calculated Tax credits on the other hand are bottom line after your taxes are calculated a tax credit is deducted dollar for dollar from the amount you owe

Tax credits offset the taxes you owe on a dollar for dollar basis but deductions are offset against your income The Further Consolidated Appropriations Act of 2020 allowed A tax credit reduces the income tax bill dollar for dollar that a taxpayer owes based on their tax return Some tax credits such as the Earned Income Tax Credit are refundable If a person s tax bill is less than the amount of a refundable credit they can get the difference back in their refund To claim a tax credit people should

Download Are Tax Deductions Dollar For Dollar

More picture related to Are Tax Deductions Dollar For Dollar

Tax Deductions For Charitable Donations

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA17y0HM.img?w=3000&h=2000&m=4&q=100

The Deductions You Can Claim Hra Tax Vrogue

https://images.ctfassets.net/ifu905unnj2g/5pTiksjFeNz6NJxIHRTFCO/1a3452b342e68decbc284efdc894ead5/Small_Business_Tax_Deductions_graphic.png

Standard Deduction U s 16 ia For Ay 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-3.jpg

Tax credits and tax deductions are two different things While they re both tax breaks that can reduce your tax liability they work in different ways The benefit of a tax deduction depends on your tax rate Here are some commonly overlooked tax deductions Tax credit vs deduction An example Generally tax

[desc-10] [desc-11]

Tax Deductions For Small Business How To Claim Tax Deductions

https://www.affluentcpa.com/wp-content/uploads/2016/11/Tax-Deductions.jpg

Small Business Expenses Tax Deductions 2023 QuickBooks

https://quickbooks.intuit.com/oidam/intuit/sbseg/en_us/Blog/Graphic/standard-vs-itemized-deductions.png

https://www.bankrate.com/taxes/tax-credit-vs-tax-deduction

Tax credit A tax credit gives you a dollar for dollar reduction in your tax bill For example if your federal tax bill is 10 000 and you are entitled to a 2 500 tax credit that credit cuts

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg?w=186)

https://money.usnews.com/money/personal-finance/...

Tax credits reduce your tax liability dollar for dollar while tax deductions reduce your taxable income You can take some deductions before you calculate your adjusted gross

Tax Credits Vs Tax Deductions Making The Most Of Your Tax Benefits

Tax Deductions For Small Business How To Claim Tax Deductions

Tax Deductions You Can Deduct What Napkin Finance

10 Most Common Small Business Tax Deductions Infographic

What Are Tax Deductions And Credits 20 Ways To Save Yoursharelink

Early Peek At 2021 Tax Rates Fuoco Group

Early Peek At 2021 Tax Rates Fuoco Group

Small Business Tax Deductions Deductible Expenses

Rates Commodities The Globe And Mail

How To Find Average Income Tax Rate Parks Anderem66

Are Tax Deductions Dollar For Dollar - Tax credits offset the taxes you owe on a dollar for dollar basis but deductions are offset against your income The Further Consolidated Appropriations Act of 2020 allowed