Are Tax Refunds Considered Income First federal income tax refunds are not taxable as income Second interest from both the federal and state governments is considered taxable income and should be reported Finally

1 Best answer DoninGA Level 15 A federal tax refund is not entered on a federal tax return so it is not income A state tax refund can be considered income on a federal tax return if you itemized deductions in the year of the tax refund View solution in original post June 7 2019 4 51 PM 0 Reply Bookmark Icon DoninGA Level 15 A tax refund on your federal income tax isn t considered income Taxpayers don t need to worry about paying more taxes on the refund they received since it s technically the taxpayer s money

Are Tax Refunds Considered Income

Are Tax Refunds Considered Income

https://image.cnbcfm.com/api/v1/image/106876560-1619790504375-gettyimages-500841183-8ea5f914-a8c1-4546-8889-cdf092c90cbb.jpeg?v=1619811161

How Long To Get My Tax Refund From HMRC Swift Refunds

https://www.swiftrefunds.co.uk/wp-content/uploads/2019/08/tax-refund-min-2-e1566379535551.jpg

30 Of Younger Americans Might Blow Their Tax Refunds This Year

https://www.gannett-cdn.com/-mm-/dc8c471a194a6e11d95130f1cf23c3262647d422/c=0-54-580-380/local/-/media/2018/03/28/USATODAY/usatsports/tax-refund_gettyimages-525343163_large.jpg?width=3200&height=1680&fit=crop

Updated January 25 2024 Reviewed by Janet Berry Johnson Fact checked by Vikki Velasquez Investopedia Joules Garcia What Is a Tax Refund The term tax refund refers to a reimbursement Generally tax refunds are not considered taxable income If you receive a refund because you overpaid your taxes it is not subject to federal income tax This is because the refund is seen as a return of your own money rather than new income However it s worth noting that state tax refunds can have different taxability rules

What s not taxable Compensation Income from fringe benefits Click to expand Key Takeaways Income received as wages salaries commissions rental income royalty payments stock options dividends and interest and self employment income are taxable Unemployment compensation generally is taxable United States citizens are required to file tax returns once they hit the income thresholds for their filing statuses which ranges from 12 950 to 27 300 for tax year 2022

Download Are Tax Refunds Considered Income

More picture related to Are Tax Refunds Considered Income

IRS Will Issue Refunds On Up To 10 200 In Unemployment Taxes In May

https://www.al.com/resizer/5CfdI4L8H0mOdVtjO83mXsSwFvI=/1280x0/smart/cloudfront-us-east-1.images.arcpublishing.com/advancelocal/6SV3T63ZEFFTFM2BWX7ZLAW2KQ.jpg

Taxable Refunds Credits Or Offsets Of State And Local Income Taxes

https://i.ytimg.com/vi/O0FErGyvHzY/maxresdefault.jpg

Tax Refunds 1 1B In Unclaimed Money Awaits Tax Returns

https://www.gannett-cdn.com/-mm-/c854498003ddfe79bd56377d5c65f844b5eb72ce/c=0-444-2398-1799&r=x1683&c=3200x1680/local/-/media/2018/03/08/DetroitFreeP/DetroitFreePress/636561017843565093-tax-refund.jpg

Tax Tip 2022 49 March 30 2022 Once taxpayers file their federal tax returns they re eager for details about their refund When it comes to refunds there are several common myths that can mislead taxpayers You can request a tax refund from the government by filing an annual tax return This document reports how much money you earn expenses and other important tax information It will help you to calculate how many taxes you owe schedule tax payments and request a refund when you have overpaid

Most income is taxable unless it s specifically exempted by law Income can be money property goods or services Even if you don t receive a form reporting income you should report it on your tax return Income is taxable when you receive it even if you don t cash it or use it right away State income tax refunds can sometimes be considered taxable income according to the IRS You must report them on Schedule A of Form 1040 if you claimed a deduction for state and local taxes the year before

Your Tax Refund Is The Key To Homeownership

https://files.mykcm.com/2019/03/25075643/20190325-MEM-ENG.jpeg

How Long Does It Take To Get Tax Returns Tax Return Tax Refund Irs

https://i.pinimg.com/736x/25/84/14/258414a9ba63687de99d431af3bce628.jpg

https://www.bankrate.com/taxes/claim-tax-refunds-as-income

First federal income tax refunds are not taxable as income Second interest from both the federal and state governments is considered taxable income and should be reported Finally

https://ttlc.intuit.com/community/taxes/discussion/...

1 Best answer DoninGA Level 15 A federal tax refund is not entered on a federal tax return so it is not income A state tax refund can be considered income on a federal tax return if you itemized deductions in the year of the tax refund View solution in original post June 7 2019 4 51 PM 0 Reply Bookmark Icon DoninGA Level 15

Step To Check Income Tax Refund Status Reasons For Delay Chandan

Your Tax Refund Is The Key To Homeownership

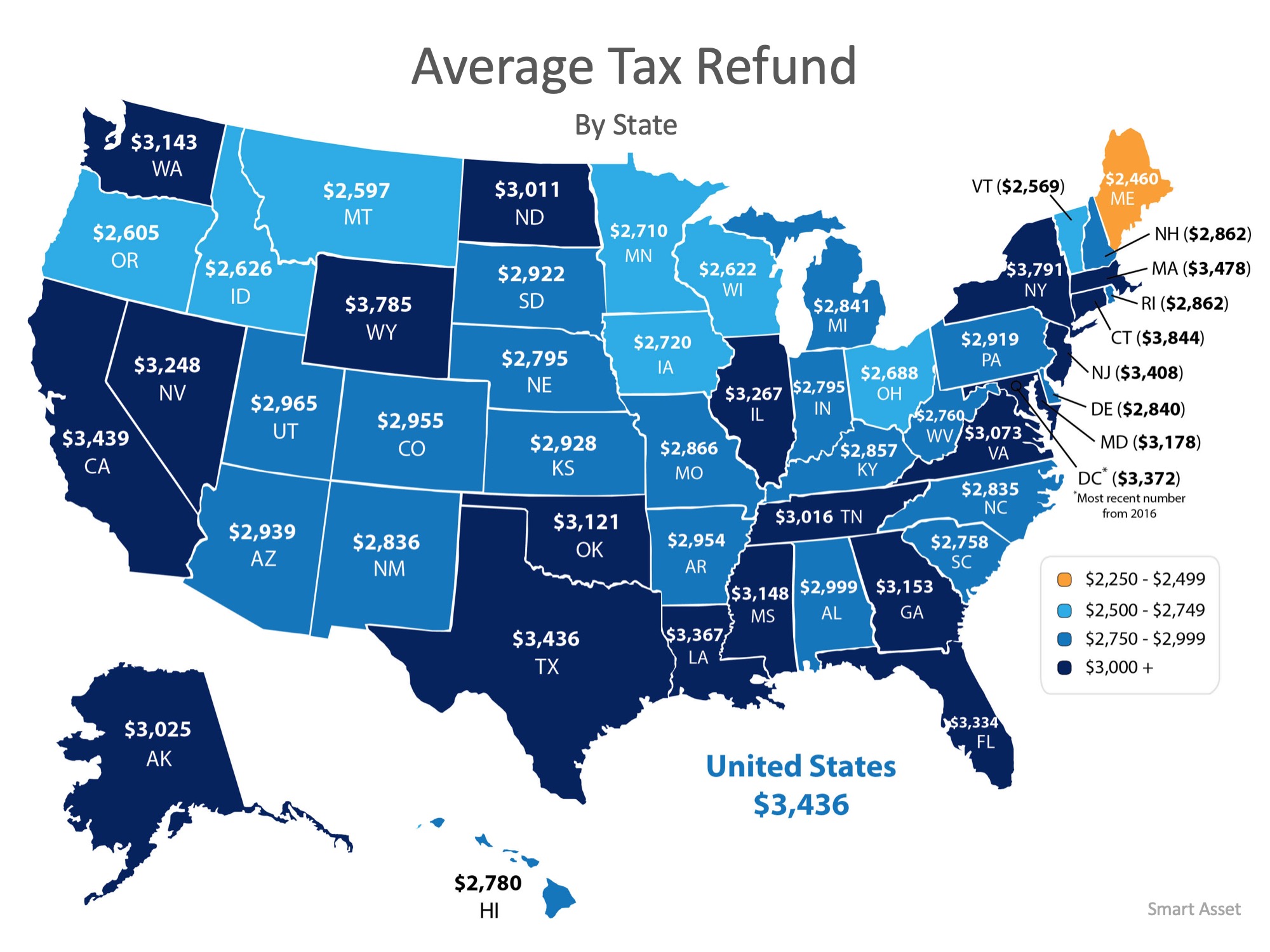

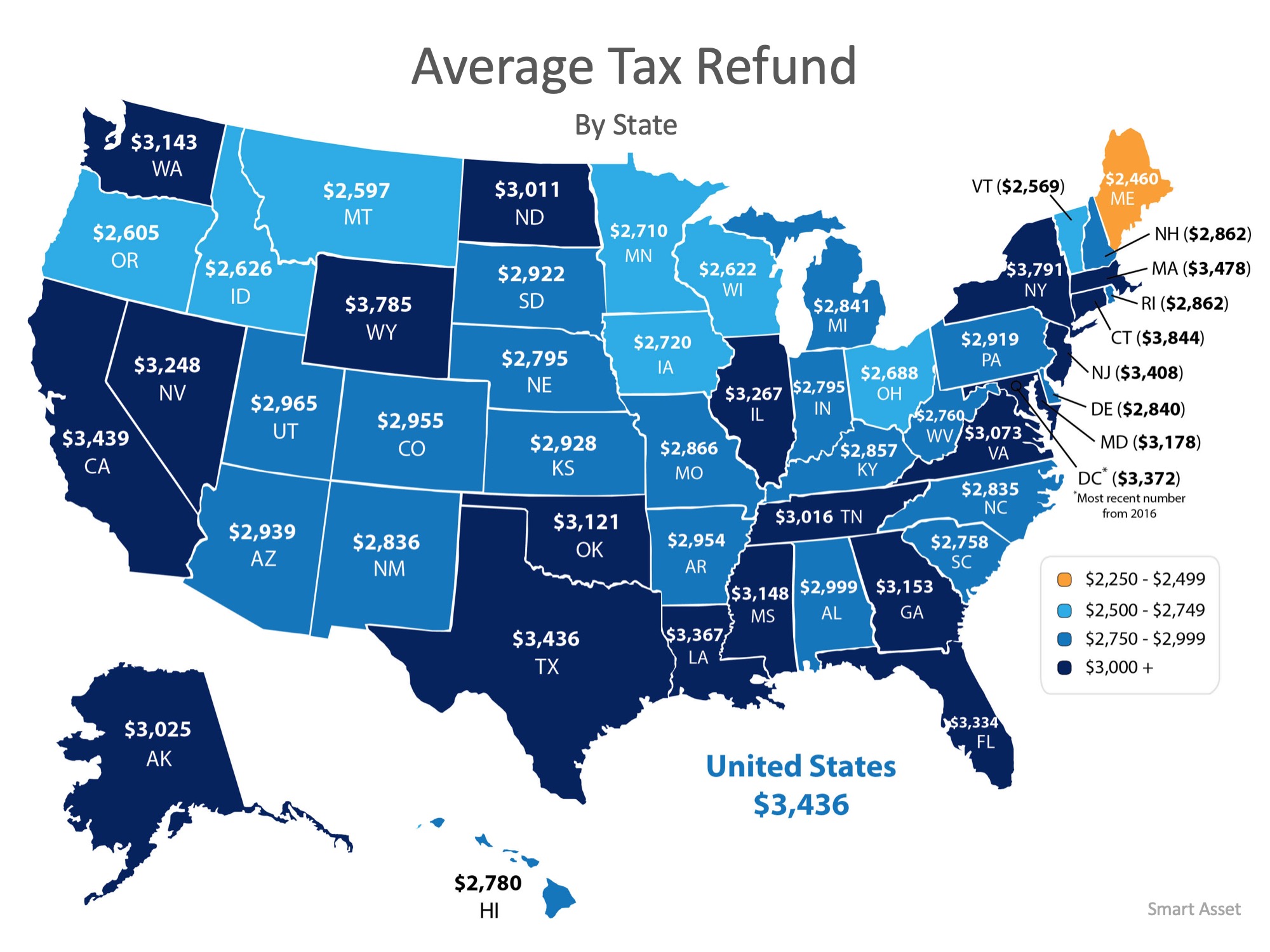

Average Tax Refund In Every U S State Vivid Maps

Tax Refunds On 10 200 Of Unemployment Benefits Start In May IRS

3 Reasons You Shouldn t Receive A Tax Refund Next Year GOBankingRates

Haven t Received Income Tax Refund Yet Do This Business News

Haven t Received Income Tax Refund Yet Do This Business News

Tax Refunds For Expats MyExpatTaxes

How I Finally Got My Income Tax Refunds In Malaysia Just An Ordinary Girl

Why Is My Tax Refund So Low Weareiowa

Are Tax Refunds Considered Income - Updated January 25 2024 Reviewed by Janet Berry Johnson Fact checked by Vikki Velasquez Investopedia Joules Garcia What Is a Tax Refund The term tax refund refers to a reimbursement