Are Termination Payments Tax Deductible Web 29 M 228 rz 2023 nbsp 0183 32 Reporting termination payments to HMRC Do payments made on termination always qualify for the 163 30 000 exemption No Just because a payment is made on termination of employment does not

Web 23 Dez 2023 nbsp 0183 32 Personal deductions Alimony payments Individual taxpayers may take deductions up to EUR 13 805 for the alimony paid to a divorced partner Charitable Web 29 M 228 rz 2022 nbsp 0183 32 Policy paper Changes to the treatment of termination payments and post employment notice pay for Income Tax Updated 29 March 2022 Who is likely to be

Are Termination Payments Tax Deductible

Are Termination Payments Tax Deductible

https://images.ctfassets.net/ifu905unnj2g/5pTiksjFeNz6NJxIHRTFCO/1a3452b342e68decbc284efdc894ead5/Small_Business_Tax_Deductions_graphic.png

13 Tax Deductible Expenses Business Owners Need To Know About CPA

https://gurianco.com/wp-content/uploads/2018/11/tax-deductions.png

Invoice Payment Free Stock Photo Public Domain Pictures

https://www.publicdomainpictures.net/pictures/270000/velka/invoice-payment.jpg

Web 6 Apr 2018 nbsp 0183 32 RTA constitutes termination payments and benefits which meet all of the following criteria the payments or benefits fall within section 401 1 a ITEPA 2003 i e they are received directly or indirectly in Web 2 M 228 rz 2023 nbsp 0183 32 There is a common misconception that any termination package can be made without deduction of tax if it does not exceed 163 30 000 While this relief may be available in many situations in some

Web 1 Apr 2018 nbsp 0183 32 The first 163 30 000 of a payment which is paid in connection with the termination of employment is tax free as long as it is not otherwise taxable as earnings Any excess over 163 30 000 is subject to income tax Web 8 Aug 2022 nbsp 0183 32 The IRS determined that transaction termination payments are Section 165 losses and not Section 162 business expenses Applying Section 1234 the IRS Office of

Download Are Termination Payments Tax Deductible

More picture related to Are Termination Payments Tax Deductible

Termination Payments Tax Advantages And Tax Allowances Lotuswise

https://www.lotuswise.co.uk/wp-content/uploads/2018/05/Termination-Payments-Are-Changing.jpg

Corporation Prepaid Insurance Tax Deduction Financial Report

https://i2.wp.com/www.patriotsoftware.com/wp-content/uploads/2019/12/business-tax-credit-vs-tax-deduction-visual.jpg

Employee Termination Payments Tax What You Need To Know Pears

https://www.pearsca.com.au/site/wp-content/uploads/2021/10/Employee-Termination-Payments-Tax-–-What-You-Need-To-Know.png

Web 6 April 2018 Last updated 30 November 2018 See all updates Employers will need to pay Income Tax and Class 1 National Insurance contributions NICs on an element of Web The common belief that any termination payment can be made without deduction of tax provided that it does not exceed 163 30 000 often turns out to be wrong While this relief

Web 9 Mai 2023 nbsp 0183 32 Termination payments will either be fully taxable partially taxable or fully exempt depending on the nature and the amount of the payment Although widely Web 13 M 228 rz 2018 nbsp 0183 32 Summary of changes The final law enacted is similar in concept to the draft law considered in last year s article in that employers will still need to consider what

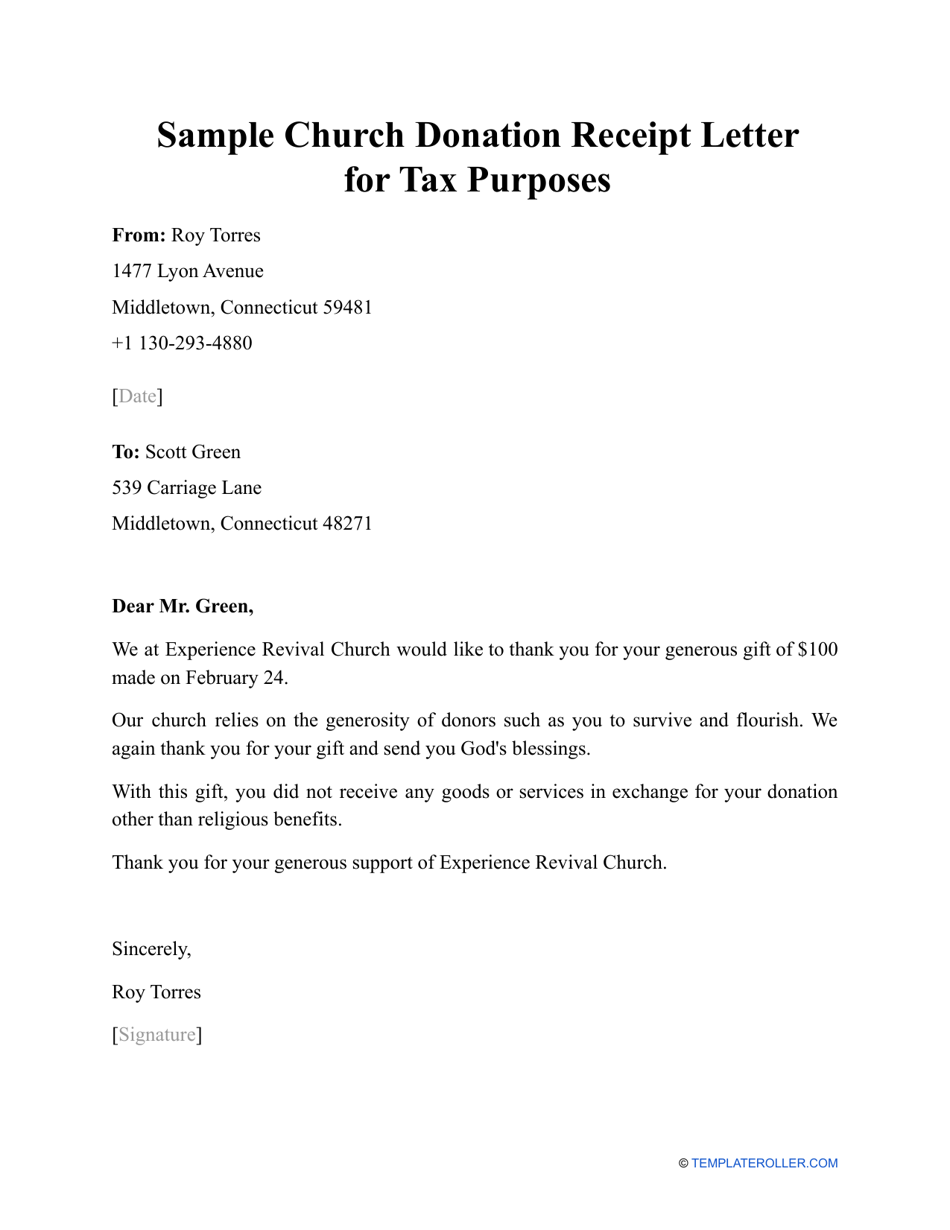

Sample Church Donation Receipt Letter For Tax Purposes Fill Out Sign

https://data.templateroller.com/pdf_docs_html/2209/22095/2209587/sample-church-donation-receipt-letter-for-tax-purposes_print_big.png

Tax Deductions The New Rules INFOGRAPHIC Alloy Silverstein

https://alloysilverstein.com/wp-content/uploads/2019/03/Tax-Reform-Deductible-vs-Non-Deductible-Infographic-2019.png

https://www.lewissilkin.com/en/Insights/Frequ…

Web 29 M 228 rz 2023 nbsp 0183 32 Reporting termination payments to HMRC Do payments made on termination always qualify for the 163 30 000 exemption No Just because a payment is made on termination of employment does not

https://taxsummaries.pwc.com/germany/individual/deductions

Web 23 Dez 2023 nbsp 0183 32 Personal deductions Alimony payments Individual taxpayers may take deductions up to EUR 13 805 for the alimony paid to a divorced partner Charitable

Payment Of Legal Costs Under A Settlement Agreement Tax

Sample Church Donation Receipt Letter For Tax Purposes Fill Out Sign

Termination Payments The 30 000 Question

Credit Cards And Itemized Deductions What To Know Before Filing Your

Investment Expenses What s Tax Deductible 2024

List Of Tax Deductions Here s What You Can Deduct

List Of Tax Deductions Here s What You Can Deduct

How To Decrease Late Payments From Clients Due

Tax Reduction Company Inc

Tax On Termination Payments HR Guide Matt Gingell

Are Termination Payments Tax Deductible - Web 2 M 228 rz 2023 nbsp 0183 32 There is a common misconception that any termination package can be made without deduction of tax if it does not exceed 163 30 000 While this relief may be available in many situations in some