Are Termination Payments Taxed Any tax and National Insurance due on your termination payment will be taken automatically by your employer in your final payslip Your employer will put any taxable parts of your termination

The employer is obliged to deduct tax using the 0T code on any payments including share based payments made after the P45 is issued which are subject to income Since 2018 legislation has deemed payments related to the termination of employment to be Relevant Termination Awards RTAs and we need to consider a two step process to decide whether and to what extent an RTA is

Are Termination Payments Taxed

Are Termination Payments Taxed

https://www.lotuswise.co.uk/wp-content/uploads/2018/05/Termination-Payments-Are-Changing.jpg

Termination Payments Curo Chartered Accountants

https://curoca.co.uk/wp-content/uploads/2019/11/iStock-503556232.jpg

Employee Termination Payments Tax What You Need To Know Pears

https://www.pearsca.com.au/site/wp-content/uploads/2021/10/Employee-Termination-Payments-Tax-–-What-You-Need-To-Know.png

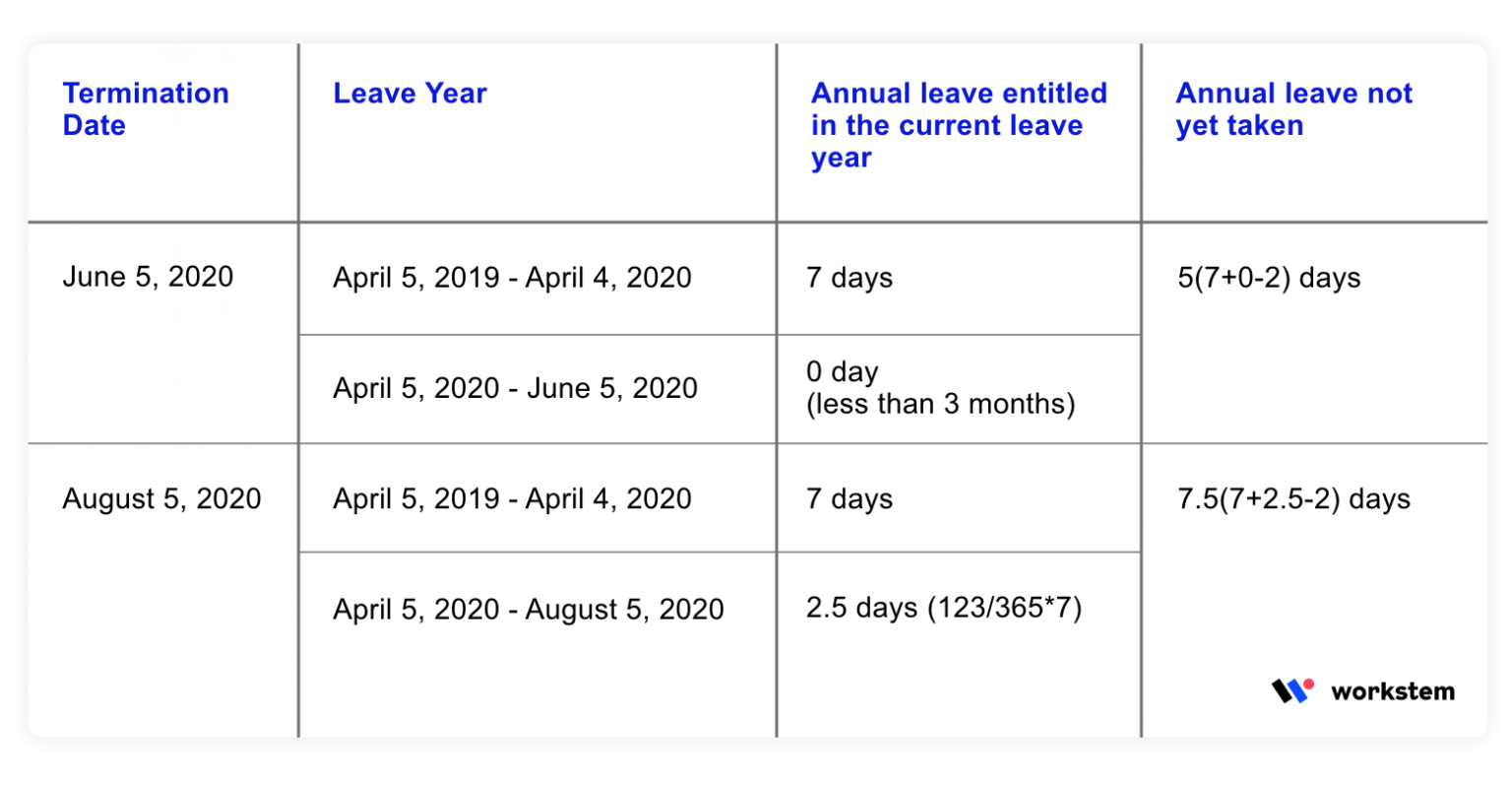

How are termination payments taxed Tax free termination payments A termination payment paid as compensation for the termination of your employment can be paid free of tax and Payments that relate to any period worked prior to the termination will be subject to income tax and national insurance in the normal way This will include payments for accrued but untaken holiday at the date of termination

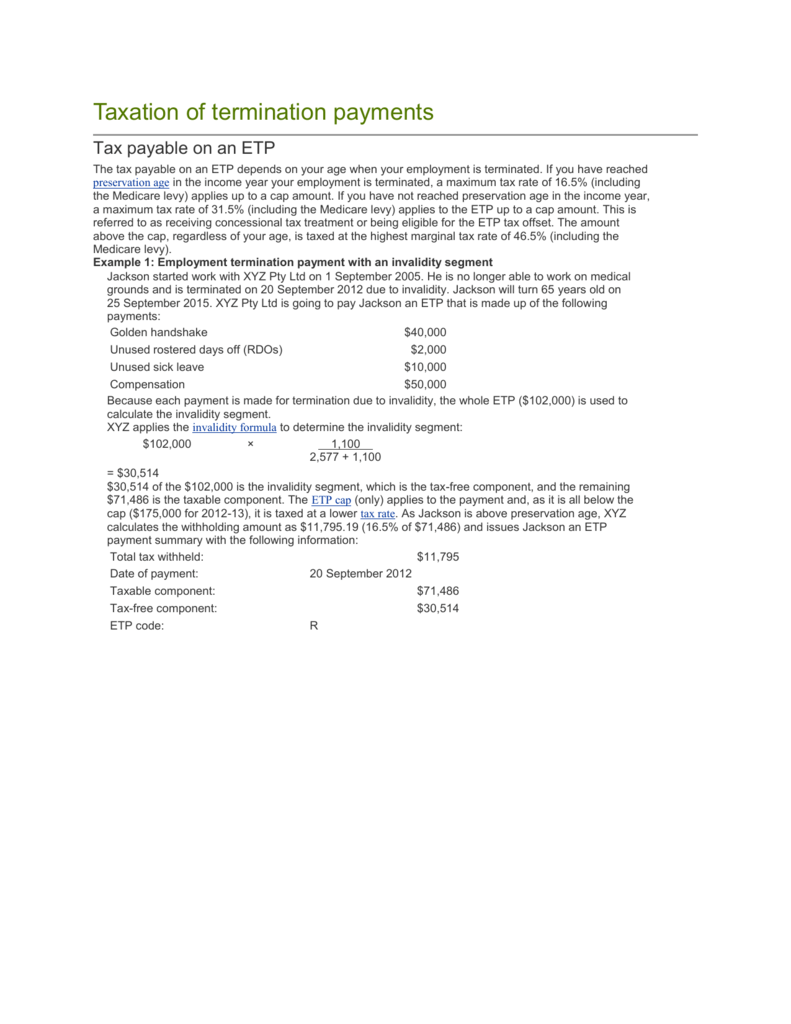

The taxability of termination payments hinges on their nature and magnitude rendering them fully taxable partially taxable or completely exempt from taxation The term termination payments Termination pay is taxed on an employee who has resigned or has been dismissed due to gross misconduct Payment received following a Tribunal decision or court order for unfair dismissal is partially exempt

Download Are Termination Payments Taxed

More picture related to Are Termination Payments Taxed

Taxation Of Termination Payments VJH Accountancy

https://www.vjhaccountancy.co.uk/wp/wp-content/uploads/2018/12/2017-08-10-241151.jpg

Mortgage Payments Finance Image

http://www.picpedia.org/finance/images/mortgage-payments.jpg

Tax On Termination Payments HR Guide Matt Gingell

https://www.mattgingell.com/wp-content/uploads/2018/02/tax-law-changing.jpg

Termination payments can essentially be split into two parts The first is post employment notice pay PENP PENP is the amount of basic pay an employee would have earned had the employee worked his or her notice period in full Termination payments refer to the monetary or non monetary benefits provided to employees upon the cessation of their employment These payments can be fully taxable partially

Termination payments must be taxed correctly HM Revenue Customs HMRC can recover unpaid tax national insurance contributions NICs penalties and interest from the business if No the Government announced that it intended to subject all termination payments above the 30 000 threshold to Class 1A NIC employer liability only However this reform has been

How Is Your Employment Termination Payment Taxed In Australia

https://www.odintax.com/wp-content/uploads/2023/06/tax-on-employment-termination-payment.jpg

.png)

Payments For Regenerative Practices

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjBVkddbIa8dpxTBAGErz6PliZ6kATav0uofQD1GivdDvDtgIdeyvAPI7CM0PkKHM-VHxclCoFY67kt0R6N8g2JyHcX5-TYHKOOdDhshl5JOk42lhSbh8dpfZw8_ztgFVF81O5U94BGWyIlg8hVMa96Ib_3rqq2fj2y36GuVif8-KMo1xopTO7Nf9j6Oow/s16000/Untitled design (13).png

https://www.gov.uk › termination-payments-and-tax...

Any tax and National Insurance due on your termination payment will be taken automatically by your employer in your final payslip Your employer will put any taxable parts of your termination

https://www.lewissilkin.com › insights › ...

The employer is obliged to deduct tax using the 0T code on any payments including share based payments made after the P45 is issued which are subject to income

Tax Deductions Investment Watch

How Is Your Employment Termination Payment Taxed In Australia

Comment Calculer Le Paiement Des Cong s Annuels La R siliation Du

Termination Payments

Termination Payments

Employee Termination Payments What You Need To Know Owen Hodge Lawyers

Employee Termination Payments What You Need To Know Owen Hodge Lawyers

Contract Termination Request Templates At Allbusinesstemplates

Taxation Of Termination Payments Taxable Component

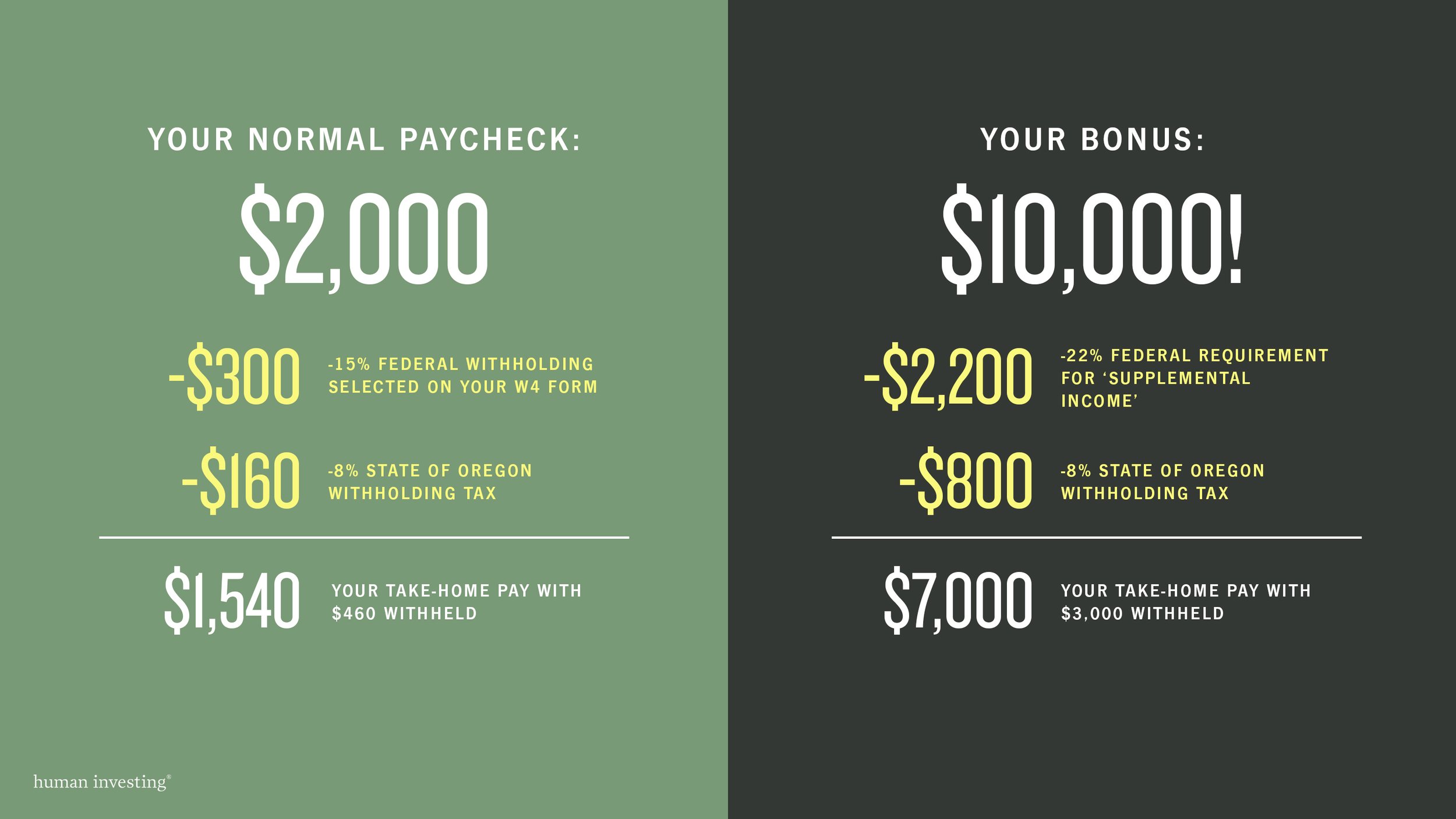

Really My Bonus Is Taxed The Same As My Paycheck Human Investing

Are Termination Payments Taxed - Termination pay is taxed on an employee who has resigned or has been dismissed due to gross misconduct Payment received following a Tribunal decision or court order for unfair dismissal is partially exempt