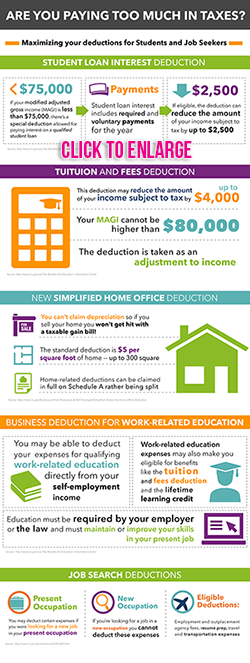

Are There Any Tax Credits For Graduate Students It is a tax credit of up to 2 500 of the cost of tuition certain required fees and course materials needed for attendance and paid during the tax year Also 40 percent of the credit for which you qualify that is more than the tax you owe up to

If you re going to grad school or taking any continuing education classes even if you aren t working toward a degree you may be eligible for the lifetime learning credit The American Opportunity Tax Credit is a federal tax credit that allows you to lower your tax bill by up to 2 500 if you paid that much in undergraduate education expenses last year

Are There Any Tax Credits For Graduate Students

Are There Any Tax Credits For Graduate Students

https://ytkmgt.com.sg/wp-content/uploads/2021/05/Article-FB-post.png

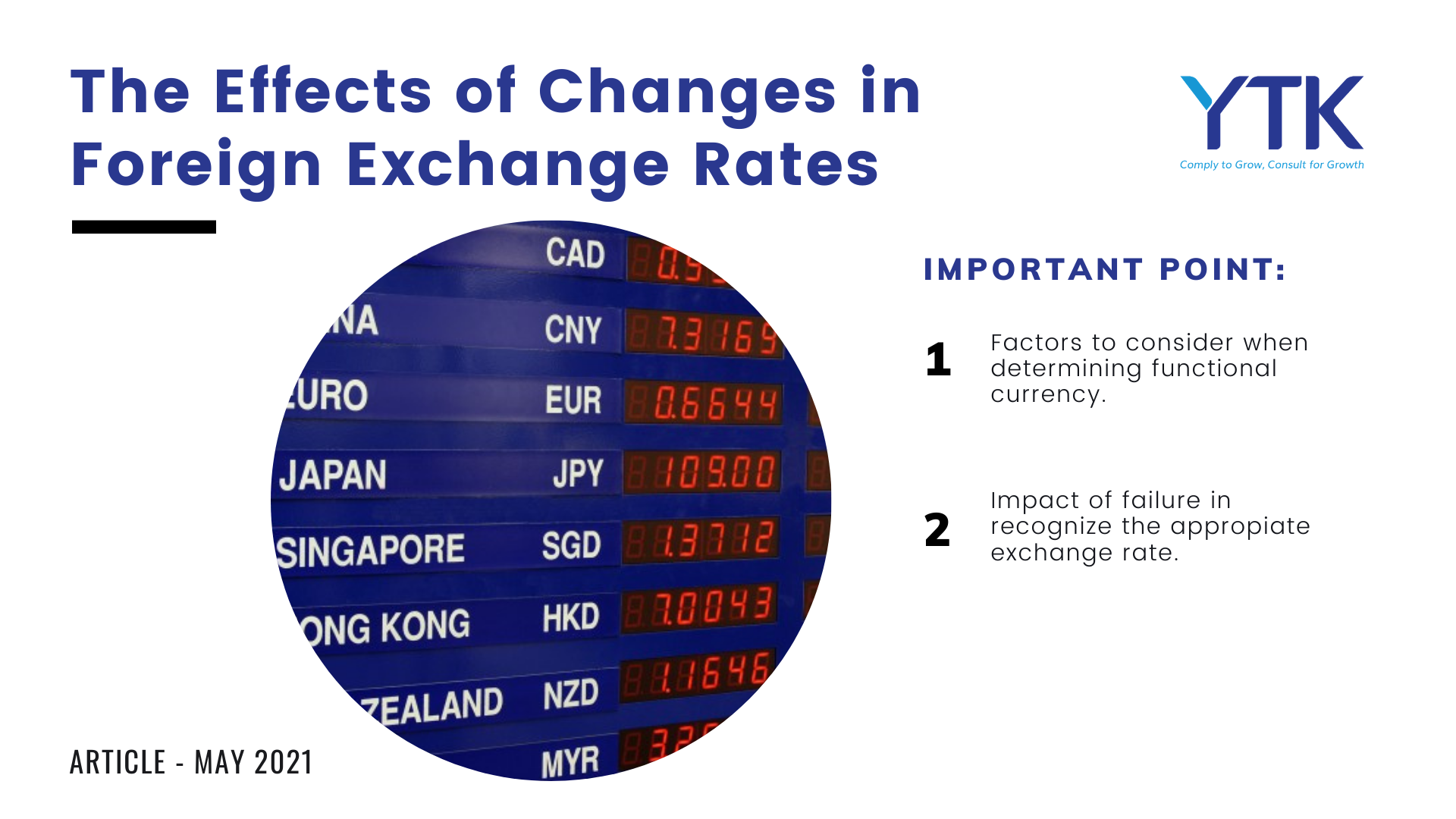

TaxTips ca Canadian Non refundable Personal Tax Credits

https://www.taxtips.ca/nrcredits/2023-personal-tax-credits.jpg

Transfer Credits Within Graduate Colleges CollegeHippo

https://i0.wp.com/www.collegehippo.com/blog/wp-content/uploads/2023/05/Did-You-Know.png

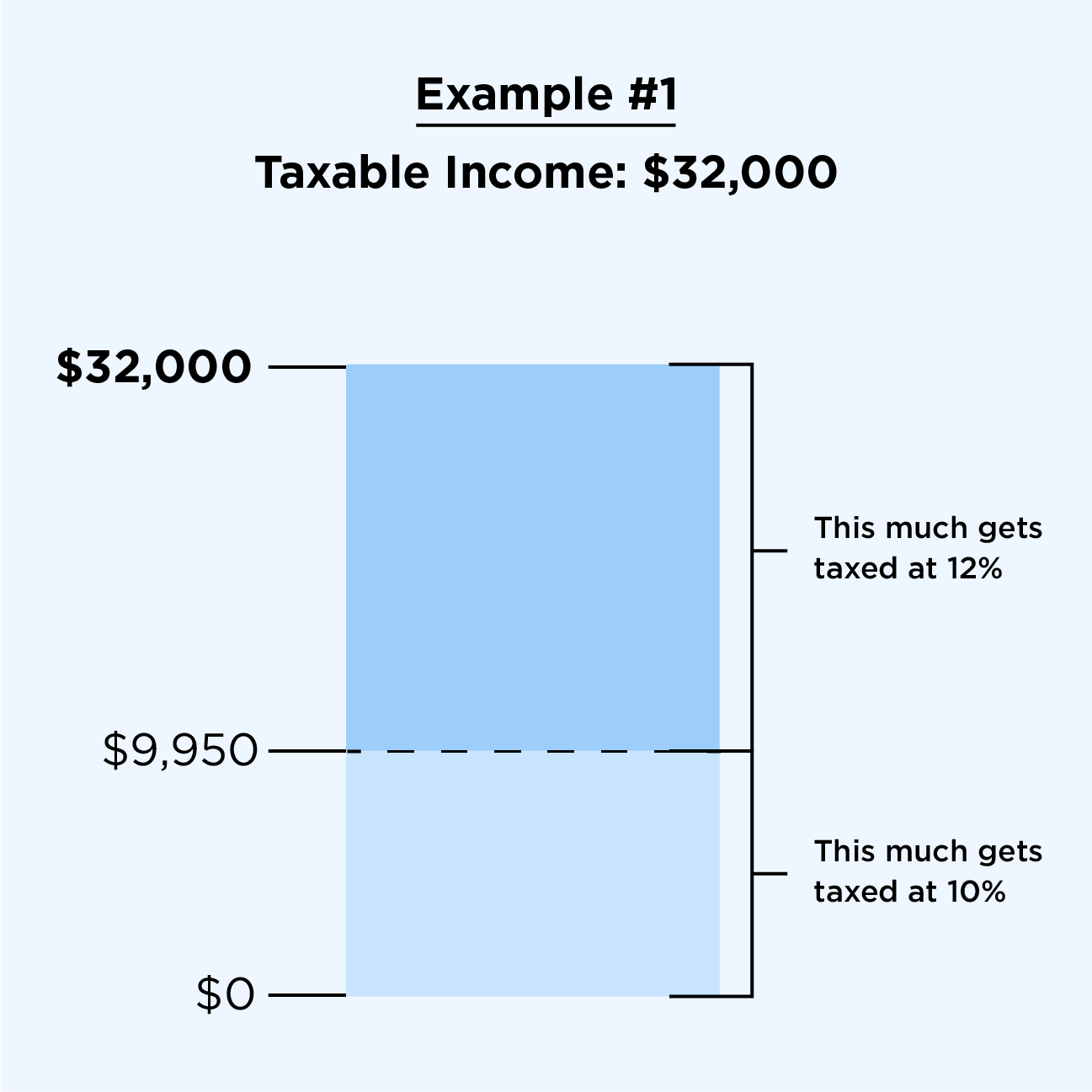

There are two credits available to help taxpayers save money on higher education the American opportunity tax credit and the lifetime learning credit Taxpayers use Form 8863 Education Credits to claim the credits Just like an undergraduate student a graduate student is usually eligible for grad student tax deductions including Tuition and fees deduction Lifetime Learning Credit However graduate students usually aren t eligible for the American Opportunity Credit Was this topic helpful Yes loved it Could be better File online

Unlike the American Opportunity tax credit eligible graduate students can claim the credit And students don t need to attend at least half time to claim the credit With upper income undergraduates now qualifying for American Opportunity Tax Credit graduate students became the only group left who could benefit from the original tuition and fees

Download Are There Any Tax Credits For Graduate Students

More picture related to Are There Any Tax Credits For Graduate Students

Tax Credits And Deductions For Parents Of College Students Almost

https://i.pinimg.com/originals/5a/68/53/5a685311a46aef9c818d5125bee9ab8f.jpg

Why Maryland Requires The Most Credits To Graduate High School

https://data.highschoolcube.com/1665887469221.jpg

Increase Your Tax Refund By 100 10 Tax Deductions Not To Miss Tax

https://i.pinimg.com/originals/a5/60/a4/a560a49f6001660d749769a76c97c802.jpg

Even if you are a student or a young person you may be able to claim deductions and credits that make a difference on your tax return You might even qualify for a tax refund that you could use to pay down debt or The Lifetime Learning Credit is for graduate or undergraduate costs and there is no limit to the number of years you can claim it This is an ideal credit for graduate students and is one of the most common types of tax

Am I eligible for any tax credits as a graduate student What resources does Duke provide for filing taxes What resources exist outside of Duke University for help with graduate student taxes Internal Revenue Service IRS Publication 970 provides specific information about tax deductions and credits available to graduate students There are two federal education tax credits that can cut your tax bill by thousands of dollars You ll save more with the American Opportunity Credit up to

Are Taxes Taken Out Of Disability Disability Talk

https://www.disabilitytalk.net/wp-content/uploads/ontario-disability-forms-tax-credit.jpeg

2022 Education Tax Credits Are You Eligible

https://www.taxdefensenetwork.com/wp-content/uploads/2022/11/2022-Education-Credits-Comparison-scaled.jpg

https://www.irs.gov/credits-deductions/individuals/...

It is a tax credit of up to 2 500 of the cost of tuition certain required fees and course materials needed for attendance and paid during the tax year Also 40 percent of the credit for which you qualify that is more than the tax you owe up to

https://money.usnews.com/money/personal-finance/...

If you re going to grad school or taking any continuing education classes even if you aren t working toward a degree you may be eligible for the lifetime learning credit

What Is A Refundable Tax Credit Universal CPA Review

Are Taxes Taken Out Of Disability Disability Talk

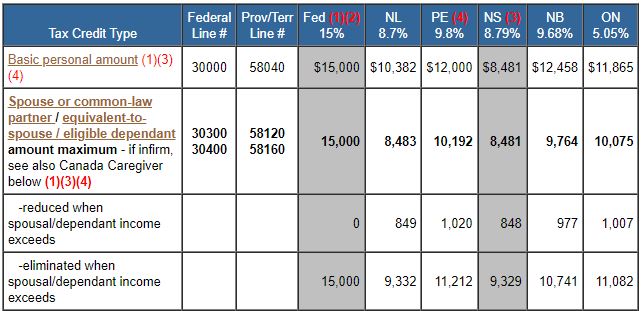

Understanding Five Major Federal Tax Credit Proposals Common Dreams

How Tax Credits Work YouTube

Tax Saving Tips For High Income Earners Uk Laronda England

7 Business Tax Credits You Can t Afford To Miss Out On

7 Business Tax Credits You Can t Afford To Miss Out On

Tax Credits For College Students Fort Myers Naples MNMW

Are There Any Tax Benefits To Being Married Over Being Single AS USA

Tax Credits For Students American Opportunity Credit

Are There Any Tax Credits For Graduate Students - Just like an undergraduate student a graduate student is usually eligible for grad student tax deductions including Tuition and fees deduction Lifetime Learning Credit However graduate students usually aren t eligible for the American Opportunity Credit Was this topic helpful Yes loved it Could be better File online