Are There Federal Tax Credits For Heat Pumps Air Source Heat Pumps Tax Credit This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032 How to Claim the Federal Tax Credits Strategies to Maximize Your Federal Tax Savings

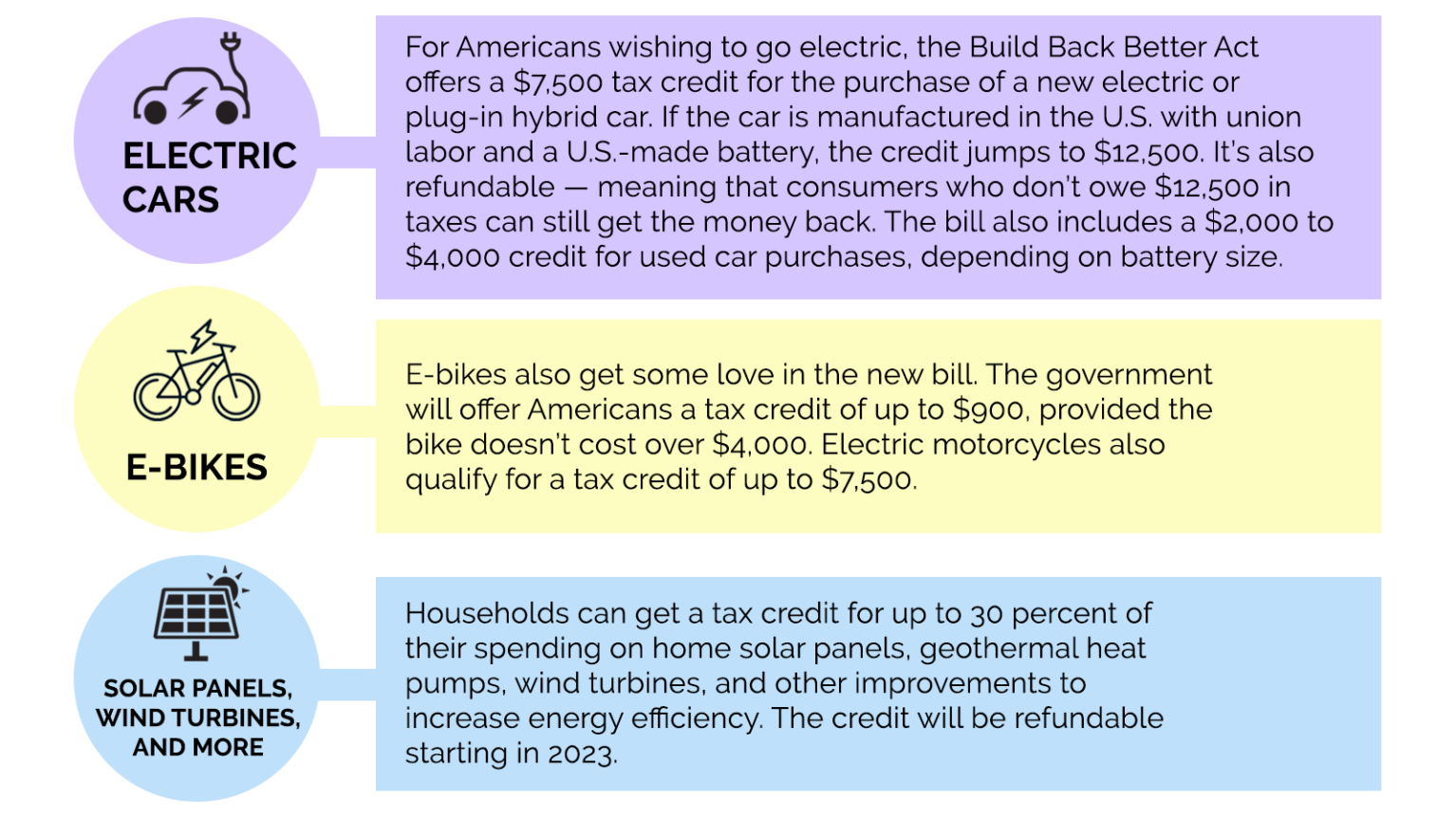

If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses were expanded by the Inflation Reduction Act of 2022 Tax credits are applied to the tax year you install the heat pump For example if your heat pump is deployed in 2023 you can redeem your credit when you submit your taxes in 2024

Are There Federal Tax Credits For Heat Pumps

Are There Federal Tax Credits For Heat Pumps

https://oregoncapitalchronicle.com/wp-content/uploads/2022/09/Heat-hot-weather-Getty-Images.jpg

Get The Power Of Tax Credits For Your Businesses

https://imageio.forbes.com/specials-images/imageserve/6382a9dd088a90f846f35930/0x0.jpg?format=jpg&crop=3207,3207,x0,y0,safe&width=1200

Federal Tax Credits For Air Conditioners Heat Pumps 2023

https://kobiecomplete.com/wp-content/uploads/2023/01/federal-tax-credits-2023-graphic-white-web.png

Yes There is a 1 200 aggregate yearly tax credit maximum for all building envelope components home energy audits and energy property Electric or natural gas heat pump water heaters electric or natural gas heat pumps and biomass stoves and biomass boilers have a separate aggregate yearly credit limit of 2 000 Save Up to 2 000 on Costs of Upgrading to Heat Pump Technology These energy efficient home improvement credits are available for 30 of costs up to 2 000 and can be combined with credits up to 1 200 for other qualified upgrades made in one tax year

Today s DPA manufacturing investments complement the direct consumer savings that the Biden Harris Administration is providing with the Investing in America agenda making homeowners now eligible for up to a 30 federal tax credit on the total cost of buying and installing a heat pump and providing states with funding for home Through President Biden s Investing in America Plan homeowners are now eligible for tax credits when they install an air source or geothermal heat pump up to 30 federal tax credit on the total cost of buying and installing a heat pump

Download Are There Federal Tax Credits For Heat Pumps

More picture related to Are There Federal Tax Credits For Heat Pumps

Is There A Federal Tax Credit For Heat Pump Installation RAVINIA

https://raviniaplumbing.com/wp-content/uploads/2023/08/Are-There-Federal-Tax-Credits-Available-for-Heat-Pumps_-1-scaled.jpg

Heat Pump Cost Archives WeLoveHeatPumps

https://weloveheatpumps.com/wp-content/uploads/2024/02/thermostat.png

Federal Tax Credits For Heating And Air Conditioning

https://www.myqualitycomfort.com/wp-content/uploads/2023/06/Up-to-2000-tax-credit-on-Heat-Pumps.png

If you opt to install a heat pump you ll be eligible for a federal tax credit for models that achieve the Consortium for Energy Efficiency s CEE highest tier for efficiency Starting in 2023 continuing this year and through the end of 2032 all homeowners will be eligible for a 30 federal tax credit on the total cost of buying and installing their new heat pump with a maximum credit of 2 000

There are tax credits available in 2024 to help pay for your heat pump If you install an efficient heat pump you are eligible for a federal tax credit that will cover 30 up to 2 000 of the heat pump cost and installation A credit for heat pumps meanwhile was claimed on more than 260 000 tax returns Some households may have claimed both

Heat Pumps How Federal Tax Credits Can Help You Get One

https://environmentamerica.org/center/wp-content/uploads/2022/12/51322503903_6b8b80baa4_o-scaled.jpg

Federal Rebates For Heat Pumps Save Money And Energy USRebate

https://i0.wp.com/www.usrebate.com/wp-content/uploads/2023/05/Federal-Rebates-For-Heat-Pumps.png?ssl=1

https://www.energystar.gov/about/federal-tax...

Air Source Heat Pumps Tax Credit This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032 How to Claim the Federal Tax Credits Strategies to Maximize Your Federal Tax Savings

https://www.irs.gov/credits-deductions/home-energy-tax-credits

If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses were expanded by the Inflation Reduction Act of 2022

Green Incentives Usually Help The Rich Here s How The Build Back

Heat Pumps How Federal Tax Credits Can Help You Get One

Tax Credits MJA Associates

How To Leverage Inflation Reduction Act Tax Credits For Energy Savings

Clarion H R Block Tax Tips Claiming Energy Tax Credits For 2022 And

Energy Tax Credits For 2023 One Source Home Service

Energy Tax Credits For 2023 One Source Home Service

Double The Rebates For Heat Pumps Capital Regional District

Heat Pumps Wattsmart Savings

30 Federal Tax Credits For Heat Pump Water Heaters 2023

Are There Federal Tax Credits For Heat Pumps - Through President Biden s Investing in America Plan homeowners are now eligible for tax credits when they install an air source or geothermal heat pump up to 30 federal tax credit on the total cost of buying and installing a heat pump