Are There Tax Incentives For Hybrid Cars Consumer Reports details the list of 2023 and 2024 model year electric vehicles and plug in hybrids that qualify for federal tax credits of up to 7 500 under the

Here Are All The EVs And Hybrids That Qualify For A Tax Credit In 2024 Updated The tax credit for EVs provides up to 7 500 toward a purchase of a If you place in service a new plug in electric vehicle EV or fuel cell vehicle FCV in 2023 or after you may qualify for a clean vehicle tax credit For more information on how to qualify see Publication 5866 New Clean Vehicle Tax Credit Checklist PDF

Are There Tax Incentives For Hybrid Cars

Are There Tax Incentives For Hybrid Cars

https://www.freshbooks.com/wp-content/uploads/2022/04/tax-incentives-examples.jpg

Concerns Over E car Tax Incentives Have Been Raised With U S EU Trade

https://www.theglobeandmail.com/resizer/Wc-lByM2TIitItXhNSgdbPhHS7Q=/1200x779/filters:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/tgam/ERQVJWX475JEBI6X7Z4TBXEJXM.JPG

Can I Get A Tax Credit For Buying A Used Hybrid Car Juiced Frenzy

https://i0.wp.com/juicedfrenzy.com/wp-content/uploads/2021/11/Depositphotos_186124840_S.jpg?w=1000&ssl=1

Many have heard about government incentives when purchasing a vehicle that plugs in and plug in hybrid PHEV as well as battery electric vehicles can qualify A federal hybrid car tax credit is available to consumers who buy plug in electric vehicles EVs in the United States According to the U S Department of Energy you can receive a tax credit of

Oct 6 2023 If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles Qualified two wheeled plug in electric vehicles may also be eligible for this credit All electric and plug in hybrid vehicles purchased new from 2010 through 2022 may be eligible for a federal income tax credit of up to 7 500 The credit amount

Download Are There Tax Incentives For Hybrid Cars

More picture related to Are There Tax Incentives For Hybrid Cars

All About Tax Credit For EV PHEV And Hybrid Cars CarBuzz

https://cdn.carbuzz.com/gallery-images/1600/954000/800/954828.jpg

The Most Common Problems Of Hybrid Vehicles HP Automotive

https://hpautomotive.com.au/wp-content/uploads/2022/06/The-Most-Common-Problems-of-Hybrid-Vehicles.jpg

What Are Maryland s EV Tax Credit Incentives Easterns Automotive

https://www.easterns.com/wp-content/uploads/2021/07/Electric-Vehicle-Incentives-Easterns-Automotives-1170x250.jpeg

Which EVs qualify for tax credits Here s a list of car models new and used that qualify for EV federal tax credits All electric plug in hybrid and fuel cell electric vehicles purchased new in 2023 or after may be eligible for a federal income tax credit of up to 7 500

Our experts show you how to qualify for a federal tax credit of up to 7 500 by leasing an electric vehicle or plug in hybrid Starting on Jan 1 2023 people who purchase eligible electric vehicles can receive 2 500 to 7 500 in tax credits The value of the credit can be directly subtracted from the purchase

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

https://www.eesi.org/images/content/Summary_of_Clean_Energy_Credits.png

Everything You Need To Know About Hybrid Cars

https://lh5.googleusercontent.com/s-F6cdcshWMEQoiSksHvV1sn1NHxYTzHLacvaALrLbkCP9kSW_OAJZo9v9qUKQWJITcjhNEHffRHFpKcS8vJn2BtHL-4jEdQpEOoVEQECiankInzGdMh2uRWIuZBB4PjC_cAEmXZQkG_1HoB4yk

https://www.consumerreports.org/cars/hybrids-evs/...

Consumer Reports details the list of 2023 and 2024 model year electric vehicles and plug in hybrids that qualify for federal tax credits of up to 7 500 under the

/cloudfront-us-east-1.images.arcpublishing.com/tgam/ERQVJWX475JEBI6X7Z4TBXEJXM.JPG?w=186)

https://insideevs.com/news/702784/ev-tax-credit-2024-official

Here Are All The EVs And Hybrids That Qualify For A Tax Credit In 2024 Updated The tax credit for EVs provides up to 7 500 toward a purchase of a

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

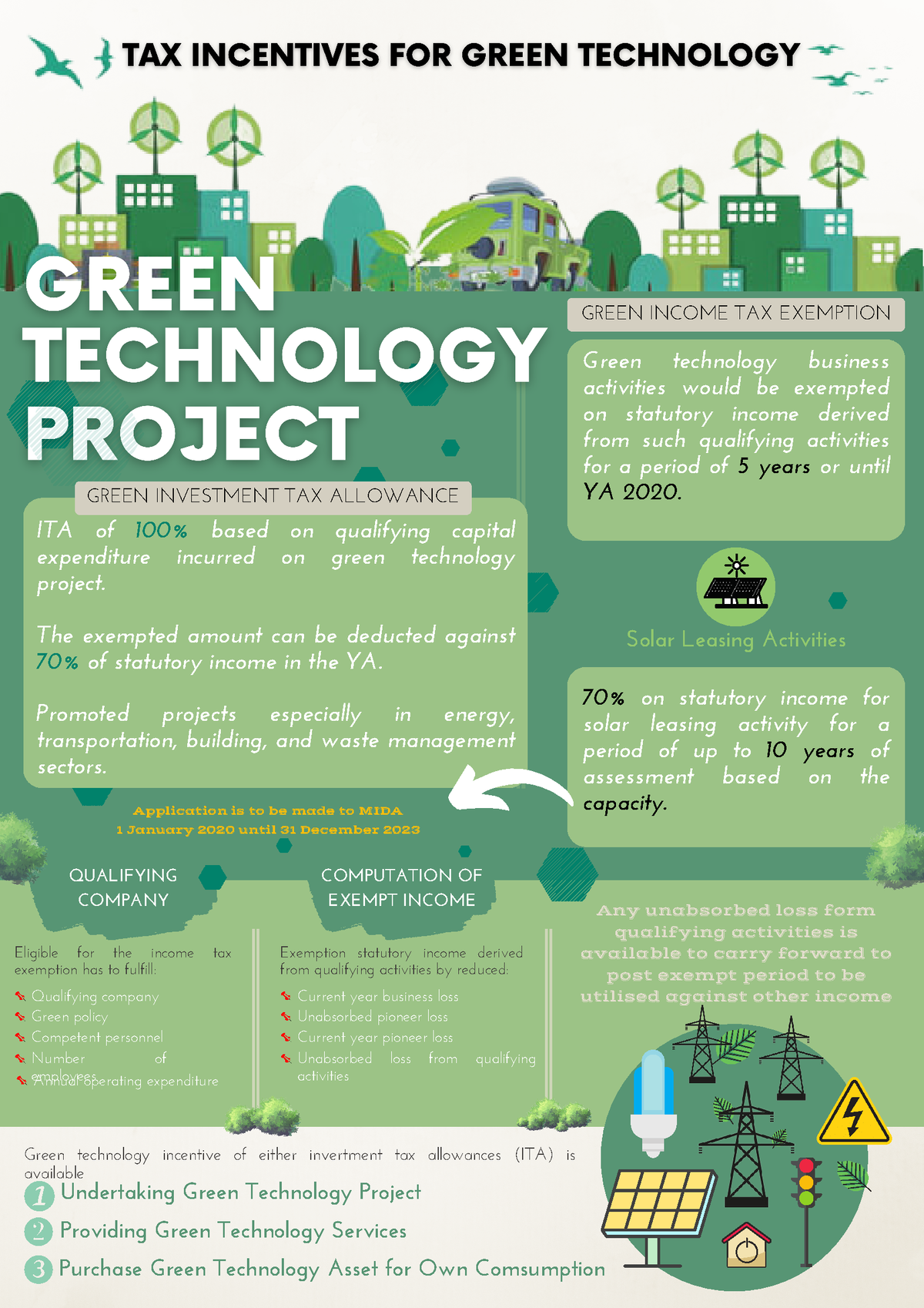

TAX Incentives FOR Green Technology Wan Sharmirizal GREEN INCOME

RHB Launches Sustainability Financing Plan Including Solar Panels

New Window Tax Incentives Affordable Replacement Window Systems

Federal Solar Tax Credit What It Is How To Claim It For 2024

Federal Solar Tax Credit What It Is How To Claim It For 2024

Exploring How Does Hybrid Work The Pros And Cons Of Driving A Hybrid

2020 Toyota Prius Is The Proto Hybrid The Review Garage

Tax Credits Save You More Than Deductions Here Are The Best Ones

Are There Tax Incentives For Hybrid Cars - Many have heard about government incentives when purchasing a vehicle that plugs in and plug in hybrid PHEV as well as battery electric vehicles can qualify

/cloudfront-us-east-1.images.arcpublishing.com/tgam/ERQVJWX475JEBI6X7Z4TBXEJXM.JPG)