Are Us Savings Bonds Tax Exempt If you hold savings bonds and redeem them with interest earned that interest is subject to federal income tax and possibly federal

Tax Exempt Bonds Information about tax advantaged bonds including tax exempt tax credit and direct pay bonds Resources for issuers borrowers and bond Updated December 15 2021 Reviewed by Thomas J Catalano Fact checked by Marcus Reeves How Are Savings Bonds Taxed According to Treasury Direct interest from EE

Are Us Savings Bonds Tax Exempt

Are Us Savings Bonds Tax Exempt

https://i.pinimg.com/originals/2c/f7/2a/2cf72a705f002bb93df3dedba51bbd6f.jpg

Savings Bonds And Your Estate Keystone Elder Law P C

https://keystoneelderlaw.com/wp-content/uploads/2021/09/Savings-bonds.jpg

There Are 29 Billion In Unredeemed US Savings Bonds Congress Wants To

https://bostonglobe-prod.cdn.arcpublishing.com/resizer/fLrVBURjCc7JDh0F66dNESMkPmM=/960x0/cloudfront-us-east-1.images.arcpublishing.com/bostonglobe/SW5T6V555FCTVINWNPSTKPTCA4.jpg

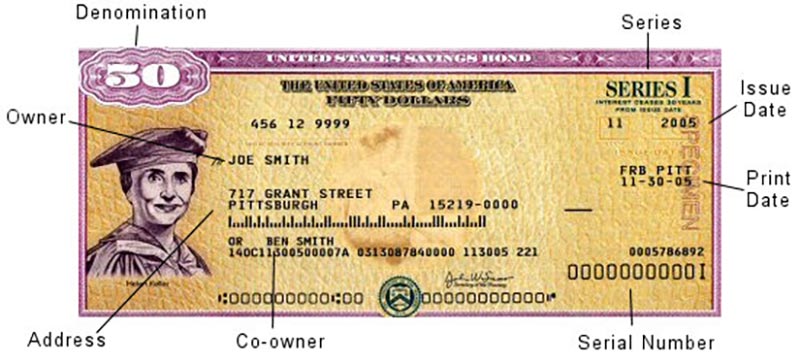

Tax Topic 403 Interest Received Form 8815 Exclusion of Interest From Series EE and I U S Savings Bonds Issued After 1989 Bonds are divided into two classes taxable and tax exempt A bond s tax exempt status applies only to the bond s interest income Any capital gains generated from selling a bond or

Savings Bonds Savings bonds are issued by governments to the public and are deemed safe investment vehicles with many benefits Series EE savings bonds are For example interest earned on I bonds is exempt from state and local taxation Also owners can defer federal income tax on the accrued interest for up to 30 years Unfortunately though

Download Are Us Savings Bonds Tax Exempt

More picture related to Are Us Savings Bonds Tax Exempt

Cashing In The Savings Bonds Ramblin With Roger

https://www.rogerogreen.com/wp-content/uploads/2020/12/Savings-Bond-1024x443.jpg

Understanding Inherited Savings Bonds Altman Associates

https://altmanassociates.net/wp-content/uploads/2021/01/Inherited-Savings-Bonds-Explained.jpg

/-1000-denomination-us-savings-bonds-172745598-cdf4a528ed824cc58b81f0531660e9c9.jpg)

Treasury Bond T Bond Definition

https://www.investopedia.com/thmb/n6If8c7dJV7FvUW3O-hAhQo3674=/3486x2277/filters:fill(auto,1)/-1000-denomination-us-savings-bonds-172745598-cdf4a528ed824cc58b81f0531660e9c9.jpg

Listen 1 min The tax bill is coming due for one of the hottest investments of the past two years Millions of Americans rushed to buy I bonds in 2022 when a Yes I bonds are subject to taxation But they provide certain tax benefits that distinguish them from other investments and can result in lower tax payments The

U S savings bonds are a tax advantaged way to save and pay for education expenses The rules that govern the exclusion of earned interest can be tricky Plan Exempt From State and Local Income Taxes One big benefit of Series EE savings bonds is that they are exempt from state and local taxes This is very

Series EE Savings Bonds When To Redeem For The Maximum Return

https://d187qskirji7ti.cloudfront.net/news/wp-content/uploads/2019/05/when-it-is-best-to-cash-out-a-series-ee-savings-bond.jpg

How To Choose The Right Bond Funds Bond Funds Savings Bonds Us

https://i.pinimg.com/originals/fa/0f/93/fa0f932fb83dd2e7c0649fb126c99364.jpg

https://smartasset.com/taxes/how-can-i-avoid...

If you hold savings bonds and redeem them with interest earned that interest is subject to federal income tax and possibly federal

https://www.irs.gov/tax-exempt-bonds

Tax Exempt Bonds Information about tax advantaged bonds including tax exempt tax credit and direct pay bonds Resources for issuers borrowers and bond

Municipal Bonds The Comprehensive Review Of Tax Exempt Securities And

Series EE Savings Bonds When To Redeem For The Maximum Return

The Secret Feature Of Series EE Savings Bonds Wealth Management

Interest Rates On Series EE And I Savings Bonds Increased In May

What Are I Bonds And Why I m Buying

Series EE Savings Bonds Series EE Bonds Were Originally Offered On

Series EE Savings Bonds Series EE Bonds Were Originally Offered On

Treasury Bills Bonds And Notes How Are They Different

US Savings Bonds Closeup Closeup View Of 100 Dollar Us Savings Bonds

/GettyImages-637141824-8aa32cebbf5847c1948f9fcda236ad9d.jpg)

How To Find Out If You Have Savings Bonds Informationwave17

Are Us Savings Bonds Tax Exempt - For example interest earned on I bonds is exempt from state and local taxation Also owners can defer federal income tax on the accrued interest for up to 30 years Unfortunately though