Are Utility Rebates Taxable The IRS has issued guidance providing that rebates for energy efficient improvements under two Department of Energy DOE programs will generally not be included in income unless they are paid directly to business taxpayers in connection with the sale of goods or the provision of services

Key takeaways include understanding the favorable tax treatment of energy efficient upgrades for homeowners who benefit from rebates not being treated as taxable income This effectively lowers the cost of such improvements encouraging greener living without the burden of increased taxes In most cases an amount included in your income is taxable unless it is specifically exempted by law Income that is taxable must be reported on your return and is subject to tax Income that is nontaxable may have to be shown on your tax return but isn t taxable

Are Utility Rebates Taxable

Are Utility Rebates Taxable

https://seo4.serpcom.com/imec/wp-content/uploads/sites/7/2019/09/Utility-Rebate-Management.jpg

Are Idaho s Tax Rebates Taxable KBOI

https://idahonews.com/resources/media2/16x9/full/1024/center/80/8e10439d-0103-42f2-82a7-689400e9e5e3-large16x9_Taxes_Logo.jpg

Utility Rebates Can Help Offset The Rising Cost Of Energy CUB Minnesota

https://cubminnesota.org/wp-content/uploads/2022/02/rebates-768x553.png

The income tax treatment of rebates however has been a simmering dispute for more than 50 years leaving uncertainty for both payers and recipients as to characterization and timing Recently the IRS has taken steps to reduce some of the confusion Rebates paid at the time of sale under two home energy rebate programs created in the Inflation Reduction Act are not includible in individual purchasers gross income or cost basis the IRS said Friday in Announcement 2024 19 The announcement also includes coordination rules for taxpayers who want to claim a federal tax credit for those

Taxation of utility rebates matters to the property owner because the tax on the payment functionally reduces the rebate amount Thus a taxable rebate payment will not cover as much of the property owner s out of pocket expense The IRS ruled that where electric utility customers who install energy saving devices receive incentive rebates in the form of rate reductions or nonrefundable credits reducing their electric bills such incentives are nontaxable

Download Are Utility Rebates Taxable

More picture related to Are Utility Rebates Taxable

Utility Rebates Available By State QuietCool

https://quietcoolsystems.com/wp-content/uploads/2020/06/Rebates_694x635.jpg

Are ACA Rebates Taxable HealthPlanRate Healthplanrate

https://www.healthplanrate.com/wp-content/uploads/2020/07/ACA-rebates-tax-deductible-1-768x518.jpg

AC Rebates Utility Rebates Magic Touch Mechanical Mesa AZ

https://web.archive.org/web/20180501073344im_/http://airconditioningarizona.com/assets/templates/main/images/utility-rebates.jpg

Key takeaways include understanding the favorable tax treatment of energy efficient upgrades for homeowners who benefit from rebates not being treated as taxable income This effectively lowers the cost of such improvements encouraging greener living without the burden of increased taxes Energy Rebate Programs will be treated as a purchase price adjustment for the purchaser for Federal income tax purposes Any such rebate is therefore not includible in the purchaser s gross income under 61 See Rev Rul 91 36 1991 2 C B 17 utility rate reductions and credits related to customers purchase of subsidized

Utility rebates From the IRS If you re a customer of an electric utility company and you participate in the utility s energy conservation program you may receive on your monthly electric bill either A reduction in the purchase price of But expansion of IRC Sec 136 to water conservation rebates would require a legislative change What amounts are reportable for federal tax purposes Utilities must issue Form 1099 MISC to consumers who receive 600 or more in rebates in a calendar year

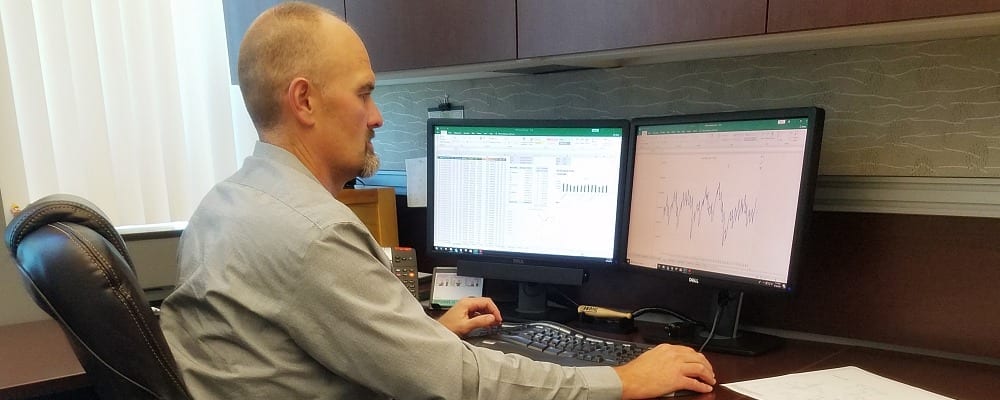

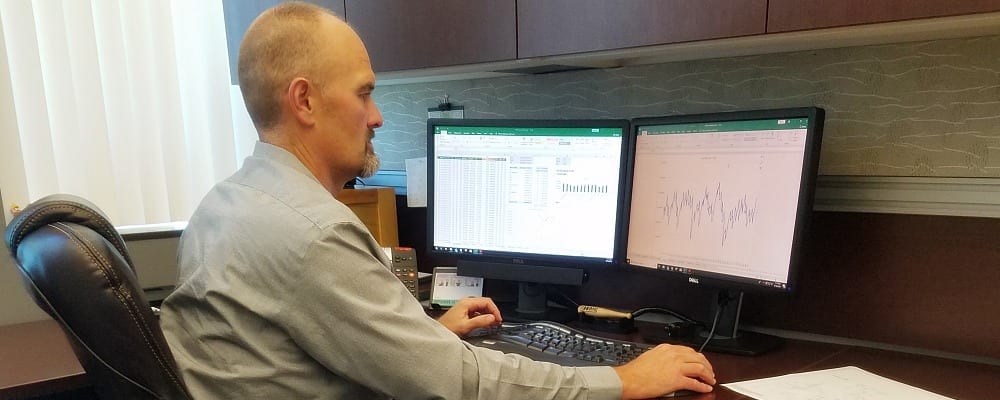

Utility Rebates Made Simple Buildings

https://img.buildings.com/files/base/ebm/buildings/image/2022/05/1651537078324-300x250facilityproduct_database.png?auto=format,compress&fit=fill&fill=blur&w=1200&h=630

Municipal Utility Rebates Orange City

https://orangecityiowa.com/wp-content/uploads/slider-utilities-and-serv-rebate1.jpg

https://www.grantthornton.com/insights/newsletters/...

The IRS has issued guidance providing that rebates for energy efficient improvements under two Department of Energy DOE programs will generally not be included in income unless they are paid directly to business taxpayers in connection with the sale of goods or the provision of services

https://rsmus.com/insights/tax-alerts/2024/...

Key takeaways include understanding the favorable tax treatment of energy efficient upgrades for homeowners who benefit from rebates not being treated as taxable income This effectively lowers the cost of such improvements encouraging greener living without the burden of increased taxes

Rebates

Utility Rebates Made Simple Buildings

2022 Tax Brackets Married Filing Jointly Irs Printable Form

Are Buyer Agent Commission Rebates Taxable In NYC Buyers Agent Nyc

Rebate Adjustment Sample Clauses AccountingCoaching

Are Car Rebates Taxable In New York 2023 Carrebate

Are Car Rebates Taxable In New York 2023 Carrebate

Are Rebates Important YouTube

Check Back Often To See What Rebates Are Currently Available Click

Utility Rebates ICS Tax LLC

Are Utility Rebates Taxable - Utilities require water conservation rebate recipients to complete a W 9 and will issue them a 1099 where the rebates are 600 or more More and more appliance manufacturers and government agencies offer utility rebates for households who switch to cleaner energy Full tax details here