Are Vehicle Leases Tax Deductible You can claim back up to 50 percnt of the tax on the monthly payments of your lease up to 100 percnt of the tax on a maintenance package and depending on the vehicle s CO2

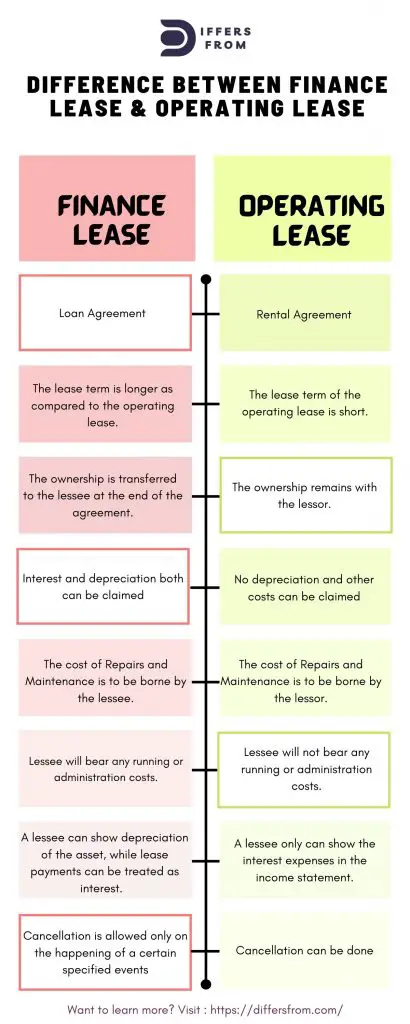

With a lease the lease payments are an expense and you do not use the depreciation write off You use the lease payment as a deduction if you write off actual vehicle expenses you cannot This guide answers key questions regarding reporting and paying tax when you lease a vehicle for work if you re a self employed contractor freelancer or sole trader Here s what we ll cover the pros and cons of vehicle

Are Vehicle Leases Tax Deductible

Are Vehicle Leases Tax Deductible

http://tehcpa.net/wp-content/uploads/2019/03/common-operating-vehicle-expenses_2018-uber-driver.jpg

Car Lease Steps And Process Explained By LeaseGuide

https://www.leaseguide.com/wp-content/uploads/2014/11/Life-of-a-Car-Lease.png

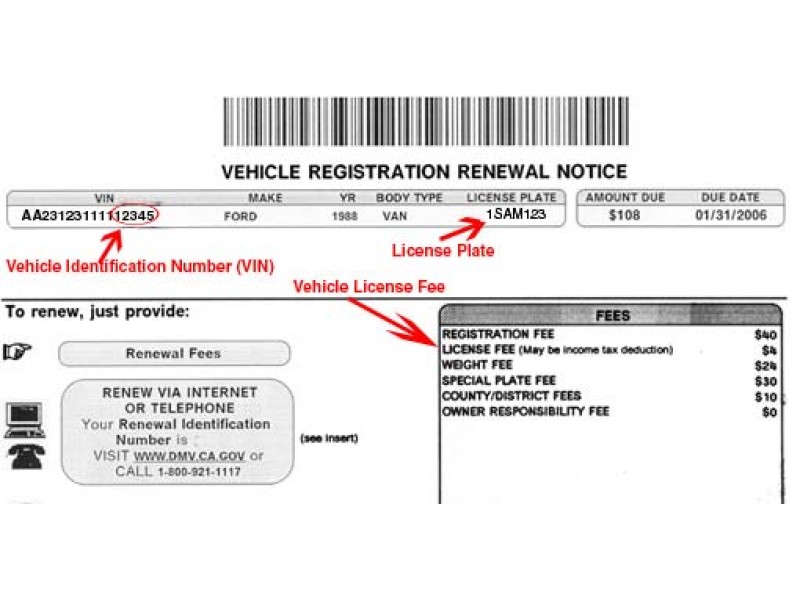

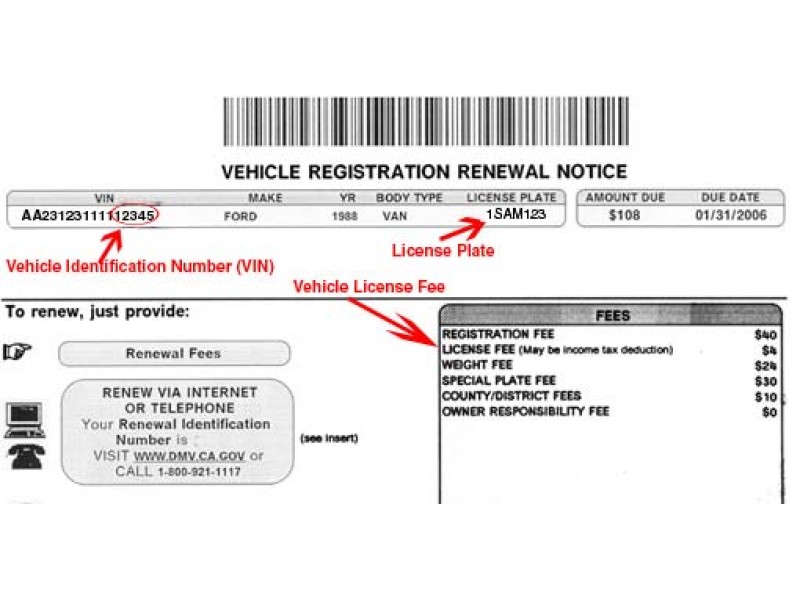

How To Find Tax Deductible Vehicle License Fee VLF Step by step

https://i.ytimg.com/vi/es395fRiorI/maxresdefault.jpg

Yes you can write off your car lease if you use the vehicle for business and the use qualifies for a deduction Sound complicated It s not Just make sure you know the basics of deducting car lease payments and you ll be Are car lease payments tax deductible In short yes Car lease payments are considered a qualifying vehicle tax deduction according to the IRS With that being said there are restrictions on who can and who can t write off

Car lease payments aren t always tax deductible but with business leasing you can reclaim up to 100 of VAT Check out who s eligible and how to claim Hiring or leasing a car is an allowable and tax deductible expense but you must disallow 15 of your costs if the vehicle CO2 emissions are more than 50g km This was previously set at

Download Are Vehicle Leases Tax Deductible

More picture related to Are Vehicle Leases Tax Deductible

Is Car Loan Interest Tax Deductible And How To Write Off Car Payments

https://blog.way.com/wp-content/uploads/2022/07/car-loan-tax-deductible.jpg

How Much Of My Lease Payment Is Tax Deductible Payment Poin

https://marqueegroup.ca/wp-content/uploads/2019/05/Lease3.png

Are Automobile Registration Fees Deductible YouTube

https://i.ytimg.com/vi/tSNj7rZ38HE/maxresdefault.jpg

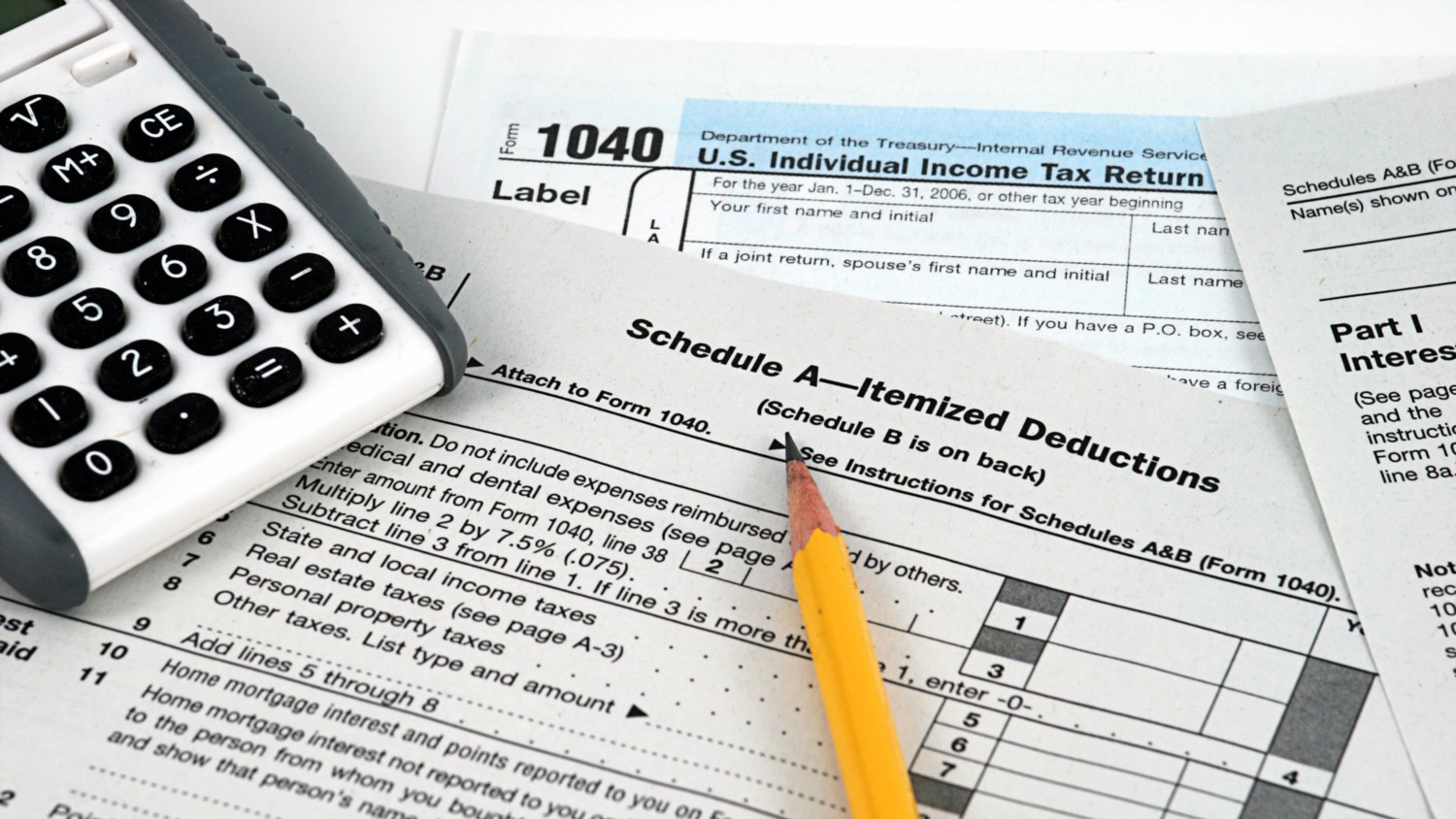

The good news is that for most types of lease including contract hire car lease payments are tax deductible for corporation tax purposes However there are a number of provisos that should be considered The If you lease a car you use in business you may not deduct both lease costs and the standard mileage rate You may either Deduct the standard mileage rate for the business miles driven

Individuals who own a business or are self employed and use their vehicle for business may deduct car expenses on their tax return If a taxpayer uses the car for both If you plan on leasing a vehicle you may be eligible to deduct the sales tax from your new car lease Since every monthly payment comes with a sales tax your lease payment

Do You Know What DMV Fees Are Tax Deductible Fair Oaks CA Patch

http://cdn.patchcdn.com/users/22511888/2015/03/T800x600/20150354f87ac574b9e.jpg

CHAPTER 18 Lease Financing Types Of Leases Tax Treatment Of Leases

https://slideplayer.com/slide/15459724/93/images/4/How+are+leases+treated+for+tax+purposes.jpg

https://www.moneyshake.com › car-leasing-guides › ...

You can claim back up to 50 percnt of the tax on the monthly payments of your lease up to 100 percnt of the tax on a maintenance package and depending on the vehicle s CO2

https://smallbusiness.chron.com

With a lease the lease payments are an expense and you do not use the depreciation write off You use the lease payment as a deduction if you write off actual vehicle expenses you cannot

Tax Deductions The New Rules INFOGRAPHIC Alloy Silverstein

Do You Know What DMV Fees Are Tax Deductible Fair Oaks CA Patch

Difference Between Finance Lease And Operating Lease

What Are The Requisites Of Deductible Expenses AccountablePH

Commercial Lease Guide For Landlords Lofti

Property Expenses What s Tax Deductible In The Year Of Occurrence

Property Expenses What s Tax Deductible In The Year Of Occurrence

.jpg)

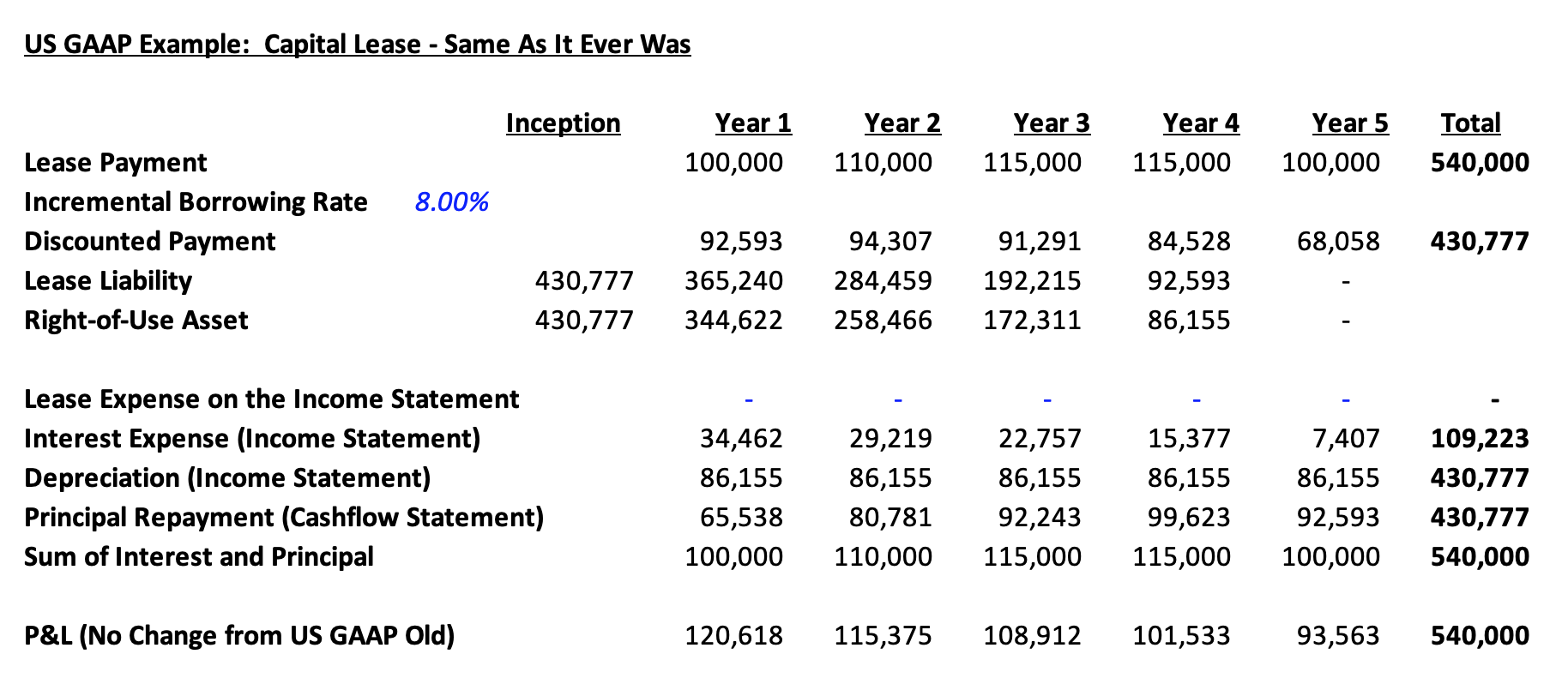

Financing And Leases Tax Treatment ACCA Global

Are Closing Costs Tax Deductible Under The New Tax Law PNWR

Car Allowance Taxable In Malaysia JorgefvSullivan

Are Vehicle Leases Tax Deductible - Are car lease payments tax deductible In short yes Car lease payments are considered a qualifying vehicle tax deduction according to the IRS With that being said there are restrictions on who can and who can t write off