Are Work Clothes Tax Deductible For Self Employed Canada The Canada employment amount provides recognition for work related expenses such as home computers uniforms and supplies in the public and private sector Self employed

Are work clothes tax deductible for self employed workers in Canada Photo by Kampus Production from Pexels Maybe in the case of uniforms and protective clothing and shoes but Many small business expenses can be tax deductible Here are some of the most recognized items Accounting and tax prep software If you re self employed or run your own small business tax preparation

Are Work Clothes Tax Deductible For Self Employed Canada

Are Work Clothes Tax Deductible For Self Employed Canada

https://brucelandersoncpa.com/wp-content/uploads/2019/03/tax-deductions-for-self-employed.jpg

Advisorsavvy Self Employed Tax Deductions Canada

https://advisorsavvy.com/wp-content/uploads/2023/05/Self-Employed-Tax-Deductions-Canada-In-Post-600x900.jpg

Are Work Clothes Tax Deductible For Self Employed The TurboTax Blog

https://blog.turbotax.intuit.com/wp-content/uploads/2017/10/stocksy_txp9e362efd2ji100_medium_377316.jpg?resize=600

Q I am self employed and I need to buy appropriate business attire to meet my clients Can I deduct these wardrobe purchases as an expense Employee Clothing and Footwear The cost of special clothing or footwear required for your job is not deductible However special clothing or footwear provided

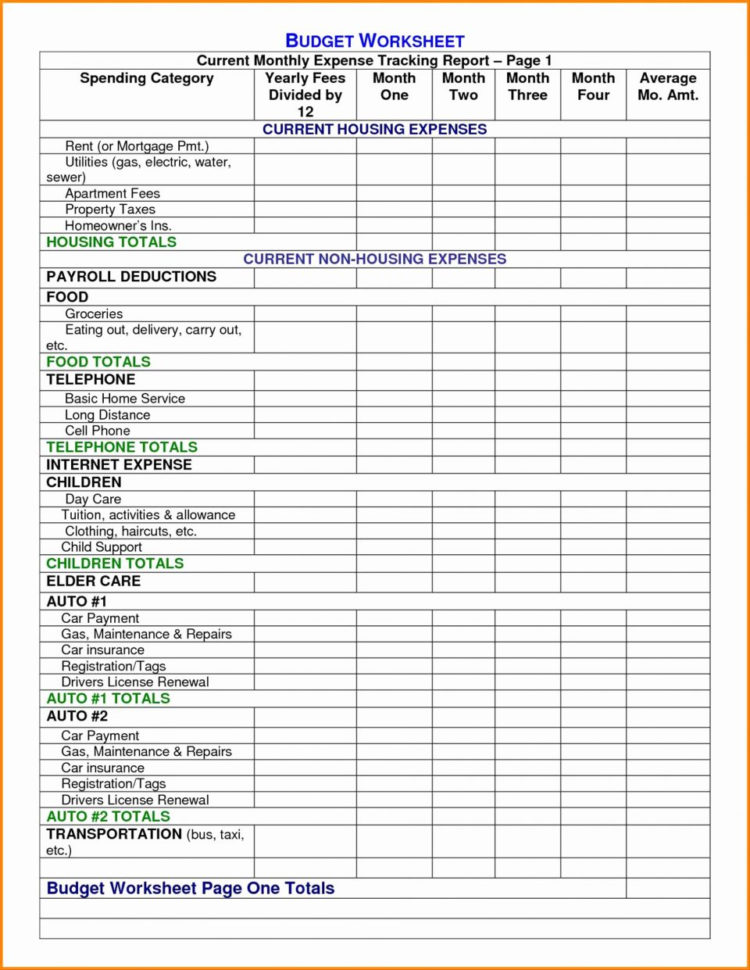

10 Common Tax Write Offs for Self Employed Canadians 1 Rent If you work from home you are eligible to deduct a portion of your rent on your taxes This portion should be relative to the space in your home that you Some examples of business taxes that may be deductible are municipal taxes land transfer taxes gross receipt tax health and education tax and hospital tax You can

Download Are Work Clothes Tax Deductible For Self Employed Canada

More picture related to Are Work Clothes Tax Deductible For Self Employed Canada

Are Work Clothes Tax Deductible For Self Employed The TurboTax Blog

https://blog.turbotax.intuit.com/wp-content/uploads/2014/03/stocksy_txp6346db6aeq3000_small_88919.jpg?w=600&h=577&crop=1

Http www anchor tax service financial tools deductions medical

https://i.pinimg.com/originals/93/fc/e8/93fce8e4872e20094e9c7743332faf81.jpg

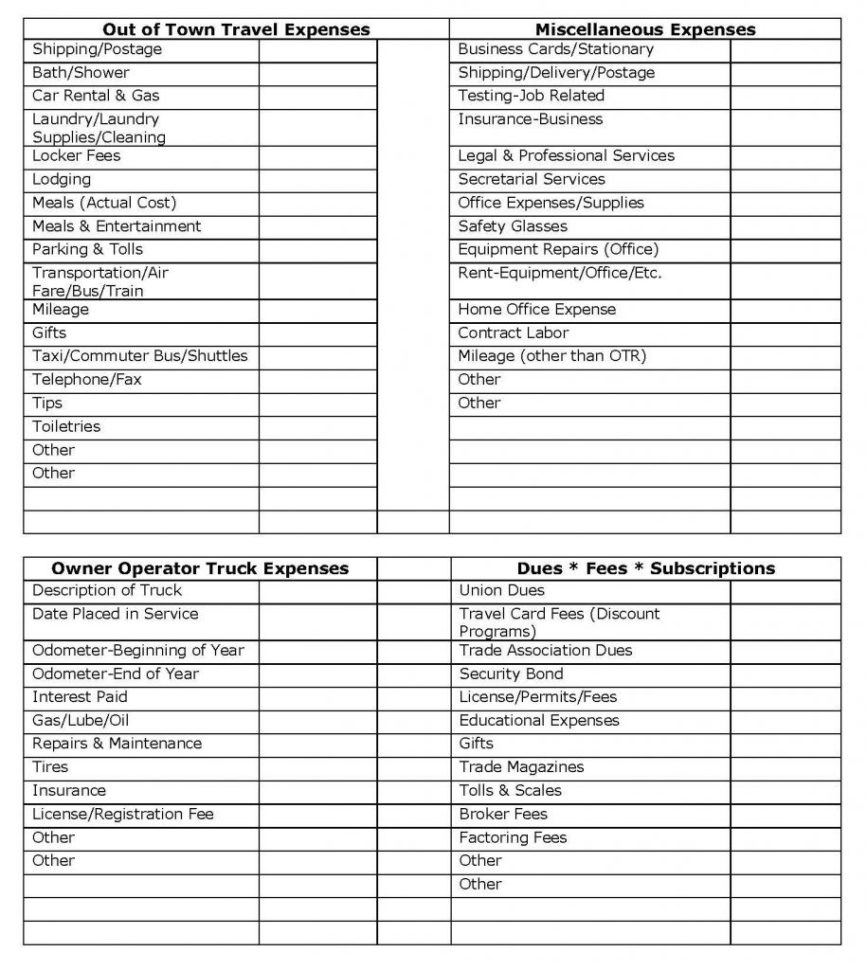

Self Employed Tax Deductions Worksheet Soccerphysicsonline Db excel

https://db-excel.com/wp-content/uploads/2019/09/self-employed-tax-deductions-worksheet-soccerphysicsonline-6-867x970.jpg

Are work clothes tax deductible for self employed people in Canada No clothing is not an expense you can typically claim on your taxes when self employed in In general expenses incurred in order to earn business or property income are tax deductible Many of your expenditures will be fully deductible in the year in which they

Are work clothes tax deductible for self employed in Canada If you require specific clothing to work and you are self employed then yes the cost is tax deductible You should For 2024 self employed Canadians must prepare to pay the CRA 11 9 of their income up to a maximum of 7 735 Self employment deductions Expenses In order to reduce the

Income Tax Rates For The Self Employed 2020 2021 TurboTax Canada Tips

https://turbotax.intuit.ca/tips/images/self-employed-taxes-canada.jpg

Tax Deductions You Can Deduct What Napkin Finance

https://napkinfinance.com/wp-content/uploads/2020/12/NapkinFinance-TaxDeductions-Napkin-10-13-20-v05-1.jpg

https://www.reddit.com/r/PersonalFinanceCanada/...

The Canada employment amount provides recognition for work related expenses such as home computers uniforms and supplies in the public and private sector Self employed

https://www.moneysense.ca/earn/careers/si…

Are work clothes tax deductible for self employed workers in Canada Photo by Kampus Production from Pexels Maybe in the case of uniforms and protective clothing and shoes but

Are Work Clothes Tax Deductible For Self Employed The TurboTax Blog

Income Tax Rates For The Self Employed 2020 2021 TurboTax Canada Tips

Tax Forms For Self Employed Canada Employment Form

Are Work Clothes Tax Deductible For Self Employed The TurboTax Blog

Self Employed Tax Spreadsheet Spreadsheet Downloa Self Employed Tax

Are Work Clothes Tax Deductible For Self Employed The TurboTax Blog

Are Work Clothes Tax Deductible For Self Employed The TurboTax Blog

Are Work Clothes Tax Deductible For Self Employed The TurboTax Blog

Qualified Business Income Deduction And The Self Employed The CPA Journal

Printable Itemized Deductions Worksheet

Are Work Clothes Tax Deductible For Self Employed Canada - 10 Common Tax Write Offs for Self Employed Canadians 1 Rent If you work from home you are eligible to deduct a portion of your rent on your taxes This portion should be relative to the space in your home that you